Every morning I wake up to at least one email or comment from someone who gives out their mutual fund folio number and wants me to send them their statement.

I used to reply to such requests explaining why I can’t send it to them and what they should do, but I have stopped because I never get a response back, and when I do, it is from people who fail to understand why I can’t send them their statement.

It is a little disheartening to see how so many people lose track of their investment, and lack the means to track it back or understand what’s going on.

I was going through a few such emails last week, and in exasperation I wondered if anyone is making any money on stocks at all. If people can’t even track their mutual funds, how the hell do you expect them to make any money out of these beasts?

It was with such depressing thoughts that I wrote my post about most people losing money in the stock market. At that time I expected the response to be largely negative, but to my pleasant surprise, more than half the respondents said that they have made money in the stock market. If I were CNN, I would have told you how un-scientific this poll was, but I expect OneMint readers know that already.

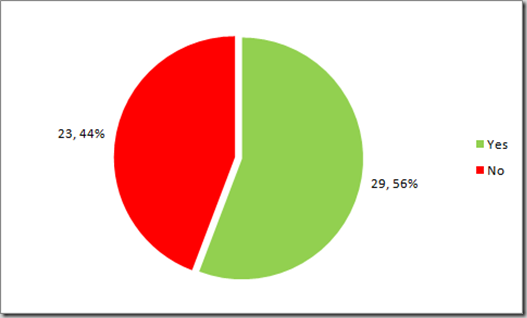

The results still make for an interesting reading, and here is a pretty little pie chart that summarize them for you.

There were some pretty interesting comments on the post too, and they are definitely worth a read too.

I am happy to see that things are not as bad as I expected them to be, and the fact that we are in a up – market certainly helps too. I’d like to follow up on this poll, and invite you to share your story of why you made or lost money in the stock market, and how you would have done things differently, or what you would have wished was different. Kind of like Patrick’s comment who lamented the high brokerage cost, or Tony’s comment who took better control of his own money, or Pallavi who goes the way of MF systematic investment plans.

Leave a comment or send me an email.

I’ll start off with a couple of my own thoughts.

First off, I never go after something which everyone else is interested in. I lost some money in the dot com crash, which was my first experience with the stock market, and then I saw people losing money in the real estate crash, I know a lot of people who lost money on IPOs, and I wonder if the same is going to happen with gold someday. I feel that by the time something gets popular enough to interest the ordinary investor, the party is already over.

This is probably overly simplified but over the years, I have found it very difficult to invest in anything that is popular. For example, gold is popular now, and although I write a lot about it, I am not invested in it at all.

Second is day trading or getting into something with the prospect of making a quick buck. To Patrick’s point, getting in and out ensures that you incur a lot of costs, and they eat into your profits, and in general it has never worked for me, and I don’t think it ever will.

So, in summary, my own experience and mind – set tells me to stay away from popular investing themes and frequent trading.

Your turn now! Leave a comment or send me an email.

In your article you have mentioned “leave a comment or send me an email”, but what is your email address?

Use the contact form, for any emails, but this article is dated so there is not much point in sending anything now.

sorry…. i thought that was “dot” and not “comma”

Hi Manshu,

How come the pie chart percentage do not add up to 100%?

The absolute numbers are 23 and 29, and then the percentages are 44 & 56. They do add up….