A few days ago I posted the premiums charged by different term insurance companies, and as a follow up to that post I shared the claim settlement data of some insurers last week.

Today I’m going to share the claim settlement ratio of all 23 life insurance companies in India for the December 2010 quarter. Rejections are simply claims that the insurance company has refused to pay, and lower the rejection – better it is for you.

This is very interesting data, and the one thing that jumps out at you is the low rejections by LIC.

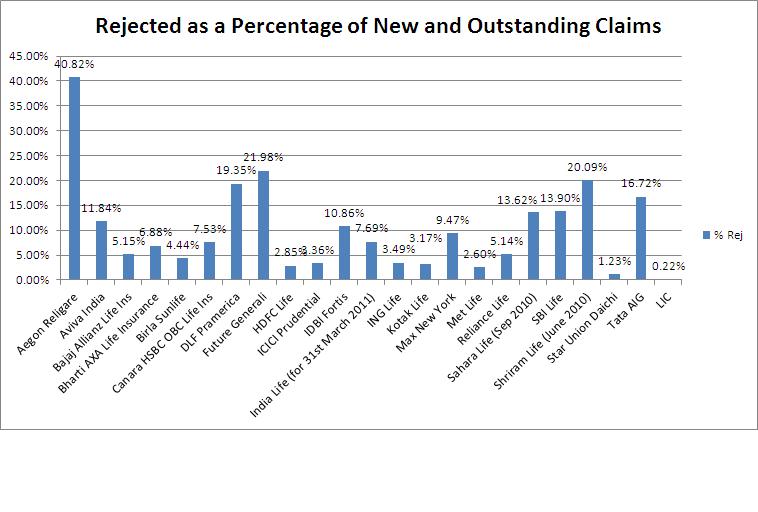

Here is the first chart which shows the percentage of claims rejected by all the insurance companies for the December 2010 quarter. (Exceptions in time period are noted in the last table which has the raw data.)

(click for larger image)

Now, when I looked at this two questions came to my mind:

1. How much difference does the relative volume make to these numbers?

2. Are these numbers skewed because of the 2 year rule?

Let’s think about the question of relative volume first. The new plus outstanding claims of Religare was 47 for that period, so even if they rejected 2 claims that would be a rejection rate of close to 5%; that they rejected 20 doesn’t exactly inspire confidence, but you can easily see why this number can’t be compared with LIC which has about 2.3 lac policies for that period.

The 2 year rule is that insurance companies can’t reject policies that are older than 2 years unless they can prove fraud. Loney – who is easily the most prolific commenter here has dug up the relevant act as well, and here is how it quotes:

Section 45 of Insurance Act, 1938 states: In accordance with Section 45 of Insurance Act, 1938, no policy of life insurance shall, after the expiry of two years from the date on which it was effected, be called in question by an insurer on the ground that a statement made in the proposal of insurance or any report of a medical officer, or a referee, or a friend of the insured, or in any other document leading to the

issue of the policy, was inaccurate or false, unless the insurer shows that such statements was on material factor or suppressed facts which it was material to disclose and that it was fraudulently made by the policyholder and that the policyholder knew at the time of making that the statement was false or that it suppressed facts which it was material to disclose.

So, are these rejections influenced by the fact that some insurers have been around for much longer, Â and most of their claims are from policies that are older than 2 years.

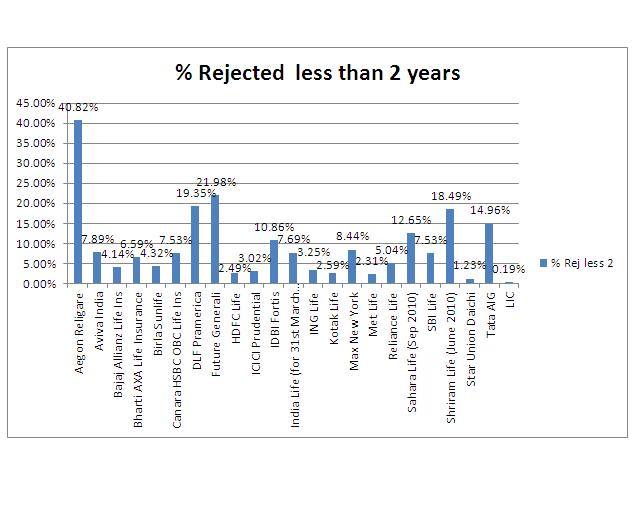

So, let’s look at the data only for rejected claims that are less than 2 years old across life insurers.

