There are two types of Options that you can trade in – Call Options and Put Options. You buy Call Options when you think a share is going to go up in value and you buy Put options when you think a share is going to go down in value. This means that the value of your Calls go up as the stock rises, while the value of your Puts go up when your share falls.

For a retail investor, there are three common reasons for owning an Option.

Why own an Option?

1. Speculation: Options are a way to take a short term speculative position given that they can’t be held for very long.

2. Going Short: You can’t borrow and short sell shares in India, so along with selling Futures, buying a Put Option or selling a Call Option (without owning it first) is a way to go short a share or index.

3. Leverage your position: Buying a Call Option is the same as buying a share in the sense that you profit from both the trades when the share price rises then why buy a Call Option at all? Options can leverage your positions which means that you can gain or lose a lot more with the same amount of money using Options than you can by taking cash positions. This is akin to trading on the margin, and has the same effect.

Hedging is a popular reason given for owning Options but I don’t think it is all that applicable when talking about small investors, especially with a product that expires in a short time. But theoretically, hedging is also one reason to own Options.

Popular Definition and Key Terms of a Call Option

Let’s get to the popular definition of Call Options now which I will use to give an example and explain them in detail.

Call Option: A Call is a right, not an obligation to buy an underlying asset at a predetermined date at a predetermined price by paying a certain amount upfront.

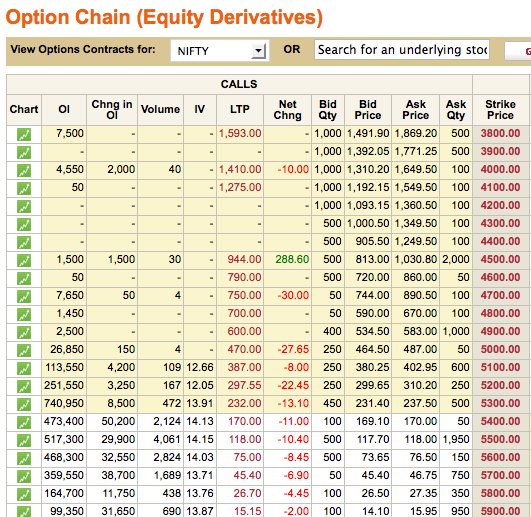

Now, look at this picture below and let’s take that example to understand Call Options a little better.

I took this screenshot from the Options chain section of the NSE website, and this shows the Call Option details for NIFTY which expires on 25th October 2012. Every Option has an expiry date and the Option becomes worthless on that expiry date. The expiry date is the predetermined date in the definition.

This is a Call option to buy components of the Nifty, so the Nifty is the underlying asset from the definition.

The Strike Price which is the right most column in this image shows at what price you will be buying Nifty. If you look at the first row that’s a price of Rs. 3,800 and then it increases by Rs. 100 at every row, and this is the predetermined price from the earlier definition.

Now, if you look at the sixth column from the left of this picture – that’s “LTP” which stands for “Last Traded Price” and this shows you at what cost per unit the last transaction happened for this contract. A Nifty Call Option is made of 50 units, so you pay 50 times whatever is listed in the LTP column.

The Nifty closed at 5,392 this week, and let’s look at the last highlighted row in this picture which is for the strike price of 5,300 and see how that fits our definition.

This Call is a right, not an obligation to buy Nifty at a predetermined date of October 25th 2012 at a predetermined price of Rs. 5,300 by paying Rs. 232 per unit upfront.

So if you bought this contract today, you will have to pay Rs. 232 and in return you will have the right to buy a Nifty contract at Rs. 5,300 on October 25th 2012. If Nifty is at say 6,000 on that date, then your Call option will be worth a lot more than Rs. 232 because you can buy it at 5,300 and then sell it at 6,000. That’s also why in the image above you see that the price of the Options keep increasing as the Strike Price keeps going down.

