This post is written by Shiv Kukreja

The Hindu Undivided Family (HUF) structure is a very effective way to save tax and a lot of people are eligible to create HUFs but somehow there is very little awareness about it.

I think that’s because most of us don’t know how easy it is to create an HUF. In fact, it is as easy as getting married. I would say it might be difficult for somebody to get married but it is very easy to create an HUF.

An HUF is automatically constituted the moment a person gets married and completes seven pheras around the holy fire and they get married.

That means a Hindu male needs to do nothing to get an HUF created but to get married to a Hindu female. It is one marriage gift that all Hindus get from the government or Hindu Law. It is not necessary to have children to create HUF.

Sikhs, Jains and Buddhists can also create an HUF under the Income Tax Act even though they are not governed by the Hindu law.

What is an HUF?

An HUF is a separate and a distinct tax entity. The income of an HUF can be assessed in the hands of the HUF alone and not in the hands of any of its members. The senior most member of the family who manages the affairs of the family is called the Karta. Minimum two people (at least one male member) are required for the HUF to come into an existence.

A coparcener is a member of the HUF, who by birth acquires an interest in the joint property of the family, whether inherited or otherwise acquired by the family.

Coparceners have a right to claim partition of the HUF. Other members of the family cannot ask for a partition of the HUF and have no right to claim a share in the family property. Coparceners consist of a Karta and his lineal descendants within the following four degrees:

- 1st Degree: Holder of the ancestral property for the first time – Karta

- 2nd Degree: Son(s) and Daughter(s) of the Karta

- 3rd Degree: Grandson(s) of the Karta

- 4th Degree: Great Grandson(s) of the Karta

A daughter, after her marriage, would remain a coparcener in her father’s HUF and at the same time, can become a member in her husband’s HUF. In the event of the death of the Karta and in the absence of any male member, two females can continue to run the HUF and the senior female can take over as the Karta. A son can create his own HUF while remaining a coparcener in his father’s HUF.

Capital Infusion: Here comes the most difficult part for someone to start the HUF operating – generating capital for the HUF.

One should not contribute his own personal assets or funds into the HUF as any income generated from these assets or from its investment will be clubbed into Individual’s personal income under Section 64 (2) of the Income Tax Act and hence taxed accordingly.

But there is a way out – one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income.

This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.

Gifts or inheritances meant for the benefit of all the members of a family should be diverted specifically to the HUF. HUFs are liable to pay tax if the value of the gifts taken from the strangers exceeds Rs. 50,000. Though there is a limit for an HUF to take gifts from the strangers, gifts of a higher value can be taken from the relatives, who are not the members of the HUF.

Here is the list of people who fall in the category of relatives:

- Karta’s Wife

- Brother(s) or Sister(s) of the Karta

- Brother-in-law or Sister-in-law of the Karta

- Immediate Uncle(s) or Aunt(s) of the Karta

- Immediate Uncle-in-law or Aunt-in-law of the Karta

- Lineal ascendant or descendent of the Karta or Karta’s wife

A father can also gift money to his son’s HUF but need to specify in the gift deed that the gift has been made to the son’s HUF and not to the son as an individual. Ancestral property can be an asset of the HUF and an income earned on this property can be classified as the income of the HUF. If any of these ancestral properties are sold, the money received on such a sale should be transferred to the HUF.

How to get started with the HUF?

Once there are two eligible family members ready to operate an HUF, the first thing to do is to apply for a PAN card in the name of the HUF and have a separate bank account opened.

For a PAN application, an affidavit by the Karta stating the name, father’s name and address of all the coparceners on the date of the application is considered sufficient as the document proof of identity of the HUF. Also, the identity and address proof of the karta will be treated as the address proof of the HUF.

Then start seeking for gifts or inheritances from relatives or strangers, keep on infusing your own capital, transfer family’s assets/properties to the HUF and do all the possible things that you can keeping in mind the clubbing of income provisions.

Here is a link that contains a sample HUF deed.

