Update: Updated data for Day 4 now.

Day 1 of the MOIL IPO is over, and I thought I’d create a subscription numbers page like I did for the Power Grid FPO. MOIL is an IPO where no new shares are being issued, and the stake of the state and central government is being sold so the money raised from MOIL IPO is going to go to the state and the center government.

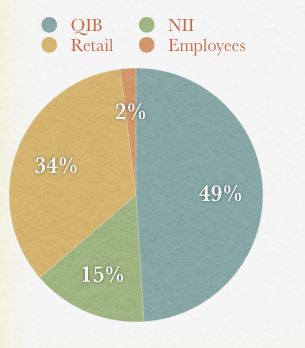

An IPO is divided into various categories like Qualified Institutional Bidders (QIB), Non Institutional Investors (NII), Retail and Employees, and here is how the shares offered are split amongst various categories.

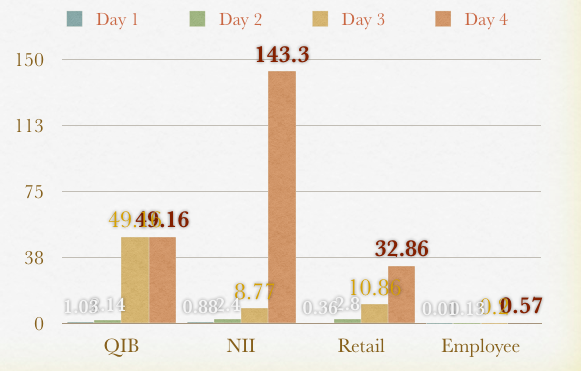

Here are the subscription numbers from NSE at the end of Day 1. I will update these numbers every day to get an idea of how the numbers move.

Update: Look at the QIB number zoom on Day 3, and looks like the retail number will also end up a lot higher than we have seen in the past. I will do a full post once the subscription closes, and update this with Day 4 numbers as well.

The green bar represents the second day from NSE. Usually you see QIB zoom up, and retail only grows on the last day but here retail is slightly higher than QIB on the second day. There are two more days left so let’s see how high the retail goes.

Also read other details about the MOIL IPO.

Hi Suprio,

I read your comment only now. Sorry for the delay in replying. There is only one way by which you could solve this problem and that is to convince the Registrar that your bank account number has changed. To do that, send your refund cheque along with a proof of bank account like cancelled cheque leaf that has your name or copy of passbook or bank account statement attested by the Branch manager to the registrar with a letter asking for correction in bank details. Alternatively, you can send the request through the nearest Karvy office so that you can follow-up with them (though they are of not much use).

Thanks Loney …i will find out the nearest Karvy Office and try to forward the details as mentioned by you through them.

Hello Loney/Manshu,

I had asked my broker to apply for MOIL IPO as i was out of station at that time, and he wrongly put in the demat account details of my old depository account which i have not been using for long time. This depository account had a bank account associated which has been closed long back. Now i have got the refund order with this Bank account number printed on it. My current bank is not accepting this chq. Can anyone please suggest what is the process to be followed. I have sent a mail to the registrar but they have not yet responded.

Regards

Suprio

I’m sorry Suprio, but I don’t know that answer to that.

There is only one way by which you could solve this problem and that is to convince the Registrar that your bank account number has changed. To do that, send your refund cheque along with a proof of bank account like cancelled cheque leaf that has your name printed over it or a copy of passbook or bank account statement attested by the Branch manager of your bank to the registrar with a letter asking for correction in bank details. Remember to keep a copy of the cheque and the letter that you have sent. Remember to send the cheque by Registered Post and keep the receipt in safe custody. Wait for 20 days. If there is no response log onto SEBI Investor Grievance Redressal stating the full detail.

http://www.sebi.gov.in/Index.jsp?contentDisp=SubSection&sec_id=38&sub_sec_id=38

Goto Customer Complaint Forms -> Type – I

Check

Duplicate RO after correction

and

Duplicate RO for correct bank details

hey guys …..i have a query regarding inflation. i would appreciate if anyone could answer……..

here it is…

as of now i don’t know how much cash reserves indian government have, how much they generate through taxes….but somehow govt. is running our country.

our economy is doing well…

let’s assume that from somewhere indian government get some trillion dollar package.

what would be its effect on the inflation and to the whole economy? after all its huge money…..

This is actually quite an involved question Saurabh – but in general printing more money is a way to stimulate demand, and raise inflation. However, this is not always the case as you would have read that in the US they have done a second stimulus worth 600 B USD but still unable to raise inflation by any meaningful number.

More money chasing same amount of goods in an economy will generally lead to inflation, but this is quite an involved concept, and there are several exceptions to it as well.

This post that I wrote a couple of years ago might get you started on understanding the relationship between the various factors a little better.

http://www.onemint.com/2007/04/27/of-exchange-rates-interest-rates-and-inflation/

There are two reasons for inflation

1. A mismatch in demand-supply ratio.

2. Excess Liquidity in the system.

Inflation due to demand-supply mismatch cannot be corrected by any means. If there is excess supply and less demand, the prices will drop and there will be deflation. If there is supply side pressure, prices will rise and there will be inflation.

Inflation due to excess liquidity can be either due to

1. Loose monetary policy (Pumping in liquidity by keeping the printing press running).

2. Near-zero interest rates. (If the interest rates are near zero, people donot park their money in FDs and this money seeks various assets and prices of assets starts to rise. Prolonging this situation may lead to assets bubbles across various asset classes.)

Now, coming to your question, whatever be the money the govt. gets it doesnot find its way directly into the system. It just adds up as the reserves of the government. Only when government spends on various projects, this money gets into the system.

To top it all, we have a watchdog in RBI, which takes stock of all the factors affecting the system in its Quarterly monetary policy. If RBI senses excess liquidity in the system, it has a range of ammunition at its disposal.

1. Statutory Liquidity Ratio

2. Repo Rate

3. Reverse Repo Rate

In addition to these, RBI may curb lending to certain sectors and make capital dearer thereby easing inflationary pressure. With these ammunition, central banks can deal with inflation.

The case with US is that the Fed has lost all its ammunition (since the interest rate is already near zero and it cannot be reduced further) and therefore it is struggling to keepup inflationary pressures intact and its economy is losing steam time and again even after repeated influx of huge doses of liquidity and this liquidity is finding its way into our economy and thereby giving all sorts of head ache to the RBI.