There was a question on the forum on how you can save capital gains that arise from selling property, and Loney responded to that by the suggesting the Section 54EC Capital Gains exemption bonds.

I have not written about them earlier, so I thought I’d do a post on these bonds now. So, here is a post with some details on 54EC bonds.

Who should buy Section 54EC Bonds?

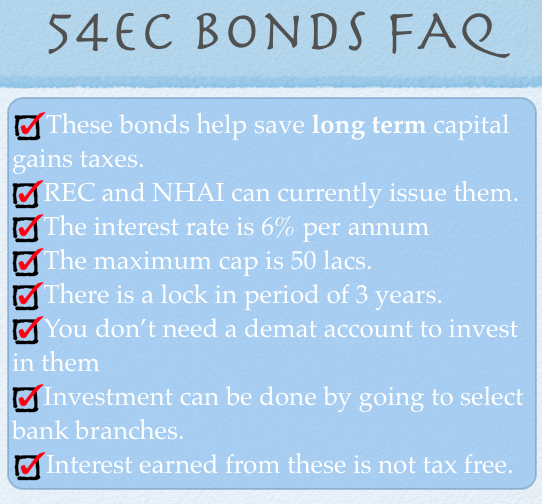

These bonds are specifically meant for people who have made some long term capital gains, and would like to save capital gain taxes on this amount.

Only long term capital gains are eligible for these bonds though, and short term gains are not covered under section 54EC.

What is the upper limit for investing in these bonds?

The maximum gains are capped at Rs. 50 lacs in a year, so you can invest in a maximum of Rs. 50 lacs worth of 54EC bonds in a year to avail of the tax benefit.

Please note that the section is not cut and dry, and there are conditions on how much money will be exempted based on whether the profit made is more than the cost itself, and I will try to detail out the sections in a later post, or if you have a link that does a good job of explaining this then please leave a comment and I’ll link to it.

Who is issuing 54EC bonds?

REC (Rural Electrification Corporation) is issuing these bonds, and from the current information present on their website I see that they will be issuing these bonds till March 31st 2011.

Here are their contact details:

(Application Form can be downloaded from the website : http://rec.rcmcdelhi.com)

Our Registrar to the Issue :

RCMC Share Registry (P) Ltd.

B-106, Sector-2, NOIDA

U.P. -201301

Ph.: 0120-4015880-81

Fax: 0120-2444346

Email:bonds@rcmcdelhi.com

Website : http://rec.rcmcdelhi.com

For Investor Grievances

& Non-Priority  Sector Bonds

Email : bonds@rcmcdelhi.com

For any assistance or clarification please contact:

Investor’s Relation Cell

Core-4, SCOPE Complex

7, Lodhi Road

New Delhi – 110003

Email: investorcell@recl.nic.in

Phone : 011-24361320, 011-2436 5161 extension 527

Tollfree No. : 1800-200-1333

NHAI is also issuing 54EC bonds, and their details can be found on this page.

What is the interest rate on 54EC bonds?

Currently, both REC and NHAI are offering 6% interest on their bonds.

What is the lock in period of these bonds?

The lock in period of these bonds is 3 years, so you can’t sell them before the 3 years.

Is the interest on these bonds taxable?

Yes, the interest from these bonds is fully taxable, and there is no exemption on that. TDS is however not charged on them.

Who can invest in these bonds?

Resident individuals, HUFs, partnerships, companies, banks, financial institutions, regional rural banks, co-operative banks, insurance companies, provident funds, super annuation funds, gratuity funds, mutual funds, FIIs, trusts authorized to invest bonds, NRIs investing out of NRO account on non repatriable basis can invest in these bonds.

So, everyone except your pomeranian can invest in these bonds.

Where can I buy these bonds?

A lot of bank branches sell these bonds, so you can ask at your local bank. Unfortunately, I don’t have a list of branches with me, so you will have to rely on other sources, or check with your local branch.

Do I need a demat account for them?

No, you don’t necessarily need a demat account for them because the bonds are issued in paper as well as demat form.

I’ve tried to cover whatever points I could think of about these bonds, but I’m sure there are several aspects that I missed, so feel free to ask any questions in the comments section, and of course any other observations are also welcome.

My dad will be selling my grandfathers house for 30lac and do three equal shares amongst his sister n brother, so on a share of 10 lac can he gift it to me as I have a home loan already running and can pay it off, what are the other options as my dad doesn’t have any means of income he wanted to live on the interest, one last thing since the sale amt of 30lac would first come into his a/c and later he will split hope we shouldn’t worry about tax on entire amt

Can income tax on long term capital gainearned by self be saved if theamount earned is invested in property in the joint name of self and wife?

Yes, you can save capital gain tax this way but the exemption will be limited to the amount invested as one’s share in the cost of the new joint property.

Example:

Capital Gain earned in the sold property = Rs. 40 lakhs

Cost of the new joint property = Rs. 60 lakhs

Proportion of amount invested in the new joint property = 50:50

Eligible exemption = Rs. 30 lakhs (Rs. 60 lakhs * 50%)

Taxable Capital Gain = Rs. 10 lakhs (Rs. 40 lakhs – Rs. 30 lakhs)

If the whole of the capital gain is invested as one’s share in the new property, there will be no capital gain tax to be paid.

