Another post from Suggest a Topic.

This time we’re going to cover the recently announced SBI retail bonds, and if last time was any indication these will become hot as hell when they open for subscription.

For this post I’m going to cover the features of these SBI Retail bonds, and then answer some questions leveraging what people asked last time around.

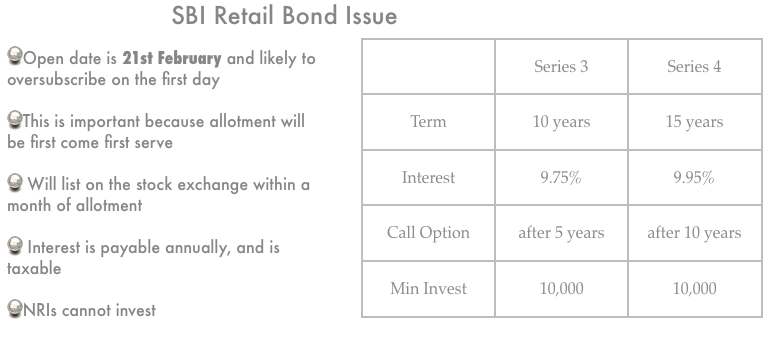

SBI Retail Bonds: Open and Close Date

I think only the open date is important in this issue because last time around the issue got over-subscribed the first day itself, and it’s quite likely that it gets over-subscribed this time again.

The open date for Tranche 1 is February 21, 2011 and close date is February 28 2011.

If you decide to buy these bonds, then I’d highly recommend doing so on February 21st itself. If you’re not able to buy them on February 21st then make sure to check how much they have been over-subscribed by since these SBI bonds are on first come first serve basis, and there might be no point in applying for them after the 21st.

Interest Rate on the SBI Retail Bonds

For retail investors these bonds will pay out 9.75% for the 10 years series, and 9.95% for the 15 years series.

| 10 years | 15 years |

| 9.75% | 9.95% |

There are banks that give you 10% for fixed deposits, but none of them allow you to lock in to that rate for this long a period. In that sense – these SBI bonds are offering quite a good deal compared to whatever is available at present.

I say at present because that’s important. When SBI came out with their retail bond issue last time around – there was a huge demand for that and it was a pretty sweet deal too. But, that was at a lower rate than the current offering, so you don’t know how interest rates are going to look like 5 years from now or 10 years from now.

Your money does get locked in with the SBI bonds since this is not like a fixed deposit that you can break at your will. If you go for the 10 years tenure then it will be redeemed at the end of 10 years.

SBI has the option of redeeming them at the end of 5 years and 10 years as well (more on that later), but they will only do so if the interest rates are lower at that point in time, so in that sense – keep in mind that you are committing to the redemption time period.

SBI Bonds will list on the stock exchange

These bonds are going to list on the stock exchange so you will have the option to sell them in the secondary market even if you can’t redeem them.

Keep in mind though that bond prices move about in the secondary market, so this is not the same as redemption because the prices will depend on the demand and supply plus the interest rates at that time.

Minimum and Maximum Application

The face value of one bond is Rs. 10,000 and that’s the minimum investment for the retail investor. The maximum application amount for the retail investor is Rs. 500,000.

Compulsorily in Dematerialized form

These bonds will not be issued in physical form, so you will need a demat account in order to apply for these bonds. Since this is a short point I’ll add that for the 3 of you who care these are unsecured bonds, but are rated AAA by CRISIL.

Can I get loans against these SBI Retail bonds?

No, you won’t be able to pledge these bonds like fixed deposits, and get loans against them. Similarly, you can’t break them before time like I said earlier.

Can NRIs apply for these bonds?

No, NRIs are not allowed to apply for these bonds.

When will the bonds start trading in the stock exchange?

You won’t have to wait for a long time for the SBI bonds to start trading on the stock exchange. If last time was any indication then the trading will start in less than a month of allotment.

What kind of listing gains can I expect?

I wish I knew because then I could make money without doing any real work, but alas that’s not to be. I’m sure there is going to be a lot of speculation around this, and the only input I can provide is that last time around the SBI retail bonds listed at a 5% premium.

