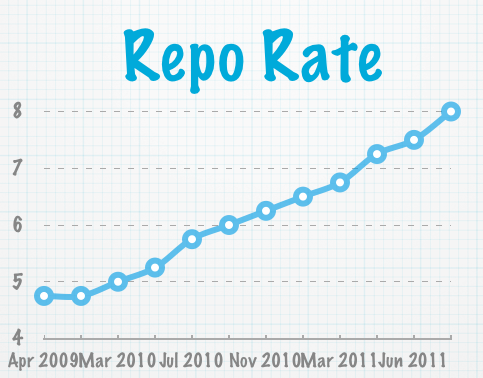

RBI increased the Repo rate to 8.00% today, and while the hike itself was not a surprise, the fact that it was half a percentage instead of a quarter percentage surprised everyone.

I was going through the report today, and there were several interesting things that caught my eye. Let me list down some of them here because they help understand RBI’s perspective on what the economy is facing, and also facilitates an understanding of what they’re doing, and what they are likely to do in the future.

Inflation is more generalized now

We have been seeing high inflation for much more than a year now, and while initially the primary culprit was high food prices, that has now translated into higher prices in other areas as well, and triggered what the report says is a more generalized inflation.

There is a case of demand push inflation with sales of various companies increasing during the past year, and companies utilizing more of their capacity which shows that there is sufficient demand in the market even with the high inflation. The RBI looks at a survey called the OBICUS (Order Book, Inventory and Capacity Utilisation Survey), and this survey shows that capacity utilization has increased in 17 out of the 22 industries covered in it.

However, rising sales have not translated into profits that have risen correspondingly. Profit growth has been slower due to high input prices.

Outlook same as before

In line with what they said earlier, RBI states that inflation will be high for another quarter, but then they expect it to recede in the latter half of the financial year.

This is of course based on how things stand today, and there are three things in particular which the report calls “The troika that may alter baseline growth and inflation projections” that can impact inflation and GDP growth expectations adversely.

These are:

- Bad monsoon

- Commodity bubble or collapse

- Euro Zone debt crisis assuming a full blown proportion.

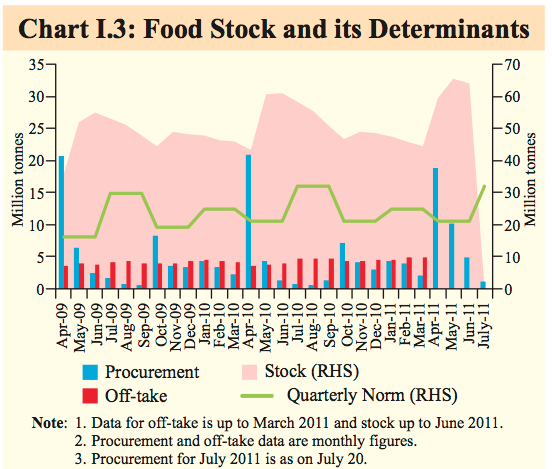

Food continues to remain a big cause of inflation.

The report has this staggering statistic that food stocks have reached 65.6 million tons in June 1 2011, which is twice the food security reserve requirement, and which exceeds the current storage capacity! It also touches upon the commonly cited statistic that 40% of our fruits and perishable items go waste due to lack of storage and infrastructure.

There is an excellent chart in the report that shows how the food stock has grown in the past few months, and the relationship between the procurement and off take of food stock.

This reinforces what has been said earlier, and something I’ve also written about quite a few times. To really tackle the problem of inflation, you have to tackle the supply side issue of food procurement, storage and distribution.

Investments slowdown, but private demand continues to remain strong

The corporate investment in the second half of 2010 – 11 dropped 43% from the figure in the first half. The rising interest rates obviously contribute to this but there are probably other factors and policies like allowing FDI in multi brand retail, and removing other constraints will help investment pick up. The private demand was however buoyant and the report attributes this to improved agriculture growth

Subsidies are likely to overshoot budget

The petroleum subsidy for the current year has been estimated lower than what it came to last year, and RBI says that this could overshoot by as much as 1% of GDP!

The level of subsidy could overshoot by 0.50% of GDP, payments to oil marketing companies for the under recovery they incur could overshoot by 0.20%, and elimination of customs and excise duties may cause loss of revenue to the extent of 0.30% of GDP.

Current Account Deficit Improved

The CAD (Current Account Deficit) improved or moderated, and the deficit turned out to be 2.6% of GDP last year instead of 2.8% as was the case in 2009 – 10.

