This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

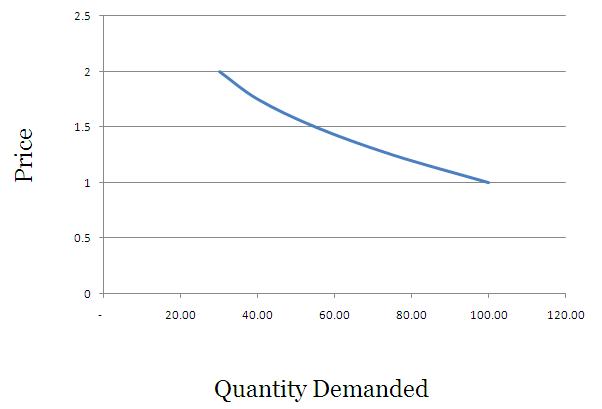

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

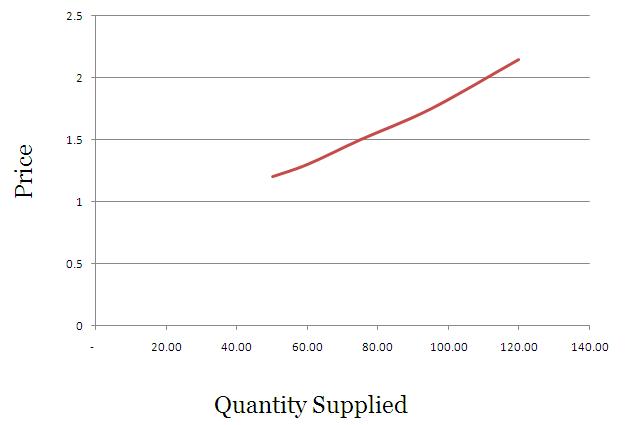

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

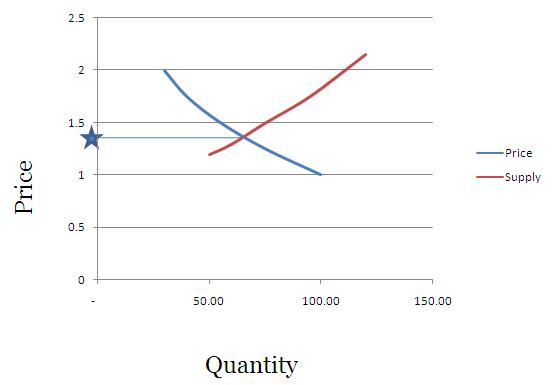

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

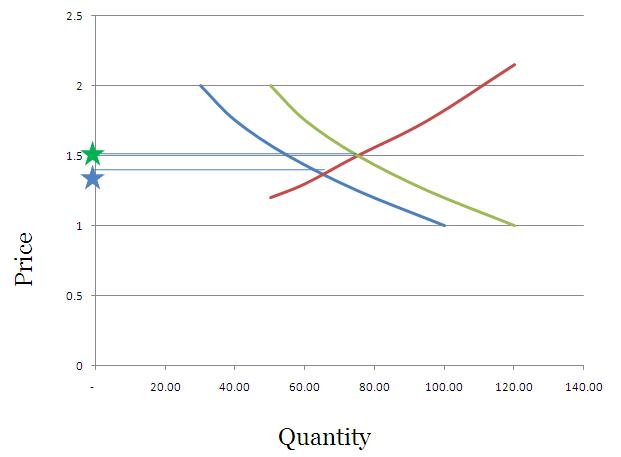

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

Awesome!! Simple yet Crisp and clear article.. That resonates the intellectual ability of you, Manshu…

Btw, I am looking for similar clarity for topics such as:

1. How GDP of a country is determined and measured

2. How Currency exchange is determined (appreciation and depreciation)

3. What is Sensex 10000 mean

The above are just my curiosity, pl. ignore if you have other already planned topics of your specific interest.

Please keep up with your good work.

Thanks a ton!

Hi Manshu,

You have explained it with the assumption that ‘govt prints money and distributes to everybody’. In that case the amount of commodites will be the same and with everybody having more money the prices will shoot up.

Now, lets suppose that is not the case.

Let’s say Indian Govt can print ‘x’ amount of currency (INR) today and value of 50 INR is equal to 1 USD today.

If Indian Govt prints 100x INRs and starts buying USDs (or swiss francs or gold or anything which is most stable) slowly over a period of time (slowly as not to increase more supply and not let the forex rate get affected). Value of 50 INRs will still be the same. But, Govt will be able to buy more valuable thing (e.g. USD) with the help of less valuabe thing (e.g. INR)

What stops Indian Govt from doing so ?

