This post is written by Shiv Kukreja

If you have taken a home loan and have been paying your EMIs quite regularly without even a single default, then it is highly likely that the next time you require any car loan or a credit card, you may be able to secure any of them with quite an ease, that too at a lower rate of interest and probably get your bank to waive the processing charges also. Why is it so and how is it possible? I’ll try to share all of that with a series of posts about it.

What is a Credit Information Bureau and how it functions?

A Credit Information Bureau (CIB) is a repository of credit information of all the customers of bureau’s members, which includes banks, financial institutions, non-banking financial companies, housing finance companies and credit card companies. Members share this credit information of their customers with CIBs on a monthly basis so that their database gets regularly updated.

CIBs collate only credit information i.e. information on loans such as home loans, automobile loans and personal loans and information on credit facilities such as overdraft facility and credit cards. They do not have any details of customers’ savings accounts, fixed deposit accounts or other such investments which constitute the liability portfolios of banks or financial institutions.

At the same time, CIBs disseminate the information to these same lenders, as per their requirements, helping their credit underwriters to make effective credit or lending decisions. These lenders use this information to generate Credit Information Reports (CIRs) and Credit Scores.

CIBs are also also known as Credit Information Companies (CICs). In India, RBI regulates these bureaus. In 1999, RBI proposed setting up such kind of CIBs and start operating. First of such CIBs – CIBIL was set up in 2000. In November 2008, RBI allowed FDI of up to 49% in credit information bureaus, with a ceiling of 10% of the total voting rights for any single investor group.

What is CIBIL and which other CIBs are there in India?

Credit Information Bureau of (India) Limited, or popularly known as CIBIL, became the first such organization that started collating credit information contributed by its members and maintaining records of an individual‘s payments pertaining to loans and credit cards.

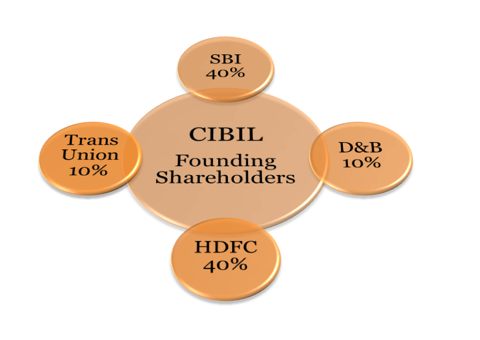

CIBIL was incorporated in 2000 with State Bank of India (SBI), Housing Development Finance Corporation (HDFC), TransUnion and Duns & Bradstreet (D&B) acting as its founding members and in a due course, the shareholdings got diversified to include many other banks and financial institutions. It started with a paid up capital of Rs. 25 Crores.

Founding Shareholding:

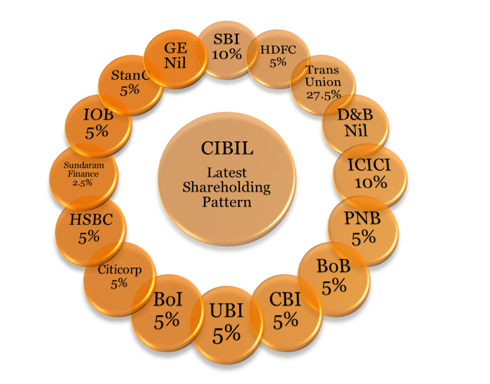

Current shareholding pattern.

Apart from CIBIL, there are three other credit information bureaus operating in India at present – Equifax, Experian and High Mark. But a large chunk of market share is with CIBIL only as it started collating data quite early and this is the reason I have decided to focus on the working style of CIBIL and the parameters it uses for this purpose.

What is a CIBIL TransUnion Score and what is its significance?

CIBIL TransUnion Score is a score measured out of 900 which provides a lender with an indication of the â€probability of default†by an individual based on their credit history. This score suggests lenders the pattern of an individual’s credit usage and loan repayment behaviour.

Your CIBIL TransUnion Score is like your marks in any competitive entrance exam, say like CAT entrance exam for MBA. A higher score in the exam (credit score) do increase your chances of getting admission into a good B-school (getting a loan approval) but doesn’t guarantee it unless you do good in your interview, group discussion and Ex tempore (your income, years of employment, debt burden, age etc). All these things should fit with a lender’s internal credit policy before one’s loan application gets the final approval.

