This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

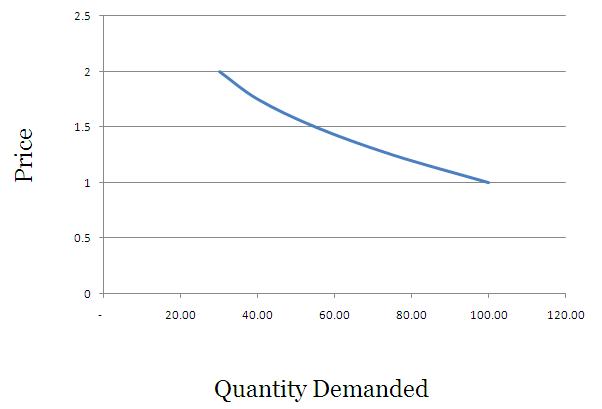

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

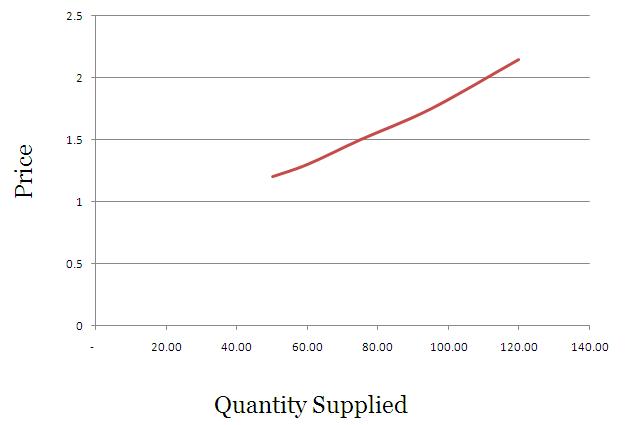

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

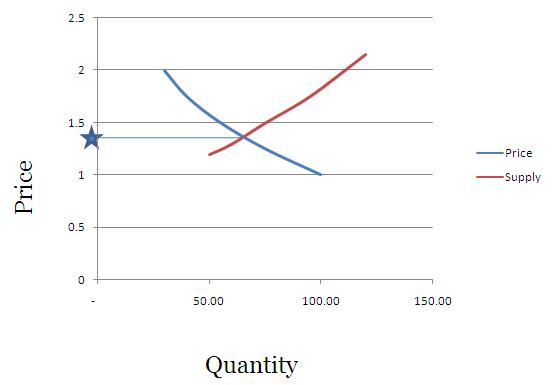

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

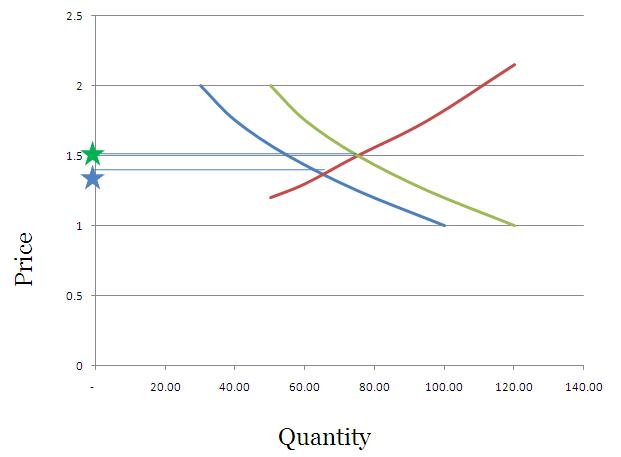

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

Good article. Can you please give me a source that our currency is not backed by gold? Some questions:

1) I saw a movie “money as debt” which stated that bank loan money out of thin air by just feeding the numbers into account and after receiving payment account is terminated and it’s all bank’s profit. Is it true? It said that the debt will be perpetual because loan creates money and since everything in circulation is principal, there is no money to pay interest. Refer to this

http://www.moneyasdebt.net/

2) If we were able to produce as much currency as we want, what was the need of external debt? And can’t we print too much inr, convert to usd, and pay all our debt?

3) If currency has no value, then what determines the total wealth that our country have?

4) Is the value of currency determined just by demand? Does it mean that demand of usd is 45 times that of inr? If not, what determines its value?

Thanks.

1. I haven’t seen the movie and am not inclined to read about the movie and answer your question. However, from what you say it sounds fiction.

2. Foreigners they don’t accept INR and we import from other countries.

3. We will become Zimbabwe if we were to flood the market with INR. As I’ve written above only countries like Japan or Switzerland who have demand for their currencies can afford to print more and be stable.

4. Currency has value – saying that currency is not backed by gold doesn’t mean it has no value – it means the value is not based on the price of gold. The various currency values are determined by the forex market trade on the various currency pairs.