Can I apply for the SBI bonds online?

No, there’s no option of applying for these bonds online – you have to necessarily apply using the physical form.

Is the interest from these bonds tax free?

I’ve had at least a couple of questions last time on this, and I think somehow the fact that the bonds are listed makes some people think that the interest is tax free or that there is no capital gains tax on it. This however, is not true – the interest is taxable, and if you make any capital gains selling the bonds then that’s liable to tax as well.

Where can I buy the SBI bonds from?

You can get the application form in a bank branch, and then fill it and submit it there. Someone told me last time that it helped to go to the bank before hand and get the forms and fill it because of the rush later on. I don’t know how true this will be for everyone, but sounds like a good idea.

What does the call option mean?

There is a call option with this bond which means that for the bond with 10 years tenure SBI has the option to redeem it after 5 years if they want to, and for the bonds with a 15 year tenure SBI has an option of redeeming it in 10 years if they want to.

Remember, this is their option – not yours. They will exercise it if they see it fit, but you can’t ask for buyback after 5 years if you want. In that sense this is different from the infrastructure bonds, which are the other bonds currently selling in the market.

I’ve tried to answer all questions I could think of, and have kept the post as simple as possible. Please feel free to ask any question that I have left out, and I’ll try to answer them, and of course there are a lot of other smart readers who answer questions these days, so you may not even need me.

What is a BSE code for current SBI bond of 9.95%?

961703

Thanks.. Do you know on which site we can see updated price for this bond?

Go to http://www.nseindia.com > Type SBIN in “Get Quote” > Select N5 under “Other Series”…

Alernatively check the BSE link: http://www.bseindia.com/bseplus/StockReach/AdvanceStockReach.aspx?scripcode=961703

SBI interest credited to my bank account. At 7%, they have paid me interest for 21.326 days. My money was with them only for 21 days. Can’t figure out how!

HI NEEL

I HAVE STILL NOT CREDITED ANY KIND OF INTEREST THOUGH I HAVE ALLOTED BOND.

WHAT SHOULD I DO?

PLZ SUGGEST ME AND MIAL ME ON MY MAIL ADDRESS.

Hi.. plz write a mail to “Datamatics Financial Services Limited”, the Registar for the SBI Bonds Issue at Investor Grievance ID: sbi_eq@dfssl.com

Yup, you are right 🙂 Am waiting for 23rd March. And then for the next tranche 😉

now the RBI plays spoilsport 🙁 couldn’t have they waited till next weekend to announce the hike in repo rates…

No spoilsport here Neel.. it was widely expected & RBI was as honest about Inflationary Expectations as it could be amid false figures & hide & seek plays in all Governmental communications.. so full marks to RBI for its Credit Policy.. 2022 G-Secs. yield moved up only marginally to 8.08% from 8.06% after the announcements made.. so just keep your 🙂 intact..

Also the expected listing date is March 23rd.

Super. They have also paid 7% interest as promised. Am happy and smiling 🙂

That’s quite awesome! They did a prompt job and didn’t leave people hanging like some of the infra bond issues.

hey more smiles would come on listing.. so keep saving your smiles for the listing day.. all is well here till now.. only thing which is required now is a good no. of buyers for these bonds in the market.. thats it!!.. Hip Hip Hurrrrrahhh in the making!!… 🙂

Thanks for the info Shiv – much appreciated – this will help a lot of folks and I’ll make a mini post out of it soon.

Hi,

Can anybody please tell me what is the allotment date for SBI bonds? And when is the listing?

Thanks,

Jenish

I don’t think that’s been declared that Jenish – it should be within a month of closing date, so can’t be too far away.

I called Datamatics on 022-66712156 today and they said they will be done with allotment by tomorrow.

Excellent!

Hi

The allotment has been done. Please check this link with your respective Application Nos.: http://www.dfssl.com/iposerv/SBIBONDS2011.asp

I think for retail the issue is 1000 CR

Does any one has idea if retail portion is fully subscribed or not ?

Also SBI has 10,000 CR green shoe option for retail investor and hence does that mean all retailers will get 100% allotment ?