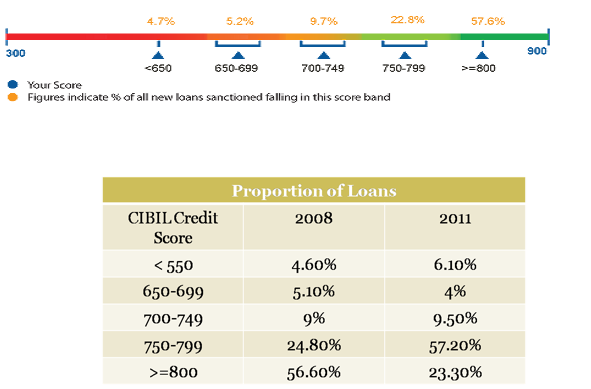

CIBIL TransUnion Score ranges from -1 (or NH) to 0 (or NA) and 300 to 900. Loan providers used to prefer a credit score which was greater than 700 and over the years their preference has gone past 750 now. The closer the borrower’s CIBIL TransUnion Score is to 900, the more confidence the lender will have in borrower’s ability to repay the loan and hence it becomes more likely that the loan application will get approved and the better would be the terms offered by the lenders.

Without a Score, the lenders would treat all loan seekers equally, probably charge a higher rate of interest to all the borrowers. In other words, the entire class of students (borrowers) getting a punishment for the mischief played by a few (defaulters).

Though I did not find anywhere what ‘NH’ or ‘NA’ stand for in CIBIL TransUnion Score terminology, I assume the full form of NH to be “No History†and NA to be “Not Applicableâ€. An applicant gets a score of NH or -1 when he does not have a credit track record at all and a score of NA or 0 when his credit track record is less than 6 months.

As per CIBIL, a credit score of NA or NH is not a bad thing at all. These mean one of the below:

1) One does not have a credit history at all or enough of a credit history to be scored, i.e. the applicant is new to the credit system.

2) One does not have any credit activity in the last couple of years.

3) One has just add-on credit card(s) and no direct credit exposure in his/her own name.

If a person has never used a credit card or taken a loan, then there will not be any relevant credit score for a lender’s reference. The eligibility for a loan, in that case, will be based on one’s income, years of employment, age, etc. That means, if you did not appear for the CAT entrance exam then the B-schools will judge your abilities and give you the admission on the basis of your marks in 10th, 12th or college exams and other factors such as interview, group discussion, Ex tempore etc.

This was the first post on CIBIL Credit Score system and Credit Information Report. I’ll soon come back with some more details to throw some more light on this unique system of keeping record of an individual’s credit history.

Coming Soon:

- What is a CIBIL Credit Information Report (CIR) and what is its significance?

- Â How to check your Credit Score and purchase the Credit Information Report?

- Factors affecting your Credit Score and Can a Credit Score be improved?

- How to get the discrepancies corrected on my CIR? and some cases of customer disputes.

Dear Lalitha ,

A credit score of NA or NH is not viewed negatively by a lender, however some lenders’ credit policy could prevent them from providing loans to an applicant with Scores of “NA” or “NH” (applicants with no credit track record).

We would suggest that you opt for a secured credit card and build your credit history over a period of time. Your timely repayments against this card would help minimizing the rejections of having no credit history.

Regards,

Credexpert

http://www.credexpert.in

My credit score is NH. Its eligible for Personal loan or not pls clarify the doubt

regards

Lalitha

Dear Viewers,

We have released a guide on “Credit, Credit Bureaus and all that..”

The main purpose of this guide is to make all our viewers understand the basics as well as the nuances of credit bureau reports & scores.

Our proactive initiative to facilitate our viewers on the topics related to credit, credit bureau, implications of credit bureau decisions, and much more are covered in this guide.

Download your FREE credit guide copy now..!!

http://www.credexpert.in/eguide/

Warms Regards,

Credexpert

http://www.credexpert.in

Hi,

Can you any one know CIBIL also checking credit report for NRI’s who looking home loan in inida ?

any one know this ?

Thanks in advance…

Dear Kumar,

If you have any past borrowings – loans or credit cards from Indian credit institutions, these details will be reflected in your CIBIL report.

