L&T has come up with the second tranche of their infrastructure bonds, and this will be open from the 7th Feb 2011 to the 7th March 2011.

The bonds are issued under section 80CCF so they will get you an additional tax relief in the form of reduction of taxable salary outside of what you get under Section 80C.

L&T Infra bonds have been rated CARE AA+ by CARE which denotes low credit risk. The bonds can be purchased in the physical or Demat form, and the minimum investment needed in the bond is Rs. 5,000.

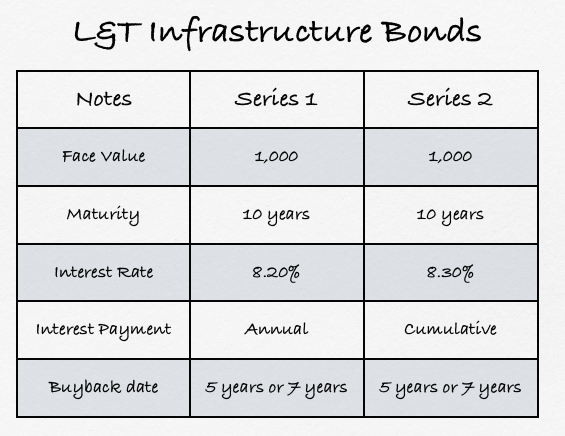

There are two series on offer by L&T and the maturity period of both the series is 10 years. However, there is a buyback option that can be exercised by you at the end of either 5 or 7 years.

Here are some details about this issue.

As you can see above the series which pays annual interest rate has a slightly lower interest payment at 8.20% when compared with the series that pays out cumulative interest. Personally, in the high interest scenario we are in I’d go for the slightly lower interest rate for getting an annual payout, but that’s just my preference.

You can invest in these bonds through your trading accounts like ICICI Direct, through financial advisers, or you could do it directly by filling out a form, and submitting it in one of the collection centers.

Sir,

I have purchasedL&T ingratiate bond .23/03/2011 to 23 /03/2016 (lock in peried)

Name in holder =I.Arumugam

No of Debenture =20

Regid folio no = 11341314

Certificateno = 701193

Distinctive nos =2704400-2704419

Complete for my bond. So, I want to maturuity + bonous amound for my

Icici A.c. =614601005508

Regards

I.Arumugam

8004064148

I have invested in L & T infrabond in the year 2011. The lock in period closed on 22.3.2016. When shall I get back money?

I have purchased infra bonds on 23/03 /2011 due on 22/03/ 2016 .I did not yet receive any cheque nor the amount has been deposited in my bank account. My folio no is 10824583

Sir I had purchased infra bonds 2011 on 23/03/2011 under folio no

10470404 and redemption was due on 22/03/2016 but not recieved

amt after 15 day. No phone is attended by L$T people and nor they send

amt in my bank . A example of a private section which not bother

about service and brand

I have purchased L&T infrastructure bonds Rs. 20000/- in Feb 2011. I want to withdraw now after the lock-in period is over, Currently i am staying in bangalore, Please help me with the steps to be followed to withdraw my bonds.

Thanks & Regards,

Muqthar Ahmed.

Sir,

I had purchased infra bonds 2012 on 10 Jan 2012 and redemption was due on 09 Jan 2017 but did not receive amt even after after 15 days. No phone is attended by L$T people and nor they send

amt in my bank .

sir I have purchase L&T Infrastructure bond Rs 20000.00in march 2011.Iwant to withdraw but where submit of document .I leave in Delhi Please send the Adress in my Mail.

Dear sir,

I have also invested in L&T infra bonds on 22/2/2011.

I want to know when the money will be credited to my account from these bonds.

DP ID/ CL ID / Folio #: 383344-10541972

Regards,

Manish Chawla

9136001645

Sir/madam

I bought a long term infra bond 2011A series of rs 20000/- on 23-03-2011 folio no. 10871140 which can be sold on 22-3-16 I already send original bond certificate with cancelled check and other kyc but couldn’t find my repayment Please look in to the matter and do the needful.

Attach photocopy of send documents

Dinesh soni

9461070779

We have alloted 20 bonds opted for call option of withdrwl on 23/3/2016

but still it shows in my DP A/c.IN-301774-10385947 & DP-IN-301774-10629967 & DP-IN-301774 -11468796 still We have not recived neither payment nor any intimation.

Reply soon.

D/sir,

Kindly let me know when I will get the refund amount of L&T Infrasture Bond invested in the year 2011. (Rs. 20000)

kindly let me know reply of above mentioned comment of Purnima Kamath

please help me that i had deposited rs.20000 of l&t infra bond in feb 2011 through a person but till i dont know bond was purchased or not .i have not any document.i have missed my counterfoil too.please help me.

Appled for L&T bonds how to get Allotment advice

I also applied for L&T bonds in physical form. I received following email notification (given at the end) on 24-Mar-11. I was able to download allotment advice from the given link. I also have a credit of the interest (Rs. 85.48) in my bank account. But till date, I haven’t received physical bond certificate on my address. I tried to call their numbers (18001022131 & 022-40605444), but nobody receives the call. Also, I emailed to investor2011A@ltinfra.com, but it gave me failure delivery. Finally, I emailed to savetax@ltinfra.com and yet not received any response. Has anybody got the certificate?

Dear Investor,

20 L&T Infra Bonds 2011A Series have been allotted on 23.3.2011. Allotment Advice is being dispatched along with Debenture Certificate/Refund Order / Interest Warrant by Speed Post. You may also download the Allotment Advice through our website http://www.shareproservices.com

Click here to access Allotment Advice.

Regards

Customer Care

Sharepro Services (India) Pvt. Ltd.

*** This is an auto-generated email. Please do not reply ***

I just got certificate yesterday (08-Apr-11).

Sir, I was purchaged L&T infrastructure bonds under section 80c on 3.3.2011 .I got income tax revate on it.BUt i got tel. massage from your agent that ,you had not issued the bonds. Money has also already been withdrawn by you from my bank A/c.Now what can i do for further?Reply me as soon as possible.Thanking you.

Please talk to your agent or banker. This is like a news website.

Dear manshu

i want to invest in l & T infracture bond but problem is that issues has been closed so pls tell me how i can invest in this issues pls help asap

Dear Rashmi – you can invest in infra bond issues that are currently open and they will give you the tax benefit as well. The currently open issues are from PFC and IDFC, and you can select one of them.

Hi Manshu,

Why would you prefer to invest in the noncompunding scheme even if it pays lower rate of intrest?

Because of the tax benefit Girish.

Want to invest in infrastructure bonds

G.Shankar

Want to invest in infrastructure bonds

how do we apply for this

the web site is not opening ? help

You can get in touch with an agent or go to a bank or if you have an online account like ICICI Direct or something they might have an option to do that as well.

L &T INFRASTRUCTURE BONDS – SECTION 80 CCF

TAX EXEMPTION…

PEOPLE FROM PUNE CAN CONTACT ON 9762847432 ( RISHIRAJ)

HURRY!!! ISSUE CLOSES 7TH MARCH 2011.

I think it makes more sense for an investor to got for this one as tax-adjusted yield for 5 yrs works out well above 14% for 30% tax category. But the limitation of 20,000 per person would be a turn off.

Yeah – these bonds are all about tax saving, and if someone is not looking to save taxes from this investment then there are other better avenues available.

Mara husband ka bonds 2011Aseries ka hai maine inka nominee ho atho 2016 march ko katham hwova mainay phone keya vho bala 2017 two years by back keya ub my mara bond ka vivaran degiya by back kaliya my kya karna hai