5. No it’s not 45 or 50 times of that – but it is the demand and supply which is more complex than saying X is 50 times Y.

For the source – you can Google this up yourself and I’m sure you will find numerous articles on the topic – you can stop when you find something that looks authoritative enough.

Thanks for answering.

If you don’t want to watch the movie, read this article which is also about the same subject and please tell me if it is true or not. It is about banking system of USA, but I want to know if it happens in India.

And what I was saying is that can’t we print required inr to pay debt, convert it to usd and pay the external debt? What will stop us?

Thanks

Buddy – the issue with this is you are trying to understand a very complex system with just a movie scene! That’s not wise at all. You will be misinformed if you go that route. All modern economic systems use what is called fractional reserve banking and you should google that up to learn about it.

Please don’t rely on movies to understand economic systems – it will do more harm than good.

Yeah, I know Economics is complex. I will devote some time afterwards because currently I am preparing for 12th boards. But economics interests me because I read somewhere that it is made complex so that less people understand what is going on.

Thanks.

All the best for your boards and do some solid reading after your exams get over. I would suggest going through Wikipedia and then clicking on the footnotes and reading those papers to get a better understanding of this. That will be a lot better way of understanding these things instead of the method or movies you’re following right now.

You can’t print money to pay debt because you have to buy the USD from someone willing to sell it and that person / institution will not be interested in selling you his dollars for INR if you flood the market with INR and devalue the INR.

A great way to learn about this and understand this is to read about what happened to the Zimbabwe dollar on this link http://en.wikipedia.org/wiki/Zimbabwean_dollar

Also, you need to keep an open mind about this and understand that if the answer to our problems were as simple as printing money then it would have occurred to the thousands of brilliant people working on it and they would have done it already.

That is the coolest thing about economics. Nothing is fixed. What someone is willing to pay, becomes the value.

It seems there was some problem as I was posting from mobile and the link didn’t come through. This is the article I was talking about. Please tell me if it happens in India.

http://www.hasslberger.com/economy/money.html

Thanks.

My question is about black money supposed to be stashed away in swiss banks. if it is true, why can’t we print new currency equal in value to that hoarded and put to circulation. if your answer is inflation ,then the question is even if the original black money were recovered from swiss bank and circulated won’t it inflate our economy like the new currency?

I have a same concern and can think it might have to do with agreement between countries . I know the answer won’t be simple or RBI would have already taken action.

Manshu any thoughts on the question by Venkat

This is a weird notion and I don’t know how you think this will do anything at all – The thing with black money is that tax gets evaded and the government then gets into a deficit for which they have to borrow money and financing that deficit leads to inflation. Printing money equivalent to lost revenues doesn’t solve anything at all – the parallel economy with all the lost revenues is still there and in addition to that you want to just create more money out of thin air!!!

Please appreciate the fact that every time more money is put into circulation – currency loses its value because there is more supply of the same thing. Printing money is not the solution to anything – it will make matters worse.

There is a lot of scary talks about Greece debts and defaut.If you read them you will think the financial markets and the world will end tomorrow.I have so far not seen any news about the exact implications in Rupee terms if the Greece Govt is unable to meet it,s monetary obligations. Has any such specific study has been done particulaly with reference to INDIA.? if so, may I pl.have referene to any web site where this info is available?I dont want vauge jargons.I want anaswer in specific Rupees, pl.

No, there is no such study.

That was quite insightful I guess I had missed this post earlier!

This is a pretty old post so I wonder how you reached here after so long?

i need some more time to do my reading before i post my comments.

i still some more reading to do before i post my comments.

Manshu

you say that the money is created out of nothing.OK.But,how does the money reach the common man?

This is a great question, and the idea / assumption is that when you get all these funds to the banks they will then loan it out to people to start businesses, buy houses etc. and stimulate the economy through the flow of credit. Now, that didn’t happen so much in QE1 because the banks were afraid of their own balance sheets and would much rather keep the cash with them than suffer further credit losses.

Thanks Manshu for your prompt reply.

I got one more question. When Federal Reserve start printing $ using the program QE, I know they actually add some zeros on their balance sheet and expanded it. Shouldn’t the money come from somewhere.

Did they actually auction off some treasury to get the money to put onto the balance sheet or they simply add the zeros?

What they do is buy securities through the various primary dealers and what they buy depends on each round. So, as I remember QE2 was mostly govt. bonds from the private players which was sold to them in an auction, while QE1 was MBS and other assets that they took from the bank’s balance sheets to their own.

This money is newly created money, and they do create the money out of thin air or out of nothing.

Manshu thanks for your reply it is very useful.

Is there any agency to keep track of the Dollar created?

