Liquid funds are getting increasingly popular these days because of the high interest rates, safety, and tax advantage that they offer.

Liquid funds invest in treasury bills, government securities, call money, repo and reverse repos and other such instruments that are quite safe in nature and have a short maturity. This means that they are good for parking that part of your money that you would have otherwise put in a bank savings account.

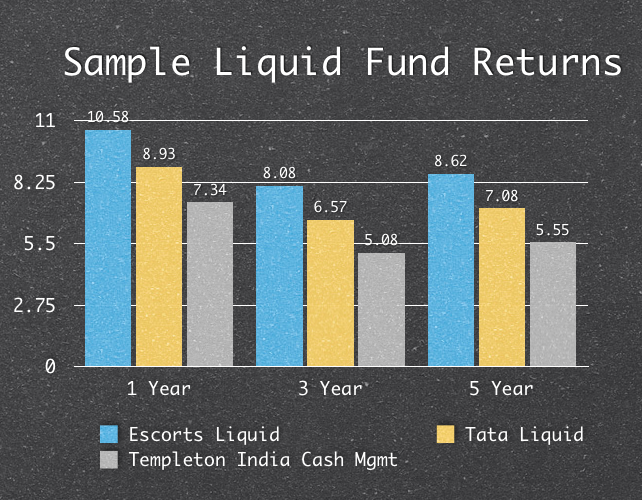

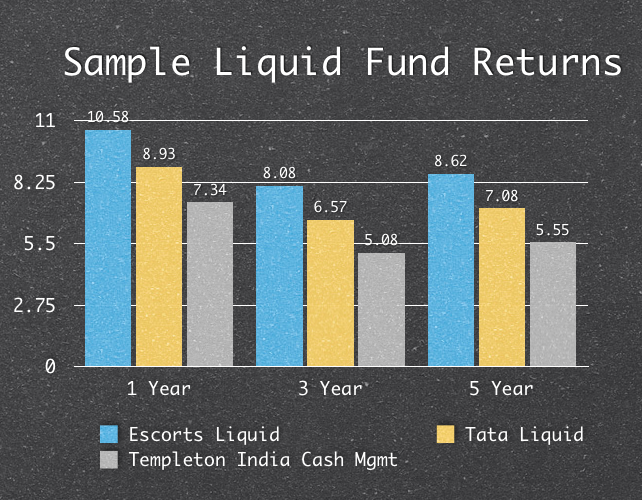

There are a large number of liquid funds available in India and to give you an indication of the returns they have generated in the past few years, I took the returns of 3 funds that were rated high, medium and low for the long term by Value Research.

You can see those returns in this chart.

As you can see, last year has been particularly good for liquid funds, and that is beginning to show in the fund inflows as well. ET reports that during the month of May 2012, liquid funds had the largest inflow of funds in any category and got over Rs. 25,000 crores.

Liquid Fund Tax Benefits

Liquid funds are taxed long term capital gains at 10% without indexation and 20% with indexation. The short term capital gains are charged at the marginal tax rate of the investor and the dividend distribution tax is charged at 25% but that’s in the hands of the fund house and not the investor, so the returns that you see in the chart above have taken care of that.

In general, liquid funds do not have exit loads, and the ones that I checked showed this to be true, however I’m not sure that this is true across each and every liquid fund that exists in India.

Liquid Funds versus Savings Account

It used to be that liquid funds were a lot better than savings accounts because their returns were higher than savings account interest rates and they were taxed at a lower rate than the savings account interest income.

While this is still true, two things have reduced their advantage in recent times.

The first one is that savings bank rates have been liberalized and you can get 6% or so in a savings bank account now, and secondly, bank fixed deposits for short periods like 3 months can now give you as much as 8.25%, and you can always move some part of your emergency funds to these short term deposits especially when a lot of these can be opened electronically and don’t have a penalty when you break them.

I feel that liquid funds definitely have a place in your portfolio if you are in the higher tax bracket but you can’t focus too much on it because the absolute difference that you get by investing in a liquid fund versus a savings bank account shouldn’t be a lot. If it is a lot, then you have to ask yourself where else you can invest this money for a longer duration to get better returns.

This post was from the Suggest a Topic page