Sections/Provisions under which HUFs can claim Deduction/Exemptions and Save Tax

As already mentioned, an HUF is a separate and a distinct tax entity and just like any other Resident Individual assessee, it also enjoys a basic tax exemption of Rs. 2,00,000. All other tax slabs are also exactly same as for an Individual. Here is a useful link from Bemoneyaware that shows the TDS rates for Individuals and HUFs.

Section 80C: HUFs can claim tax exemption under Section 80C by investing money in ELSS, ULIPs, traditional insurance plans, NSC or 5 year Bank FD with a scheduled bank. Principal repayment on a housing loan taken by the HUF can also be claimed under this section. HUFs are not allowed to invest in PPF anymore.

Section 80D: Members of the HUF can take a family floater policy and make the HUF pay for its premium and enjoy the tax benefit too.

Section 80DD: If any dependant member of the HUF is normally disabled (not less than 40% disabled) and the HUF makes an expenditure for the medical treatment, training and rehabilitation of that disabled member, then the HUF can claim a deduction of Rs. 50K under this section. If the condition is of a severe disability (equal to or more than 80%) then the HUF can claim a deduction of Rs. 100,000.

Section 80TTA: Interest earned on the money deposited in the savings bank account up to Rs. 10,000 p.a. is exempt for an HUF also.

Section 24 (b): Interest on Housing Loan: If an HUF takes a loan for buying out a residential property, it can claim a deduction of Rs. 150,000 in respect of Interest on Housing Loan.

30% Standard Deduction on a Rented Property: An HUF can claim a standard deduction of 30% from the rental income it earns by letting out a property.

Capital Gains on a House Property: Tax on Capital Gains made by selling a house property can be saved if the HUF invests the proceeds into buying another property within two years from the sale of the said property. The money can also be invested in Capital Gain bonds offered by REC and NHAI with a lock-in period of 3 years. The interest income on these bonds would be considered a taxable income of the HUF.

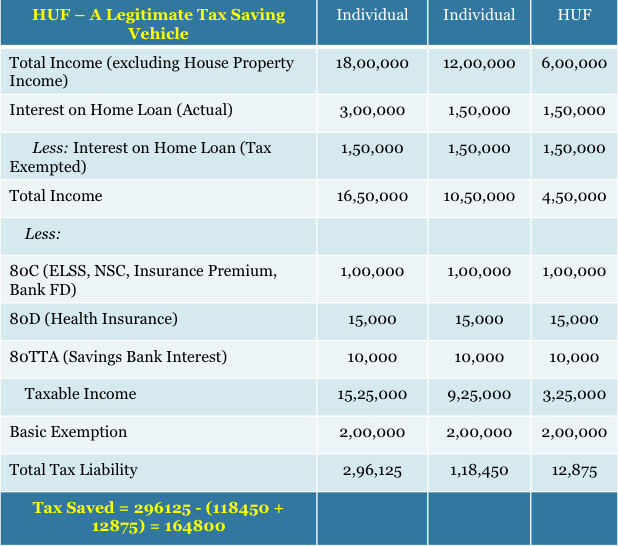

The table below shows how the income of an individual in the 30% tax bracket can be split between two entities to lower the final tax outgo:

Some Other Important Points

- Karta can be paid a reasonable salary for his services of managing day to day affairs of the HUF. The salary will be considered his personal income but at the same time it is deductible as an expense from the books of the HUF.

- Only one member or coparcener cannot form an HUF. There have to be at least two members and at least one male member.

- HUF can keep its normal functioning even with two females after the death of its sole male member.

- The Hindu Succession (Amendment) Act 2005 has given equal rights to male and female in the matters of inheritance as a result of which a daughter now also acquires the status of a coparcener.

- An HUF cannot become partner in a firm but a Karta can.

These were some important aspects when it comes to creating an HUF and everyone, who is eligible to create an HUF and pays taxes, should strongly consider this option as it is a very efficient and good way to save tax.

Dear All,

I have a query with regard to HUF bank account operation, kindly clarify.

Kindly clarify whether Karta of HUF can route his personal transactions through the HUF account.

For Ex:can a deposit into HUF account a cheque which is issued in his individual name?

