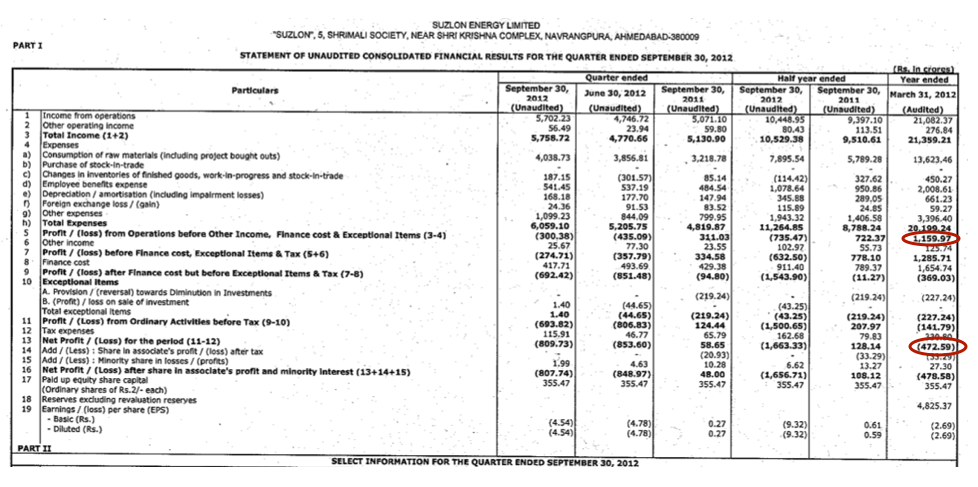

The government starts off its disinvestment program for this financial year with the divestment of up to 9.59% stake in Hindustan Copper tomorrow.

They have set a floor price of Rs. 155 which means that bid for shares can only come at that price or higher, and the entire process will close tomorrow.

The announcement says that it will take place on a separate window of BSE and NSE, and this doesn’t seem to follow the usual IPO or FPO process. I’m not quite sure how retail investors can bid for these shares, and if anyone has information on that then please do leave a comment or send me an email.

The Hindustan Copper stake sale is very interesting in one respect which is the fact that the floor price set by the government is Rs. 155, and the stock closed at Rs. 266.30 today.

If your eyes lit up thinking about the great arbitrage opportunity here, hold your horses.

Remember how the government is willing to divest up to 9.59% of its stake in Hindustan Copper? That’s because they have already divested 0.4% of the stake in Hindustan Copper, and that’s all the stock that trades in the stock exchange.

So, the the float is so low that the current market price doesn’t indicate much, and by extension, the huge discount of floor price to the market price doesn’t mean much either.

Also note that this is the floor price and not the price at which the shares will be ultimately sold. That level will be decided by how many bids come at what levels.

In my opinion, the thing to remember is to forget about the discount of offer price to current market price.

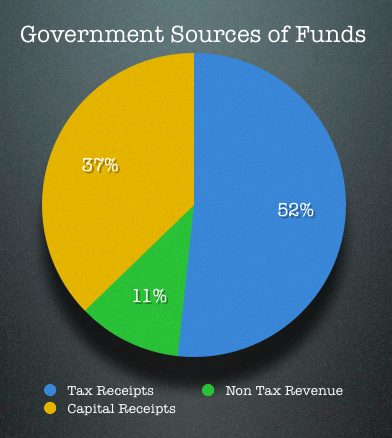

Treat this is as an IPO and think of valuation in terms of P/E multiples or free cash flow or whatever else you normally use. A quick look at the financials show that the EPS in the last financial year was Rs. 3.50, so that’s a trailing P/E multiple of about 44 on the floor price.

This will likely not present an arbitrage opportunity because the shares offered in the current sale are so much more than what’s already traded in the market, and therefore your decision to buy should be based on whether you’re willing to hold the shares for at least the slightly longer term.

Edit: Changed the discount number mentioned in the title from 70% to 40%.

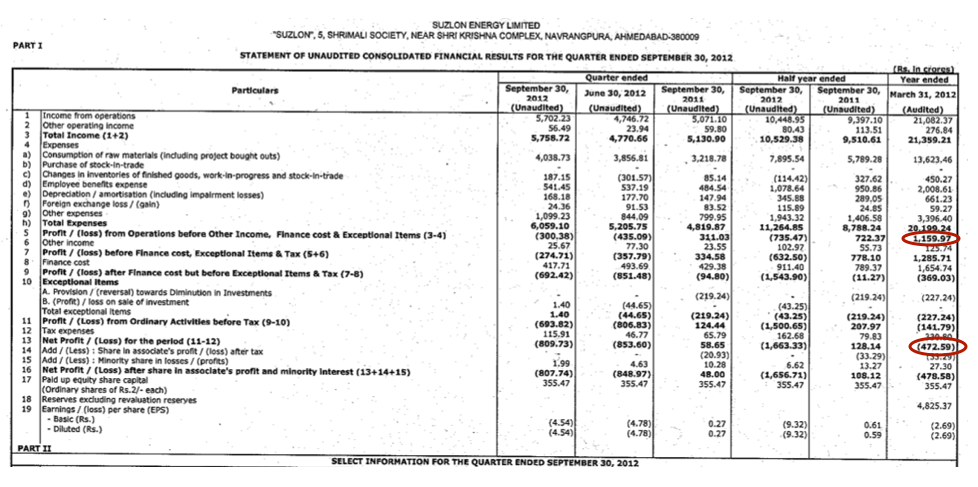

What does it mean when a company has positive operating income but a negative net income? To my understanding the these two numbers differ only by the taxes and interest to be paid. Does that mean the company has lots of debt? Is it a good idea at all for one to seek employment with such a company, given that the person has a median financial profile (in terms of savings and debt)?

Reply