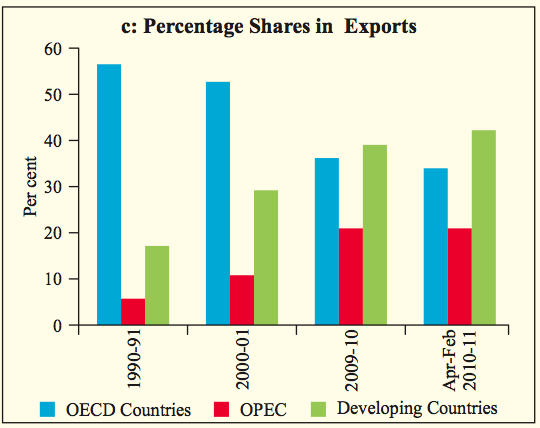

This was due to an increase in invisibles, which was supported by an improved performance by the software sector. Another interesting statistic is the changing composition of the countries India exports to. In the last two decades the percentage of OECD countries have come down to make way for developing countries. Another interesting nugget is that China and South Africa accounted for about 32% of the increase in share of exports to developing countries.

Here is an excellent chart from the report which highlights the changing export destinations quite well.

I wasn’t aware of this changing composition till today, and it was quite interesting to see the data like this. When you think about it, it makes sense that our exports are growing in the countries who are growing themselves, but generally when someone is talking about exports or even when you read about them you almost always think about exporting to developed countries.

Conclusion

This by no means covers everything that was present in the report, and in fact I’ve left out the section on Monetary and Liquidity position that I want to do a full post later on.

However, these statistics do give you a good idea of the environment and factors that RBI is operating in, and considers while making changes to the interest rates.

If you found this post interesting, then I’d also recommend my other posts in the Economy section, and especially the two posts I did on the budget earlier this year.

I read that your blog. It was very interesting. Now i am understanding how the monetary policy work & on which basis it work. Actually i am a student of CFP. I am just trying to correlate all these gov issues with share market. How this monetary policies affect the market.

thanks for simplifying a document like this for a lay person like me. i have one question though (that i know many others too share) and that is ‘why and how does the euro zone crisis affect me?’

as i understand it, any monetary crisis like the euro zone one will affect the FII investments in the stock market. but why should an individual like me worry about something happening in Greece for example?

is there a simple way of understanding this?

Hi Arvind,

The problem is not Greece alone, there are other countries there that are much bigger and may have problems much larger than Greece. You must have read about Italy’s 2 trillion debt, and surely that’s too big to bail out. If creditors have to take a hit on that big a debt then that disrupts financial markets, and also affects the flow of credit which in turn disrupts commerce, and while Indian banks don’t have direct exposure to European debt, exports will slowdown, and then that plays into the domestic policies that RBI follows in order to regulate market rates etc.

I don’t know how much of this makes sense and how much of this seems like garbled nonsense but the global economy is tightly integrated, and I don’t know if you noticed but the last recession has taken the word decoupling out of the vocabulary of everyone. Float together, and sink together.

Thanks. That was crisp! 🙂 I guess i better not gloat at the difficulties of the so called ‘developed’ nations. Better to float together. 😐

Dear Manshu

Interesting post. Saved my time of going through the RBI report. 🙂

few chords struck from the above post. one is the topic of inflation.

I completely agree with you on the statement

“To really tackle the problem of inflation, you have to tackle the supply side issue of food procurement, storage and distribution.”

exactly my views. The actual inflation that we are facing might be much higher than the projected figures. and food inflation cannot be tackled through monetary policies.

As it is clearly supply driven inflation and not demand driven. To feed an increasing population one needs to increase its production and not expect people to starve.. How can one expect to curb the demand for food?

I have written about it on my blog.

The post is about a RBI report on statistics, the quality of data on which the crucial figures are based upon, and also WPI v/s CPI

http://complexityisthefatherofsolution.blogspot.com/2011/07/few-answers-and-some-more-questions.html

Do leave a comment if you would like to share your view.

Regards

Supriya

Sure Supriya – I’ll have a read. The name of your blog is interesting – complexity is the father of solution – is that right? Why that?

Thank You Manshu..

Well.. We generally dont look for solutions for simple things .. right? 🙂

So.. as necessity is the mother of invention.. Complexity is the father of Solution.. 🙂

Ah, I wouldn’t have made that connection in a million years 🙂

Also, I liked your article, but can’t comment there because currently your set up doesn’t allow anyone to comment with just a name and email id.