I think it is pretty hard to monitor the money supply created.

Or we simply trust the statement on the Treasury Balance Sheet.

I think they are fairly trustworthy 🙂

Japan been trying to devalue Yen to become competitive, isn’t printing Money a easy solution?

only if there is demand for your currency, else you will face the fate of Zimbabwe.

tks mansur

I think India pegs its Rupee to the Dollar, thats why the Rupee falls when the dollar falls.

Also India’s international debt and export income comes in dollars, not in Rupees.

Officially India stores its Forex in dollars, so the more dollars we have the better, any thoughts?

Rupee peg to Dollar means a constant USDINR exchange rate, which is not the case for India. The exchange rate can vary as much as 20 – 25% in a year. There is no such thing as Rupee falls when the Dollar falls. Usually when someone says rupee has fallen that means it has fallen against the dollar so by definition they move in opposite directions.

India primarily holds USD as its reserves but that’s not the only currency, it holds other assets also like JPY, EUR, Gold etc.

But in general yeah, the more dollars you have the better it is.

Since most of the countries peg their currency against the dollar, cant the us simply get ricer by printing more dollars, since there will always be a need for it. Especially since the import/ export of most countries are in dollars.

That is not true – Arun – most countries don’t peg their currency to the USD. From the top of my head I can only think of China that maintains the peg, and in order to maintain the peg – they have to buy huge quantities of US bonds which only they can afford.

To the next point, they can’t simply print more dollars because that will flood the market and people will then move on to other assets like Swiss Francs, Japanese Yen, Euro? and even gold.

What is the source data which tells the Govt of India to print more notes?Who decides,Finance Minister or RBI? How do they decide the quantum of fresh notes to be printed?

RBI does this, and at least theoretically the government shouldn’t have any say on this. Monetary policy is to realm of RBI who targets inflation rates and uses the current inflation rates,economic conditions and other factors to decide that.

Good Article! amazing stuff you have written here! I have learned something today that I had never known before. Now I can actually sit in a gathering and discuss this topic because I know something 🙂 thanks

That’s a wonderful comment and great to know that – thank you!

thanks for the nice article…still some questions remain in my mind.even thiough you have said many factors decide the amount of currency a nation can print you have not mentioned them.could you at least suggest some links where i can get more information.

There are several great articles that explain this, but I don’t know of a single one that covers everything comprehensively. Use this Google search link to go through some of the documents you see listed there.

http://bit.ly/oYP9tW

Hi Manshu,

I think apart from the informative write up there is so much more to learn and understand further from the comments. Thanks.

I found the interview by India Together’s Subramaniam Vincent with Dr. Narendra Jadhav @ http://www.indiatogether.org/2005/dec/ivw-jadhav.htm very informative on the currency, inflation and other aspects.

Dr. Narendra Jadhav is presently serving as Member, Planning Commission, Government of India in the rank and status of Minister of State.

Very nice article Raghu – thank you for sharing.

Hi Manshu, Nice post. have been trying to figure out the same like many other readers. A couple of queries.

1.What do you think, is the reason for the current inflation? Is it the increased consumption because of the growing populatio, and hence, greater demand and hence, rising prices? or is it the amount pumped into the economy by the present Govt thru’ NREGA scheme and other measures? or is there some other reason to it as well? or is it a combo of several factors (as is usually the case)?

2.By increasing the Bank FD rates and Home loan rates, i understand that the RBI is concerned about overheating of the economy and is trying to make the citizens reduce their consumption and push their money into the banks. As this will be mostly affecting the middle and upper classes,

a.What will happen to the lower socioeconomic groups who are not bothered abt a house right now? Do they have to wait till the effect of these measures come into effect and the prices cool down?

b.If inflation were to be explained in such supply, demand, consumption terms, is it possible to have a Standard Operating Procedure whenever the situation demands it (apart from these rate hikes)?

c.Is increasing production, cutting down on losses, more efficient management practices, clampdown on hoarding other measures to deal with it? If so, have we exhausted these options?

My views may be too simplistic…. I am just learning…. Please excuse me for the same if it is silly!

Great questions Vijay – and let me try to put forth my perspective on them.

1. It started out with food inflation for sure, and that was the cry from RBI for much of last year and this year as well. In fact Dr. Subbarao had himself pointed out that structural issues are causing food inflation, and there is not much monetary policy can do to fight this last year. Well, not that it can’t do anything, but the main culprit was food inflation, and that’s due to structural issues. However, things started to change this year, and the monetary policy this year referred to a survey called OBICUS which measures the capacity utilization, and that showed that capacity utilization in 17 out of 22 sectors has increased. So, you have a situation of growing aggregate demand and to slow that they use policy measures which is to increase the interest rates – that’s when they increased the REPO rate from 7.5% to 8.00%. This year they also referred to something called “generalized inflation” and said that the food inflation is now showing up in other places as well.