Hi Vijay… HUF is a separate legal entity for financial and taxation purposes. It is strictly not allowed to deposit the cheque(s) received in favour of Karta or any of the members/coparceners into the HUF’s account. Only in case of investment accounts like demat account, which has to be mandatorily opened in the name of the Karta only, RBI has clarified that a mandate may be taken by banks from the accountholder that the cheques drawn in favour of ‘Karta’ can also be collected in the account of HUF and vice-versa.

https://nsdl.co.in/downloadables/pdf/Policy-A-M-C-Version-3.0.pdf

Grandfather purchased land in 1960 in the name of the eldest son who was then 32. Grandfather has 4 sons. The sons are till date living together. Sons had a family business started by Grandfather since 1944. The property was purchased by Grandfather with the business income for which no proofs are availabl. Partnership deed since 1974 are available to proove that it was a jointly run business. elder son did not have ant other income apart from family business when the purchase was made. elder son is now claiming that it is an individual property. Please advice how can the other 3 brothers claim the rights. All the 4 daughters are also supporting the 3 brothers to claim the rights. Please advice.

Hi Harsh… Your case would probably involve some legal advice also. This forum is probably not appropriate to discuss such matters. Kindly discuss the matter with a financial advisor or legal expert in personal. Thanks.

Hi Shiv, thanks for your reply. As you have suggested, will take this matter with the legal advisor. However whats your thoughts in this regard. Please throw some light regarding this.

Hi Harsh… I’m sorry, this seems to be a complicated case and I think I’m not competent enough to make any statement in this regard. But still, I think the property is in the name of the eldest son and therefore it would be difficult for the younger sons to claim their share in the property.

Harsh, this type of forum is more suited to answering general questions, and I think you will do more harm than good in trying to answer your specific question which has legal implications by Googling for it.

Dear Shiv,

Thanks a lot for this information

You are telling that we cannot transfer any income from our personal income then how a HUF will start his Business or Share Trading or any thing else a HUF is katra only, he’s not a different person

Very Simple question: I don’t want to pay huge Taxes from my Salaried Income and I am having a HUF account how I can save my Taxes can I deposit some cash in HUF account do there is any problem???

Or

Can I open a proprietorship company and save tax???

Dear Rohit… HUF is a separate legal entity for taxation purposes. Karta is the head of an HUF and in that way, the caretaker of the HUF. You just cannot transfer your own income or income of any of the members of the HUF to save tax. The income generated out of investment from this fund transfer will attract clubbing of income. There is a way out to avoid this clubbing, which is mentioned above.

Capital Infusion or Capital Formation for the HUF has also been explained above in the post itself. It can be done by selling any of the ancestral property of the family or taking gifts from the relatives.

The income of your proprietorship firm will again get added to your personal income only. You can discuss your individual case with a financial advisor or CA to save tax.

Thank you Shiv for such a useful information. The taxmann link is of great help.

While reading it and further relating to Section 54F , the concept is bit clear to me.

One more quick query tough : In my case the sold assets were 2 different properties in the same city ( not being a residential house), so in this case can the original assets be considered different ? Any link of taxmann if you can provide that discuss it in detail it will be useful

Thank you very much for your cooperation in this matter.

Best

Sumedh

Hi Sumedh… There is no restriction as to utilise the capital gain proceeds from the sale of two different non-residential properties but again, you will get exemption for buying only one residential property. Please check this link and see if it matches with your case somewhat.

http://www.simpletaxindia.net/2010/06/54f-capital-gain-exemption-two-plot.html

You are welcome with your queries and further participation!

Dear Shiv…..

Your posts are very informative and I feel fortunate to have read this thread. Thank you so much.

Their are some of my doubts related to HUF regarding which i will request your guidance

My HUF bank account has recieved capital from sale proceeds of ancestral property. I now want to invest the capital in some property in order to save capital gain. My queries are :

a) Can HUF purchase more than one residential units ( flats) out of the proceeds

b) I was informed that HUF can purchase a plot but some construction needs to be done within 3 years of purchase. Is it true ?

c) Can HUF purchase dwelling units ( flat) which is under construction. And for how many year it can enjoy tax exempt.

