Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

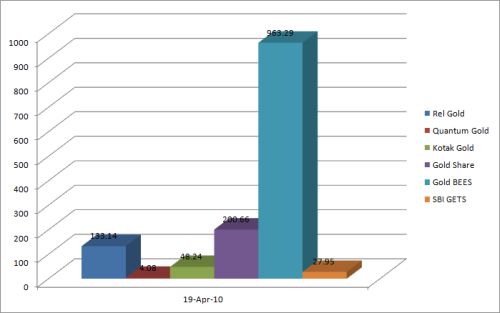

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

i have no account at broker, i want to invest some money in gold etf, how i can do it.

There’s no other way Ajit.

Hi Manshu

Your response to various questions regarding gold ETFs is very clear & impressive.

You are giving clear a picture and will be usefull for many investers.

Thanks dear, God bless you

Madhu

Wow Madhu! Thank you so much for your kind words, and taking the time out to write this comment!

i have no account at broker, i want to invest some money in gold etf, how i can do it.

Sravan – It is necessary to have a Demat and trading account in order to buy a gold ETF, so you will have to open that first.

Hi Manshu, tks for your advise. ForETF, i chked but seems i am unable to locate that whether sitting here i can open a demat or a trading a/c as i dont have one. Cannot do it just fm NREa/c. I probably need tovisit India for the same. Pls adv.Rgds

Deepak – I don’t have any experience with this, but what I’d recommend is for you to to go to the website of your bank say HDFC or SBI or wherever and then they have forms where NRIs can fill up info to request account opening, and their representative gets in touch with you. So, do that and see how it goes, at least this way you will not have to wait till you’re back home.

Somebody mention that 11-15% is straight loss if buying gold jewellery and selling thereoff. What abt Gold bar , buying and selling? Still when you go in Mkt to sell, 11-15% is deducted??. Pls adv. I have another question, i am NRI, can i go for Gold ETF sitting o/seas.

Yeah, people who have tried to sell gold coins have reported that the jewelers have told them that they’d have to deduct about 5%, so you can expect the deduction to be somewhere in that range. Also, it’s far better to be able to sell the gold coins from the jeweler you bought them originally from, and check the terms of sale at the time of purchase. Since this is not jewelery things like making charges etc. are not deducted viz. probably were the 11 – 15% figure come from.

I think NRIs can invest in Gold ETFs, so you can check your trading site Deepak to see if they show up in the list of securities you can buy or not.

hi pls tell me how can i, invest 1st time in ETF gold,………..

You can buy an ETF just like you buy any share Anurag, so if you have a demat, and a trading account through which you buy shares, you can use the same thing to buy ETFs also.

Hi Manshu, Your blog is very informative and a guide to many small and early stage investors like me. I am planning to invest 60- 70 Krupees every month and out of that I am planning to buy 2gms gold every month and 1/2 kg silver per anum. And may go for some IPOs rarely. So as an early stage investor my annual investmentdoesnt cross 1 lakh and I maynot go for trading the shares very rarely. Right now I dont hve any Demat and Trading account. So based upon my portfolio which tading account you suggest me now.

Please let me know your suggestion ASAP, coz I am planning to execute my idea from this newyear 2011.

Thank You,

Rama Sudheer

So, you’re talking about opening a trading and demat account? Well, if you’re going to just buy bonds, and gold then with your amount I don’t see a need for you to open an account because you can buy bonds in physical form, and for gold coins you don’t need an account anyway.

I hope I understood this correctly Rama – please leave a comment if I didn’t.

I dont want to buy gold coins, I want them in ETF only because I want to transform into cash at any point of time. And there is a chance for me to trade aswell (in the future), so out of your experience, for a early stage investor which account would yor suggest?

SBI is something that’s cheap and reliable so that might be a good bet for you. Although there are several other trading and demat accounts I feel that your trading is not going to be much, so you are not likely to run a lot of commissions, and may look into SBI.

You can always check with the bank that you currently have a relationship as well because then that makes things a little streamlined and easier to manage.

Dear Rama,

We would suggest to look at E-Gold and E-Silver as an option if you are looking for a better option to INVEST and also TRADE in FUTURE. They are traded on NSEL and are 100% backed by underlying Gold or Silver. Their rate are more near to the Physical Gold and Silver price. You can buy as low as 1 gm of Gold and / or 100 gm of Silver, which is the minimum qty available for sale/purchase. You need to have a Demat account to Store and trade.

Unlike GOLD ETF, It doesn’t depends on other factors like how much expenses the fund is charging investors, and the tracking error, which is how efficiently the fund is tracking gold prices.

It is more like direct investing in Gold and Silver but in Electronic form, easier to keep, safe and trade.

I have heard its better to have term insurance & investment separately rather than ULIP plan having both this together..Any specific reason for same ??

