It’s raining NCDs these days, and the latest company to offer its bonds is Manappuram Finance. Most of you will know them by their ads on TV about gold loans, and that’s the business they’re in.

They give loans against gold to customers in the rural and semi urban areas, and have been in this business since 1999.

They are primarily a South Indian company as 86% of their loans are made in Andhra Pradesh, Karnataka, Tamil Nadu and Kerala.

Manappuram Finance was incorporated in 1992, but the business has been in existence for quite some time. The gold loan business, and rising gold prices have been a boon for them as their revenues have increased rapidly in the past few years driven by that business. On March 31st 2011 their portfolio of gold loans stood at Rs. 63,705.41 million, which rose from Rs. 18,512.26 million the year before, and was Rs. 4,000.63 million in the year before that.

This is about 52.97 tons of gold as at 31st March 2011, 22.45 tons in 2010, and 13.34 tons in 2009.

Their revenues last year were Rs. 11,815.26 million, and a profit after tax of Rs. 2,826.64 million. You can see this is a fairly big company with a pretty decent profit margin, and that shows in its credit ratings which is P1 + from CRISIL for short term debt instruments which is the highest rating a company can have.

These are some of the things that have been going well for the company, now let’s take a look at some risks that the company faces as described in their prospectus.

Risks Mentioned in their Prospectus

Manappuram lends by keeping gold as a pledge, so of course the big risk they face in their business is if gold prices took a dive. Other than that you have seen that there are other NBFCs getting into the loan pledging business and the competition is really heating up here.

An interesting risk that I saw in the prospectus was deficiencies found by RBI when they had conducted a routine inspection. Manappuram Finance auctions the gold pledged against loans which borrowers aren’t able to repay, and RBI found that there was a big time gap between when the loan became overdue, and when they conducted the auction.

RBI also found that some of their branches didn’t have seemingly basic information about who won an auction, how much did they bid, mode of payment etc. There was also one case where RBI says that Rs. 95.86 million from an auction proceed were ploughed back in the company as working capital where it should have been returned to the concerned borrower.

Another RBI routine inspection in June 2011 found deficiencies in their loan documentation. Some branches didn’t have sufficient identity documentation, and others didn’t have records of the scheme under which the loans had been disbursed.

Other notable risks include the promoters having given a personal guarantee for loans worth Rs. 6.63 billion, and if the lenders require any alternate guarantee then that would put the burden on Manappuram to come up with either alternate source of funding or come up with adequate guarantee.

The promoters have also taken a loan of Rs. 1 billion from Religare by pledging their shares in the company. NSE website shows that they have pledged about 20% of their total shares.

As I’ve written before – this is a red flag that I like to watch out for because in my opinion the last thing you want to do is to pledge your ownership stake by taking loans against shares.

These were some things that stood out for me as I was going through the prospectus. Now, let’s take a look at the NCD itself.

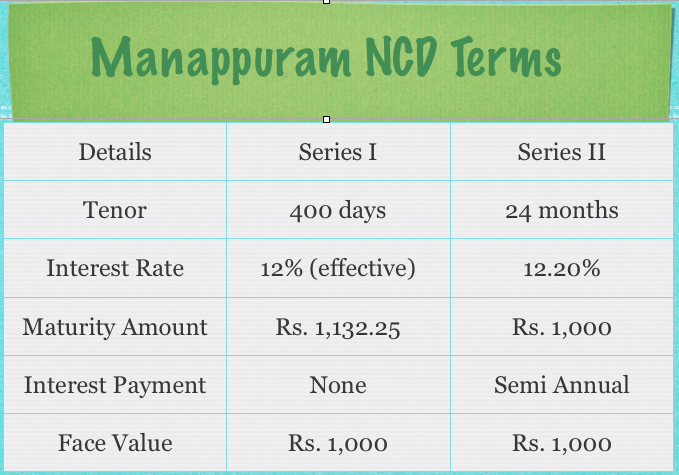

Manappuram NCD Terms

The minimum application is Rs. 5,000 and the issue will open on August 18th 2011, and close on September 5th 2011.

The issue has been rated CARE AA- from CARE and BWR AA- by Brickwork. The rating by Brickwork stands for high degree of safety regarding timely servicing of financial obligations, and the CARE rating also stands for high safety for timely servicing of debt obligations.

This NCD will be listed on the BSE, but not on the NSE, and here are the other important features of the Manappuram NCD.

These bonds are secured in nature, and let me reiterate that it doesn’t mean your money is guaranteed by the RBI or anyone else, but simply means that if the company were to go bust, there are some assets which are allocated towards this debt which will be sold off to recover your money. Now, those assets may sell for less than what the company has marked them for, or there could be other creditors who also have claim to them so you don’t get the full money back.

Secured debt is better than unsecured debt, but it doesn’t mean a guarantee in the sense that a lot of people think of it.

So overall, the good thing about the Manappuram NCD is that it’s giving higher rates than the other NBFC NCDs that I have reviewed here, and the credit rating is good as well, but the negative factors are the deficiencies found by RBI during their routine inspections, promoter’s pledge, and managing as well as sustaining its rapid pace of growth.

Which NCD is better Muthoot OR Mannapuram in terms of security?

is manapuram trustworthy?

