This post is written by Shiv Kukreja

The Hindu Undivided Family (HUF) structure is a very effective way to save tax and a lot of people are eligible to create HUFs but somehow there is very little awareness about it.

I think that’s because most of us don’t know how easy it is to create an HUF. In fact, it is as easy as getting married. I would say it might be difficult for somebody to get married but it is very easy to create an HUF.

An HUF is automatically constituted the moment a person gets married and completes seven pheras around the holy fire and they get married.

That means a Hindu male needs to do nothing to get an HUF created but to get married to a Hindu female. It is one marriage gift that all Hindus get from the government or Hindu Law. It is not necessary to have children to create HUF.

Sikhs, Jains and Buddhists can also create an HUF under the Income Tax Act even though they are not governed by the Hindu law.

What is an HUF?

An HUF is a separate and a distinct tax entity. The income of an HUF can be assessed in the hands of the HUF alone and not in the hands of any of its members. The senior most member of the family who manages the affairs of the family is called the Karta. Minimum two people (at least one male member) are required for the HUF to come into an existence.

A coparcener is a member of the HUF, who by birth acquires an interest in the joint property of the family, whether inherited or otherwise acquired by the family.

Coparceners have a right to claim partition of the HUF. Other members of the family cannot ask for a partition of the HUF and have no right to claim a share in the family property. Coparceners consist of a Karta and his lineal descendants within the following four degrees:

- 1st Degree: Holder of the ancestral property for the first time – Karta

- 2nd Degree: Son(s) and Daughter(s) of the Karta

- 3rd Degree: Grandson(s) of the Karta

- 4th Degree: Great Grandson(s) of the Karta

A daughter, after her marriage, would remain a coparcener in her father’s HUF and at the same time, can become a member in her husband’s HUF. In the event of the death of the Karta and in the absence of any male member, two females can continue to run the HUF and the senior female can take over as the Karta. A son can create his own HUF while remaining a coparcener in his father’s HUF.

Capital Infusion: Here comes the most difficult part for someone to start the HUF operating – generating capital for the HUF.

One should not contribute his own personal assets or funds into the HUF as any income generated from these assets or from its investment will be clubbed into Individual’s personal income under Section 64 (2) of the Income Tax Act and hence taxed accordingly.

But there is a way out – one can transfer his personal assets or funds into the HUF if the income generated from these assets or from its investment results in a tax free income (like tax free bonds) and hence there is no scope of any tax liability due to clubbing of taxable income.

This tax free income can then be reinvested to earn even taxable income and eventually all of the income would fall out of the clubbing provisions.

Gifts or inheritances meant for the benefit of all the members of a family should be diverted specifically to the HUF. HUFs are liable to pay tax if the value of the gifts taken from the strangers exceeds Rs. 50,000. Though there is a limit for an HUF to take gifts from the strangers, gifts of a higher value can be taken from the relatives, who are not the members of the HUF.

Here is the list of people who fall in the category of relatives:

- Karta’s Wife

- Brother(s) or Sister(s) of the Karta

- Brother-in-law or Sister-in-law of the Karta

- Immediate Uncle(s) or Aunt(s) of the Karta

- Immediate Uncle-in-law or Aunt-in-law of the Karta

- Lineal ascendant or descendent of the Karta or Karta’s wife

A father can also gift money to his son’s HUF but need to specify in the gift deed that the gift has been made to the son’s HUF and not to the son as an individual. Ancestral property can be an asset of the HUF and an income earned on this property can be classified as the income of the HUF. If any of these ancestral properties are sold, the money received on such a sale should be transferred to the HUF.

How to get started with the HUF?

Once there are two eligible family members ready to operate an HUF, the first thing to do is to apply for a PAN card in the name of the HUF and have a separate bank account opened.

For a PAN application, an affidavit by the Karta stating the name, father’s name and address of all the coparceners on the date of the application is considered sufficient as the document proof of identity of the HUF. Also, the identity and address proof of the karta will be treated as the address proof of the HUF.

Then start seeking for gifts or inheritances from relatives or strangers, keep on infusing your own capital, transfer family’s assets/properties to the HUF and do all the possible things that you can keeping in mind the clubbing of income provisions.

Here is a link that contains a sample HUF deed.

Sections/Provisions under which HUFs can claim Deduction/Exemptions and Save Tax

As already mentioned, an HUF is a separate and a distinct tax entity and just like any other Resident Individual assessee, it also enjoys a basic tax exemption of Rs. 2,00,000. All other tax slabs are also exactly same as for an Individual. Here is a useful link from Bemoneyaware that shows the TDS rates for Individuals and HUFs.

