Ankita Dhokia posted the following comment in the Suggest a Topic page back in August:

- Ankita Dhokia August 28, 2012 at 8:17 pm [edit]

-

Hi ,

I wish to invest in mutual funds. I am an amateur and am completely lost in the numerous schemes offered by all companies. I wish to know the co relation between interest rates and stocks, debentures and money market instruments. Kindly guide on the same.

Thanking you ,

Ankita

What is a mutual fund?

The first thing to understand is that mutual funds are investment vehicles, and that simply means that investors pool their money together and then the mutual fund invests that money on their behalf. The easiest way to understand this is to think that as an individual investor you would’ve gone to the stock market and bought a share, but now as a mutual fund investor you buy a mutual fund unit, and then the mutual fund pools together your money with money from other investors and then goes and buys shares on your behalf.

What do mutual funds invest in?

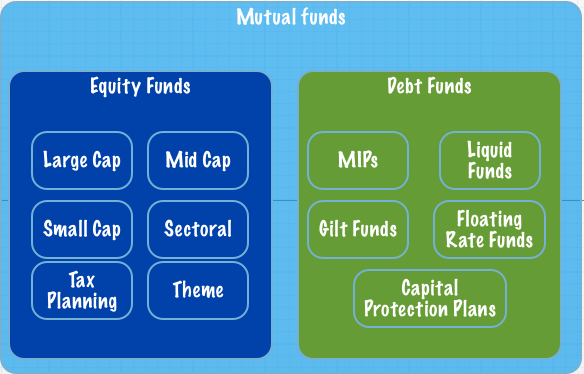

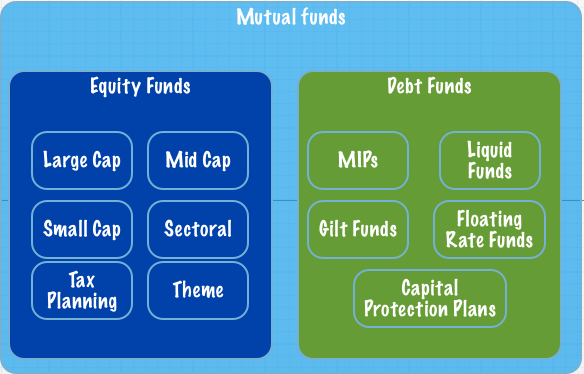

There are four main type of mutual funds based on what they invest in.

1. Equity Mutual Funds: These are mutual funds that invest in shares of other companies.

2. Debt Mutual Funds: Debt mutual funds are mutual funds that invest in debt instruments so they may buy debentures of a company or government and other such things. Here is an article that lists out the different types of debt funds.

3. Commodity Mutual Funds: These are mutual funds that own commodities like gold, and in reality, India only has gold based mutual funds.

4. Hybrid Mutual Funds: Hybrid mutual funds invest in a mix of the above three classes at the same time. So for example, they may invest 65% of their money in shares and 35% in debt.

The answer to which mutual fund you want to invest in depends on what you actually want to buy and your appetite for risk.

If you want to invest in shares and understand that investing in shares can sometimes mean that you even lose your capital then equity funds are for you.

If you want to be safe and protect your capital then you should only invest in debt mutual funds.

If you were interested in getting returns from gold then you should invest in a gold mutual fund. A hybrid fund is for someone who needs a balance.

Take a look at this page with the explanation of the different types of debt mutual funds, and this page if you want to know the difference between a debt and an equity product.

Deepak Shenoy has a great video on the different type of equity mutual funds.

How can I buy a mutual fund?

There are several ways to buy a mutual fund, you can go to the website of the mutual fund directly and buy it from there. You can buy them from an agent offline, you can buy them from a brokerage portal like ICICIDirect.com, and then there are free platforms like FundsIndia.com that you can use to buy mutual funds.

Conclusion

I understand that even this basic information can be a little overwhelming for the beginner so I think if you know nothing, then start by learning three things about them – what they are, what do they invest in and how can you invest in them?

The what is simply that they are investment vehicles that pool together money from different investors and then invest it on their behalf.

They invest in either shares, bonds, commodities or a combination of these.

And you can invest in them by using online portals or just contact an agent offline; there are many ways to buy them based on what you’re most comfortable with.

Please leave a comment if you have any questions or comments.

There are 44 fund houses which manage around 69270492.89 lakh of money with thousands of schemes. The choice set is so large that, not just entry level, but even older investors get flummoxed. Magazines, TV shows, internet flood the often already confused investor with lists, facts and figures

First step in understanding about mutual funds is explained by Manshu with pointers.

The various types of Mutual funds are:

By Structure :Closed Ended Funds, Open Ended, Interval funds

By Nature :Equity, Debt, Balance

By Investment Objective :Growth Schemes, Income Schemes, Balanced Schemes, Index Funds

Remember that Mutual funds fate or performance is linked with performance of the underlying securities. If stock market is doing well then equity diversified funds will also do well. If Gold prices are going up so will the returns of Gold ETF. Often with mutual fund advertisment we find following statement

Mutual Fund Investments are subject to market risk. Please read the offer document carefully before investing. Past performance may not sustain in future.

Also remember It’s not that if you invest in mutual funds you will never have loss. There are always leaders as well as laggards. So choosing the right mutual fund becomes important.

Please try to limit the number of funds in your portfolio. Don’t simply chase funds that have become star performers. There’s no magical “right†number of mutual funds. Nearly everyone agrees that there is no need for dozens of mutual funds

Often for first time mutual fund investor valuereseachonline suggests following :

For your first mutual fund investment we suggest you go with a balanced fund to start with to experience mutual fund investing and understand how your investments grow over the next six months. You can later move to a large-cap fund

These are excerpts from our article Investing in Mutual Funds for Beginner

I think structure can be the second part of this article, and probably include the division between growth and dividend options as well.

Thanks Manshu for such a detailed explanation. I think we can take help from any bank and invest in them directly. But KYC should be ok.

Thanks for bringing that up, I think I don’t have a post on KYC here, need to do one for that too.

Hi Santanu… 9 out of 10 times, you’ll be sold an insurance plan if you visit a bank to invest in a mutual fund. The best way is to do your own research or hire an unbiased financial advisor.

Thanks for the mention, Manshu!

You are welcome Deepak! It’s a very good video and I’m glad you allowed me to embed it within the post.

Hi,

I heard from a friend that I can invest directly to fund house. This way I can save on the fund management charges year after year.

Do all mutual funds have this direct route?

I have never heard of this direct route before.

Hi Tom… Fund Management Charges are the expenses a fund house charges for managing your investments/funds. These charges have nothing to do with the “Distribution Expenses” which an investor would be able to save from January 1, 2013 onwards, if he/she invests in a scheme directly.

Investors can still invest directly with the fund house, but they don’t get any advantage for doing so. It only increases the margins of a fund house at the expense of a distributor. Also, all mutual funds have this ‘Direct’ route.

Thanks Shiv, I got confused with this comment and didn’t realize this is what he is referring to.

It happens sometimes… perfectly fine!