IS PREMATURE WITHDRAL FROM CAPITAL GAIN BONDS POSSIBLE

No, it is not possible.

Myself and my brother jointly held a residential property which we sold recently. The sale proceeds were used for acquiring another residential property again in joint names. Both of us already have seperate residential properties individually. Please answer whether the investment in new residential property in joint name qualifies for capital gains tax exemption.

Thanks in advance

Murali

Arun,

Yes you can split the amount in these two options.

Can the capital gains amount arising from sale of housing property be split between Capital gains Bonds (upto a max of Rs. 50 lakhs in a financial year) and investment in residential property and still gain exemption from capital gains tax?

Hello sir/madam,

my name is shobha. i am in bangalore. i want to invest in NHAI 54EC Capital Gain Bonds.

where shall i contact? whom do i consult? please suggest me.

thanking you

shobha

Hi Shobha

You can download the application form online from the below pasted link. Just attach the Investment Cheque and self-attested copies of your PAN card & Address Proof along with the duly filled form and submit it at any of the bank branches of IDBI Bank or Union Bank of India anywhere in India. Thats it, you are done!

https://www.sbicapsec.com/Bonds.aspx

For more info or to invest in REC or NHAI Capital Gain Bonds (Tax Saving Bonds u/s 54 EC), Call/SMS 9811797407 (Gurgaon, Delhi or Noida) or mail us at ojascap@gmail.com

Dear Sir, This is about 54EC Capital Gains Bonds.

I sold a house on 30th April 2011. The 6 months period is upto 30 Oct 2011 for me to invest in Capital Gains Bonds. I issued a cheque for the amount dated 30 Oct 2011 and deposited the same with the authorised Bank Branch HDFC Bank on Oct 31, 2011. My cheque was pertaining to PNB. HDFC Bank sent the cheque in clearing on Nov 1st, 2011 and my account with PNB was debited on Nov 2, 2011. The collecting Bank HDFC Bank received the cleared funds on Nov 3, 2011 and accordingly, HDFC Bank intimated the date of realisation as Nov 3, 2011.

In the above case, what will be deemed date of allotment ? Will it be Oct 31, 2011 or Nov 30, 2011 ? And Interest on Bonds will be paid to me from Nov 3, 2011 or from Oct 31, 2011?

Mr. Sharma,

As per NHAI webiste the deemed date of allotment i s” Last day of each month for application money cleared and credited in NHAI’s collection account” . Hence its Nov 3 2011 as date of allotment.

Hi… I think the Deemed Date of Allotment here would be November 30th, 2011. I’m not sure whether the investment was successfully done within the specified period of 6 months or not because the form was submitted on October 31st, the cheque got cleared on November 2nd and the Deemed Date of Allotment is November 30th. I’m sure the date of the cheque, October 30th, is irrelevant here.

I’m pasting here a link which has details of a I-T tribunal case. This case looks like one of the closest to the above situation. I hope you get the due tax deduction.

http://www.taxmann.com/TaxmannFlashes/Articles/taxmann_com(ART)18-2-12-DTL-18(240).htm?aa=

Hi Manshu and Hi Jitendra

Nabard and two other institutions – NHB and SIDBI – are no longer allowed to issue 54EC Capital Gain Bonds with effect from 1st April, 2006. Only REC and NHAI can issue these Capital Gain Bonds.

Source: http://law.incometaxindia.gov.in/dittaxmann/incometaxacts/2008itact/dtcdiv1_p494B.htm

Thanks Shiv.

These capital gains we consider only from the sale of property or even a sale of equity stake would be considered as capital gains. Please let me know.

Garima,

These capital gains bonds are aviailable only for property.In equity long terms are tax free hence you do not require any provision for such bonds.

Sir,

I will have an indexed capital gain of Rs.5 lacs by selling my flat @ 20 lacs. (Indexed purchase price is 15 lacs). My query is to save tax, I have to invest the capital gain in purchase or construct the house. With 5 lacs investment it is not possible to purchase or construct the house but I can only purchase a plot at a city outskirt. Can I save the Tax by investing Rs.5 lacs in purchasing a plot and take housing loan for constructing the house in 3 years? Because I don’t want to use a single rupee of indexed purchase price of 15 lacs on new house.

Kindly reply

Ramakrishna Reddy

Ramakrishnan,

The tax provision is not available for buying a land.You should buy or construct a property within the stipulated time. It will be more wise to invest in bonds if you want to save tax.

Thanks for link: http://www.bemoneyaware.com/blog/capital-gain/.

One important information provided in this article is that earlier 54EC Bonds were issued by NABARD, NHAI, NHB, REC and SIDB but from April 2006, only bonds of NHAI and REC will be available. I found the similar information on link: http://www.financialexpress.com/news/54ec-bonds-offer-attractive-returns/133927/

Hi friends

Yesterday evening I came across a very detailed article on Capital Gains in the blog by Bemoneyaware, a regular contributor to comments in OneMint on various financial topics.

