I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

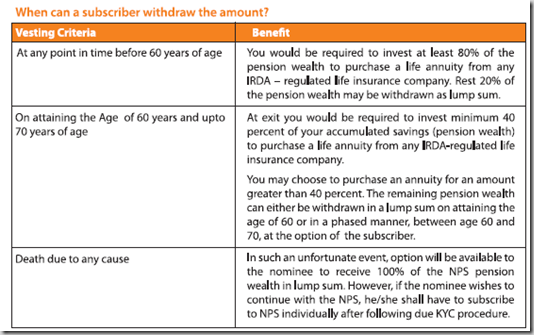

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

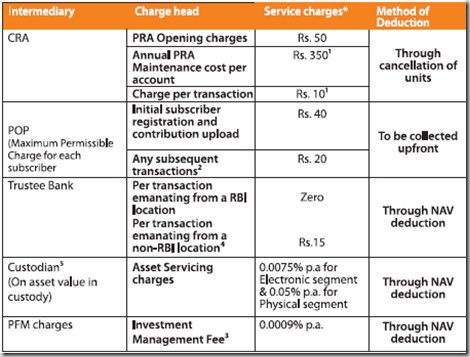

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

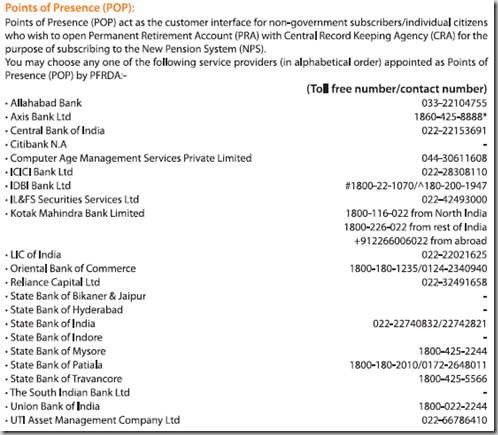

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

I have few questions

1) Is Tier 2 account allowed now or not? I read many articles about this NPS and could not locate any benefit in Tier 1. Obvious choice for anyone is Tier 2. Is it not?

2) I am 34 yrs old, and if i start an NPS account now and contribute till I am in job (say 45 Yrs) !! ….And in my 46th year (without job) if I opt withdraw the accumated amount (Tier 2), what is the tax rate applicable? Pl note now I am in 30% slab, so effectively all my investments will save 30%.

In other case, if only Tier 1 is possible, what is the tax implication for the 20% allowed withdrawal? Please clarify

You need a Tier 1 necessarily in order to open a Tier 2 account, and have to invest a min of 6k per year in the Tier 1 account to maintain it before you can move on to the Tier 2 account. A lot of clarifications are expected with the implementation of DTC in the NPS scheme so if you’re not mandated to invest in it then it’s better to wait for them to come before you make a decision.

Thanks for the info you are providing through this forum. Appreciate it! May I know some examples of annuity investements with IRDA that is being mandated (at least 40% at retirement age)?

The annuities from LIC should be part of this.

Hi.. I am working now in a private sector. My age is 26. I have heard about the NPS . Kindly guide me which one will be better , Tier 1 or 2 . I have an annual income of 3.5lac. I want to start in a monthly basis please inform me how much i should invest ?

Hi, I am working for central govt from 2007, they are deducting Tier.I contribution from my salary but till now they did not give me PRAN NUMBER please tell me the procedure to get the PRAN NUMBER.

I’m sorry Shylaja – but I’m not familiar on how one goes about doing this in a government setup.

i want know about new pension scheme in detail plz..

Hi I want to know whole details, i am interested and wnat to know whole the scheme and what amount to be invested per month.

can you please provide my the right person and agent who has open my account in state bank of india for NPS.

Anil – this excel sheet has list of banks that can open a NPS account. Please open it and look for one close to where you are located.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

I joined Kendriya Vidyalaya in 2007 as a PGT Commerce but in 2009 I resigned from the Kendriya Vidyalaya. I was the member of NPS during that period. Can I withdraw the accumulated deposited money in my NPS account .

The restriction on Tier 1 account is that if you withdraw before the age of 60 then they will make you buy an annuity with 80% of your money first, so if you’re okay with that then you could withdraw it or else you will have to maintain the account for longer.

what to do on joining new job.will it continue itself or i have to give my previous details.is my new employer will seek new nps /pran no.?

i am abt 2 join new govt. job after 6 month gap in between my previous one.what should i do?as i don’t want to continue my previous nps a/c or PRAN

can i transfer myNPS/PRAN no. to my relative/dependents?

