The SCI FPO dates and pricing are out; in fact the first day is already over, but there hasn’t been much activity on the subscription front probably because people were too busy with the MOIL IPO.

SCI FPO Price Band

The price band has been fixed between Rs. 135 and 140, and the EPS last year was Rs. Rs. 9.29 which was down from Rs. 22.66 EPS in 2009, and Rs. 17.82 EPS in 2008.

The stock closed at Rs. 143.65 on the NSE on Tuesday, which means that a price of Rs. 140 is not all that attractive for people. The subscription numbers are pretty low but that could also be because this is the first day, and the other disinvestment IPO – MOIL has generated a lot of interest today.

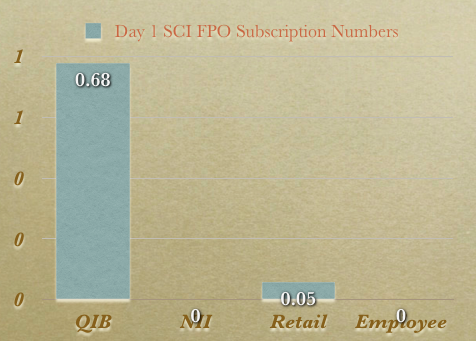

Here are the subscription numbers at the end of Day 1 of the SCI FPO. I will update this post with new numbers as each day progresses.

All data from NSE.

Also read the detailed SCI FPO post.

SCI on 11/Feb, down to 107, any views on this? I hold quite a lot of shares in this from FPO. If I have to hold for good 10% return (say 150) how log to hold? is SCI a good company to hold for long term?

No, I haven’t looked at the stock after the FPO at all, and beyond what’s written in the post I don’t have anything to add Sree.

Just an update SCI FPO “Subscribed 4.92 Times on Last Day, Retail 4.53″…good figures after a luke warm response on first day..

Wow, that sure shot up!

I think this is an attractive FPO…i have looked at the trend and what i found is stunning..the average price at which SCI is traded is Rs 162…and the same share company is offering at the price band of 135-140..Trust me investors will get the FPO for 136-137 (considered the discount too)…as not many people are intrested and subscription is low..the current price at which SCI is trading is Rs 144.15…so on 1 share..investor can easily make Rs 7-8…but we have to be patient till January..I think it will start trading at the price of Rs 159-Rs 162 by that time..which means profit of Rs 18-Rs 19 per share in 1 month…if you people look at PowerGrid Corp…then same thing happened..it was trading at Rs101 and the moment EGOM announced the price band of Rs 85- Rs90…the share price came to Rs94..same thing has happened with SCI too..lot of us have hopes of making money through MOIL..trust me Retail investors/people.. nobody will get more than 40 shares (look at the subscription)…which shrinks our profit making opportunity…if somebody is looking at making profit in short run..then SCI is the real opportunity…Am i too optimistic??

MS, this type of punting is really dangerous to building long term wealth, and is best left to traders who devote their entire life to that profession.

For regular investors it’s better to stick to index funds, or mutual funds, and if you must invest in stocks then do so only in companies that are fundamentally sound, make good products, and that you believe will do well in a 5 – 10 year time frame.

Personally, I discourage this type of speculative discussion here, but you can go to Moneycontrol message boards, and I’m sure you will get a lot of people to opine on your analysis.

Thanks.

Sure Manshu..even i believe in long term investment..my views were for people who look forward to making gains in short term..and yeah I was not aware of the protocols..will take extreme care from next time.. Thanks 🙂

That’s great to hear MS. I see a lot of message boards where people are coming up with price targets, and days and months in which the target is going to be achieved, and recently there is this trend of people receiving SMS about stocks from unknown people, and the amount of info out there which is absolute crap just amazes me!!!

I’d like this site to be useful to people who are interested in disciplined investing, are smart about their money, and are not fly by night type of punters, so that’s the only reason I made my request to you. I’m glad to see that so far the audience on the site does consist of helpful folks who are obviously smart about their money, and I hope that can continue in the future too.

I have bidded for 3 lots/150 shares @ Rs 140 (don’t want to loose on this one..so bidded at the cut off price)…response is luke warm on this FPObut looking at the figures company has been profitable and looking forward to invest in good ventures (buying new fleet)..lets see how it shapes up…

All the best MS – since you are so obviously interested in the stock markets, I’d recommend you read One Up on Wall Street by Peter Lynch. It is a great investing book, and will help you in the long run for sure.

Thanks alot Manshu..will definitely grab a copy of it…nowadays i am occupied with Tipping Point..

Are you enjoying it? If you liked it, you can look up Malcolm Gladwell’s column in New Yorker Magazine also. Sometimes there is some really good stuff from him there.

I am just amazed at the examples which author took to explain his points..will definitely try to catch up with his column..nowadays I am closely following the views of Dominique Strauss-Kahn (MD-IMF) on Greek and Irish issues, emergence of India,China and Brazil (Inflation) and probability of Montek Singh Ahluwalia becoming the chief of IMF

Hey MS, I started a contest where you can win a copy on this book….you can enter it if you’re interested.

http://www.onemint.com/2010/12/03/win-a-free-copy-of-one-up-on-wall-street-by-peter-lynch/

Thanks alot Manshu..