Section 80C: HUFs can claim tax exemption under Section 80C by investing money in ELSS, ULIPs, traditional insurance plans, NSC or 5 year Bank FD with a scheduled bank. Principal repayment on a housing loan taken by the HUF can also be claimed under this section. HUFs are not allowed to invest in PPF anymore.

Section 80D: Members of the HUF can take a family floater policy and make the HUF pay for its premium and enjoy the tax benefit too.

Section 80DD: If any dependant member of the HUF is normally disabled (not less than 40% disabled) and the HUF makes an expenditure for the medical treatment, training and rehabilitation of that disabled member, then the HUF can claim a deduction of Rs. 50K under this section. If the condition is of a severe disability (equal to or more than 80%) then the HUF can claim a deduction of Rs. 100,000.

Section 80TTA: Interest earned on the money deposited in the savings bank account up to Rs. 10,000 p.a. is exempt for an HUF also.

Section 24 (b): Interest on Housing Loan: If an HUF takes a loan for buying out a residential property, it can claim a deduction of Rs. 150,000 in respect of Interest on Housing Loan.

30% Standard Deduction on a Rented Property: An HUF can claim a standard deduction of 30% from the rental income it earns by letting out a property.

Capital Gains on a House Property: Tax on Capital Gains made by selling a house property can be saved if the HUF invests the proceeds into buying another property within two years from the sale of the said property. The money can also be invested in Capital Gain bonds offered by REC and NHAI with a lock-in period of 3 years. The interest income on these bonds would be considered a taxable income of the HUF.

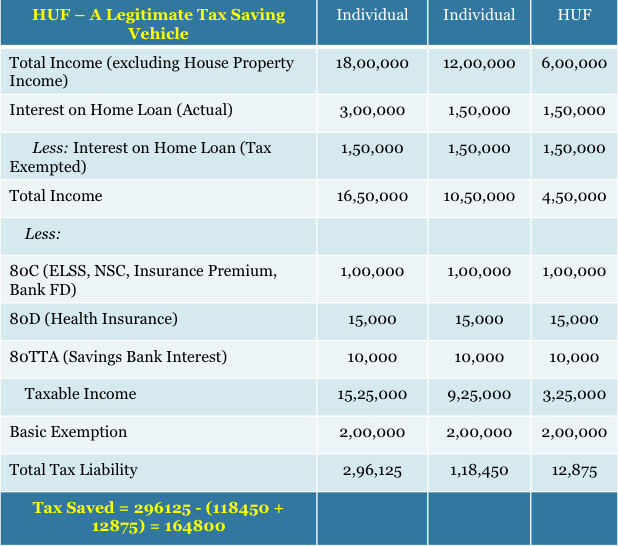

The table below shows how the income of an individual in the 30% tax bracket can be split between two entities to lower the final tax outgo:

Some Other Important Points

- Karta can be paid a reasonable salary for his services of managing day to day affairs of the HUF. The salary will be considered his personal income but at the same time it is deductible as an expense from the books of the HUF.

- Only one member or coparcener cannot form an HUF. There have to be at least two members and at least one male member.

- HUF can keep its normal functioning even with two females after the death of its sole male member.

- The Hindu Succession (Amendment) Act 2005 has given equal rights to male and female in the matters of inheritance as a result of which a daughter now also acquires the status of a coparcener.

- An HUF cannot become partner in a firm but a Karta can.

These were some important aspects when it comes to creating an HUF and everyone, who is eligible to create an HUF and pays taxes, should strongly consider this option as it is a very efficient and good way to save tax.

Hello Shiv,

Can a HUF transfer its property by will or the property of HUF can be transferred only on partition of HUF.

Hi Himanshi,

As far as I know it is possible only on the partition of the HUF.

Dear Shiv

Can HUF be created by son under following sitation

There is no father HUF

Father is deceased

Father has not left any will

Father’s Bank Account is ran by mother

Now can HUF be created by mentioning I son of late shri xyz delacre that i have reciev sum of Rs. 20000 from late shri XYZ……………….

If not can mother give gift to Son’s HUF for creation of HUF?

Pl clarify

Father’s HUF cannot be created after his death but if it already exists, the same can continue with son taking the responsibilities of Karta. For creation of son’s HUF, he needs to get married first and acquire a family. Sisters and mother cannot become member of son’s HUF.

Mother can gift money to her son’s HUF but need to specify in the gift deed that the gift has been made to the son’s HUF and not to the son as an individual.

