There have been quite a few interesting articles that I read this week. I am listing out a few here.

- Inspiration and Passion and Whatnot: A post about passion and inspiration from the creator of Dilbert – Scott Adams. In this post Adams says that “When I had a full-time job, before Dilbert, I awoke at 4 AM, sat alone in a comfortable chair with a cup of coffee, and waited. I did that for a year or two, just emptying my mind and freeing my imagination. I don’t remember the day I picked up a pencil and started drawing instead of sitting during those hours, but I’m sure I didn’t have a choice.” This is something that I have been thinking about all week. Freeing up your mind of junk – a very intriguing thought.

- When is the right time to start a business: A very interesting post about starting up a business during tough times by The Digerati Life. It was a very measured post; of something that is quite close to my heart – entrepreneurship.

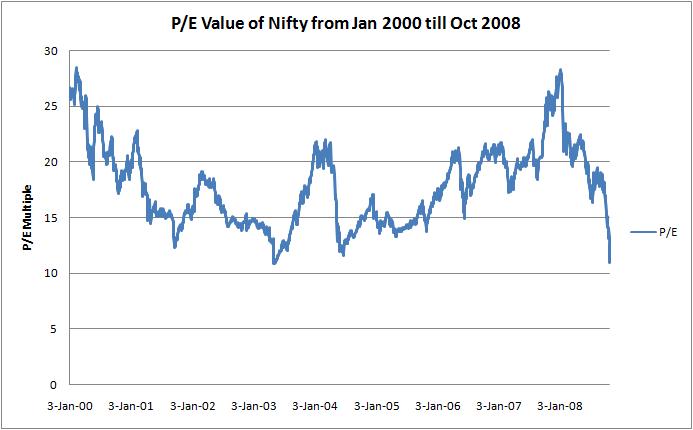

- When will the stock market stop falling? The Baseline Scenario had this interesting post about the loss in stocks this week.

- Transfer a Brokerage Account: How much does it cost?: Sun wrote this informative post about transferring your brokerage account.

These were some interesting posts that I enjoyed reading this week.