So while it is a combination of everything, as far as my understanding goes – I think food is where it all started, and is a key to resolve the issue as well.

2. RBI increases its REPO rate – that’s the rate at which banks can borrow from RBI, and in turn that increases all the rates – now this affects housing loans, personal loans and all that, but it also affects rates at which companies can borrow which then slows down investment and reins in aggregate demand. So, the rate hike is not only targeted towards home buyers, but also towards the industry, largely towards the industry in fact.

About standard operating procedures 🙂 yesterday someone tweeted out that based on where you went to school you can have totally different views of economics 🙂 what he meant was that there isn’t consensus on treating the economy in the right way. There is extremely bitter debate and you can’t really think of economics in the same vein as you think of Maths or Physics. So, there is a lot of opinion there.

About lowering inflation – my views on this are very simplistic viz. you have this situation where food rots and people go hungry, and that’s because your storage infrastructure is nil, and the PDS is broken. How can you progress without fixing this situation? It’s not just food inflation, I mean its not just a number, this is a serious thing that affects people at every level. You have statistics where you have malnutrition among Indian children worse than sub saharan countries – why is that? Because they can’t afford food of course!!! And this can only be fixed by fixing the rotting food problem, which I think will only be fixed when you have huge companies like Walmart invest in cold storage and distribution. So allow multi brand FDI in India and see what happens. I don’t think anyone can say confidently that there will be no negative effects, but look at the other sectors that have been opened up? Have they had to redact even one liberalization policy? When nothing went wrong there why this inertia and fear to open it up here?

That’s the way to go in my opinion, and the lesser the government does the better it is – let the private sector handle it.

Sorry about the longish comment, got a bit carried away…..

If I am understanding it right then you want to say :

The more money will increase the spending of persons, and the demand will increase, If supply is not enough then to earn more profit company will increase the rate. Inflation, Inflation Inflation !!!!

But I think that will be a short term inflation due to mismatch in demand and supply. To overcome this or to avoid it from a long-term inflation, company can increase the supply so price will be same and increasing supply will require more man power which can reduce the unemployment problem. Why don’t they think in this way? I am not a management student nor a commerce student but If I can conclude a solution for inflation why others can not?

The issue is that supply is rather limited even in the long term. If people had thousand times the money they had today just in the form of currency notes – how long will it take to produce thousand times the milk or cement or computers or anything at all?

If the solution were this simple, it would have been implemented by now, and how I wish it were this simple 🙂

Well I think this can not be an ideal case. If we think in Ideal terms then Increasing money thousand times will not increase the demand of same thing by thousand times. I agree it can be increased by twice or thrice for the same product and few new demand will be introduced for some new products and these demand can be supplied after short term inflation.

Second thing which I guess is why they do not implemented such solutions is just because they want more and more profit and don’t want to go back. Lets take an example:

Step 1: When demand turned high, they increased the price due to less supply, and they gained more profit.

Step 2: In few days or weeks, to gain more profit in short-term duration(High price time), they increased the production by say 50%. Now the production is 150% or it can go above also. They are still selling on high price to get more profit. But Ideally they should decrease the price as production is also high now but this never happens and due to this other related products also increases their rates because “This output can be an input for other things”. Now the question is who would like to go from High profit to average profit and that is why price go high with time span. Every one likes to be on Forbes list 🙂

and this is where govt should put rules & restrictions but I think they are getting commissions or some profit percentage.

I can only suggest you to read this article about hyperinflation on Wiki – http://en.wikipedia.org/wiki/Hyperinflation#Hyperinflation_and_the_currency

There is not much more I can contribute to this discussion. Thanks!

and thats why uk is in a much better position…coz it has its debt in its local currency..??thx for the info..this question has been puzzling me for several yrs. thx a lot:) lookin fwd for more informative posts..

yeah, so recently you must have read about the US debt ceiling debate and also how ridiculous that was because the US owes its debt to people in USD, and they can print USD, so technically they can never default on their debt.

Thanks a lot for the informative post. Can u elaborate on the query asked by saran…if a govt prints more money.. the money will go into the hands of its people…fuel demand and hence give rise to inflation. But a country can very well use the printed money to repay debts/loans taken from other countries. In this way, there will be no inflation worries also…please explain

External debt is usually held in a foreign currency and a very good example to understand that right now is Greece. Greece is struggling because it owes most of its debt in Euros and it doesn’t have an authority to print Euros. That’s usually why countries end up defaulting in external debt since they can’t print the currency that the debt is denominated in.