Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

5. Which option has the highest yield?

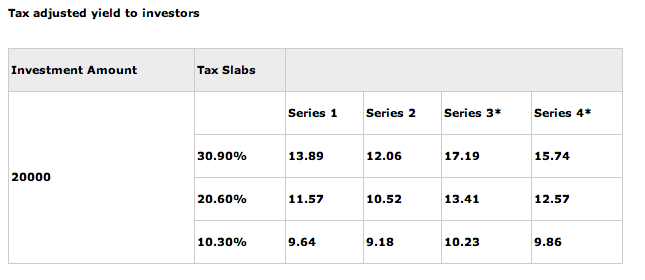

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

I have applied for IDFC bond . I have not got credit in my D- Mat account,there is no information about allotment of bond to me.From where I can get information ?

Its really late and you should have got them credited by now. Please contact your agent to see what went wrong and when you will get the refund. Also there is an IFCI bond of similar nature open for subscription right now that you can use.

Really good information. Thanks to all for the comments.

I have applied by submitting the pplication at ICICI bank. 15 Days back I was able to see the BONDS creditted in my DEMAT a/c. It is appearing only by icici.com( I have linked DMAT a/c with my savings a/c). I am unable to see the same info through icicidirect.com.

I spoke to karvy regarding physical form of the BOND, they told me that if we can apply in the form of DMAT, they will not provide any physical bond. Is this correct?

Are we going to recieve any Bond or document for tax proof?

Some other folks have been told that they can use the print out of the demat holding page if they haven’t received the physical certificate so you can also try using that Chinna.

Regarding the demat allocation at http://www.icicidirect.com, As the units are under Lock in period you would be unable to view the same. However, you would be able to view your holdings in IDFC bonds by following the below mentioned path.

1. Log in to http://www.icicidirect.com.

2. Click on FD/Savings.

3. Click on hyper link FD/Savings Demat balance.

Also regarding the document for tax proofs, IDFC will mail a physical allotment advice letter.

Thanks for your detailed response Brine!

I wish to purchase infrastructure bond for tax saving purchase.

I am residing in Dimapur Nagaland.

I have no demat account

Can I purchase & How?

The current IFCI issue requires a demat so you won’t be able to buy that without a demat. Maybe another issue in the future might come which doesn’t require a demat and then you can subscribe to that. So, that’s something you can watch out for. The only issue is that future issues might also need the demat account compulsorily, and there is no way to tell which way that will turn out.

I have applied for 4 nos of bond in physical form because i dont have any demat a/c. Till date i did not received the bonds. Although Karvy shows, that I have alloted the same. Can anyone tell me how to see the detailed allotment status or delivery status of the same

I don’t know of a way to look at the delivery status Sumit. Maybe someone else who knows better can answer your question.

I have applied for IDFC bond . I have not got credit in my D- Mat account, pl advice procedure to be followed to obtain Credit.

If you didn’t get the bonds then there was probably an error in the application, and please contact your agent to help you out on this.

Please let me know how to invest in infrastructure bonds?

Krishna, IFCI is the infrastructure bond that’s currently open so you can talk to your broker to see if they can help you buy this, or call an HDFC bank branch, and they might be able to help you as well.

Hi,

I have not received physical copy of my certificates. Anyone got the certificates yet????

Same here. I have bought the IDFC and L&T infra bonds through my HDFC demat. And know when i have to file IT proof i have yet not received the allotment letters from either of them, HDFC is also reluctant to help saying as a DP they are not authorised etc etc…..

Please does anybody know the references where to enquire about the allotment certificates for L&T and IDFC infrabonds?

Rohan,

For IDFC you can go to this link, input your application number, and get the scanned copy of the allotment advice letter:

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

For L&T you can use the following contact:

For scanned copy of allotment advice (L& T Infrastructure bond), you can write to ltinfra@shareproservices.com or contact them at 022 6772 0400/6772 0300.

Thanks to Shubho & Vinutha for sharing this info.

Thanks Manshu for this very important information. I was able to get my allotment certificate.

Appreciate the fact that you took the time out to comment Pankaj, and many thanks to Shubho who shared this link initially.

Great, I got exactly what I was looking for. Many thanks Manshu!

Awesome! Appreciate your response.

This helped me bigtime. Thanks for sharing this information

You’re welcome Prashant.

