This is another post from the Suggest a Topic page, and in this post we’re going to take a look at some of the main aspects of income tax that affect most salaried people.

The suggestion was to write a post for someone who has just started earning, so I’m going to write this post with what I think are the main aspects that someone who is starting out should be familiar with.

What are deductions?

If you understand deductions in the beginning itself that will make it easier to understand how taxes are calculated later on. Deductions are items that are allowed to be reduced from your taxable income.

For example – current income tax rules allow you to invest up to Rs. 1.2 lacs in certain specified assets, and when you do so, the equivalent amount is reduced from your taxable salary.

So, you could have a salary of Rs. 5 lacs and if you invested Rs. 1 lac in a deductible asset – your taxable salary will only be Rs. 4 lacs, and you won’t have to pay tax on the whole 5 lacs.

It is important to remember that deductions reduce your taxable salary and thereby reduce your taxes. They are not to be directly reduced from your tax liability.

Main Salary Heads

When you look at your salary – you will notice that it’s divided into certain categories, and that’s because current income tax rules allow certain deductions based on different categories.

Usually, you will find the following categories:

1. Basic Pay: Your employer has to contribute a certain percentage of your basic pay to your provident fund which is why this is usually a small part of your total remuneration.

2. Leave Travel Allowance (LTA): LTA is taxed differently from your other salary and there are rules specific to it. That’s why you will find a separate head for that as well. You can read my post about LTA here.

3. House Rent Allowance (HRA): Like LTA, there are special provisions for HRA as well, so it forms a different head of the salary. You can read my post on HRA here.

Income Tax Slabs

India has a progressive tax structure which means that the tax rate increases as your income rises, and you have to pay taxes at a higher rate when your income rises.

For the current financial year following is the tax slab.

Upto 180,000: 0%

180,000 – 500,000: 10%

500,000 – 800,000: 20%

800,000 & above: 30%

This slab is different for women and senior citizens, and you can find all the tax slabs here.

This is fairly straight-forward and the only thing I’d like to mention here is that if you make 9 lacs then not all the 9 lacs is taxed at 30%. Only the sum above 8 lacs (i.e. 1 lac in this case) is taxed at 30%. The rest of the amount is taxed at the rate of the respective slab.

Deductions under Section 80C

If you are just starting to earn (and not a commerce student) then you probably haven’t heard of Section 80C. It’s a section within the Income Tax Act that specifies what instruments you can invest under that allow you a reduction in your taxable income.

This is important because it allows you to save tax and invest your money at the same time. The catch here is that everything under this section comes with a lock in period, so you can’t access your money for some time. That said, try and plan for this section well in advance and take as much advantage of it as possible.

You may find my article on Section 80C Tax Saving instruments useful for this purpose. The maximum tax advantage you can get is Rs. 1 lacs, and your provident fund also forms part this limit so you may not even need to invest the whole amount here.

Deductions under Section 80CCF

80CCF is much like 80C, but adds to the limit available in 80C. Using this section you can reduce an additional Rs. 20,000 from your taxable income over and above the 80C deductions.

You can read my detailed article on 80CCF here.

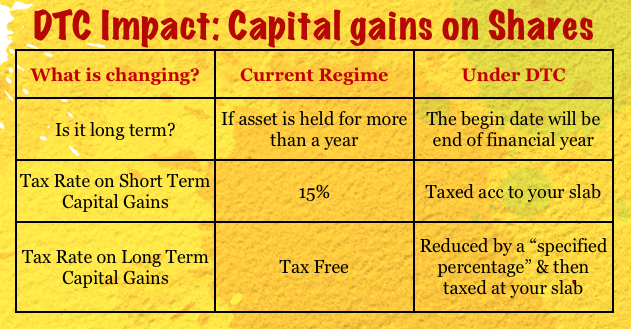

Capital Gains on Shares and Mutual Funds

Apart from your regular income you may invest in shares and mutual funds as well, and any gains from these sources are called Capital Gains and treated differently from your regular income.

You can take a look at my post on capital gains on shares and mutual funds to get a quick view on how dividends and capital gains are taxed on these instruments.

Tax on Debt Instruments

I had written a post earlier on tax specifically related to debt instruments and this might come in handy if you want answers on what instrument attracts TDS, on which ones you need to pay tax even though there is no TDS etc.

Conclusion

In my opinion, knowing these things about tax will be a good start for someone who is starting to earn. This is basic information that most people should have, and at the same time it’s not likely that it overwhelms you either.

Do let me know if you have any other questions, or if you think I missed something.