Thus, when applying for a loan in India, the bank will access your CIBIL credit report and score.

Regards,

Credexpert

http://www.credexpert.co.in

Hi,

Thank you for response.

During the home loan borrowing time Indian banks also verify the overseas credit report/checks? or only for Indian institutions borrowing checks? CIBIL normally checking overseas credit checks?

Any one have any idea ?

Dear Kumar,

As per the Credit Information Companies (Regulations) Act, 2005, Indian credit institutions have to be a member of any one of the Indian credit bureaus. And as per the regulations, they have to report credit data to these bureaus. This information is only available to members of the credit bureau.

Thus, since this information is only accessible to the members, institutions outside the purview of the regulations will not have access to this information. And credit bureaus – CIBIL in your case, and its members do not have access to information outside India.

Thus as mentioned before, if you have taken any loans or credit cards in India, only this information will be available on your CIBIL report and the banks will have access to the same.

However banks could ask you to pull your individual credit report from an overseas bureau for a credit check on any borrowings you may have in that country.

Regards,

Credexpert.

http://www.credexpert.co.in

Shash Finance lease is harassing me on behalf of Standard charterd bank, to pay Rs25560/- to remove name from CIBIL, i have cleared all the due and i have temporay receipt & Full and final settlement letter . still it reflecting o/s, even my person loan has been rejected due to us, i want to know whether my name is there is CIBIL and what is the procedure to remove the name from CIBIL.

Thanks& Regards

Michael

Dear Michael,

Information of any credit facility availed by individuals is reported to the credit bureau by lending institutions. The updation of this information is done on a monthly or quarterly basis by lending institutions. This information is reflected on your credit report and based on it a credit score is calculated. So, all the loan/credit cards, open or closed will reflect on your credit report and cannot be removed.

The fact that you have repaid and closed the personal loan availed from Standard Chartered Bank has to be updated. The supporting like the receipt and full & final settlement letter can be used to establish the fact of closure of this account.

Rightly so, this could be one of the factors that have hindered your personal loan application.

Kindly directly coordinate with the bank or raise a dispute with CIBIL. Do not deal with any third parties involved in collections/recovery.

Regards,

Credexpert

http://www.credexpert.co.in

sir,my score is 772. Can i eligible to get a personal loan

Dear Mr. Ranjan,

Firstly, apply for a Personal loan only if you have a genuine need.

772 is a decent score for a personal loan (i.e. unsecured loan). Although, credit scores are one of the important factors considered by lending institutions while evaluating a credit application, they also consider their internal credit policies. Hence we would not be able to comment on the approval of your personal loan application.

The best way to find out is to apply to your preferred lending institution and wait for their reply. Ensure that you do not apply randomly as this would only increase the no. of enquiries appearing on your credit report. High no. of enquiries is viewed negatively by lending institutions.

Regards,

Credexpert

http://www.credexpert.co.in

Dear Sir,

i take bike lone from icici bank in 2008, my lone will be complite in 2010,my esi deducted in stanstard charted bank, i last emi deposited,but bank icici bank will not duduct. i check after 4 month emi not deduct. After 2 years icici bank call me and told your emi is pending, than i will go in Stan C. Bank emi still deposit in bank,than i deposite last emi in icici bank, But now i applied personal Lone in Hdfc bank my fil will be regect cause of icici bank so please help me what record my in cibile a/c.please do the need full.

Dear Mr. Yogesh

Every late payment towards an EMI is updated in your credit report. This means that if you pay your EMI, say 10 or 15 days after the due date, this late payment date is reflected on your credit report.

In your case, depending on your score and your payment record in your other accounts, you may request HDFC Bank to consider your application, given the above circumstances.

Would request you to clear all your dues towards ICICI Bank. This account will then reflect as closed against your ICICI account in your CIBIL report. The clear status might open a window for loan application approval.

Regards,

Credexpert.

http://www.credexpert.co.in

Report

I m using bank of india credit card since july 2012. I checked my cibil report in march 2013. It shows score NH. am i still new for cibil

Hi Pankaj… normally the report shows ‘NH’ if your credit history is less than 6 months old. Only CIBIL will be tell you why it is still showing NH. I think you should either approach CIBIL or wait for a month or two and retry after that.