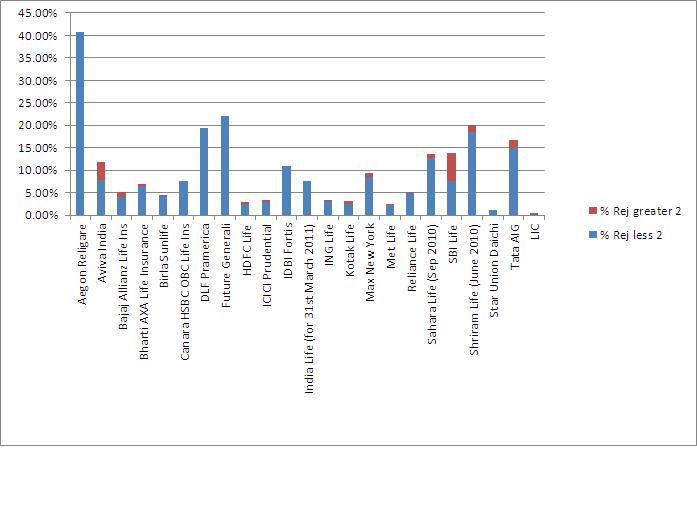

The numbers don’t seem to change much, and finally let’s take a look at the ratio of claim rejections between claims that are more than 2 years old and less than 2 years old.

As expected, the claims that are less than 2 years old are rejected more often than claims that are older than 2 years, and obviously that will weigh on some of the newer insurers.

However, no matter what way I look at it LIC’s low claim rejections jump out at me. That they are expensive when compared with others makes the choice of a term plan difficult, but this is certainly something worth keeping in mind – especially for people who smoke socially or have minor health problems that can later become a cause for denial of your claim if not declared properly.

I’m enclosing the raw data in this table below, so you can use it if you want, and the sources are the same as mentioned in my earlier post, so I’m not pasting those ugly links again.

| S.No. | Insurer | Claims O/S | New Claims | Claim settled | Claims rej | Less 2 y | Greater 2 y | % Rej | % Rej less 2 | % Rej greater 2 | % Settled |

| 1 | Aegon Religare | 22 | 27 | 13 | 20 | 20 | 0 | 40.82% | 40.82% | 0.00% | 26.53% |

| 2 | Aviva India | 0 | 532 | 469 | 63 | 42 | 21 | 11.84% | 7.89% | 3.95% | 88.16% |

| 3 | Bajaj Allianz Life Ins | 2,548 | 6,485 | 6,268 | 465 | 374 | 91 | 5.15% | 4.14% | 1.01% | 69.39% |

| 4 | Bharti AXA Life Insurance | 127 | 222 | 168 | 24 | 23 | 1 | 6.88% | 6.59% | 0.29% | 48.14% |

| 5 | Birla Sunlife | 173 | 3,113 | 3,029 | 146 | 142 | 4 | 4.44% | 4.32% | 0.12% | 92.18% |

| 6 | Canara HSBC OBC Life Ins | 74 | 72 | 50 | 11 | 11 | 0 | 7.53% | 7.53% | 0.00% | 34.25% |

| 7 | DLF Pramerica | 14 | 17 | 6 | 6 | 6 | 0 | 19.35% | 19.35% | 0.00% | 19.35% |

| 8 | Future Generali | 2 | 230 | 162 | 51 | 51 | 0 | 21.98% | 21.98% | 0.00% | 69.83% |

| 9 | HDFC Life | 208 | 1,196 | 1,139 | 40 | 35 | 5 | 2.85% | 2.49% | 0.36% | 81.13% |

| 10 | ICICI Prudential (Full year) | 901 | 15,605 | 14,862 | 554 | 498 | 56 | 3.36% | 3.02% | 0.34% | 90.04% |

| 11 | IDBI Fortis | 70 | 105 | 75 | 19 | 19 | 0 | 10.86% | 10.86% | 0.00% | 42.86% |

| 12 | India Life (for 31st March 2011) | 0 | 13 | 7 | 1 | 1 | 0 | 7.69% | 7.69% | 0.00% | 53.85% |

| 13 | ING Life | 112 | 1,550 | 1,462 | 58 | 54 | 4 | 3.49% | 3.25% | 0.24% | 87.97% |

| 14 | Kotak Life | 411 | 631 | 627 | 33 | 27 | 6 | 3.17% | 2.59% | 0.58% | 60.17% |

| 15 | Max New York | 707 | 1913 | 1669 | 248 | 221 | 27 | 9.47% | 8.44% | 1.03% | 63.70% |

| 16 | Met Life | 206 | 3562 | 3150 | 98 | 87 | 11 | 2.60% | 2.31% | 0.29% | 83.60% |

| 17 | Reliance Life | 957 | 4,025 | 3,272 | 256 | 251 | 5 | 5.14% | 5.04% | 0.10% | 65.68% |

