In part 1 of this series I wrote about the evolution of an investor to either a trader or a long term investor, and said that I favor long term investing to short term trading.

Then in the second part I wrote about the implicit assumption that a long term investor makes which is over a very long period of time the market will move upwards, and then also spoke about the nature of a share or stock. That nature I said was that a stock is a representation of the earnings of a company, and looking at it that way helps you stomach the volatility that exists in the market and deal with the daily ups and downs.

In this part I’m going to build on the two concepts I spoke about earlier and share a few thoughts on execution.

I invest regularly in the market throughout the year but I don’t have a SIP set up and I do this on my own. I invest very aggressively in the market when there is doom and gloom and put in as much as I can like I was doing last December, and during the Lehman crisis, and I slow down (but still keep investing) when there isn’t much doom and gloom but people are not over the top as well. The market right now resembles that situation and while I’m investing in the market the sums that go in the market aren’t as much as they were last December.

There are three big ideas behind this type of thinking – one is that in the long term I expect markets to edge upwards so even if they are down today I feel that they will be up 3, 4 or 5 years down the line and as long as no one forces me to sell the position – I can wait for the tide to turn and sell at that time.

The second big idea is that markets don’t move in a linear fashion, and no one knows when, why or by how much they will go up or down. You can’t simply stop investing with the fear that the market will go down more because there is no way to know when the tide will turn and by how much the market will rise then. If you sit on the sidelines when the market is down, then I’m pretty sure you’re sitting on the sidelines through most of the earnings that come about when the tide turns.

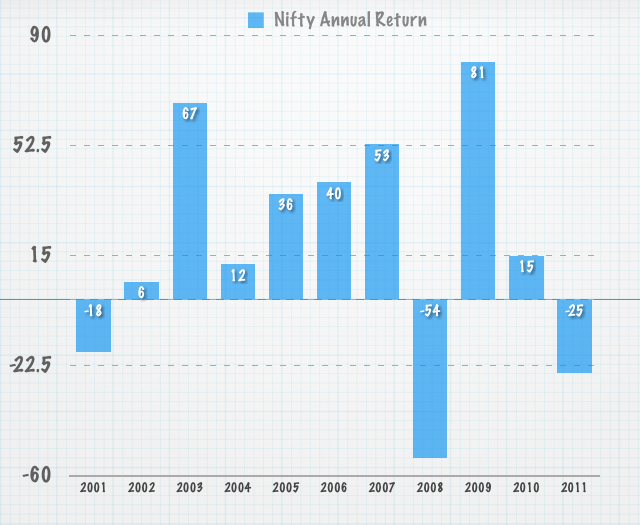

The past decade has shown us that up moves have been as violent as down – moves and that too at very unexpected times, so that’s why I like to stay invested in the market as much as I can. I hear a lot of people say that I’m going to start investing when the market turns and perhaps Santa whispers when the market is about to turn in their ears, but I am not one of those people.

Here is a chart that illustrates what I’m talking about.

The third big idea is that while you can’t time your in and out, you can try to calibrate how much you put in the market, and while that exposes you to additional risk – if you don’t have any loans and can stomach risk and volatility then it is possible to make this volatility work in your favor rather than give you jitters.

The big difficulty in doing this is it’s very hard to buy when everyone else is paring down and the general atmosphere is of doom and gloom. However, if you view a stock as ownership in a company (like I wrote in the earlier post) and if you believe that the company will survive the downturn – that gives you confidence to hold on and continue buying. Then when the tide turns you will be sitting on some good profits, and you won’t be rushed into investing in the market like the people who feel left behind by sudden market jumps, and the jumps are always sudden, so at that time you can moderate your investments.

I think people who are starting out can leave calibrating out of the equation and start with investing small sums monthly which they continue with even when the market is down. I say small sums because it doesn’t hurt as much when you see them in the red (which you inevitably will) and it makes it easier to continue investing small sums even when the market is falling. Within a three to five year period you will get a sense of where you stand as far as shares are concerned and whether you want to stay away completely from them (understandable) or want to go in very aggressively (also understandable) but whichever way you eventually turn to I’d recommend you follow this approach initially rather than buying and selling daily or weekly in an ad-hoc manner.

In the next part of this series I will write about some type of mutual funds that can be used to invest in equities regularly and execute this strategy.

- Part 1: How should beginners approach investing in the stock market?

- Part 2: How should beginners approach investing in the stock market?