From what I know, you cant buy USD with INR in the international market. You have to have either gold or other commodities for buying USD.

u can’t buy USD through xchanging INR..because trading at international markets can only be possible with globally traded assets like gold and global currency like USD..

But say I can afford gold worth x rupees and suddenly I have 100x rupees to spend on gold. Now if I invest the newly printed money on gold over a long period, then I can sell back the gold to buy USD. What is the discrepancy here?

Hi Arpan .

There is a deposit called “Forex Reserve” which every country maintains to meet its Trade obligations and other requirements of its citizens i.e. foreign travel, medical treatment in abroad etc….US Dollar has the status of the “world’s trade currency”;that mean anybody can use US Dollar anywhere in the world to buy any goods or services.That is why all countries in this world keep majority of their Forex reserve in US Dollar.Apart from US Dollar there are Euro, British Pound , Japanese Yen , Australian Dollar, Canadian Dollar and Swiss Franc which have the place in the forex reserve kitty of the countries.

Now if we analyse the component of the reserve country we may easily come to the conclusion that all the reserve currencies belongs to the developed countries who commands the major share in the international trade turnover.

As far as India is concern;Export, NRI remittance, ECB, Foreign Direct Investment, FII investment in equity and debt markets are the major source of India’s forex reserve.

Now the point is how we can sell our INR to buy USD or gold or EURO or CHF ?? First question comes to our mind is who are interested in our INR to keep it in their reserve or locker ? What is the purpose of exchanging USD,gold or any other strong and stable currency to acquire INR….. The answer is only those who have some direct dealing with India in terms of trade or investment who takes a view on our country. Hence to acquire forex reserve India needs to be an attractive investment destination where Foreign Investor put their home currency or US Dollar. Nobody will come here and sell USD or other strong currency to buy INR and invest here unless they feel that they will get higher return for their investment. So we can conclude that its not in the hands of India to sell INR for USD , it is in the hands of Foreign investor to sell their USD against INR if they feel so…

Great explanation.. even a small kid can understand this wordings and all explanations are crystal clear:)

Ajai

Great JOB! MANSHU..

I would like a employee like you with me!

Great article.. Was very helpful.. But could yu please clarify the other aspect of a country’s wealth – yes i.e., the aspect of ‘Gold’.. Does the amount of gold in a country also has a role to play in it..??

Hey Manshu,

A very informative article ….

Can u help me in explaining as to how and y (as in y was the need to print money) this inflation happened in zimbawe..

And how do the capital markets operate there with prices getting doubled so fast…

When the government spends more than it earns, it needs to borrow that money and that borrowing results in printing more money.

There are no capital markets in Zimbabwe as far as I know (not at least in the same form that we think of them here) plus a lot of the trades there have started to happen in the USD which of course is much more stable.

thank you for the valuable information in its simplest form possible!

In this paragraph “So, let’s get back to our earlier example…..” either the number of units or the price should have been swapped! Simple explanation, though. Loved it. 🙂

No, it should be the same, we’ve had the discussion in the comments earlier as well, please if you could go through them you will see why I’ve used that.

it was good manshu

Thanks!

I’ve never had any economic related book in my hands in my entire life simply because i’m from different profession but this absolutely simple and excellent article taught me everything that i wanted to know about just like a hot knife cuts a butter, yeah it was that easy to understand.

With Love from Pakistan 🙂

That’s just great to hear – thank you for leaving the comment.

@Madhav

Rightly said.

There must be a match between inflation and growth. Excessive inflation is always bad. BUT, it is not only money supply and production of goods and services but also the Velocity which matters ie.. how the money gets rotated

@Harish and Manshu

I dont think tax evasion is the major issue there. The money that goes out of the country and deposited elsewhere is in the form of Dollars since banks do not accept rupee deposits. They have to be either USD, Euro or CHF. And it at all the money returns back to India, we will get dollars which will boost our forex reserves.

If you ever wondered where money comes from, how it’s created, and why it’s created in the way it is, then Read – Michael Rowbotham’s “The Grip of Death”

COPIED FROM ONE OF YOUR READERS-

My question is about black

money supposed to be stashed

away in swiss banks. if it is true,

why can’t we print new currency

equal in value to that hoarded

and put to circulation. if your

answer is inflation ,then the

question is even if the original

black money were recovered

from swiss bank and circulated

won’t it inflate our economy like

the new currency?