Hi Manshu,

Please provide me the details of buying 80% of annuity.

If i am wrong, 80% of total money in NPS account will be given as pension and remaining 20% as cash. But they are not providing it.

I have resigned from gov job in Dec,2008. But till now no money is returned to me.

Regs

Avneep

Sorry one typo is there..

pls read “If i am wrong, ” to “If i am not wrong,”

thanks

Hi Avneep,

They don’t get you a pension directly. They ask you invest 80% in an annuity from LIC or someone, and they pay out the rest of it to you as lumpsum. Also, this has to be paid at the time of retirement, and not resignation in the Tier 1 account, so probably that’s why they’re not giving you the money yet.

I had discussed this at CRA customer care. They are saying that policy to pay pension and lumpsum is not defined yet.

Once it will be defined then it will be paid.

Following is the response which I got from CRA:

Dear Subscriber,

This has with reference to your trail e-mail, regarding withdrawal of Tier I account. As per the guidelines for withdrawal stipulated by Pension Fund Regulatory & Development Authority (PFRDA)/Ministry of Finance (MOF), the subscribers can exit form New Pension System (NPS) on his / her retirement, resignation or death. * Retirement: On attaining the age of 60 years, a subscriber would be required to invest minimum 40% of his / her accumulated savings (pension wealth) to purchase a life annuity from any IRDA (Insurance Regulatory and Development Authority) – regulated life insurance company. A subscriber may choose to purchase an annuity for an amount greater than 40%. The remaining pension wealth can either be withdrawn in a lump sum on attaining the age of 60 or in a phased manner, between age 60 and 70, at the option of the subscriber. * Resignation: On resignation of the subscriber, 80% of the corpus has to be annuitized and the subscriber can withdraw remaining wealth. * Death: On death, the entire corpus of the subscriber will be handed over to the nominee of the subscriber.

However, the operational procedures for the withdrawal are yet to be finalized by PFRDA in consultation with MOF. Once they are finalized the offices will be intimated about the same. The withdrawal request should be routed through the associated PAO.

Further, if you are transferring from central government firm to another central government firm or within the same state government, then you have continue with the same PRAN Number. But in case of transfer from central government to state government/private sector or vice versa, you will need to deactivate the existing PRAN number and apply for the new one. For more information, kindly contact your nodal office or PRFDA at http://www.prfra.org.in in this regards.

Thanks & Regards,

Subscriber Care Group

CRA

Devendrappa K Nadavalamani September 28, 2011 at 10:50 pm

Your comment is awaiting moderation.

HI i am working as a probationary sub-registrar in gadag very soon will be posted to some other places, last month i have received my PRAN KIT in which i found my name is incorrect . my correct name is DEVENDRAPPA KARABASAPPA NADAVALAMANI, in pran kit it is written my sur name as NADAVINAMANI WHICH IS WRONG and may lead some problems in future so kindly tell me what is the procedure to rectify the same, and also i want to change nomination … KINDLY LET ME KNOW WHAT TO DO

PLEASE DO THE NEEDFULL IN THIS REGARD

WITH REGARDS

This is not the NPS website and no one can do the needful here – please call up your company to help you get this issue resolved.

I want to know about the NPS. my age is 30 years, agar mein aaj invest karta hoon aur har saal 10000 rupees deta hoon till 60 ( 30 years ) so my total invested amount is Rs. 300000 then how much i get pension after 60 years and if any misshapenning with me then how my family get the money back or what is the procedure for it.

Pratush – Please use the calculator on this site to calculate how much money will accumulate at the end of the period:

http://www.camsonline.com/PensionSystemServices.aspx

my father is a barber (hair saloon), he is 45 years old. if he credited 1000 ropees per month, then how much he get after 60 years old.

how to open the account, & where, i need complete details.

hooping the best.

thank you.

Vijay:

NPS will not pay pension directly. You will invest money regularly, and then they will pay a lump-sum at 60 years. This is more like provident fund payment.

This link has complete details on how you can open the account:

http://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

How much amount is required to invest in this scheme & for how many years.

Alo

9827239867

k

6,000 per year is the minimum for a Tier 1 account, and you can get the money back only at 60 years of age.

MAINE SUNA HAI KI AGAR HUM HAR MAHINE RS- 1000/- DEPOSIT KARE TO MUJHE GOV. SE KITNA MILEGA PER MONTH.

OR KITNE YEAR TAK ? OR HAME KITNE YEAR TAK MONEY BHARNA RAHEGA?

