The tax filing season is closing in on us, and you don’t want to leave everything down to the last minute. There are still a few months left, and if you haven’t already started planning for your taxes – now is a good time to start.

I’m going to start a series on tax saving instruments here, and every week I’ll try to write at least one post on a tax saving topic.

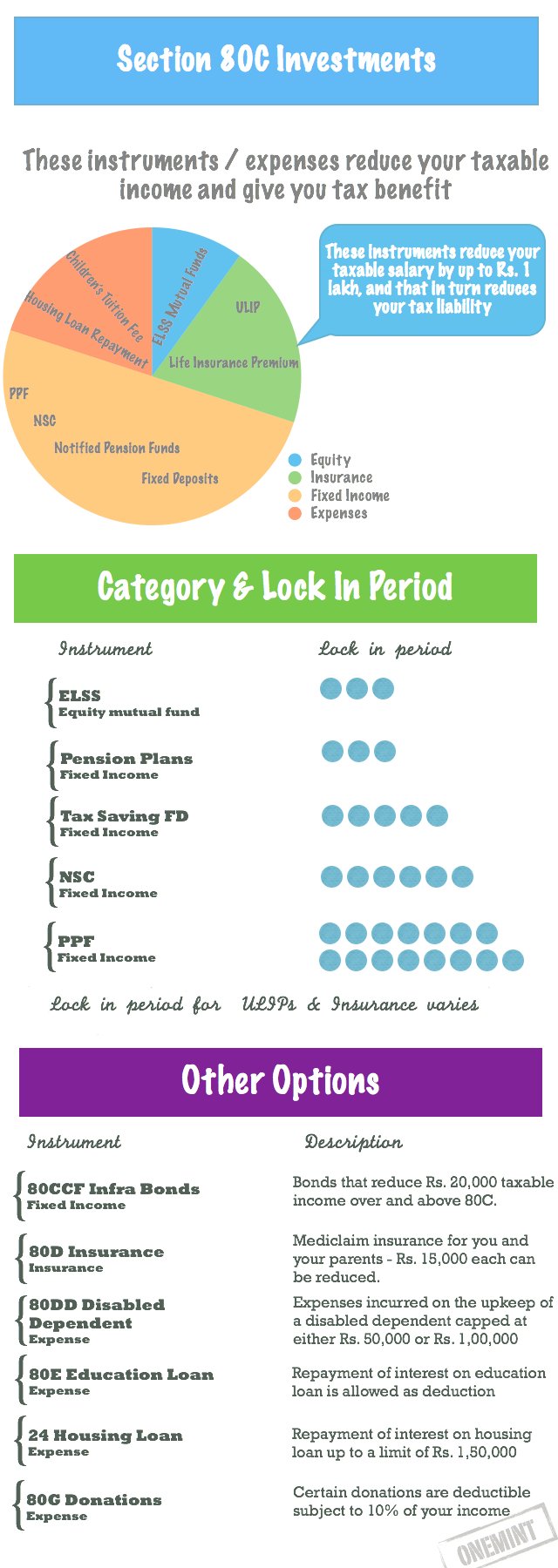

This week, I start off with an infographic I created with the hope of giving an overview on the various tax saving instruments especially 80C instruments in an easy to digest and graphical manner.

I hope this provides a good overview on the various instruments, how much they save and their lock in period.

I was a little wary of including returns because they can vary so much, and it is natural to compare one with the other but that’s not right since the risk profile of the instruments is different.

Please let me know if you see any mistakes, and also if you want to see any other information on this.

Please share it with friends and colleagues if you think this will be beneficial to them, and as usual I look forward to your comments!

Hi Manshu,

Please clarify follwoing situation:

Supoose my salary is 6Lacs and out of this Company’s contribution to PF is 20K and my contribution is also 20K.

Now when we count tax deductions then only 20K will come in my 80C limit and compnay contribution to PF will reduce my net taxable salary. in this case net taxable will be 5.8Lacs and i can claim 1 lac under 80C which includes my 20K PF contribution.

I’m sorry I don’t understand this situation enough to comment on it. Additionally, different contributions to Recognized, Statutory, Unrecognized and PPF is treated differently and I’m not familiar enough to comment on that.

Hi shankar,

Company contribution is not taken into consideration when taxability is calculated as it is an income for the employee.Since mandatorily the employer have to contribute its keep on increasing the PF accumulation.The benefit is that it is a tax free income.

In your case net taxable is Rs 6 lac and you can claim Rs 20 k under section 80C.

Thanks for this article Manshu…The pictures make things very clear…By the way its intresting to know why a govt has to come up with Tax saving instruments and created a headache for all of us…Read out my analysis on this topic in this blog of mine…http://sidsavenue.blogspot.com/2011/03/ecomonics-of-tax-saving-instruments.html

Sid – There’s a typo in the spelling of economics in your title – I make these type of mistakes all the time, and realize it can turn away readers pretty quickly – you might want to correct that. Just my opinion.

Thanks a ton Manshu…I am sure experience helps to develop such a keen eye and I am glad that you pointed the error and took time to inform me…

Wonderful post! At one view it gives all the options available for Tax savings under section 80C. Instruments such as Life insurance should have tax savings are the secondary objective. It is not at all advisable to buy an insurance product in haste just for saving taxes. A much better strategy would be to carefully evaluate your need and understand the different product options. Then when we purchase a product after this evaluations, tax savings can be an add benefit.

Hi Hari, thanks for sharing the link. But article is not clear if the amount can be invested in Tax saving Mutual fund or any other tax saving instrument by parents when we gift the money. Manshu, do you have any idea about this?

