This post is written by Shiv Kukreja

Once quite popular with the investing community, post office small saving schemes have recently gone out of favour with the investors. No hike in the interest rates of these schemes for quite a long period of time, higher interest rates on other instruments like bank fixed deposits, NCDs, tax free bonds etc. and aggressive marketing by the banks and other issuers have played their role in people not investing in post office schemes in large numbers as they used to do earlier.

In fact, with bank deposits giving over 9% return, NCDs of companies like Muthoot, Religare Finvest, Manappuram etc. yielding 13% plus returns and the tax free bonds giving a similar “tax-free†return, investors are switching their funds into these deposits and hence there has been a net outflow from the post office schemes.

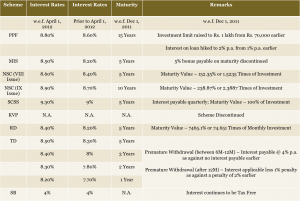

To make these schemes catch up with other market instruments and following the recommendations of Shyamala Gopinath Committee, the government decided in November 2011 to link their interest rates with the market rate of interest. It has also been announced that the rate of interest on small savings schemes will be aligned with the rates of government securities of similar maturities on April 1 every year.

Earlier there were media reports that the interest rates on all small savings schemes have been made ‘floating’ but later on Finance Ministry clarified that the interest rates will remain fixed till the maturity of the schemes except for PPF, for which the applicable rate will remain floating and will change on April 1 every year.

PPF – Still Quite Attractive

The one thing I’m certain of is that it has made Public Provident Fund (PPF) a darling of a scheme for the investors, especially people in the 30% tax bracket who are looking for long-term investment avenues. Rate of interest on PPF has been hiked twice from 8% to 8.6% w.e.f. December 1, 2011 & then to 8.8% w.e.f. April 1, 2012. The effective rate of interest for a person in the 30% tax bracket works out to approximately 12.73%, which I think is amazing, considering it also gives you a tax deduction under section 80C. The ceiling on annual contributions to PPF has also been hiked to Rs. 1,00,000 w.e.f. December 1, 2011 from Rs. 70,000 earlier.

I think this is the first time in the history of Indian fixed income investments that the interest rate on PPF has been fixed at a higher rate of interest of 8.80% against the interest rate on Employees’ Provident Fund (EPF) of 8.60% and at the same rate of 8.80% on General Provident Fund (GPF). Though the interest chargeable on loan taken against your PPF deposits has been hiked to 2% p.a. as against 1% p.a. earlier, the idea is to discourage investors to take money out of a scheme which is meant to be used for one’s retirement years. A loan facility of up to 25% can still be availed from the 3rd financial year till the 5th financial year while a withdrawal of up to 50% is allowed from 6th financial year onwards.

Popular Schemes – KVP Discontinued & 5% Bonus Withdrawn on MIS

Monthly Income Scheme (MIS) and Kisan Vikas Patra (KVP) have been the most popular schemes of post office with approximately 35% and 25% share respectively of the total outstanding of all small saving schemes put together.

Issuance of Kisan Vikas Patra (KVP) has been discontinued w.e.f. November 30, 2011 due to apprehensions of it getting used for money laundering (parking unaccounted money). It is important to mention here that KVP was a kind of bearer instrument as it did not carry the investor’s name on it, was freely transferable and no KYC requirements were there for one to invest.

The changes have also taken the steam out of Monthly Income Scheme (MIS) by scrapping the payment of 5% bonus on maturity, which has been the most attractive feature of this scheme.

Introduction of 10-Yearly NSC (IX Issue)

Post offices now have one more dish on their menu to offer – National Savings Certificates (NSCs) with 10 years of maturity. These new NSCs carry 8.90% rate of interest p.a. and like the older NSCs, the amount invested as well as the interest earned every year qualify for a deduction under section 80C.

Interest rates offered on Senior Citizens’ Savings Scheme (SCSS), time deposits (TDs), recurring deposits (RDs) and saving bank accounts have also been hiked in line with the market rate of interest. Though interest earned on all these schemes is taxable, these schemes have been left untouched as far as TDS is concerned except SCSS on which TDS is deducted if the interest amount is more than Rs 10,000 per annum.

Interest rate on SCSS has been raised to fetch 9.30% and it is payable quarterly. MIS and SCSS are the best investments for senior investors who desire regular stream of definite cash flows either monthly or quarterly. SCSS continues to enjoy deduction under section 80C though it is likely to change once DTC comes into effect.

Maturity periods of MIS and the older version of NSCs have also been reduced from 6 years earlier to five years now. In case of premature closure of time deposits after one year, the deduction from the applicable interest rate has been reduced to 1% p.a. from 2% p.a. earlier. An interest rate equal to the post office savings bank rate of 4% p.a. will be payable if the premature closure is made after the first 6 months of opening the time deposit.

I think passive investors looking for a reasonable risk-free return, can consider parking their funds in these post office schemes. It is just a matter of time that these Post Office schemes will again become lucrative from the interest rate point of view once the inflation comes down and banks start cutting rates on their deposits seeking direction from the RBI. The fate of many of these schemes will undergo many changes with the onset of the DTC but let us see how things pan out as the applicability of DTC continues to remain in question given the way it has been deferred year after year.