Hi Sumedh… Thank you for your kind words!

Here are the answers to your queries:

a) No, an HUF cannot seek exemption u/s. 54 (and save Capital Gain tax) by investing the capital gain proceeds in more than one residential property. However, some exceptions are there, which I would term as some of the smart moves by the taxpayers. You can refer the cases from this link – http://www.taxmann.com/fileopener.aspx?stype=3&searchid=7047

b) Yes, a plot can also be purchased for getting exemption but the time period for completing the construction is 3 years from the date of transfer of the original capital asset.

c) Yes, an under-construction flat can also be purchased. The applicable years for the exemption with respect to an under-construction property would be 3 years.

Hi Shiv,

The information which you have shared is really very informative and helpful in understanding the HUF concept. One of my client is going to sell his ancestral property and have few understanding gaps in this, request to help me out on this:-

Background of the case:-

They are 2 brothers, one sister & mother, have one ancestral property which their great grandfather had purchased in 1932. It was inherited to their grandfather who was the only son. Their grandfather had distributed this property to his 2 sons in 1995 thru a family settlement by a court in which all the 3 daughters and other family members were the witnesses. It means their father became owner of this property in 1995 legally. Their father has expired in 2008 and ideally this property has been inherited to all 4 of them (2 brothers, one sister & mother). Now they are selling this property in 2012-13. The cost of purchase in 1932 was almost negligible. My Concerns are as follows:-

1. Is this property be treated as the HUF property as per Hindu law or any court of law.

2. If yes, than what would be the treatment as per Income Tax Act though they have not created any HUF as per Income Tax law.

Hi Nitin… The father got his share of property after the court settlement and on his death, assuming there is no will by him also, the property would belong to the four members of the family in equal proportion. Now when this property is sold, the tax on the long-term capital gain on the sale of the property would be payable by these four members in their individual capacity in the same proportion.

Dear Shiv

I have created a HUF, i would like to know, which income i can transfer to HUF account. I am a salaried person, for which i have a separate PAN no. and IT return is also filed separately. Can i transfer income generated as “income from other source” like income from family business or part time jobs etc in HUF account. Is it required to have each income to be deposited by cheque in HUF account.

You cannot transfer any personal income to the HUF’s account. Income from part time jobs is purely your income and if you are running the business in your name, then also it is your income. If the business is operated in the HUF’s name, only then the income from such business can be transferred to the HUF’s account. Cash can also be deposited in an HUF’s account.

If I have an HUF account at a bank and wish to deposit cheques/income recieved in my personal name as Karta or that of my coparceners in my HUF account, can my bank refuse this? If yes is it because its a totally different entity from me and my family members? Any RBI clarification on this available?

Hi… It is strictly not allowed to deposit the cheque(s) received in favour of any of the members/coparceners into the HUF’s account. In case of investment accounts like demat account, which has to be mandatorily opened in the name of the Karta only, RBI has clarified that a mandate may be taken by banks from the accountholder that the cheques drawn in favour of ‘Karta’ can also be collected in the account of HUF and vice-versa.

https://nsdl.co.in/downloadables/pdf/Policy-A-M-C-Version-3.0.pdf

Assuming karta and its coparceners live together in a joint family.

Can the HUF’s money be used to pay the regular day-2-day expenses of karta+coparceners like:

– rent

– food/groceries

– doctors fees

– petrol

– utilities like electricity/phone bills.

Yes, the HUF’s income can be used for the household expenses of the family.

Hi Shiv,

The article says:

“But there is a way out one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income. This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.”

I am trying to understand the phrase

“eventually all of the income would fall out of the clubbing provisions.”

Suppose I gift 100Rs to my HUF which invests the money in tax-free bonds. The interest that is being generated by the bonds every year now belongs to the HUF. Now, lets say the bonds mature after 15 years. When the bonds mature, the bond company will pay back 100Rs to the HUF. The interest that was generated is now owned by the HUF but what about the principal? Who is the owner of those 100Rs – the HUF/karta? If the HUF keeps the 100Rs and generates taxable income on it, would the clubbing provision still apply. If yes, keeping track of this after 15 years can be a big headache.