If the Nifty closes below 5,300, the Option will expire worthless because why would you buy Nifty at 5,300 when you can buy it for lower in the market. The part of the definition where it says that the Option is a “right but not an obligation” comes into play here because if Nifty closes below what you paid for it then you don’t have to do anything at all as it is your right to buy, but you aren’t obligated to buy.

This means that when you buy a Call Option your loss is defined to what you paid for it. You can’t lose more than that on the transaction.

The seller of the Call however who is known as the person who writes the option doesn’t have a cap on how much he loses and can lose an unlimited amount (theoretically) in the transaction. This is because the person who writes the option has an obligation to sell you the underlying asset at the price decided in the contract.

As far as Options trading in real life is concerned you don’t actually buy and sell the underlying asset but pocket the difference between the price you paid for the Option and the price at which you sold the Option.

One last thing about this is that Call Options that are lower in value than the underlying asset or are profitable are called “In the Money” and in the image above these are highlighted in yellow. Other Options are called “Out of the Money”

Now, let’s move on to the Put option.

Popular Definition and Key Terms of a Put Option

Let’s look at how a Put option is defined now.

Put Option: A Put is a right, not an obligation to sell an underlying asset at a predetermined date at a predetermined price by paying a certain price upfront.

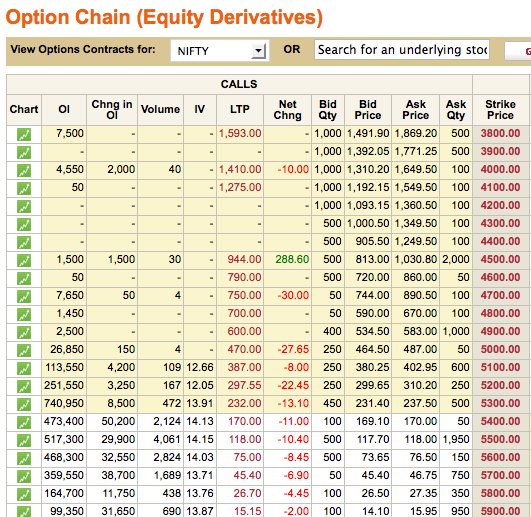

Now, look at this picture below and let’s take that example to understand Put Options a little better.

This screenshot is also from the Options chain section of the NSE website, and this shows the Put Option details for NIFTY which expires on 25th October 2012.

Since this is similar to Call Option but in a Put you have the right to sell instead of the right to buy, let’s look at the first highlighted row and see if we can define it the way we defined the Call Option.

This Put is a right, not an obligation to sell Nifty at a predetermined date of October 25th 2012 at a predetermined price of Rs. 5,300 by paying Rs. 81.10 per unit upfront.

So if you bought this contract today, you will have to pay Rs. 81.10 and in return you will have the right to sell a Nifty contract at Rs. 5,300 on October 25th 2012.

If Nifty is at say 4,800 on that date, then your Put option will be worth a lot more than Rs. 81.10 because you can buy it at 4,800 from the market and sell it at 5,300.

So, in the case of a Put option, you benefit from the contract when the price of the underlying goes down because you have the right to sell it at a much higher price.

Like Calls, you benefit from Puts by pocketing the difference between the price you paid and the price the Put is currently trading at – you don’t have to actually own the underlying asset and then sell it to profit.

And like Calls, Puts also limit your maximum loss to what you paid when you bought the contract. You can’t lose more money than that and this makes it a good way to go bearish on something because the other alternative is by selling a Futures contract and you can stand to lose a lot of money very quickly there if the market turns against you.

Conclusion

Options are a fascinating subject and I’ve spent many hours researching and looking at different Options strategies and trades because of this. For someone who is coming across them for the first time, they can seem a bit intimidating but once you get the hang of it they are fairly easy to understand and build positions with.

If you have any questions about this post, or any other observations, please leave a comment and I’ll answer them.

- Part 1: Introduction to Futures and Options

- Part 2: How do Futures Work?

- Part 3: How do Options work?

Edit: Lot size corrected.Â