Is it advisable to Have SIP in gold ETF , if one is looking to build this asset for future purpose as well as return ?? What is difference & more advisable to invest in terms of returns i.e Gold ETF v/s Gold Mutual Fund ??

Hi Manshu,

I am new to Gold ETF. I want to buy Gold ETF units. I have a demat account in Shriram Insight. So How can I buy the gold ETF funds from there. Is that similar to normal equity shares kind of thing.

Please reply me for the same

Yes, buying gold ETF is exactly the same as buying a share, so if you have done that before you can do this the same way. Just find the code for the Gold ETF in your system and you can buy it the same way you did the stock.

what is teh advantage of buying gold thru ETF? As it will always be less than market price because of teh expense cost incurred?

It will be a lot easier to sell when compared with gold coins because when you go to sell a gold coin the jeweler usually deducts anywhere from 2 – 5%.

Thanks Manshu for your quick response. ll check that link.

You’re welcome, appreciate your reply, and I’ll see if I can myself write something up for the future.

Hi Manshu,

Very good n useful information….I’m a NRI..Would like to invest in Gold ETF…How will I invest in ETF from abroad. Can you please throw more light on it…

Thanks VJ, I’ll try to write about that topic in the future, you can take a look at this link from ICICI Direct to get started though – it has useful info. You can use any other broker of your choice; I am just pasting this link here because I knew about it.

http://content.icicidirect.com/mailimages/ETF%20FAQ.pdf

I am an investor, and normally trade in shares only. But If i go for Gold ETF, which company can give the best returns of my investment. Though Gold ETF price is directly connected to the price of Gold, but i want to know which company has the lowest charges.

Gold BeeS is the one with the lowest charges Amit.

Very good information provided, but still not sure for which ETF should I go?

I want to start SIP of ETF , Pl suggest some fund

Well Amit, I guess the question is why you want to start a SIP with an ETF? Normally people buy ETFs as a way to buy the underlying gold or index or oil or some other asset like that.

What is your goal with this?

Very good information about gold ETFs. i want also same informations about SILVER and also want to compare which one is best from ‘Return on investment’ point of view gold or silver

Sunil, there are no silver ETFs currently trading in the Indian market. There are other ways to get exposure to silver mentioned here: http://www.onemint.com/2010/04/15/silver-etf-in-india/ and a commenter has left a comment stating that if you have foreign stocks enabled in your trading account you can get exposure to US Silver ETFs from there also.

I also have a post this week about some more investing options in silver, so that will give you some more ideas. As for historical returns – I’ll look for information, and see if I can create a post in the next week or so.

Hi

Can you pls tell me if there are any fund houses that run a fund on gold along with shares of companies dealing with gold (mining,jewellery etc)

Hi Swaroop,

There is only one listed gold mining company – Deccan Gold Mines Limited in India, but they aren’t profitable yet, and haven’t started gold mining as well.

Hutti Gold Mines is the only company in India that mines gold but it’s not listed.

Given this fact – there is a DSP Blackrock World Gold Fund that gives you exposure to global gold mining companies, but not local ones.

You can read details on gold mining here:

http://www.onemint.com/2010/10/10/gold-mining-in-india/

hai iam new invester in gold etf iam planing to by physical gold for use but i dont have that much many so i planed to invest sistamaticaly any gold etf for 5 years than i will by physical gold so please give me good and low expansive and safe gold etf fund details thanks waiting for reply

Koti, GoldBees from Benchmark is a gold ETF you can buy. You might know this already, but I thought I’d just note that you can’t exchange the ETF for physical gold, so when you buy gold jewelery eventually you will have to sell the ETF, get cash and buy physical gold.

Dear friends ,can anybody help me to mention to invest in GOLD ETF in SIP form with NAV @Rs 10.I mean new ETF funds avilable in the market.

Hi,

Besides considering the aspects like expense ratio & volume do we have to also consider reliability of the fund as well, meaning

1) Are all the present Gold ETF’s in india reliable? or is it suggested safe to buy Gold ETF’s only from funds like UTI, SBI, HDFC, ICICI, Kotak.

2) Can any listed Gold ETF fund in NSE get de-listed? if yes, then what happens to its investors?

Cheers,

Amrut.

Hi Again Amrut!

1. Gold ETFs in India are supposed to be backed by physical gold, so that should give you some comfort as far as the underlying asset is concerned.

But you will read a lot of threads online that say there is actually no gold and other crazy scary stuff like that. So if you trust the regulator then the reliability itself shouldn’t be a differentiating factor.

2. I don’t know of any gold ETF that got delisted in India, and don’t know what would happen. However, in the US, it is quite common for ETFs to delist, and most commonly I see that the investors are paid the closing NAV less any costs that are there.

One last word Amrut – there is always the option of buying physical gold if you are not comfortable with the paper product.