I am trying to understand how eventually *all of the income* will fall out of clubbing. Could you please explain a little. Thanks.

Hi VikasG… Please read this line once again – “This “tax free income” can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions”

Taking your example, suppose the HUF earns Rs. 8.30 tax-free income every year (and Rs. 124.50 in 15 years) on Rs. 100 invested, when this tax-free income is invested in any of the taxable instruments (say NCDs) earning 12% p.a., then all of the income 8.30% and then 12% on Rs. 8.30 would be tax-exempted.

After 15 years, the principal amount of Rs. 100 would belong to the HUF only. But, again investing this Rs. 100 in taxable instruments would invite clubbing of income, till the time the Karta is alive.

Equity MFs can also be considered for generating tax-free income or capital gain. Please let me know in case of any further query.

Thanks Shiv. I understand this now.

1) Is there any way the 100Rs can somehow move out of clubbing provisions?

2) Can the HUF return the original 100Rs back to karta after 15 years. From this point onwards, all of its money can be invested without any fear of clubbing provisions.

1) I have no idea how this can be done except when the Karta is no more.

2) Yes, the HUF can return the original Rs. 100 back to the Karta after 15 years.

Dear Shiv,

Interesting and most informative article so far i read on the issue of infusion of capital. Although this article and your trailing replies solved most of my queries still left with some doubts.

First, whether Karta wife’s ( who is obviously part of HUF) can give gift to HUF without attracting clubbing provisons?

Secondly, whether AO will induce clubbing provision in case if I give gift to my father of say 100000 by cheque and later on receives gift from him into my HUF by cheque. Is their any chance of doing this transaction ( like doing these two transaction is two seperate AY or something like that).

Thanks Kanuj for your kind words!

None of the members of an HUF including Karta’s wife should give any gift to the HUF as it attracts clubbing of income.

Gifts received by “an individual” from specified relatives, including sons, are exempt from Income Tax. But the same does not apply to HUFs. While you can gift any amount to your father and avoid tax on it, if you receive a gift of more than Rs. 50000 from your father it will be chargeable to tax.

Can a son start his HUF while the HUF of father is alive i.e.no partition took place.

If yes,how can it be done? How can the PAN for HUF be taken?

Minimum amount of gift required to start the HUF?

Yes definitely, the son can start his own HUF while his father’s HUF is still there. He will remain a coparcener in his father’s HUF.

As mentioned above – “An HUF is automatically constituted the moment a person gets married”.

Please check this link to apply a new PAN: https://tin.tin.nsdl.com/pan/form49A.html

“Category of Applicant” is there at the bottom of this page.

As mentioned above – “For a PAN application, an affidavit by the Karta stating the name, father’s name and address of all the coparceners on the date of the application is considered sufficient as the document proof of identity of the HUF. Also, the identity and address proof of the karta will be treated as the address proof of the HUF.”

There is no stipulation for the minimum amount of gift required to start the HUF.

Thanks for your early reply…But please let me know that how and what documents needs to be given to whom so that all this transfer may further take place….

please give me detailed answer explaining me whole procedure….

Thanks

_Abhinav

Sorry Mr. Abhinav, I wont be able to explain you all the things here. Probably you need to meet a financial advisor or a legal professional or a CA for the same. But I’ll share whatever little I can or I know.

As the son must be the legal heir, all the assets legally belong to him. He first needs to check whether all the accounts & investments carry the nomination or not and if yes, he is the nominee in all of them or not. Also, if there is any ‘Will’ made by the father or not. He also needs to get the death certificate made and get it notarised as it would be required at most of the places.

He should approach all the respective banks, financial institutions & brokers to check their policies regarding the assets transfer and do the needful. Rest you should discuss it with an expert.

Dear Mr.Shiv

The article and info given about HUF is good and informative as well…

I am giving you one condition in case of HUF account and please help me in finding out the solution for it.

Suppose that there are only 2 members in a family, a father(karta) and an unmarried son aged about 30 years. Now if the father dies, what will happen to huf and how will the proceedings of HUF be transferred into son’s individual accounts, whether it be bank balance, FD’s, shares or any other investment.

