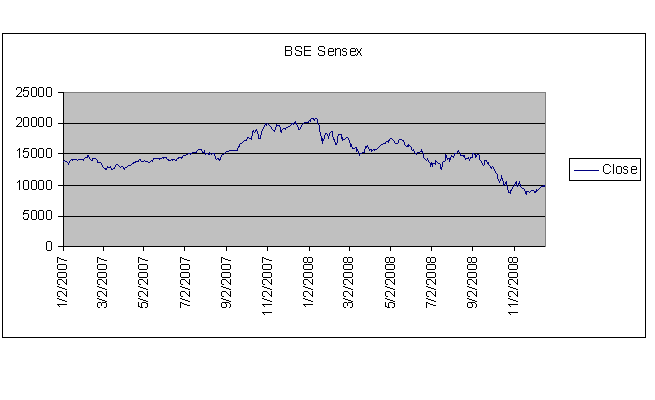

As the year 2008 ends – the beginning of the year seems like a distant memory. The year 2008 started with a big bang and markets all over the world were doing great. The Indian benchmark Sensex rose to about 21000 during 2008 and made all sorts of all time highs along the way.

Oil peaked at $147 and was well on its way to $200. US Dollar was going strong, China was going strong – and then Subprime happened.

Suddenly the spectacular rise in real-estate, oil, gold, stock markets, cotton and hog prices gave way to an equally spectacular fall in every imaginable asset (except the USD and Yen).

Credit Default Swaps, Bailout Plans, 0% Yields and Quantitative Easing entered the lexicon of the common man, and we witnessed bankruptcies and foreclosures – from Shanghai to Las Vegas.

The movement of the BSE Sensex during 2008 epitomizes the roller-coaster ride of 2008. The first half of the year was great and the second half of year just kept getting worse.

The Sensex has lost more than 10,000 points in six months – something that has never happened before. Every country in the world is reeling under the shadows of at least a long drawn recession and possibly a depression as well.

Since the fall has been so sharp – the year 2009 should end better than where we stand today. Things may get a little worse before they improve – but by the end of the next year – the scary memories of today will be a distant dream.

Wish you all a very happy and prosperous 2009.