Thanks

Milind

Yeah it looks like it is already over-subscribed – see this Indian Express link:

http://www.indianexpress.com/news/SBI-bond-issue-oversubscribed-over-4-times/754701

Yeah retail is around 4 times subscribed means its at 4000 CR

But they have green shoe option for retail till 10000 CR

So does that mean all retails will get full allotment ?

No, that doesn’t mean 100% allotment for sure. It’s their option to extend it or not, and I guess they will state in the coming week what they plan to do.

I read this : http://economictimes.indiatimes.com/markets/bonds/sbi-bonds-plans-to-retain-retail-over-subscription-under-issue/articleshow/7609939.cms and it’s pretty unclear.

One line says “State Bank of India today said it plans to retain a portion of the retail over-subscription to its tax-saving bonds issue, which will take the total amount raised through the mega issue up to Rs 5,500 crore” and another says, “As against an allocated Rs 1,000 crore, subscription by retail investors stood at Rs 4,500 crore, while an additional subscription of nearly Rs 4,000 crore came from other investors, including high net-worth individuals. ”

Firstly, these bonds are not tax saving! And secondly the PTI reporter does not know elementary mathematics.

Hi Neel.. As far as the tax saving part is concerned you are right in pointing out that these are not tax saving bonds.. Its a tax saving season & every other company (IDFC, PFC, L&T, REC etc.) is coming out with tax saving bonds except SBI which is not an IFC status company so it cant issue tax saving bonds.. so probably by mistake they got it printed… 🙂

But the calculations done by these guys are not wrong.. let me do it for you:

Issue Size: Rs. 1,000 Crores

Green-Shoe Option: Rs. 1,000 Crores

Issue Size (including the Green-Shoe Option): Rs. 2,000 Crores

Reserved for QIBs & HNIs: Rs. 1,000 Cr. (25% each of 2,000 Cr.)

Issue Subscribed: Rs. 8,500 Crores

Issue Subscribed by the Retail Investors: Rs. 4,500 Crores

Issue Subscribed by QIBs & HNIs: Rs. 4,000 Crores

Allotment to the Retail Investors: Rs. 4,500 Crores (Full)

Allotment to QIBs & HNIs: Rs. 1,000 Crores (Partial)

Total Amount Raised: Rs. 5,500 Crores

So out of Rs. 8,500 Crores SBI is going to return Rs. 3,000 Crores to QIBs & HNIs & retain all the over-subscription from the retail investors.. so Beer Mug is full for the retail investors.. Cheers!! 🙂

For more info Call/SMS 9811797407 (Delhi, Gurgaon & Noida)

Looks good Shiv. I don’t understand the word ‘PORTION’ used here though ‘State Bank of India today said it plans to retain a portion of the retail over-subscription to its tax-saving bonds issue’

I hope they retain all the retail subscription!

please send me an application form for 10 years tax saving bond.

u can get it from the nearest SBI branch

A fixed deposit alternative:

Canara Bank offers a pretty good interest rate on long term FD: 9.5% for 8 years & above to 10 years.

Thanks for that info Vinay.

hi all,

is it worthwile to invest in Bonds. I mean my father invested in some bonds and when they got matured the value for money was so less and I figured out that after 10 years 9.75 would mean nothing.

It’s better to go for MF or Shares than going for these bonds i guess.

Any comment?

The interest is going to be paid out annually in this, so you will get interest at 9.75% per year, and at the end of 10 years (or 5 years if SBI exercises that option) get the 10k back.

It’s not right to compare equity returns with bonds because the risk in those two is totally different. Equity investments can go down fairly quickly quite steeply, whereas bonds, especially those from SBI are quite safe.

In your situation you have to see what your risk profile is – what your other investments are, and then see if a bond issue fits into the overall scheme of things. A generic yes it is worthwhile, or no it’s not, while convenient is a completely useless answer unless you consider your own individual situation.

Thanks ..one question..there’s tax benefit for 20k for these bonds right. Would that be applicable only once or every year?

I think it would be one year only but not sure.

No.

No tax benefit whatsoever.

No Anish – there is no tax benefit from these. The tax benefit is from the infrastructure bonds, and theses have nothing to do with them.

