The world of fixed income has been made slightly more complex with the issue of infrastructure bonds and SBI retail bonds.

And then there is one infrastructure mutual fund NFO, which is adding to the confusion for a few people as well.

I’ve answered a few questions on the important distinctions between these instruments, and I thought I’d illustrate them with the help of some Venn diagrams.

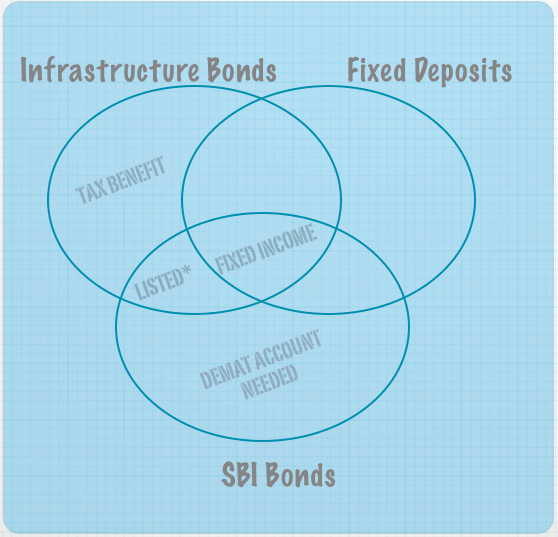

Infrastructure Bonds, SBI Bonds and Fixed Deposits

First off, what’s the similarity between infrastructure bonds, SBI bonds and fixed deposits?

The only similarity between them is that they are debt instruments.

And what about infra bonds and SBI bonds? Just that both of them will list in addition to being fixed income instruments.

In the diagram below I’ve put a little star against “Listed” though because SBI Bonds will list quite quickly after allotment, while the infrastructure bonds will list only after their lock in period which will be at least 5 years.

Look at the image below and see if the similarities and differences are clear or not.

The question that I notice pops up often is whether the SBI bond issue will give tax saving or not.

The answer to that is a big NO. Only infrastructure bonds get you tax benefit, not retail bonds like the SBI bonds.

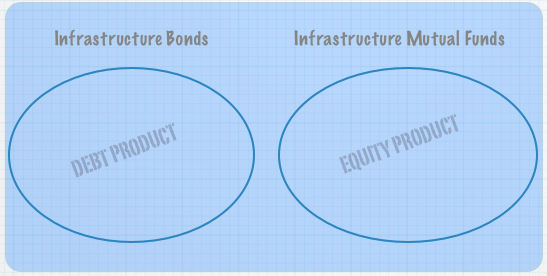

Infrastructure bonds and Infrastructure Mutual Funds

Next up, let’s deal with a simple question now.

Will I get tax benefit if I invest in an infrastructure mutual fund?

The people who ask this question are in all likelihood looking for infrastructure bonds which is the instrument that gives you the extra Rs. 20,000 tax benefit, but unfortunately for them infrastructure bonds and infrastructure mutual funds are two completely different things.

Infra bonds are a debt product while infra mutual funds are an equity product, and you can read the difference between bond and equity products here.

There is tax benefit on bonds, but not on mutual funds.

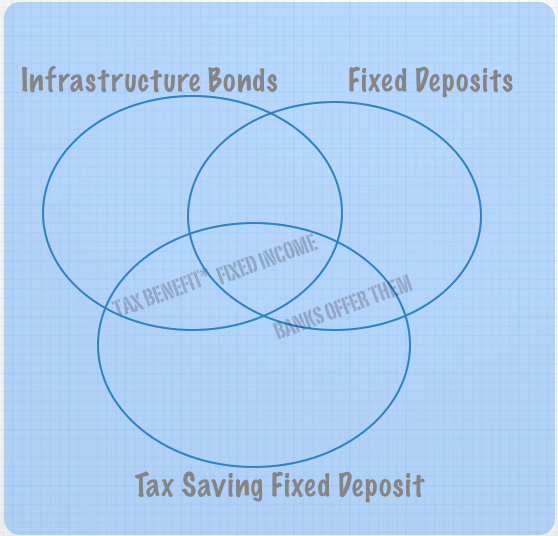

Tax Saver Fixed Deposits, Normal Fixed Deposits and Infra Bonds

The last Venn is with tax saving fixed deposits, normal fixed deposits, and infrastructure bonds, and I’ll let you take a look at it without explanation.

Notice that there is a star on tax saving because the tax saving fixed deposit comes under Section 80C, while the infra bonds save Rs. 20,000 under Section 80CCF, and while there are tax benefits, those are two different type of tax benefits.

So, there you are – a simple post with some straightforward distinctions.

Do you think I missed any questions in this post? Anything you’d like to add?

i have an amount of 15 lacs as capital gains and want to save in capital gains tax saving bonds

as R E C N H A I etc etc pl download on my email the application forms dr b g zope

I always get confused with Infrastructure bonds, MF and Fixed Deposits. The reason for confusion is as follows:-

Why should I invest in Infrastructure bonds, MF when I can place the same in the highly secured fixed deposits who are offering rates of 9.5% for 8 to 10 years. As the tenor is long, banks do offer flexibility of giving me interest every quarter. In case the rates increase in future. I can close the deposit and open the same for the higher rate and Banks will give me interest for the period the deposit has run. When I have this many flexibility why would I go for MF which is highly risky, SBI bonds for which i need a demat account and Infrastructure bonds.

The whole point of the infra bonds is that you get the tax benefit of reducing Rs. 20k over and above 1 lac in 80C. If you’re not interested in that, then there is no benefit in going for that.

Nice and simple…good work!

Thanks Chints!

Thats was a creative way of presentation . Diagram makes sure you have to write less 🙂

Manish

Thanks Manish – good to see your comment there.

Actually I got this idea from a cracked.com post where they made some fun of which movies are likely to get Oscars, so it’s not all creative on my part! 🙂

I actually prefer writing more than drawing because its quick and the formatting part of these images drive me insane sometimes!

Hey Manshu,

Nice piece of writing. Talking about infra MF in the market, am sure investors are gonna be assume its gonna have tax benefits. I expect misselling to happen here. Also given that infra companies have a very very long payback period, returns on such MF would be good only on a very long term.

So, you think agents are going to sell these saying they have tax benefits? But how can someone lie so blatantly when they know they’re going to get caught soon?

When I rec the comments I just thought it would be ignorance and didn’t suspect anything sinister really!