As the Rupee hits new all time lows against the Dollar, it is natural to look for ways to arrest this slide and look for solutions to this problem.

The problem however is the not the Rupee slide itself – the fall in the Rupee is the symptom of underlying problems and you have to look at those problems to find solutions.

You can take short term measures to stop the fall but if they are not backed by long term efforts to correct the underlying problems, nothing will change and we will have to deal with the same situation 8 or 12 months down the line.

RBI allowing banks to set their own interest rates on NRE deposits and making these NRE deposits tax free is a good example of a short term measure. That would have surely helped bring in foreign exchange at the time, but since January, the Rupee has already lost 9% against the Dollar so whatever gains an NRI will make on the interest have already been nullified by the loss in the value of Rupee, and any similar measure is not going to be as attractive a second time.

While such short term measures are essential at the time of volatile downturns, past experience has shown that they aren’t enough to reverse the trend over a longer duration.

The exchange rate depends on the demand and supply of INR and foreign currencies, and that relationship is shown in the current account and capital account of the country.

Simply put, the current account is the account that shows the imports and exports of goods and services and the capital account is the account that shows the money invested by foreigners in India, and money invested by Indians outside the country.

As far as I know, India has never had a trade surplus, which means it has never exported more than it imported and the deficit that occurs as a result of this has been met by investments by foreigners in the form of FDI and FII inflows in India. But recently, even those have slowed down putting pressure on the currency.

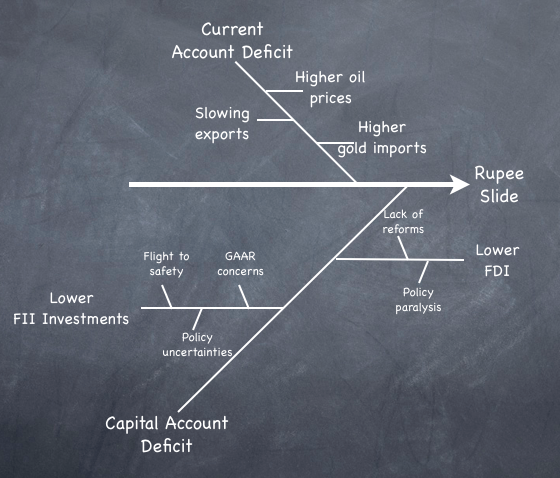

A simple fish – bone diagram will help explain this better.

Current Account Deficit

The current account deficit as measured by the difference between exports and imports of goods and services has never looked in worse shape. The trade deficit last fiscal was $184.9bn, and this is as high as 9.9% of GDP.

On the import side, higher oil prices, and gold imports are causing a lot more outflow than previous years and as I wrote in January, these two alone contributed to 43% of Indian imports.

Exports have been slowing down too and in fact March of 2012 actually saw a drop in exports from a comparable period a year ago, something that hadn’t happened for more than two years.

Capital Account Deficit

On the capital account, FDI has been in the news for all the wrong reasons. Even historically, India has attracted lower FDI when compared with other emerging countries and the lack of reforms and the inability to make any progress on issues like FDI in multi-brand retail means that India has been below its potential in attracting FDI from the world.

FII investments have dried up due to the global flight to safety because of the resurfacing Euro concerns, but even before that, after the GAAR announcement in the budget, the FII volume had reduced quite a bit in the Indian market.

Investments also depend on the general economic environment and that hasn’t been good in the past few years leading to an environment which doesn’t inspire confidence in investors (both global and domestic) to put money in the market.

If you look at these factors, some of them are within India’s control and some aren’t – India can’t do anything to influence oil prices, or do anything about the Euro problems but it can certainly take steps to simplify labor laws, get clearances fast, build infrastructure to get foreign investments and other such things. These things need to be done anyway to help improve the standard of living of the people in the country, the volatile Rupee fall just gives a sense of urgency to carry them out.

Nice article..Still INR may fall due to global situations are not up to the mark and inflation in India is still going high even though latest Inflation rate is less compared to previous. the rates of food items seems to high and petrol, diesel,LPG hike is also one of the reason fall in INR..

Nice answer

I dont know anything about indian economy.till now i’ve known nothing.i realized now and i want to know about statistics of indian economy.please can anyone help me for these questions.why always dollar demands over rupee?

Nice article..Still INR may fall due to global situations are not up to the mark and inflation in India is still going high even though latest Inflation rate is less compared to previous. the rates of food items seems to high and petrol, diesel,LPG hike is also one of the reason fall in INR..

Thats an interesting point manshu. India’s refinery capacity & production is around 200 mmtpa (i..e crude throughput); against which domestic crude production was 40 mmtpa, around ~140-150 mmtpa of crude oil is being imported at a cost of Rs 4,56,000 crore. Against which, refined petroleum product exports were exports was only 60 mmtpa, Rs 1,96,000 crore (rest consumed domestically). This gives a net deficit of around ~Rs 2,60,000 crore.

Thanks – I think simply converting that number to USD at two different exchange rates is not enough to show how exchange rate affects this equation but this is very good info = thanks for sharing.

Very well thought and written article. Although, there is structural weakness in the currency, I am of the view that the very recent depreciation in rupee to 55 (from 50 in March) has gone much beyond fundamentals. For instance, crude oil prices are already falling (~dollar imports will also decline) , gold imports shrunk 30% Jan-April 2012 (gold prices in dollar terms have remained flat since last 5 months, ~therefore gold imports in USD have declined). There is surely some speculation going on, which RBI must curb.

Nothing has changed in the last month to warrant such a fall as you say, all the factors were present much before that and it is only that people woke up to that which happens a lot in equities and other markets.

I remember we’ve had this discussion elsewhere so let me ask you this, since India has excess refining capacity, is there a way to show how oil prices affect net exports in numbers? We’re paying more to import but then we’re getting more also, thoughts?

My fear is that forex markets are increasingly becoming volatile like equity markets. But, they are much more important to people than stock market as they effect price of imported goods we use daily. This time both forex and equity markets are in a spiral (one impacting the other). Some point of time in future (hopefully!!!), it will bottom out, when FII’s see potential apprecation potential in rupee from 55-60 to 45-50. It will require some doing though

It won’t happen on its own, the government will have to show some willingness to carry out policies that they haven’t had the will to do in the past. Going after Facebook, or Twitter or banning cartoons won’t bring the exchange rate down.

Is it all about keeping gold-silver demand/prices down?

Ever since hitting all time high last year; gold-silver is being manipulated through paper contracts by whoever it is (big-banks/FED/IMF/US). Gold-silver prices in USD have dropped more than 25% from their all time high. Imagine what 25% drop in gold-silver INR prices in India would do to demand and certainly those guys manipulating gold-silver didn’t want gold-silver demand to increase in India. So they drive rupee higher and keep gold-silver prices flat (That’s what I would do if I am in their shoes). Result – Demand drops/prices flat. China is being smart on the other hand.

Great Article! Put in simple words what the country is lacking in.

Great thanks!