Abhinav Gupta

Hi Mr. Abhinav… In this case, the HUF will get dissolved as there must be at least two people to run an HUF. All the assets will get transferred in the son’s name.

if a father his having n HUF in which he is karta and his two son’s and his wife were the member of fathers HUF and both son’s are also having their individual HUF and than if father dies than who will become the next karta of that fathers HUF because both the son are already having their HUF in which they both are karta and one person can not become the karta of 2 HUF, so pls suggest me what will happen in that case

1 we have to dissolve the fathers HUF or

2 the elder son can become the karta of 2 HUF

Hi Nikhil… An individual can become the Karta of two different HUFs. In this case, the elder son will become the Karta of his father’s HUF and will continue to remain so as long as his mother is alive. At the same time, he will continue to remain the Karta of his own HUF. The original HUF will have to be dissolved once the mother is not there.

I have read several articles about how to create HUF and how to infuse money into it.

What I don’t quite understand and that nobody talks about is how to get money out of it?

Hi Saurabh… Money or Assets flow out of HUF as part of a will or inheritance once HUF undergoes a partition. I think nobody talks about it because everybody is concerned about saving tax by creating an HUF and money flowing out of an HUF doesnt solve the purpose.

I have a question on the following extract from the article

“But there is a way out – one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income.

This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.”

So, if I transfer 10 year tax free bonds currently held in my name to my HUF, the interest earned on these bonds will anyway be non taxable. If however, the HUF utilizes the interest income to open a FD, will the interest on the FD not be clubbed with my individual income? Also, how would the principle corpus be treated at the end of ten years when the bond matures? Would it accrue back to the individual or the HUF?

Hi Salil… Yes, the interest income earned on the FD will not be clubbed with your income. The taxable income earned, by reinvesting the tax free income, falls out of the clubbing provisions. HUF will be liable to pay the tax, if any, on the taxable income. The tax free income will remain in the books of the HUF.

Also, once a property or an asset is transferred/gifted to an HUF, it becomes HUF’s property/asset. Upon maturity, say after 10 years, the principal amount will accrue to the HUF and not to the individual.

and also can get tax relief in Home Loan principal and Interest. Do I need to add HUF also in Ownership and Loan Account?

HUF will get the tax deductions for both the principal payment as well as the interest payment, only if the property belongs to the HUF and the home loan has been taken in the name of the HUF.

very informative article..one clarification, so by creating HUF, someone can redirect all his FD, capital Gains towards HUF and get tax benefits..correct me if I am assuming wrong.

Sachin, one has to transfer the complete asset to HUF…and cannot just transfer the income generated from that asset. For e.g If you have some property generating rent…to get the benefit of HUF , you have to transfer the property to HUF which will attarct the registeration charges and transfer fees.

Also one should be sure of Section 64 (clubbing of Income) before accepting any gift or transferring any asset into HUF to avoid furthur tax complications.

HUF is a nice concept and helps in tax saving also, but in many cases you cannot just start a HUF and starts claiming the benefits immidiately. You have to understand the nuances in detail and then start working on it slowly and gradually. Like Recieve gifts through HUF , Inheretance through HUF (though this is not in your hand, but your parents can reduce your tax burden by writing a will in favour of your HUF) etc.

Also there are some practical problems in HUF which one will realise later on like…you cannot write any WILL on HUF Assets . So whatever is there in HUF is no longer your personal property but a joint property.

Hi Sachin… One needs to be very careful while transferring any property or asset to the HUF. If the property or asset belongs to an individual then the income generated out of it gets clubbed with the income of the individual and the combined income is taxed accordingly. This way the whole purpose of doing wise tax planning gets defeated.

One should transfer only those ancestral properties or assets which belong to the family or the income genarated out of it is a family income. The best way to form capital for one’s HUF is to get some property or asset transferred to the HUF as part of a will or inheritance.

When any ancestral property is sold, the sale proceeds received can directly be transferred to the HUF bank account and the same can be reinvested to generate some income. Then this income will be the income of the HUF and it starts the tax saving cycle.