I find the best way to track my Indian mutual fund NAVs is to do it through the free Moneycontrol.com online portfolio.

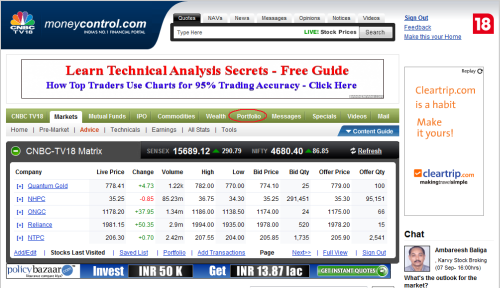

Go to moneycontrol.com, and click on “Portfolioâ€.

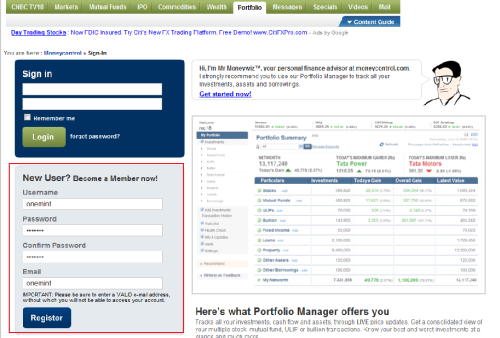

On the next screen, add your credentials.

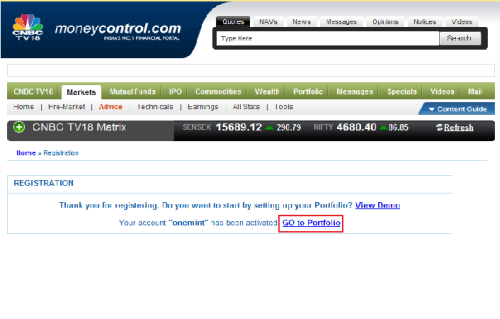

You are taken to a screen which offers you the option of watching a demo or going to the portfolio. You can watch the demo if you’d like. I’ll just go to the portfolio.

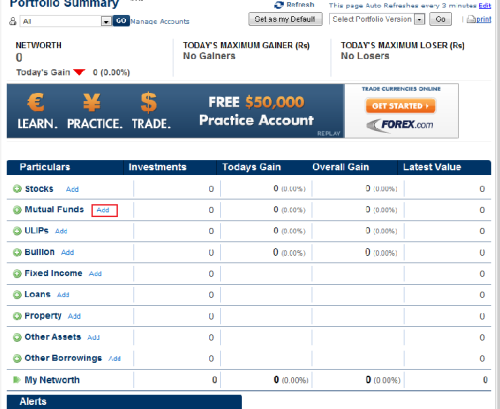

When I click on that link, it will ask me to login again. After logging in, you will see a screen that allows you to add Stocks, Mutual Funds, ULIPs etc. Click on the little “Add†next to the “Mutual Fundsâ€.

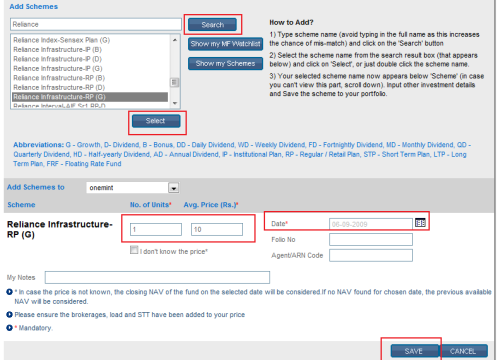

On the next screen, type in the name of the fund family, example: Reliance, and hit “Search”. You will see a list of all their mutual funds listed alphabetically. Select the one you are interested in, and click “Select”. Now, fill in the units, average purchase price, and date you bought the mutual fund, and hit “Save”. This mutual fund will be added to your portfolio.

You can repeat this process to add more mutual funds, and also add stocks and other assets. I think this is the most comprehensive free online portfolio tool for Indian investors.

I feel that the only drawback it has is that it takes too long to load on slower internet connections, but other than that, for a free tool, it’s quite good.

I want to know if I sell few units out of SIP (neither bulk sale nor sale of units of entire months) then how to do entry in portfolio. Could not figure it out. Please help. Thanks

You should know about mutual fund investments before investing in it. Can we have a article to know more on mutual fund.

Great thing about moneycontrol portfolio that a lot of other sites do not offer is in keeping track of your SIP investments. You need to enter details only once and it adds the right amounts to your portfolio periodically.

You should know the importance of mutual funds before choosing to invest in mutual funds. These funds are a type of security that can be traded, allowing shareholders to buy and sell shares in the fund. Revenues generated by the purchase of shares outstanding used in the manager of mutual funds to buy more shares of certain stocks, bonds and other securities and money market instruments.

please confirm to me I have invest 2lakhs for two years only mutual fund please send name of best 3 three fund.

No one can really confirm stuff like that for you. You need to find a good financial adviser or someone to talk about these things seriously. There are plenty of forums online that give out hot tips, and such, but you got to view them skeptically, and rely on your research.

StcksDuniya.com, are in BSE & NSE (Bombay Stock Exchange & National Stock Market), with Index of Sensex & Nifty.

For Traders, Best Picks and Tips for the Market with Quality Calls in F & O, Intraday & Delivery

StocksDuniya, provide with very few scripts but all are technical tips and Researched.

Please provide daily basis

dear sir

i would like to spend some money.

thankyou.

Hmmm, I find money control very useful but its bit cluttered. Look at all those ads they show on each page. Manshu, write a review for rediff money. You will love its simplicity.

I’ve never tried this, so will have to give it a shot sometime in the future.

Believe me, your users will love it.

BTW, thanks for replying 🙂