| 18 | Sahara Life (Sep 2010) | 281 | 233 | 156 | 70 | 65 | 5 | 13.62% | 12.65% | 0.97% | 30.35% |

| 19 | SBI Life | 685 | 5,745 | 4,622 | 894 | 484 | 410 | 13.90% | 7.53% | 6.38% | 71.88% |

| 20 | Shriram Life (June 2010) | 475 | 212 | 197 | 138 | 127 | 11 | 20.09% | 18.49% | 1.60% | 28.68% |

| 21 | Star Union Daichi | 22 | 304 | 218 | 4 | 4 | 0 | 1.23% | 1.23% | 0.00% | 66.87% |

| 22 | Tata AIG | 26 | 883 | 702 | 152 | 136 | 16 | 16.72% | 14.96% | 1.76% | 77.23% |

| 23 | LIC | 53,765 | 181,165 | 182,211 | 506 | 443 | 63 | 0.22% | 0.19% | 0.03% | 77.56% |

Custom-made personalized bracelets for guys from adrianjade.com.

We sell “designed to order” beaded and leather bracelets for guys that

perfectly fit your wrist. Our men’s bracelets are produced from the best quality natural stones including lapis lazuli, agate, tiger eye and many more.

With tens of thousands of happy customers across

the globe, adrianjade.com is growing exponentially with increased

and more happy buyers added to the family everyday.

Hello Pritam,

I will suggest you to buy Online term plan from any insurance company who has highest claim settlement ratio, In the past or currently also if the company has lowest claim settlement ratio then check the claim settlement ratio for the policy more then 3 years I believe once you crossed the early claim (3 years ) years time then no insurance company can reject any type of claim this is as per IRDA guidelines.

So in a Nutshell if any one is holding any type policy and have crossed the early claim (3 years) time and is paying the premium regularly then be sure your claim cannot get rejected in future.

Thanx Mr. Rajesh for your esteemed suggestions..

Kindly suggest me I wanna buy term plan from Bharti AXA insurance with life cover of 50,00,000/- just by paying Rs 5337/- for 30 year. Is it a good option I have selected or should I opt for any other company ? As far as claim settlement ratio is concern its showing only 44.44% which is very low comparatively with any other insurance companies.Am I going to be stuck if opt for Bharti axa ?

Hi Manshu,

Kindly provide the Term Insurance Claim Rejections for FY 12-13. We need to understand how different companies have fared up in terms of claims rejection ration for FY 12-13.

HI Manshu,

Kindly update the LIC % Settled value. It’s showing wrong value in this post(77.56%).

What about SBI life online Term Plan ????? any suggestion..

my age is 35 yrs and wanna have term plan of 1 Cr for 30 yrs..please suggest good online Term Plan>>??

A lot of these term plans are quite similar and I’m afraid I don’t have much input for you on which one is the better option to buy.

Manshu,

just wanted to point out something which i feel is amiss here or maybe its there and i missed it..

this analysis made me think that Aegon religare or for that matter few others too …are really bad at paying the claims..which means that one shouldnt opt for them and opt for others who have a better claim payout ratio.

now, since i work for an insurance org..which is there in your list..one of the major reasons for denying of a claim by an org..is hiding of data while buying insurance..apart from this reason..a term plan claim getting rejected is nearly impossible…

infact, if you look at the online term policies, where more educated people buy and buy honestly, the claim payout ratios are better than the state run insurance companies.

and i have not got the data to back-up..but i am pretty sure that this hypothesis will hold.

so, i guess we cant club entire insurance world as one..we will have to make segements and treat each of them separately.

Thank you for your comment. I would imagine that people hiding data or otherwise is the same for LIC or any other company, then why the difference? Can it be explained by tighter procedures by the private companies?

Hello;

Can you please once again share source to the information mentioned above so that i can share the same with my friends.

This post is a little dated so I’d recommend you not sharing these quotes with anyone and do your own new research.

Can you please help me regarding the data for SBI life TERM Insurance. aS LIC plans are too expensive. My Age is 32 & for 1 Cr Cover, Premium is coming to Rs 35000 Per Annum, Whicle Other’s are offering at a lower rate. But SBI is also a Govt Player & Premium amount is also lesser than Rs 18000. So, I go for it?? Or Should I stick with LIC??

Ok.

Thanks for clarifying, Manshu.

Please clarify if these claims are only death claims or including maturity claims. If it is including maturity claims, it does not make any sense. Since all maturity claims are always paid, the biggest player LIC will have the least rejection% as per your definition.

Can you get us pure death claim rejections only?

Thanks.

Term insurance does not have any maturity so this is what you’re calling “death claims”.

That’s right, Manshu.