Sir,

I got so many points about HUF. I want to know that what are the necessary documents to open a HUF account in Bank? A HUF can be in some person’s name like Anant Kr. HUF?

Hi Anant,

Please check this link to know what all documents you require for an HUF savings account:

http://www.icicibank.com/business-banking/transation-banking/cluster-current-ac/documentation.html

‘HUF’ will be added to Karta’s full name as the name of your HUF.

Thanks a lot Shiv.

You are welcome Hiren!

Sir,

I am running a trading business of packaging machineries. My wife is also running same business with different name. Both of us are proprietors of our respective ferms. Now, can a start another firm under proprietorship of Huf (which is yet to be formed) which maintains the machines sold by both of our firms and chages our firms for the same. So practically both firms will pay labour charges to huf and take up that as an expense and Huf will generate income. Will this attract clubbing of income ?

Hi Hiren… Not 100% sure about it. But I think it should not attract clubbing of income if everything is done professionally with your respective incomes. All the entities involved have their legal identity and can do business legitimately.

The articles are really excellent.I am interested in further updates in the matter.Thanks.

A.K.Saxena

Dear Sir,

Can you provide me the format of Affidavit to be filed for application of PAN for HUF? Should I prepare the affidavit on stamp paper (please let me know the stamp duty) or plai paper?

Hi Sridharan… You can get the affidavit made similar to the “FORMAT-I” available on this link – http://taxguru.in/income-tax/got-married-create-huf-to-save-tax-format-of-deed-for-creation-of-huf.html

Just remove the ‘gift’ text out of it. Also, I think it should be made on a stamp paper of Rs. 100.

Mr. Shiv Kukreja,

Thank you very much

You are welcome!

Dear Shiv

Thnaks for a Very nice & informative article. I have HUF demat account & my HUF members are my wife & a daughter

As per the answer in above quarry.

after the death of the Karta in case of a demat account The members can open new bank and demat accounts and transfer money/securities from the old accounts to the new accounts. (

Can this new accounts ( bank & Demat) be HUF accounts? ( As my wife would be a karta)

Further you also mentioned On the death of the ‘Karta’, the operations in the accounts ( bank & Demat) must be stopped immediately , Then what would be the role of Karta ( My wife) ? & what would be status of HUF?

Regards

Vijay

Thanks Mr. Vijay!

As you must be aware, a demat account gets opened in the name of the Karta only and not in the name of the HUF. In your absence, your family cannot run the existing bank and demat accounts. So, new bank and demat accounts will have to be opened and yes, these will be HUF accounts.

What role you are performing at present, your wife would play that role in your absence and the new HUF, in which your wife would be a Karta, would replace the existing HUF. I hope this clears your query!

Very Informative.

I am Karta of an HUF which has my wife and 2 minor daughters as its members. The HUF has investments in Bank FDs, mutual funds, and equity shares.

I would like to know the following:

1. In case of death of Karta, who will be entitled to inherit these investments?

2. Is there a nomination facility available in HUF Bank and demat accounts so that transmission in casse of death of Karta is smooth?

3. Do I have any other option at my disposal e.g. will from HUF which will help in smooth transmission after the death of Karta? Or suggest best way in this respect.

4. What will be the status of my daughters once they attain 18 years of age?

Thanks, Atul

Thanks Atul!

1. “In the event of the death of the Karta and in the absence of any male member, two females can continue to run the HUF and the senior female can take over as the Karta”.

2. Nomination facility is not available to the HUFs for bank and demat accounts. On the death of the ‘Karta’, the operations in the accounts must be stopped immediately.

3. The members can open new bank and demat accounts and transfer money/securities from the old accounts to the new accounts.

4. Please reframe your query.

Dear Sir,

Can HUF start trading activities like purchasing and selling item and servicing / maintnance etc.

What are the limitations

Any Limit of the Turn over and other formalities required from Tax and other C-form / State taxes / TIN number etc

Dear MP Jain,

An HUF is eligible to do any business activity and there is no restriction as such. You need to consult a CA to get more info regarding the turnover and other tax related formalities.

My Father does not have any HUF. My father is living with me. Can My Father gift his personal savings to my HUF without attracting any Gift Tax or any clubbing provisoins

Hi Aryan… As mentioned in the article – “A father can also gift money to his son’s HUF but need to specify in the gift deed that the gift has been made to the son’s HUF and not to the son as an individual”.

Dear Mr.Shiv,

The article and the subsequent answers to queries were informative. Thanks for the same.

I have one doubt:

Can a commodity trading business be undertaken in the name of HUF and can the income earned as commission be booked in HUF’s books? Can such business be undertaken by the Kartha for the welfare of the HUF. The HUF is already in existence for last 5 years and has already been filing tax returns separately.