I would like to clear my name from cibil but i do not no the procedure.i have no due certificates for the concerned products for which my name is popping out.Please give me a solution to clear my name so that i can submit the no due certificate for the same.

Hi Arun… Please check this post to know more about the procedure:

http://www.onemint.com/2012/09/14/cibil-dispute-resolution-process-rectification-of-discrepancies-in-credit-report/

or visit this link:

https://www.cibil.com/online/ManageDisputeDetailsAction.do?action=showDisputePage

Hi,

Today i got CIBIL report and found that my score is appearing as “NH”, though I had couple of credit cards, personal loans etc., out of these I had setteled a credit card – “Post Settled”.

Can I know why it is appearing as NH?

Thanks.

Hi Krishna… ‘NH’ signifies “No History”, but as you mentioned you had credit cards & personal loans, I dont know why it is showing ‘NH’ in your case.

i have apply loan in axis bank

I KNOW I AM IN DEFAULTERS LIST BUT HOW I KNOW WHICH BANK IS SENDING THE REPORT

Buy your CIBIL report online & you’ll get to know.

please send cibil report written off statement which type of cridit card, which type ofbank as early as possible

Hi Shiv, my credit score is 750, I have a citibank cc which i make more than min. payments on before every due date. I also got approved for a personal loan last month for 2.5 lacs however, my requirement was for 3.5 lacs…………so went onto to apply for another personal loan for a lakh. What are my chances of this loan getting approved. I earn about 45k per month.

Hi Andy… It is not possible for me to guess the chances of you getting the loan successfully. It totally depends on the lender’s assessment of the risk involved. A lender might take more risk to expand its loan book vis-a-vis the other lenders.

Can i get mortgage loan with a credit score of 500 i need 6 lakhs and my property worth 40 lakhs

Very high probability that you will get it.

need to know my cibil score

Hi Charles… You need to follow the online process – https://www.cibil.com/online/credit-score-check.do

Please check this post to get more info –

http://www.onemint.com/2012/08/08/check-your-cibil-credit-score-credit-information-report-online/

I agree. If my data is being collected. It is without my consent. First my consent must be taken and then, I must be provided a free copy of same say yearly.

I have a view what these lenders are doing is not unethical. It is their job and is completely fair till the time your personal information is not made public. The idea behind what they are doing is to make the lending process more efficent.

As I mentioned above “Without a Score, the lenders would treat all loan seekers equally, probably charge a higher rate of interest to all the borrowers. In other words, the entire class of students (borrowers) getting a punishment for the mischief played by a few (defaulters).”

But the problem lies in the dispute resolution. First of all, wrong methods of selling things like credit cards, personal loans etc. must be checked at the ground level. All fee and charges must be made known to the customers right from the beginning. There should be nothing hidden.

Then these lenders must justify their actions of giving a negative report on somebody’s credit profile. The person should be informed that the lender has given a negative feedback about him to the CIBIL. Dispute resolutions should be very very quick, justified and get reflected on the CIR as well as in the Credit Score as soon as possible.

These agencies get consumer’s data without their explicit consent and share it with others. While this is not ethical, modern system needs these credit scores. So, in the west they have made it legal with a rider that they should give a free report to everyone once a year. But in India, they do not do this. One has to pay to get their own credit info (jist to check if something is mis represented). This should change.

To your point about what happens in the west, I know in the US, a consumer can request his credit report once a year from each credit agency so you could plan out your requests in such a way that you get one every four months. I don’t think very many people do that, and what you get is the credit report, not the credit score which is a pretty significant thing as well, and you have to pay to get the score. Additionally, keeping a tab on your score or report once in 4 months is not enough if someone really does steal your numbers and do something to your account so there are services that monitor these things for you and charge a monthly fee for it.

Hi Manshu… I did not get the stealing part, what is that ??

I meant stealing credit card numbers and misusing them. That’s fairly common and people can’t rely on just getting these free reports to protect themselves.

The good thing is that the credit card companies themselves are very alert and very often they notify you about suspicious use and are most of the times co-operative if you can show them that your card was misused.

Hi Bhushan… I agree with you that they should share the report with people at least once a year free of charges. But, here in India, things are yet to become systematic like in the west and awareness among people is quite low.