This is a weird notion and I don’t know how you think this will do anything at all – The thing with black money is that tax gets evaded and the government then gets into a deficit for which they have to borrow money and financing that deficit leads to inflation. Printing money equivalent to lost revenues doesn’t solve anything at all – the parallel economy with all the lost revenues is still there and in addition to that you want to just create more money out of thin air!!!

Please appreciate the fact that every time more money is put into circulation – currency loses its value because there is more supply of the same thing. Printing money is not the solution to anything – it will make matters worse.

Really an awesome article ……………

Great to hear that – thanks!

Sorry MANSHU Sir….i mistaken in your name ……….hope you can understand that!!!

That’s fine – not a problem, you can email me using the Contact form but it is more likely that you get a response if you leave a comment on the relevant blog post itself.

ANSHU Sir…..can i have your mail id….please!

my Email:zarrar.shaukat@gmail.com

Hello,

Thaks for this article.It clears of some basic concepts ..so in INdia when petrol cost is rinsing much higher to that of other countries and i have heard it is 50% less means govt is trying to say save petrol or there are different reasons for rising petrol price ?

regards

nk

That’s not true – in India oil is still subsidized and then taxed as well so it is a bit convoluted, but what you’ve heard is not factual. Government is not trying to communicate any hidden message – they are just trying as best as they can to balance between loss of revenue (if they reduce the tax on petrol), and public anger (if they let the price come up to the market level).

Hi All,

The article produced is elementary and does not explain the reason for linkage between printing currency and inflation.

Printing Money that is not backed by total assets of the country has no Value at all. Inflation is not a bad word, in fact inflation has to happen for a country’s economic growth. if there is no inflation, deflation will occur and that will be devastating for any country. The amount of printed money in circulation is kept in check by the RBI with respect to total value of G&S, if the RBI prints more currency than value of G&S, you will have a deficit. this deficit is known as currency deficit, if you print less, than the amount of money in circulation will be less and prices go up. Even if you print more prices go up. The value of Money Supply in the economy depends upon the relationship between aggregate demand and aggregate supply of the value of goods and services in the country. This Value is also known as GDP. if you have a burgeoning population like ours, we have more mouths to feed than we can raise agricultural production or other value sectors we will have a imbalance in the money supply in the country. Inflation will become like a rising serpent will start pinching your pocket. Now if more money comes into the country, the value of money falls and hence what you get at Rs 10 last year will be like Rs 20/- today. what you see is Rs 20/- but factually it is only Rs 10/- that you are paying. hence inflation again. Now if RBI does not print money or stops printing , you will end up excess of goods in the country with nobody to buy and the entire production cycle comes to halt hitting employment, which leads less buying hands and inturns leads to excess goods and son on. this becomes a recession, a severe recession leads to depression like American depression of 1931 where the imbalance of money supply and concentration in few hands lead to default crisis. Now becoz of our IT sector, we will be soon having similar imbalance if we not rectify our agricultura, industrial sector where people will try to move from one sector and again have devastating effect on the country.

Hope that explains in short why excess printing of currency is bad

regards

Madhav

Hello Manshu, prior to the creation of the euro,Italy printed lira to meet some obligations and to reduce the value of the lira making its products more competitive.now that Italy is part of the euro zone and uses euro for its currency,can they print money at will,or any printing of money is governed by the whole euro zone community?

I agree that printing money will cause inflation it also devalues the currency which makes it hard for country that import a lot and payments are made in usd,however the italian debt is mostly owned by italians and the rest by europians community ,the printed money goes directly to pay off the national debt through the central bank of italy channel,the only problem i see its the devaluation of the currency,however if the rest of the west prints money there will be no devaluation among these nations,only with nations such as china ,india,brazil etc which is not a bad thing,the now devalued currency makes their products more competitive,

No, they can’t print the Euro at will and nor can the Greeks. This is a problem as they can’t devalue and export their way out like Argentina.

hi its me sai….:)

my question is that…… does india print constant amount for every stage ????????how we come to know that other country is fallowing the regulations ??? in the scence how we come to knw if they print more then the requirment???

is there any corroption amoung the people who print money ????what is the procedure taken bfore printing the money ???????can we print more money and make the india as abroad like improvement in the roads, buildin houses to the pooor??????

This is demand and supply & RBI regularly publishes data on the new currency that comes into circulation. There is no corruption in this and there is no international regulation that any country has to follow. The point that I have tried to make repeatedly here and is lost Ina lot of commenters is that there is no free lunch and you can’t print money in unlimited quantities or it will devalue your own currency and make it worthless.

thanku ……. 4 spendin the time 4 my questions…..it was a perfect answer 🙂 🙂

Okay great, thanks for your comment.