To the best of my knowledge published information does not provide the break-up between death claims and maturity claims for all insurers. So it does not make sense to compare ‘claim rejection rates’ since maturity claims are included in the denominator for large companies like LIC.

Since Term Insurance has only death claims and not maturity claims, and since maturity claims are hardly rejected, the ratio will be skewed for such companies with high maturity claims.

Hope you are getting the point. I am unsure how claims rejection ratio is defined, given this perspective.

Thanks, Manshu.

No that’s the opposite of what I am saying Kishan – these are claims for term plans *only* so that means they are only death claims as you describe it.

Hi Manshu,

Another parameter where I am certain there is a skew is the amount insured. Do 1Cr plans get rejected more often than plans worth less?

You’ve been analyzing this data so carefully, that is a real bonus for me in helping me make my purchasing decision.

Cheers,

Santosh.

That is of course a good idea but I don’t think anyone breaks out the data to that level for us to analyze if claims of over a crore get rejected more frequently.

Hi Manshu – any update on the latest figures for this year – looking fwd to having the latest figures

Since you write the article, HDFCs Click2Protect has become popular – do have any figures for 2011 or 2012??

@Shiv – your posts here at One Mint are extremely informative

I haven’t looked at these numbers for a while and given how time consuming this is, I don’t think I’ll be able to write about this topic in the near future….

Thanks Anon!

I also think term plan is wise option and insure you in true sense. You can choose various financial products as an investment.

But not all term plans all cheap. However, mostly all ON-LINE term plan products are available cheap online from private players. To name a few…

ICICI Pru – iProtect

HDFC – Click2Protect

Aviva

Shiv – using the word ‘stupid’ is not cheap, it is describing something, which you would have done in worse language.

It is not necessary to behave like you know nothing as to your cheap language – read you post and my subsequent comment on you describing and alluding that people over 70 are almost dead, have no life, should have no liabilities – that is cheap.

Go on confuse people with incorrect info, scare them so they click on your ads and you laugh all the way to the bank.

At the age of 70, there are two risks; i) coverage of health expenses, which is covered by health insurance and not the products which we are discussing ii) risk of outliving ones assets (risk of living too long..opposite of insurance), this is covered by taking annuity product. You take insurance to leave money behind for your dependents (replace your earning capacity), at 70+ you should dont have any dependent, but you yourself are a dependent. So you need money as long you live (not when you die), which is covered by annuity and not whole life.

Manshu,

I see can you cannot wait and have good colleagues to twist things to what I never said or meant.

Also I never said not to criticise LIC, I only spoke of a plan, which all cos have copied. All cos have stupid or money making plans not in tune with insurance or what it was meant to be, as far LIC goes I would say some of the plans are stupid as they are not there to make profits, except marginal to make the below payouts. which Shiv seems to think they do from their pockets – by error he was right.

Please wait before jumping on me for the nos, I will calculate both plans till age 100 as you asked, while wholelife stops after 20 or 35 premiums and is returned with bonus, term plans are not paid back and cost huge at a later age.

ankurm – I never assumed any age limit, its you guys who are advising term insurance as you make wild claims of stock market investment when they do debt markets for the plan I advocated and sorts of other claims and forget its only till age 65-70.

Shiv – if you do not want after that age please don’t go for it but don’t mislead people who will not find it available later if they go in for term insurance only – give them the options.

Also you use crass and cheap language – no one is dead after age 70-75 – ask the older people. Captain Nair started one of the biggest hotel industries around that age and is now 90 and going great guns. If banks do not give loans after that age it does not mean they do not have liabilities?

If you do not care about your older people, let it go, all are not the same.

The rest of your conclusions that LIC has to give to all older people shows your non-understanding of insurance and just some wild talk – its not some magic that LIC does, that’s the way insurance works and why its called so as its a social responsibility.

:-)… “have good colleagues to twist things”… “All cos have stupid or money making plans not in tune with insurance”… “as far LIC goes I would say some of the plans are stupid”… “you make wild claims”… “your non-understanding of insurance and just some wild talk”…

James, I’m wondering where did I use cheap language… 🙂

You need for insurance highest when your human capital (PV of future employment earnings) is highest, that is when you are working. Insurance is meant to replace present value of your future earnings (when you die) and cover your dependents. Post 60-65, your entire wealth is financial capital, human capital is zero. Financial capital is enough to cover that risk.

@James: i was never in any discussion, I am just inferencing from your comments,. Then, how can you say “you guys who are advising term insurance as you make wild claims of stock market investment when they do debt markets”. By the way i have taken all insurance products: term insurance, whole life and endowment plans, and consider taking term plan the most wise decision. The sort of risk you are covering from whole life plan, can anyways be covered by a normal retirmenet plan like PPF at a better return. Wheres the hue and cry about it.