This post is written by Shiv Kukreja.

The first quarter of calendar Yyear 2012 saw a big number of public sector undertakings (PSUs) issuing tax-free bonds. NHAI, PFC, IRFC, HUDCO and REC – they all came within a span of 70-75 days and took away approximately Rs. 28,000 Crores from the markets.

These bonds were quite attractive and offered very good tax-free returns of over 8%. mutual funds, insurance companies, other financial institutions, corporates, FIIs, NRIs, trusts etc. – all participated in these issues and many of these issues got oversubscribed on the first day itself.

Retail investors were slow to begin with but they also participated in these issues but in a wrong manner and at a wrong time. Over a period of last 30-45 days, I’ve observed their attractiveness increasing and a large number of my clients asking me more details about these bonds and investing in them.

NHAI was the first one to offer an attractive rate of tax-free return of 8.30%. I still remember I sent quite a good number of emails to all my clients and personally made calls to a few clients in an effort to make them understand the terms of the NHAI bonds issue and why it made sense to invest in these bonds at the time of its public offering itself.

But as always, clients took their own time to understand its benefits and when these bonds actually listed at a premium of 4% on the exchanges, they remained quiet because they had nobody to blame for this notional loss or opportunity lost but themselves. If I had made no efforts in informing them then they would have caught me for not putting proactive efforts. 🙂

NHAI bonds came into the limelight when Indian Railways Finance Corporation (IRFC) came out with its bond issue and due to a rosy picture shown to the investors by the broker community, investors flocked to apply for IRFC bonds. Brokers even provided funding to their clients to apply in this issue. But I knew IRFC bonds were not as attractive as the NHAI bonds were because of its “step-down interest†feature i.e. the rate of interest gets reduced to 8.10% if a buyer purchases these bonds from the original allottee in the secondary markets.

During the subscription period, IRFC bonds issue got a huge response in an expectation of a bumper listing like the NHAI issue had. But that did not materialize and IRFC bonds gave only 1-1.5% listing gains and that too were taken away by the brokers who funded the investment. HUDCO tax free bonds issue also opened for subscription on the same date i.e. January 27th but due to its lower rating of AA+ and not so heard of name, it could not be fully subscribed and listed at a significant discount of 4-5%.

REC was the last to come up with its AAA-rated tax-free bond issue in the first week of March and got a reasonable response also. But again its listing was poor with 2-3% discount due to a huge number of sellers and a very few investors showing any interest to buy. There has been no such issue hitting the street since then, despite of the fact that Finance Minister has doubled the quota for these bonds to Rs. 60,000 crore in this year’s budget.

What makes these bonds attractive?

Higher effective after-tax returns: Suppose you fall in 30% tax bracket and have invested Rs. 5,00,000 in a fixed deposit with HDFC Bank for 5 Years earning 9.25% p.a. interest. The after-tax effective rate of interest on this FD would be 6.39% (9.25%*(1-0.309)). You can also look at it as tax-free equivalent rate of interest. On the other hand, these tax-free bonds offer you 8.30% interest, which is equivalent to 12.01% effective before-tax rate of interest. So, you can either compare 9.25% with 12.01% or 6.39% with 8.30%. This comparison makes tax-free bonds a clear winner as far as the rate of interest is concerned. In actual terms, you’ll end up having Rs. 31959 as the interest with your FD after one year as compared to Rs. 41500 with tax-free bonds, a difference of Rs. 9541 every year.

Scope of capital appreciation: Then comes the capital appreciation factor. We all know India is struggling with a high inflation rate and the interest rates are ruling on a higher side. But there is a strong possibility that one or two years down the line both the inflation as well as the interest rates might cool down. Also, whenever the interest rates come down, bond prices go up. In that scenario, there is no scope for FDs to result in any capital appreciation because your FDs are not trade-able and you cannot transfer the title of these FDs in the market. At the same time, capital appreciation is possible with tax-free bonds as and when the inflation and interest rates cool down. These bonds are tradeable and freely transferable to any of the interested prospective buyer on the exchanges where these bonds are listed.

Liquidity: One more attractive feature of these bonds is their liquidity. When you break your FD before the tenure gets completed, the bank either levies a premature withdrawal penalty or gives the applicable rate of interest for the period you hold the FD for. Tax-Free Bonds score over FDs in this department also. You can sell these bonds in the secondary market whenever you want, given there is a buyer for these bonds. Till date the liquidity has not been a big negative factor for all of these issues, though at times the buyers have benefited quite a lot due to a huge number of sellers selling around listing time without thinking that they were selling these bonds at unreasonable prices.

TDS on FDs: Fourth factor which goes against FDs is that your FDs allow the banks to cut tax whenever they pay you more than Rs. 10,000 interest in a year. Needless to say tax-free bonds attract no tax so no scope of any TDS.