Thanks

Thanks G Subhasree!

An HUF can run any business but its operations should not be mixed with any other entity’s or individual’s operations. The capital required to start the business should be taken from the HUF’s bank account and the income earned should be deposited in the HUF’s bank account only.

Hi Shiv,

You had said in your article that two female co-parceners can continue the HUF on the death of the Karta and in the absence of any other male member. Could you please tell me where is this mentioned in the law as my bank is not willing to make the senior most female member as the Karta.

Hi Viral,

Please check this link for your reference:

http://www.financialexpress.com/news/a-female-can-become-karta-of-huf/85243/

“when an existing HUF is reduced to only female members, it can still continue as an HUF with one of the females as a karta. This is in view of the existence of the potential coparcenary as any widow may, in future, induct a coparcener into the family by adoption. CIT v RM AR AR Veerappa Chettiar (’70) 76ITR467 (SC)”

http://www.standardchartered.co.in/_documents/Deceased_Depositors_Policy.pdf

“In cases where there are no male members or male members are minor then eldest

female co-parcenor can be accepted as KARTA”

1. Can an individual who provides IT consultancy business generate bills in the name of a HUF and get a service tax number with respect to the same. Can he claim salary from the HUF firm being a Karta or a co-parcener

2. Can a new HUF be formed in the name of women. When both the husband and son are alive and there is no HUF created in the past by either of the family members.

Hi Jimesh,

1. Bills of an individual cannot be used as the expenses of the HUF. As mentioned above – “Karta can be paid a reasonable salary for his services of managing day to day affairs of the HUF. The salary will be considered his personal income but at the same time it is deductible as an expense from the books of the HUF”.

2. In the conditions above mentioned, new HUF cannot be formed.

Dear,

I read one article by which I am confused. So, I want to clarify that.

1. Whether Karta or any member of the HUF can give gifts of any amount to HUF ?

2. Whether HUF can give gifts to Karta or its any members of any amount ?

Neither Karta or any member of the HUF should give any gift to the HUF nor the HUF should give any gift to any of its members. Both attract clubbing of income.

The income tax paid by one of the partner of a firm is paid through the current account of the firm.

The tax return files for this partner is a HUF LR tax return. The property tax paid for the property in the partners name is provisioned in this tax return.

Does this mean / provide enough evidence to prove that the property belongs to HUF and not an individual property of the partner. Please advice….

Hi Harsh… Again, I am not competent enough to help you in this matter.

The income tax paid by one of the partner of a firm is paid through the current account of the firm.

The tax return files for this partner is a HUF LR tax return. The property tax paid for the property in the partners name is provisioned in this tax return.

Does this mean / provide enough evidence to prove that the property belongs to HUF and not an individual property of the partner.

Mr. MCA is unmarried son of CCA. His father’s HUF is in existence. His mother and father both are alive. Mr. MCA has no brother and sister. Hence, his father’s HUF consists of 3 persons, i.e. CCA [father karta], Mr. MCA [Son of CCA] and JCA [MOTHER OF Mr. MCA]. Now, can the unmarried son MCA starts his HUF having two members; himself [=MCA] as male KARTA and mother JCA ? Thus without getting married, can MCA start his own HUF consisting of Mr. MCA [Male Karta] and his mother Mrs. JCA? [Father is alive and father’s HUF is also in existence.]– Please advise me. — THANKS

Hi Divyesh… It is not possible.

Mr. MCA is unmarried son of CCA. His father’s HUF is in existence. His mother and father both are alive. Mr. MCA has no brother and sister. Hence, his father’s HUF consists of 3 persons, i.e. CCA [father karta], Mr. MCA [Son of CCA] and JCA [MOTHER OF Mr. MCA]. Now, can the unmarried son MCA starts his HUF having two members; himself [=MCA] as male KARTA and mother JCA ? Thus without getting married, can MCA start his own HUF consisting of Mr. MCA [Male Karta] and his mother Mrs. JCA? [Father is alive and father’s HUF is also in existence.]

Hi!

I would like to know if HUF can gift money to karta/coparceners. If yes,Karta/ coparcener is purchasing a property and can HUF gift the money which can then be used to purchase the property?

Hi Jaya… HUF should not give any gifts to the Karta or any of its members as it attracts clubbing. The money should be transferred only at the time of formal partition.

Thanks Shiv.

Can the money from HUF be given as loan to karta/coparcener?

Yes, a loan can be given.

Thank you for clearing my doubts.

You are most welcome! 🙂