Those interested may go through the link

http://www.bemoneyaware.com/blog/capital-gain/

Hi Jitendra

Thanks for the link you posted about various tribunal and other judgements on claiming 54EC bonds exemption in 2 fiscal years.

However there was no mention in the link that the interest income of CGS is not taxable. Will you please provide a link to substantiate this opinion.

Dear Umesh,

Thanks for your comments. I read about the timing of sale & investment in Bonds. But I was not 100% sure that limit 50L applied to fiscal year & not for bonds from a company only. Anyway, now I am not able to postpone the deal & it will certainly be much before October so I have no option but to pay tax. As CII for FY 2012-13 will be declared in August this year & I have to file return by July next year, there will be no problem in calculating tax.

Thanks once agai. Best regards, RAKESH

As far as indexation for 2012-13 is concerned I don’t think it has been notified so far. The link http://taxguru.in/files/download-cost-inflation-indexed-cost-calculator-excel-format.html says it will be announced somewhere in August 2012

Hi Rakesh

I think you are right, CGS account is not meant for those who wish to invest in bonds. As for bonds, one has to invest within 6 months from the date of transfer of the asset(s) and the money can be kept in your bank account. However, get it confirmed. But please note that the interest earned on the amount will be subject to tax and TDS and will be included in your total income.

Actually I posted that link of livemint to point out that any income earned from the CGS account, if deposited by you in CGS (as replied by Jitendra, your previous query) will be taxable (as you was asking about tax on interest on deposit in SB account). I am sorry if it made a confusion.

The limit of 50 lakhs is for a fiscal year and not for the bond of a company. It is only the timing by which you can avail this limit twice, spreading in 2 fiscal years (total 1 crore), as stated by Ramesh in comments above and in onemint first article.

I understand that you have gone through various comments posted above before you posted your query for the first time to answer. Please read the comments posted once again.

Dear Umesh,

Thanks for your reply.

Yes, I am trying to collect information for future (not very far future). As you suggest, I was collecting information & become a bit knowledgeable before I meet CA. I have also done some calculations & reached to conclusion that investing in bonds will save me some money though it would have been easier to pay tax on LTCG & forget it. I do not want to invest in house as maintaing it, chasing tenants is troublesome some times. I have done study on net & it seems, now I know enough & rest will be told/confirmed by CA.

Thanking you for your help. Best regards, RAKESH

Hi Rakesh

If you can, then delay or plan the transfer till October, better till first week or till 10th, as then you can time your saving on tax by spreading in 2 fiscal years and your total saving will be 1 crore instead of 50 lakhs but remember to invest other 50 lakhs in due time. Why I am saying till 10th of October, as you will get enough time in April 2013 to invest.

It is my pleasure, if I helped you in any way.

One more query. Where can I find Cost Inflation Index for FY 2012-13?

I am a bit confused about the following. Kindly suggest:

1. It seems for 54EC investment the LTCG money should not be kept in Capital Gain Account. As per article at URL http://www.livemint.com/2011/04/24214254/Dejargoned–Capital-Gain-Acc.html :

The CGS account can be opened with a designated nationalized bank. It applies to all assessees eligible for exemption under sections 54, 54B, 54D, 54F or 54G of the Income-tax Act, 1961.

Does it mean that till money is invested 54EC Bonds, it can be kept in normal bank account and must not be kept in Capital Gain Account?

2. If LTCG is more than 50L can one buy 54EC Bonds in same FY from two or more companies to invest full LTCG in bonds to save tax as the limit of investment is 50L in one company?

Thanking you. Best regards, RAKESH

Hi Rakesh

As already stated:

“There are so many complexities with ifs and buts in our tax laws that it is difficult for a common person a take a clear cut action. As rightly said by Manshu you should consult a practicing CA on this issue.”

Now you are asking these ifs and buts. Only a CA/tax expert can answer your questions. We people here are no experts (may be an expert appears to answer your query) and are here to try to show the way. I do not know whether you have already gained this LTCG or you want to get all these information before hand for a future LTCG.

If you have already made an LTCG then you should hurry up as all the actions to save tax are time bound and you have to pay taxes if you do not take any action to save tax within that time limit.

And if you are asking for future LTCG, then you can put your question in a tax/CA forum/blog.

But my sincere advice to you is to consult a practising CA/tax expert as amount involved is substantial and even a small mistake can cost you dearly.

As all the details about LTCG are not known, do some homework, calculate the tax on LTCG yourself, pay tax on it and invest after tax amount in an high yield investment. We people just want to avoid and save tax by some means. But sometimes it is better otherwise, pay tax and invest in high return investments than investing in low yield tax returns to save tax.

One question, why you do not want to invest in a house property to save tax on LTCG.

Dear Rakesh,

Til l the money is not utilized for investing in Sec54EC bonds r property, the money if deposited in any savings bank account will be subject to tax.However, if you deposit the amount in capital gain scheme, you will not have to pay any tax till you utilized it for investing.

The limit 50L applies to a financial year and in various court cases the limit has been upheld.

This will clear your doubt.

http://www.dnaindia.com/analysis/comment_beware-the-haze-cap-54ec-investments-at-rs50-lakh_1674267