Got the Allotment letter stating that BONDs shall go to DMAT

Thanks for your comment Bharat. Appreciate it.

any1 applyin thru HDFC has gt da allotment cert?? plz lemme know as my bank is not able to tell anythng.am anxious

I check through this link http://mis.karvycomputershare.com/ipo/ my applilcation no, its showing me bounds allocated to me, but anybody have idea when I can get the Certificate for same ?

Even the same in my case. Let me know when I’ll be getting the Certificate for the alloted IDFC Infrastructure bond. When contacted the karvy computer share directly, they informed the physical certificates were dispatched through registered post on 15th Nov, but still i haven’t got any. Do you anyone have update on it.

Typo

My previous post should be

For those who applied for the bonds in demat form, no physical certificates would be issued. But, you will be sent a letter of allotment from Karvy Computershare, the Registrars to the issue, which can be used to claim tax exemption. Everyone should receive the letter of allotment within 6 weeks from the close of the issue according to SEBI guidelines.

Thanks Loney, that’s useful info.

For those who applied for the bonds in demat form, no physical certificates would be issued. But, you will be sent a letter of allotment from IDBI, which can be used to claim tax exemption. You can expect the letter of allotment in another 4 weeks.

Dear All,

I had applied in the physical form through idbi bank till now i dont know any status about the bond can any one suggest me what to do now or where to check the status

Regards

Dixon

Finally Received the Bond certificate through UPC on Saturday 20/11/10.

Cheers 🙂

Awesome! 🙂

Ajay,

Did you receive the BOND certificate after any follow-up with IDFC, or they are sending to everyone. I got 4 bonds alloted thru ICICI.

-Santhosh

if ur address was correct, you shd get bond advice through UPC post. Askur postman.

Have not Recieved IDFC bonds in Reliance DMat A/C. Although my Application# 41811529 on Karvy site shows allotment of 4 number. Can one help me where they are gone ?

Can you please let me know where i can see the allotment on kary website.

Finally found the link where the allotment status can be checked

http://mis.karvycomputershare.com/ipo/

had applied thru HDFC, yet to receive any certs 🙁 . the bank agent is also unable to say anythng.has any1 received the bonds in physical form??

I HAD APPLIED FOR 4 IDFC INFRA BONDS ON THE BASIS OF JOINT D MAT ACCOUNT WITH MY HUSBAND WHO ALSO APPLIED FOR THE SAME NUMBER.

WHILE 4 NOS. BONDS WERE CREDITED TO OUR D MAT ACCOUNT ON 13.11.10

THE STATUS OF THE OTHER 4 IS NOT KNOWN. IT IS PRESUMED THAT MY APPLICATION MIGHT NOT HAVE BEEN CONSIDERED BEING SECONDE NAME IN THE DEMAT ACCOUNT. IN WHICH CASE EITHER I SHOULD GET THE PHYSICAL CERTIFICATE OR REFUND OF MONEY. MY HUSBAND HAS ALSO NOT RECEIVED ANY COMMUNICATION FOR CLAIMING TAX EXEMPTION. PLEASE LET ME KNOW THE NEXT COURSE OF ACTION I HAVE TO TAKE WITH FULL PARTICULARS OF ADDRESS, PHONE NO, E MAIL OF IDFC CONCERNED DEPARTMENT SINCE MY MONEY IS LYING IDLE. PLEASE ALSO LET ME KNOW WHETHER FEW MORE BONDS ARE IN THE PIPELINE LIKE LIC, ETC.

I HAVE MISPLACED MY ACKNOWLEDGEMENT OF APPLICATION OF THE IDFC BONDS AND SEARCHING FOR THE SAME.

Dear Mrs. Lokamatha,

I’d say the next course of action will be to contact the agent / broker who sold you this and find from them if there was anything wrong with the form because of which your application has been rejected, and when you will receive the refund.

There will be future issues from IDFC and others of the same type of bonds.

Had applied to the IDFC Tax Free bonds through Enam-Axis Bank in the physical Form, but yet to receive any communication. Can anyone give a clue where I can get the Status

Had applied to the IDFC Tax Free bonds through SMC in the physical Form, but yet to receive any communication. Could any one update if anyone applying in the Physical form has recived the communication.

Thanks…

Hi,

Let me know if anyone has received the IDFC bonds in IDBI DMAT account, I’m still waiting 🙁