Hi All,

I did some research on the Internet on this topic and this is what I found:

1. You (as a Donor) cannot save tax directly by gifting assets to your relatives.

2. The returns from the gift invested are not taxable based on certain terms and conditions

3. Most of the articles do not mention the above fact clearly giving one an impression otherwise.

A good clarification/explanation is available at:

http://www.jagoinvestor.com/forum/please-explain-rebate-on-gift/1742/

Hope this helps.

Thanks Hari – that’s a great links, and a good specific answer to his question. I’ll see if I can write an article on this topic myself and cover some more ground. Thanks!

No, I don’t – the other link was quite useful, and I’ll try to research this some and see if I can write a full post on it.

Manshu,

Could you please throw some light on saving taxes via gifting cash (or other assets) to ones’ parents or relatives. One reference I found was :

http://businesstoday.intoday.in/story/investing-through-children-parents-helps-save-tax/1/16581.html

Hi Hari,

Thanks for sharing the link.

It’s a refreshing reminder of tax planning via gift.

Great idea Hari – I don’t know a lot about this so I will try to research information and write about it in the weeks to come.

i think under 80cc Stamp Duty and Registration is also included for home buyers????

Yeah, that’s right.

Hi,

As I understand, does it mean that one can save 30K in 80D section? I already get benefit of 15K though Health insurance for my family. Can you plese throw some more light how to go about next 15K? Can you please suggest some good plans for parents?

Yes, 15 for you and 15 for your parents. This is specifically for mediclaim so you can get one of those eligible policies.

To be honest, I don’t have a list of these policies right now, and I’ve never done a comparison so I can’t tell you which one to opt for. Might make a good topic for future but I can’t really say right now.

Good one which gives an overview of what options are available . How did you make it?

Good one which gives an overview . How did you make it?

Tools are simply Keynote on Mac and GIMP which is an open source software of the more expensive Photoshop. I did a full post on graphics also, it’s here if you’re interested.

http://www.onemint.com/2011/04/28/how-do-i-design-my-graphics/

Manshu,

You may would like to add deduction U/s 80U availabe to disabled tax payers.

Deduction U/s 80U available to a taxpayer who is suffering from some kind of disability.

Deduction available of Rs 50, 000 in normal disabilty and Rs 100,000 in case of sever disability. For more details refer: http://bit.ly/rmz9hv

Thanks Furqan – I didn’t know about it – is this a new section or maybe I have just forgotten about it – long time since I looked this up.

So, the big difference between this and 80DD is that this is for the person himself and that’s for his dependents right?

80U is a decades old deduction.

You have understood the difference between 80DD and 80U very well.

Thanks Furqan – I wonder why this doesn’t ring a bell – I feel like I’ve never heard of it 🙂

Sec 80U as per Income Tax Dept Website:

http://bit.ly/pk2tYB

http://bit.ly/nUDtnR

Analysis/Comparison of Sec 80DD & 80U:

http://bit.ly/q1G7Nr

Awesome!!! Thanks much Furqan!!! I’ll go through it and a post is coming up

One of the most useful posts I have ever come across.. information you have presented can be found at many places but this is most readable…

That’s what my goal was so really happy to hear that from you 🙂

Hi Manshu ! Nice Overview ! Superb Pie Chart i must say ! Just wanna add my 2 cents worth of comment 😉

1.In Section 80 D, if parents are senior citizens, tax benefit of upto Rs 20,000 can be availed.

2.Newer tax saving options under 80 C include

a.ICICI Guaranteed Savings Insurance Plan (a post on which i had requested)

b.LIC BIMA BACHAT & other Single Premium Policies (another topic which i feel, merits a post !)

the returns from both of which are tax free as well (under section 10 10(D) ).

Thanks for those pointers Vijay! – ICCI Guaranteed Savings plan is already one of my drafts and I’ve written about 100 words on the topic. I was hoping to finish it last week, but didn’t get to it. I will definitely try to complete it this week.

Thanks for bringing up this these new products to my attention – quite frankly, I didn’t know about either of them, and that’s why it’s taking so long to write.

Hi Vijay,

Quick question – How do you know that the ICICI Guaranteed Plan is covered under 80C?

I actually see that 80C and 10D is applicable in the fine print of the document, but usually these things are advertised in 36 bold font, and I was wondering why that is not the case.

Thanks!!!

Manshu, ICICI has not sought to promote this product as a Tax Saving Instrument – otherwise, they would have screamed from the rooftop by advertising in 36 bold font !!! That would be the most plausible explanation!!!

Although i am sure that the salient features would come out in your post on the topic, i also noticed that an investment of upto Rs 50,000 in either of these products i.e ICICI G SIP or LIC Bima Bachat doesn’t attract the Taxman’s attention as you don’t need to provide a PAN CARD No. or Copy…. All that you require is an Identity proof, Address Proof, Photo and your Bank Passbook statement as the money will be credited directly through RTGS/NEFT to your account… So, am not sure whether the promoters wanted to mop up such money…

Maybe, i am attributing motives as i am unable to explain it…. or maybe, i am right!

Vijay,

pl elaborate on point # 1.

How can i show that i have spend /given Rs 20 k to my sr citizen parents.

What is the procedure.

thanks

Right Now,investments made under Jeevan Akshay scheme of LIC,which gives you an annuity for one time investment qualifies under 80C.Willthis continue from 1-4-2012 when DTC will come into force?Pl clarify.

After the DTC is introduced the entire 80C tax rebate section will be removed and as a result anything that offers you tax saving now – won’t do it after DTC.

This is the way things stand today, but they might change in the future as there have been quite a few revisions on this already.