- Part 3: How should beginners approach investing in the stock market?

- Part 4: How should beginners approach investing in the stock market?

I am really looking forward to your next article on this. What do u do when your MFs seem to be perpetually in red? You feel like you are throwing money in water in a SIP where there seems to be less return than FD. And I am experiencing this with well rated funds like FT Blue chip,Reliance Growth and HDFC Prudence. For the past year month after month growth is negligible and as a investor you dont know if you are squandering your money or truly investing?

But why would they be perpetually in red (in my case stocks, not MFs) if you keep buying even when they hit lows, or especially when they hit lows, you would tend to reap benefits when the market turns. If you were buying in the last four or five months of 2011, then the market is much higher today and some stocks are even higher than that. Same is the case for late 2008 and early 2009, but to a much bigger degree.

Curious to know how is your experience different Harinee?

Ok I am in FT Bluechip SIP from Jan 2011 and returns are negative as of today.HDFC Prudence same range and return is .97%. Reliance growth fund same period negative returns.

These being SIPs I contribute same amount month on month. I started these after reading about investing and researching in valueresearchonline. Oddly everywhere sector-based MFs were discouraged but these seem to be only ones giving decent returns(Pharma).

Hi Harinee

You should not go by the advice you get in personal finance magazines and do your own research. Based on my own research I invested in FMCG and Phama funds and I am satisfied with the returns considering the market condition. You are right, even the five star rated funds have done badly but you should evaluate the performance of the fund by comparing with its benchmark and peers and not by just seeing negative or low returns.

What you get in personal finance magazines these days is nothing but financial pornography. First they get you excited, then they create unrealistic expectations, and finally you are left confused, bewildered and betrayed, when at the end of the day you discover that life is not exactly like the magazines portray it.

Thanks thats good advise. But where and how do I research a MF.The only accessible material is sites like Valueresearchonline. Please advise how and where does one research these.

Honestly I know Onemint favours CFPs but I am not too sold on them and would like to do my own research.

Hi Harinee

Mutual Fund Insight and Investors India are the two magazines which I read to do my research. Even if you use the services of a CFP, doing your home work is important.

Harinee – The numbers you say aren’t bad in my opinion because Nifty has been down 15% from Jan 2011 till now, and your funds are actually doing better than that. I think that’s because you would’ve bought a lot more units during the down turn with a fixed SIP amount than you would’ve bought when the market is high.

If I had these type of numbers, I wouldn’t be worried at all. Pharma funds may have done better till now, but no one knows what will happen in the next 5 or 10 years, and not good to put all eggs in the pharma basket.

If your SIP is 1 year old chances are it is in red because the market itself has been in red. In these cases step away from emotions and see if the fall in the scheme is lower than the fall in the market. If so it means you are outperforming the market and when the tide turns (who knows when!) chances are you will rise with it. I dont follow Reliance Growth but the other 2 are exceptional long term performers. Give them time to grow.

Nice article. Thanks

Thanks for your comment Ams.

Hi Manshu

In a nut shell you have said that it is time in the market and not timing which is important. I am completely in agreement with the strategy suggested by you.

In spirituality it is said that if we want to remain happy we should learn to control our emotions. We should not be egoistic. We should learn the art of remaining detached. We should not be emotionally attached. All spiritual gurus repeat these again and again.But we don’t listen to them and continue to suffer. I think these are applicable to investing also. If we practice these we will be happy with our investments.

Since I am basically a mutual fund investor I am looking forward to the next part.

That is a very interesting analogy and I have never heard it before but I guess it makes sense. The other day I was watching something on TV and it was the grand daughter of a very famous investor and she said that his grandpa once told her that the best thing to happen to his investing was that he moved to Jamaica or some other place like that where he got the copy of the Wall Street Journal a few days late and that actually helped him!

Hi Manshu

Recently I was reading a book in which a CFP advises her clients to go out and smell flowers in the garden instead of reading pink papers and watching business channels on TV. She mainly stresses on conflict of interest. As per her the interests of journalists of pink papers, relationship managers of banks and investment pundits of TV channels never match the interests of investors.

Dear Sir,

Great article.I guess you will be writing books about investing in near future.lol!

I don’t want to write books that no one will read! 😀

Hi Manshu

You are right! The financial jungle is richly stocked with books. The problem for investors is not of scarcity but of selection. For a grounding in investing you don’t have to read a tome on the subject. Blogs like Onemint and TFL guide are doing a great job.