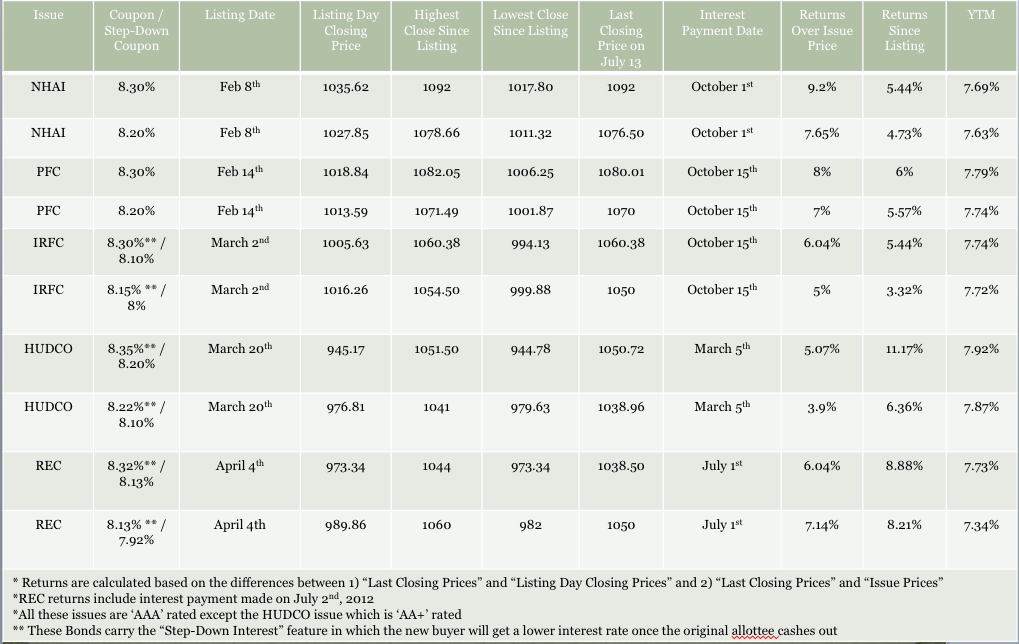

So after the first six months of this calendar year are gone, what is the current state of these bonds? – This table will tell you: (click to enlarge)

Since listing, some wise investors have bought in these bonds citing an opportunity due to weaker hands (retail investors) selling to encash their investments. These investors have made some decent returns since then. You can observe two kind of returns from the table – one is “Returns Over Issue Price†which shows the returns earned if somebody had applied for these bonds during the initial offer period. The other one is “Returns Since Listing†which shows the returns earned if somebody had bought these bonds from the secondary markets (stock exchanges where these bonds are listed like NSE or BSE).

HUDCO bonds have given 11.17% returns since listing in less than 4 months i.e. an annualized return of over 34%. Similarly, REC bonds have given 8.88% returns in just over 3 months i.e. an annualized return of over 30%. But, it would be highly unfair to expect a similar performance from these issues going forward. I would say it would be great if these bonds deliver some 10-12% returns over next one to two years, if interest rates come down.

What investors should do now?

It depends on what kind of investor you are, the reasons for which you want to invest in these bonds and the overall interest rate and inflation scenario in the country going forward. If you are in a 30% or 20% tax bracket, want to invest in these bonds from a long-term point of view i.e. more than one year, and believe that the inflation as well as the interest rates are headed lower, then you should definitely go for these bonds. You need to focus on their “Coupons†(interest rates on these issues) as well as the “Yield to Maturity†(or YTM). Coupon is the interest payment you are going to get every year on the “Interest Payment Date†over the issue price.

If you want to invest in these bonds for a very long period of time, say till maturity, then you need to focus only on the YTMs because you are going to get precisely this much yield on an annual basis till maturity considering the price you are paying over the issue price (premium in all these cases) and the remaining coupon payments.

If you want to invest in these bonds from a short-term point of view i.e. less than a year, then your returns will depend on the inflation and the interest rates over that period of time. If the interest rates fall more than expected, then your returns will be higher than the YTM and vice-versa.

I think people in the 10% tax bracket can also consider investing in these bonds considering there is no scope to have any capital appreciation in fixed deposits or post office schemes etc. but at the same time these bonds yield less to these investors or to those who need not pay any tax at all.

Given the stickiness of inflation and interest rates, the returns given by these bonds are not bad from any angle. How these bonds perform over the next year or two will depend on the inflation numbers, our fiscal deficit, current account deficit, interest rates scenario and most importantly how these companies themselves perform. I hope to see more such opportunities striking our doors in the next 8-9 odd months.