Vikrant commented on the Perfios post last Friday on how easy it was to register and file taxes on the Income Tax India website if you have income from only one source viz. salary, and that it took him only 10 minutes to file his own taxes this way.

I’m not familiar with this process, so I asked him if he would share his experience and he replied very promptly with the steps involved in this process.

Here are the instructions that he gave me (slightly edited).

It’s very simple, especially for people like me who have only one source of income which is salary income.

1. Go to https://incometaxindiaefiling.

2. You need to register first, and that’s done by clicking on the Register link that’s present on the right side of the screen, and supplying your PAN.

3. Once registered, enter your PAN number and password to login.

4.  After you login, you will find a page where you can choose to file return for this year or previous year, Let’s take an example of this year. When you point your mouse to E-Filing A.Y.2012-13 it would prompt: “Individual, HUF” as shown below.

Click on the “Individual, HUF” link.

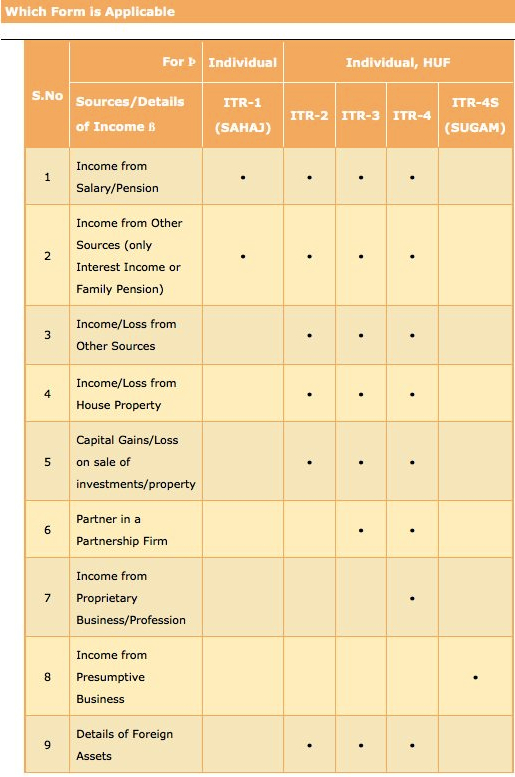

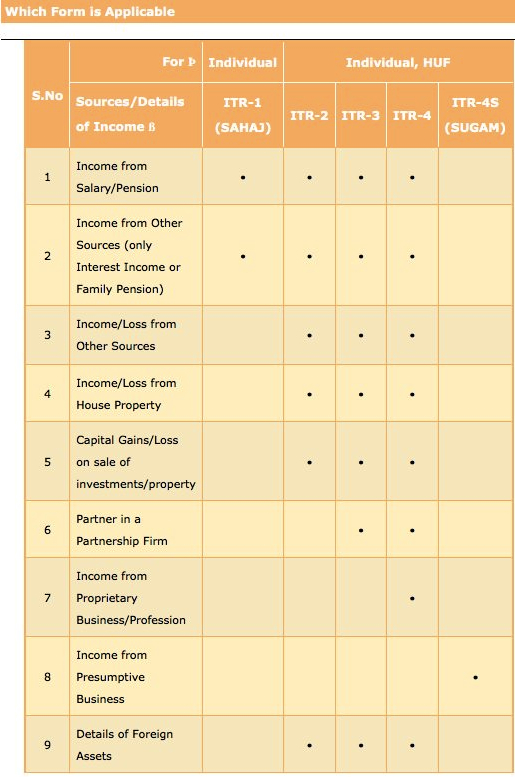

5. The next page has a set of instructions on which form you should use for your tax filing. These are fairly detailed instructions, and you can easily make out which form you should use based on the details given there.

Here is a screenshot of the instructions.

If you look at this page, it will tell you what which ITR form you need to use. Based on the kind of income you have, you will need to use the respective form like ITR1 , ITR2 and so on.

As I said, I will use ITR 1 as example as I come under Income from Salary/Pension .

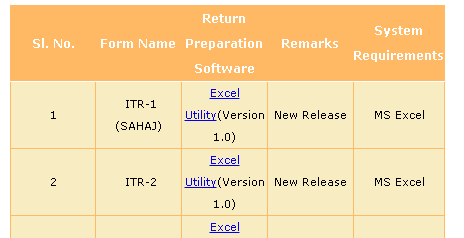

6. Click on the Excel Utility (Version 1.0) for ITR 1 and similarly for other ITR whichever is applicable to you.

7. Fill this form based on the information present in form 16 and validate that.

8. Once you have filled the form (there are 4 pages you need to fill; all those which are applicable). Click on validate and then click on Generate. This will generate a XML file which would be saved automatically in the same location where you had saved the excel file that you downloaded.

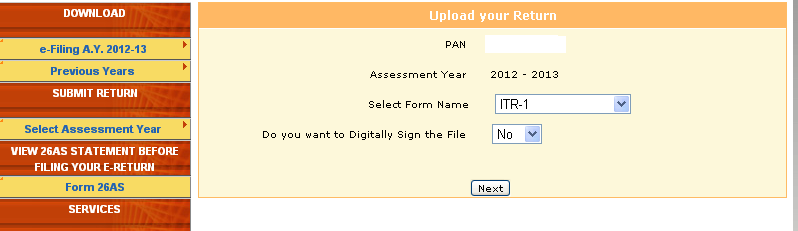

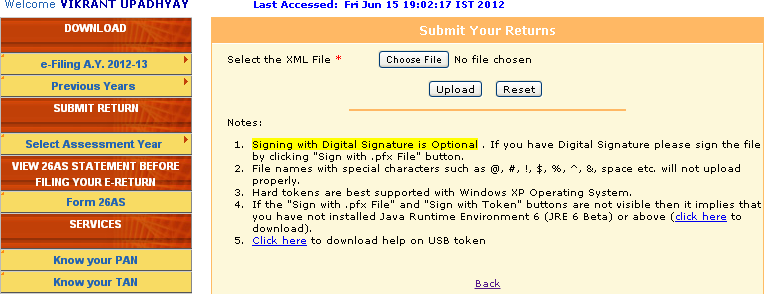

9. Once the XML is generated, all you need to do is, click on the > Select assessment year on the left hand side of the web page and select the year assessment year, which would be AY12-13 for this year.

10.Once you click on AY 12 – 13  you will find this page.

Select the option accordingly, like I have done here and click next

11.Once you click next you will find another page that looks like this.

Click on Choose file and select the XML file that got saved when you generated the XML. And click upload.

12. You will get an email from income tax office that will have a PDF file called ITRV. Take a print out, sign on the form and send it to the address mentioned on the file by ordinary post or speed post.

It’s all done! It’s a very simple process if you have income from only one source.

Conclusion

Vikrant’s instructions are fairly detailed and it looks like a simple process by the looks of it. Many thanks to him for sharing these with everyone here!

Has anyone else tried this and if so what is your experience?