Harry,

There are some issues with the company which you have to consider when you are investing.One is the high debt and second is the reliability on gold for the entire business. both these risk are high as things can go wrong if gold prices suddenly reverses.

Hence it is a high risk investment and should be considered if you have that apetite.

semi annually interest offer by mannapuram please know me its first interest date when company credit interest to our account.

I had applied for Manappuram NCD still i have not got it in my Dmat account nor in phisycal form neither any money refund. How can i inquire about it. Plz help.

Your best bet is to inquire with the company or the broker that helped you get the issue.

thanks Manshu.

can you grade the best available say top 3 NCDs for a risk adverse individual keeping in mind price/discounted price/risk reward ratio etc.?

To be honest – I think a risk averse investor should stay away from all the issues that have come out recently.

I think Shriram transport is a fairly strong, AA rated entity. Available at yields of 13%, its a steal. Consider the balance sheet size of this entity, bigger than even many private banks. I would say thts the best bet.

The CRA’s knowledge linkage is with debt markets and not share price as the latter anyways is is an outcome of a speculative activity. The prices or yield of debt papers adjust after CRA actions.

I don’t have a very high opinion of these agencies esp. Substandard & Poorest 🙂 always behind the curve.

Business judgment being qualitative and increased volatility & instability in financial markets place (asset bubbles) has lead to some wrong decisions in hindsight. But that doesnt take away the analytical rigour and importance of credit rating in pricing debt instruments (yield spread over AAA have always been benchmarks for pricing particularly in efficient and mature debt markets – this is a fact). I do tend to agree that increasing information symmetry has lead to more awareness among market participants, which should infact keep a check on rating agency’s role.

The way they have erred in the financial crisis – first contributing to causing it and then worsening the situation by downgrading stuff that should have been downgraded years ago makes me hold a less rosy view than yours.

Even now you see countries being downgraded where the info that came out is nothing new. People have known about these debt issues from years and these downgrades should have come much earlier if they had to come at all.

Hi Manshu,

Found this nice post from Prof. Sanjay http://www.sanjaybakshi.net/Sanjay_Bakshi/Articles_files/Trust_Mr_Market_Not_The_Credit_Rating.HTM

Since you write on NCD’s i thought it will be nice if you consider this angle too while publishing report .

This article is outdated and no longer relevant in the current context. Markets have become far more mature now. Anyways if ppl r taking call on a shady small cap stock or bare investment grade or lower (BBB or lower), they have only themselves to blame for the downfall.

You are a bit harsh Ank 🙂

I think the basic idea still stands true, and in general I tend to think that if the credit rating agencies know something then that means the rest of the world already knows about it and this should be reflected in the stock price, or the data about pledging shares which is something I keep an eye on.

having the seen the reaction of stock market and SBI share price to Moody’s downgrade, the agencies are ahead of the curve.

Then you need a refresher of what happened in the credit crisis 🙂

Thanks for sharing the link Raja – always good to read diff perspectives – and in general I think it’s better to avoid some of these smaller companies when it comes to fixed income. That’s one part of your portfolio where you don’t want to to for lower quality for a few percentage point gains – it’s a high risk, low reward kind of thing.

i am unable to see the prices if manappuram fin ltd ncd on bse so please provide mee the code on the bse,and also where i could see the prices.

Nikunj – Following are the BSE codes for Mannapuram:

I. 934826

II a. 934827

II b. 934828

Thanks Manshu. I’m unable to see the price of this NCD online. Also that of Muthoot; where can I see the prices.

then i could not understand what is benefit to the company persay or what is intention behind listing such type of NCD.Is it to be known in the market and get credibility.

The company is able to raise money Sandeep – that’s the benefit to them. If it trades at a discount later on then that’s not good for their brand, but it doesn’t affect the money that they have already raised.

its only post IIISL, due to heavy supply of NCDs, they are trading at a discount. it was not the case earlier. currently its good opportunity to buy bonds from market at discount, if you want to hold till maturity

thanks to guide to avoid trading. My purpose was instead of appling throguh allotment pocedure why don’t we buy from the market when it is available at lesser rate from the issue price condiering yield then my concern is how do interest calculated and paid. What is your openion. Pls suggest.

thanks, can you please help me to buy, out of any other NCD already listed, is trading on premium or offering good return for shorterm period.

hi sandeep, it will be very difficult to take a trading call on bonds (due to lack of liquidity in secondary mkt). I can only advice based on return on holding the bond till maturity. If you consider 2 year horizon, 14% should be a good yield by manappuram. Longer horizon bonds of IIISL (3/5 yr) are available at deeper discount and similar yields (as coupon rate is lesser), but risk is higher. I guess, Muthoot bonds also have potential to offer similar yield post listing when they list at discount. But its better to avoid bonds for any trading gains.

NCD is listed at bse but i could not understand why it is traded low rate infact from issue price.

hi sandeep, the discount was higher during start of the day, later it came down. If you look, the 400 day option has closed at par 1000 Rs, as shorter term paper is always considered less riskier (consider IIISL 5 yr at sizeable discount to 3 year one). The 2 year manappuram is at discount, closed at 974 (in fact at those prices, the yield is ~14%, which is a good enough reason to buy as 2 years is not a very long horizon to consider this risk)