U can definitely apply it online.. i have applied thru my Edelweiss brokin a/c..ie if ur broking house has da online facility u can apply it.. Tis facility has rly saved so much time..

It is little odd that SBI bonds require Demat acct but they dont allow to apply online brokerages …

what clould be the reason?

Sunket – I’m guessing operational difficulties or rather steps that SBI had to take which it couldn’t do in time. Having said that, a reader informed that SBI bonds are available through Edelweiss online. You might have already gleaned that from comments though.

yeah, I have read frm the comments, but then I dont have a brkerage acct with Edelwess!

Hi Sunket.. Dont lose heart as these kind of bond issues will keep coming now every quarter from the SBI. Most of the people in the Financial Services industry or involved with such things were unaware of the online facility to apply for these bonds till Feb. 16th-17th. This facility was not avavilable when I applied last time in October 2010. I’m the proprietor of a franchise of Edelweiss Broking, Ojas Capital. Even I was not not aware of this facility till Feb. 17th morning & pleasantly surprised to see it. But truly speaking it was really very easy applying for the bonds online. It took me less than 2-3 mins. to get the funds transferred from my bank a/c. & apply for these bonds online. I hope, going forward, the facility is there with most of the brokerages so that all the investors could benefit from it.

Also let me try to explain the reason for SBI to make it mandatory to have a Demat A/C. to apply for these bonds. Indian Corporate Bonds Market lacks the required depth. I think SBI wants to have a huge trading bond market for its bonds and also popularize these bonds among the retail investors. Thats the reason SBI is coming out with such big issues like this one and giving such an attractive interest on the bonds.

To invest in SBI bonds, get the Edelweiss Demat A/C. opened or for any more info about these bonds Call/SMS 9811797407 (Delhi, Gurgaon or Noida).

can anybudy tell me expected date of listing and number of listng and way of listing i.e. for retail and hni in different code as the rate is differrent.?

The listing will be within a month of closing the issue and the listing will all the different series will be under different names. They will have different codes, but I don’t think those codes are out yet.

Thanks Manshu. What are your views on RBI review in mid march?. AM of the opinion that since food inflation has reduced, there wouldnt be another hike. Also short term rates would ease as liquidity improves. In that case, this bond would make good investment for risk averse investors in lower tax bracket. Also it can result in good trading gains as yields drop. One can make a quick buck and move out :). I just wrote an entry in my blog. Do let me know your comments

I have actually absolutely no thoughts on the RBI review – haven’t given any thought to it. As for quick bucks – I strongly feel that there is no such thing. Listing gains and quick bucks and things like that give a 4 or 5% return in a transaction, but then you make one big loss that wipes out everything.

I believe in investing for the long run and ignoring all the other noise.

Is the application form already available at SBI branches?

If it wasn’t earlier, then it surely must now.

Kindly let me know , SBI bonds is tax saving bond like IFCI Boand?

Hi Sanjeev.. SBI Bonds are not tax saving bonds.. & there would be a tax liability also on the interest earned @ 9.75%/9.75%..

No, there’s no tax saving involved in this. In fact you will have to pay capital gains tax and the interest income is taxable as well.

Hi,

Where can I get the apllication form. Can anyone post the list of branches. Also will the application form will be available today in SBI branches?

Hi… You can apply for these bonds through some Designated SBI branches (not all) and through Brokers or Independent Financial Advisors like us..

To invest in SBI Bonds or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

There is a comment at this post which has a list of branches that are offering the bonds. I’m unable to verify how accurate it is so not bumping it to a post. You can check it out and see if it’s right or not.

http://www.onemint.com/2011/02/18/apply-online-for-the-sbi-bond-issue/

Better than not having info at all I guess.

In this issue, HNI / QIB are issued bonds at 9.3% (10 year) & 9.45% (15 year). Will these bonds be listed separately from bonds issued to retail which are of different coupan rate of 9.75% (10 year) & 9.95% (15 year) ? If yes, are QIB / HNI allowed to buy the bonds of 9.75% & 9.95% coupan rate, from the stock exchange after listing ? or 9.75% & 9.95% bonds are reserved only for retail even after listing ?

Yes, the bonds will be listed separately, and there is no reservation after the listing.