There aren’t many accounting posts here partly because accounts is not my strong suit and partly because financial accounting is not really all that important as far as personal finance goes.

However this question popped up a few days ago and it is easy enough to answer so I’m doing this post.

First, the original comment for context.

- Krishna V R Muppavarapu November 16, 2012 at 6:56 pm [edit]

Krishna partly answers his own question in the comment because Net Income really is Operating Income minus interest, taxes, and exceptional items.

Operating income is sales minus operating expenses and is also referred to as EBIT (Earnings Before Interest and Taxes). Sales is easy enough to understand where you don’t need further explanation on it and Operating expenses are the expenses needed to run the business like raw materials and employee salaries. Depreciation is a non cash expense that’s also deducted from sales to arrive at Operating Income.

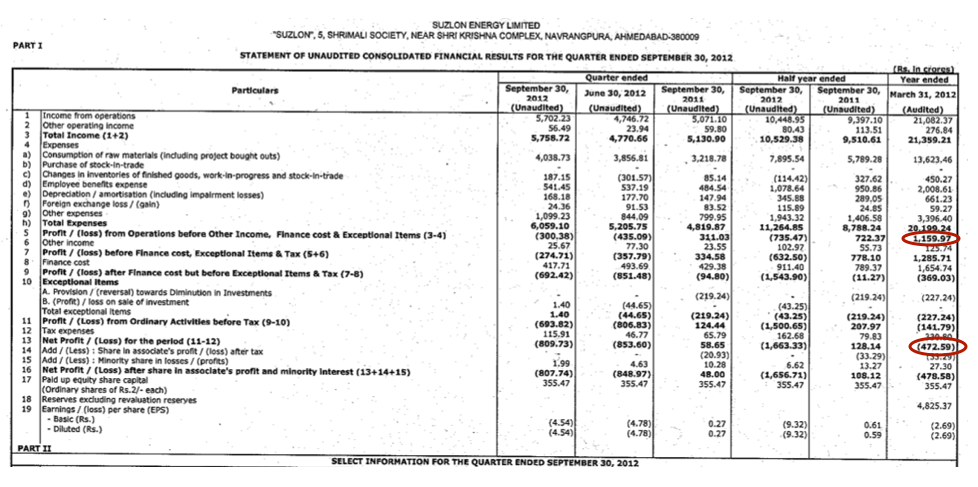

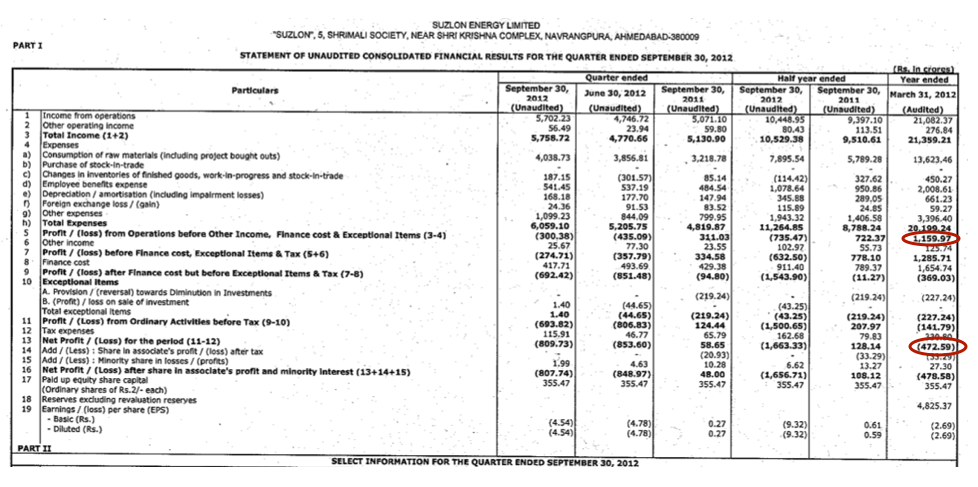

I took a screenshot of Suzlon’s financial results (click to enlarge) to show Operating Income and Net Income because I had a feeling that they are a company that is likely to have a positive operating income and a negative net income, something that proved to be right for the financial year ended March 2012, and I have highlighted the two amounts that show a positive operating income and a negative operating income.

For the second part of the question, that’s a bit harder to answer but personally I can’t see myself saying no to a job just because the company has made a loss.

If a company makes a loss this year, that doesn’t mean it will continue to make losses forever and while there is a greater chance of layoffs in such a company than a company without any losses, other things being equal, I wouldn’t say no to a job just because of this. Even if you see Suzlon’s example, it employs a lot of people and has done that for a number of years, what the future holds no one knows but just the fact that people have been gainfully employed in loss making companies in the past shows that this alone is no reason to say no to job in my mind.

Thoughts?

What does it mean when a company has positive operating income but a negative net income? To my understanding the these two numbers differ only by the taxes and interest to be paid. Does that mean the company has lots of debt? Is it a good idea at all for one to seek employment with such a company, given that the person has a median financial profile (in terms of savings and debt)?

Reply