Selling Puts and collecting premiums is being touted as collecting free money at quite a few places online. I first came across this concept when the Canadian Capitalist wrote about it — showing how wrong it is.

It took me quite some time to understand why some people think that this is free money because the reason is quite absurd.

When you buy a Put — you buy the right to sell something at a certain price and date. That means when you sell a Put — you are obliged to buy that asset at a particular price.

Let’s say that you have an island in Fiji, which has a going rate of 3.5 million dollars. I think that at 3 million dollars — this island is a steal.

I sell you a Put for a 50,000 dollars that gives you the right to sell this island to me at 3 million dollars — one year from now. Now, since I sold a Put — I get to keep the cash and you get to keep the right to sell the island.

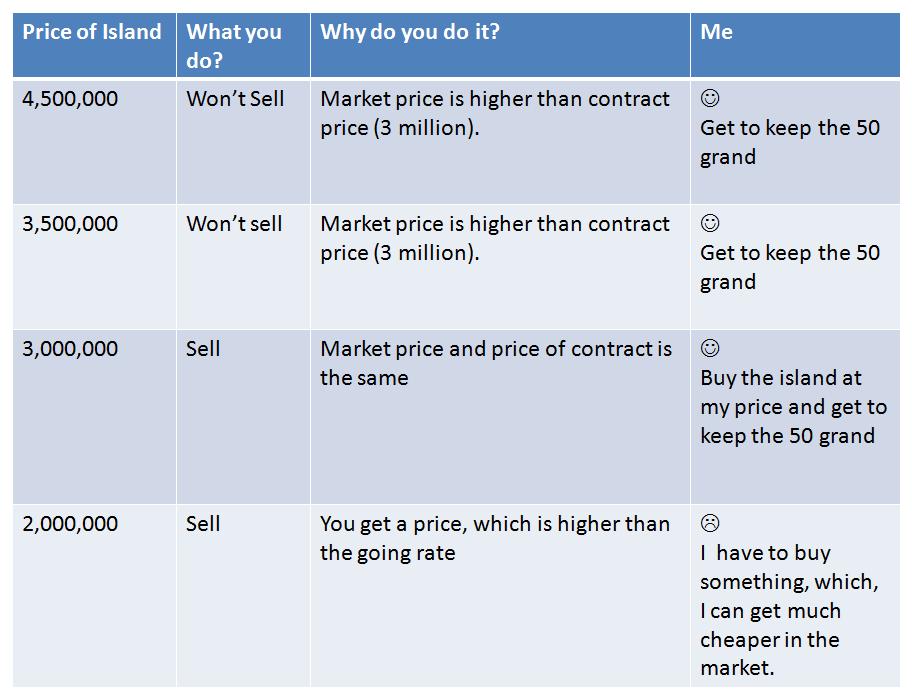

After one year, one of the following things could happen:

One look at the table above shows that I make “free” money only as long as the price of the island goes up. If the price of the island goes down — I am forced to buy the island at a premium.

For lack of a better term: the “free money proponents” say that even if I had to buy a 2 million dollar island at 3 million dollars that is okay because that’s what I thought it was worth one year ago.

That’s like saying: when AIG was trading at 50 dollars about an year ago — I thought it is a steal at 40 dollars, so even if the stock is trading at 40 cents today — I won’t mind it at 40 dollars.

Sounds pretty absurd to me.

Thoughts?

Thanks…this makes it fairly clear. Much appreciated.

To me this is like any other trading strategy, with inherent risk and rewards. It is good at some times and not so good at others. But it is certainly not free money.

Thanks for the link. That’s a nice analogy with AIG. After all, AIG was a Dow component and had a valuable insurance franchise. An intention to buy should not be confused with the potential obligation to do so.