Reader Allwyn wrote to me a few days ago inquiring about books, and websites that help people get started with investing, or if there was such a series here on OneMint, and since there is none, and it is such a great idea – I thought I will write one now.

In February this year, I wrote a post about 5 factors you should think about before you start investing, and to me that’s really the first post in this series.

Before you start investing, you need to develop some prudent financial habits so that you have enough savings to actually get started with investing.

Here is a quick recap of the five points:

1. Pay down your education loan

2. Don’t get into credit card debt

3. Understand Risk (or at least think about it)

4. Invest in tax saving instruments

5. Stay away from short term trading.

If you haven’t read that post, then spend some time going through that and thinking about some of the things written in that post, and how they apply to your own life. Then come back, okay?

The next prudent habit that I can think of is to create an emergency fund. A lot has been written about emergency funds, and I don’t know that I can add anything useful to the echo chamber about it, so I will skip that step, and write about something else (I will write about it or link out to other useful posts about emergency funds later in the week).

Now let me write about some boring but important stuff.

Diversify

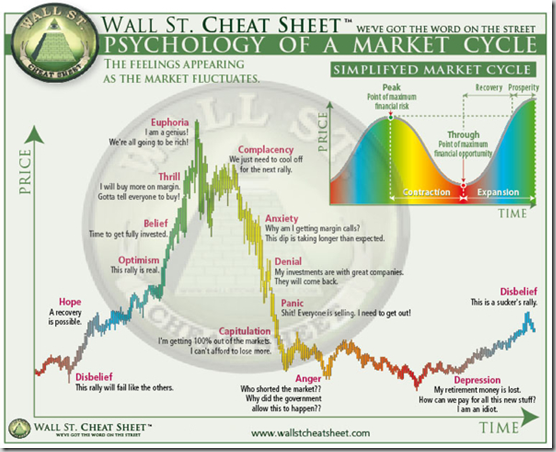

A few days ago I reproduced this amazing info-graphic from the Wall Street Cheat Sheet, and as far as the Indian markets are concerned I think we are somewhere between Optimism and Belief.

There are a lot more people interested in the stock market than when it was really down, and people are wondering where to invest their money once again, as opposed to just stuffing it in their pillows or putting it in fixed deposits.

If you are a first time investor, then there’s probably a very strong urge to invest in the stock market, and with every rise in the market, you might feel that you are missing out on the rally.

You must remember though that the market moves in cycles, and if you are starting off now, then you don’t want to put all your money in the stock market at one go, and risk losing all of it if the market crashes.

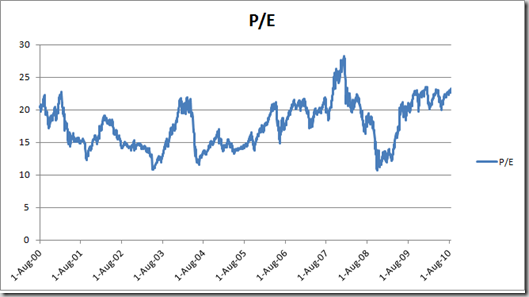

Here is a chart of the P/E multiple of Nifty for the past 10 years, and that shows you how we are at one of the higher ends.

Now it can certainly happen that the earnings of Indian companies grow consistently in the next few months or even years, and that you don’t suffer a crash at all, but it is better to diversify your savings between safe instruments like fixed deposits, and risky instruments like mutual funds and stock market, and reduce your chances of getting screwed.

There are several factors that influence how much money you put in stocks versus fixed deposits or bond funds, but the first thing is to make a decision that some of your money will find its way into safer instruments like fixed deposits.

If the recent rise in the stock market is tempting you to go all in, and put all your money in the stocks, then resist that urge and decide to take a diversified approach.

This is certainly the boring way to go, but one that protects you in case of sudden market crashes like the ones we are only too familiar with.

Diversification is key to building long term wealth and a profitable portfolio, and an idea that you should understand and embrace early on in your quest of investing knowledge.

I will write more about diversification in a later post, as there are several factors that affect diversification, and it merits an entire post on its own right.

In the meantime, please leave comments to let me know what you think about diversification, and also about the topics that should be covered as part of this series.