I am of 51 years age. If I invest Rs. 1000 per month for 9 years. How much I will get at the age of 60 and how to open account.

Please let me know.

Dear Madam – This site has a calculator that shows you how much money you can get. I calculated using 8.5% return and saw that you will get about 1.6 lacs at the age of 60.

http://www.camsonline.com/PensionSystemServices.aspx

Here is a very detailed post about opening the account that you can read.

http://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

New pesion system k bare me puri detail janna chahti hun, n uska procedure k kaise usme acount khulwana h or 1000rs kitni bar jma karwana pdega or pension kya har month milegi or kitne sal tak, n kon sa person eligible hoga ye acount khulwane k liye. Wating 4 rply.

Account khulwane ke liye aapko SBI ki branch ya kisi aur bank ki branch pe jaana padega. Is link pe sare banks ka address hai so jo ghar ke paas ho uspe jaake aap inquire kar sakte ho.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

6000 is the minimum every year aur aapko paisa 60 years of age ke baad milega. Ye paisa provident fund ki tarah milta hai matlab aapko ek lump sum amount milega and not pension every mont

You can also approach any Head Post Office of your area to open an NPS account,

You need to invest minimum Rs 500/- per month.

Any person between the age of 15 to 55 years can open an NPS account.

plz send ur office address

http://www.facebook.com/pages/New-Pension-System-India/192694610777605

i also want to detail of nps

IN NSP THERE ARE TWO WAYS TO CONTRIBUTE TIER 1 & TIER 2, SO WHETHER RATE OF INTREST SAME OR DIFFERENT ? & NOW MY AGE IS 23 YEAR AND IF I INVEST RS- 1000/- PER MONTH FOR 15 YEAR, AFTER THAT HOW MUCH I CAN GET ? , AFTER 15 YEAR CAN I WITHDRAW MY MONEY ?

It is different based on what plan you select.

Tier 1 money can only be withdrawn after 60 years of age, but you can withdraw Tier 2 money any time.

pl be inform me about age as on to day iam 52 plus how much i invest to get 10000 per month after my retirement 60 yrs and also the place where i open my account

thanks

This post has details on how to open an account:

http://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

NPS doesn’t give out a pension directly but gives you a lump – sum amount at retirement like the provident fund. Then you have to invest this amount (at least 40% in the case of Tier 1) in an annuity and remaining in an instrument of your choice to generate income. Today, banks give out about 10% or even more in some cases to senior citizens, so if you invest 12 lacs in a bank FD you will be able to generate 10K per month which is what your target is.

You can use this corpus calculator to see how much you will need to invest to get there.

http://www.camsonline.com/PensionSystemServices.aspx

I think it’d be about 8500 or so.

You can now days approach a Head Postoffice of your area to open an NPS account.

MAINE SUNA HAI KI AGAR HUM HAR MAHINE RS- 1000/- DEPOSIT KARE TO MUJHE GOV. SE KITNA MILEGA PER MONTH.

OR KITNE YEAR TAK ? OR HAME KITNE YEAR TAK MONEY BHARNA RAHEGA?

Aapko paisa milega after 60 years of your age. To kitna milega ye depend karta hai ki abhi aapki age kitni hai.

Paisa invest hoga in safe instruments to 8 ya 9% per year ka return aap assume kar sakte ho.

Is link pe aapko calculator milega which can help you in calculating the return:

http://www.camsonline.com/PensionSystemServices.aspx

sir,

if i want to close my PRAN account what should i do? wheather i need another PRAN for new job? if i quite my present job and can’t afford to maintain my NPS then what will happen .will it lapse itself?

You don’t need another PRAN. Its unique number, even if u change job, place, country. etc.

Hi

I understand after my repeated visits to SBI that you would have to download the application forms from the internet. Duly fill them and submit it along with your first contribution at SBI branches. Forms would be sent to Mumbai Zonal office for processing ( 10-15 days) then you would receive your NPS Accnt details. Subsequent contributions can be made online or at any SBI brancches quoting the NPS accnt no etc.

Now what the link to download these forms?? Can someone help here…

thanks

services are USLESSS at almost all branches of SBI in india they treat custmer like a dirt so try icici direct thats the best where everything is online nad seamless alternatively follow following link and fill online and take printout and send by courier to any 194 branches of CAMS

CAMS atfollowing link

http://www.camsonline.com/PensionSystemServices.aspx

Why not try another organization which is more responsive. Here is a link that’s got all the options where you can open the account.

http://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

i have a nps account with sib. can i transfer money from sbi a/c to nps a/c