I write about ULIPs very rarely, but in the last year or so, several people have commented that under some circumstances ULIPs are a suitable investing option, and when Roopa posted a comment inquiring about the ICICI Pru SmartKid Premier ULIP in the Suggest a Topic page, I thought it’s finally time to read up on this and do a review of this product.

Insurance and Investment

ICICI Pru’s Smart Kid Premier is a ULIP that combines life insurance and investment, and the way it works for the life insurance part is that you choose whether one or both parents have to be insured, and based on that on the death of the parent – the insurance policy pays you out. This is called the single life or joint life option under the plan.

The insurance pays out a sum assured and it also waives off the future premiums that you would have had to pay under the policy, and you continue to get benefits as if the premiums had been paid.

And how much is the sum assured using this option? The minimum sum assured is the higher of these two amounts:

- Ten times the annual premium or

- 0.5 x policy term x annual premium

These two options exist because you can decide on a plan where you pay for only 5 years but the plan has a term of 10 years.

So, if you took out a policy with a premium of Rs. 50,000 per year for 10 years, then then sum assured will be Rs. 5 lakhs in this case. Goes without saying that this cover is a lot less than what you get from a term insurance, but then there is no investment angle in term insurance either. Now, let’s get to the investment aspect of this policy.

ICICI Pru Smart Kid Premier Investing Style Options

After they have taken away some money as expenses towards the plan, the remaining sum can be invested in a choice of funds based on three different strategies that you can opt for.

1. Fixed Portfolio Strategy: This is the first of the available strategies, and if you select this strategy, you will have the choice of actively managing your portfolio, and you can pick and choose from 8 funds that they have on offer.

The 8 funds they have on offer are the following:

| Fund Name | Asset Allocation |

|---|---|

| Opportunities Fund |

Equity: 80% Debt: 20% |

| Multi Cap Growth Fund |

Equity: 80% Debt: 20% |

| Bluechip Fund |

Equity: 80% Debt: 20% |

| Multi Cap Balanced Fund |

Equity: 60% Debt: 40% |

| Income Fund | Debt: 100% |

| Money Market Fund | Debt: 100% |

| Return Guarantee Fund | Debt: 100% |

| Dynamic P/E Fund | Invests in the ratio of debt and equity based on the P/E range of the market |

I think the name is a little misleading for this strategy because nothing is fixed here, and you have to actively manage which funds you are going to buy into.

2. Life Cycle Based Portfolio Strategy: The second strategy that you can choose is the life cycle based portfolio strategy and in this strategy the fund moves around your money from an equity based mutual fund to a debt based mutual fund according your age. So, if you are between 26 and 35 years then the fund will have 75% of your money in the multi cap growth fund, and 25% in an income fund, but when you reach the age of 36 – that ratio will be changed to 65% and 35%. So as you get older, more of your money comes out from the equity fund and moves in to the debt fund.

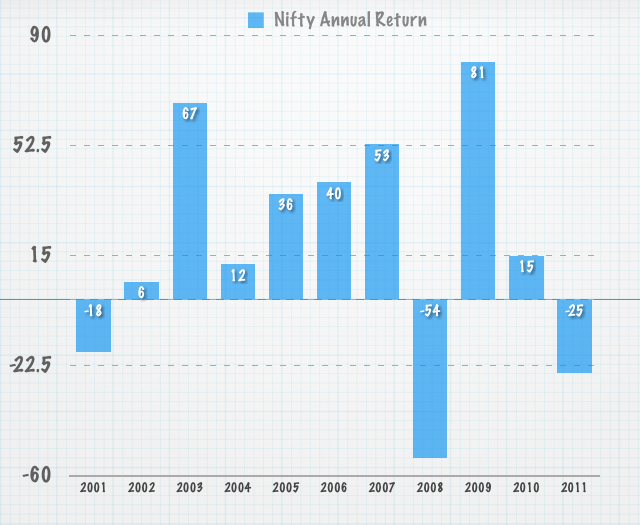

3. Trigger Portfolio Strategy: In this strategy, 75% of your money is invested in the multi cap growth fund and 25% is invested in an income fund. If the equity market rises then part of your profits are redeemed and the money is invested back in the income fund so that any downward movement doesn’t eat into your profits. If the market goes down then new money is used to invest in more equity funds such that they can maintain a 75% – 25% ratio.

To sum up whate we have seen so far, the insurance is ten times your premium and then after they deduct expenses, they allow you to choose one of these three strategic investment options. The next question is how much are the expenses of this plan.

ICICI Pru Smart Kid Premier Expenses

Just like other ULIPS, there are charges under several different heads in this one too, and I’ll list them down in this section.

Premium Allocation Charge: 2% of the premium in the first year will be deducted under this charge, so if you took a policy out for Rs. 50,000 then Rs. 1,000 will be deducted from the policy during the first year for this charge. This will be zero from the second year onwards.

Fund Management Charge: 1.35% per annum will be deducted from the fund value you invest in all the funds except for the return guarantee fund where it is 1.50% and the money market fund where this percentage is 0.75%.

Policy Administration Charge: 0.47% per month will be charged from the premium as this expense from the first year to the time you are paying the premium. When you stop paying the premium (but the term still continues) this will become 0.10% every month.

Mortality Charges: These will also be deducted monthly and they have a table for this that they refer to for determining how much will be reduced. Naturally, if the life of both parents is covered the mortality charges will increase (not by double though).

Switching Charges: You have four free switches in a year, and I think this refers to switching between portfolio strategies, anything over this will be charged Rs. 100 per switch.

Miscellaneous Charges: Policy alterations will be charged at Rs. 250, and I’m not quite sure what type of policy alterations this includes.

How do these expenses affect returns?

The policy brochure has got the following illustration which shows you sample returns at 6% and 10% for two policy terms which are net of all charges, service tax and education cesses.

- Age at entry: 30 years

- Annual Premium Amount: Rs. 50,000

- Mode of Payment: Yearly

- Coverage Option: Single life

- Choice of Portfolio Strategy: Fixed (Money invested in Dynamic P/E fund)

- Premium Payment Option: Regular

|

Term = 10 years |

Term = 15 years |

|||

| Returns at 6% p.a. | Returns at 10% p.a. | Returns at 6% p.a. | Returns at 10% p.a. | |

| Fund Value at Maturity | Rs. 5,94,574 | Rs. 7,43,261 | Rs. 10,03,955 | Rs. 14,12,382 |

| Effective Return Rate | Â 3.13% | 7.1% | Â 3.56% | Â 7.57% |

I have added the last row of the above table myself, and the effective return rate is how much you are effectively getting if the fund performs at 6% or 10%. Since the amount above that is net of expenses – it is not actually based on 6% or 10% but is arrived at after deducting all the expenses.

So, in the first option you just get a return of 3.13% if the fund actually performs at 6%, and if the fund performs at 10% then you just get 7.1%, and in the 15 year term you get 3.56% and 7.57%. I think this shows fairly significant expenses and an insurance of ten times annual premium doesn’t make these kind of expenses attractive enough.

Conclusion

Having reviewed this tells me that  ULIPs aren’t as bad as they once used to be and some people may actually find use for them if they want to boost their insurance coverage for example. But as far as I’m concerned, I don’t see any compelling reason to buy this policy, and I would much rather buy a term plan and make other investments according to whatever plan and preferences I have. That way I can buy whatever mutual fund I want instead of being limited to the ones offered through this plan and can also make changes mid way.