The topic of Futures and Options has come up quite frequently in comments and emails but I’ve never done a post on them till now because the posts got too long. I can remember deleting at least two drafts because they got too unwieldy, and complex.

I’ve tried to give it another shot, and simplify it by breaking it into parts. Here is the first part with some very basic and easily digestible information on futures and options.

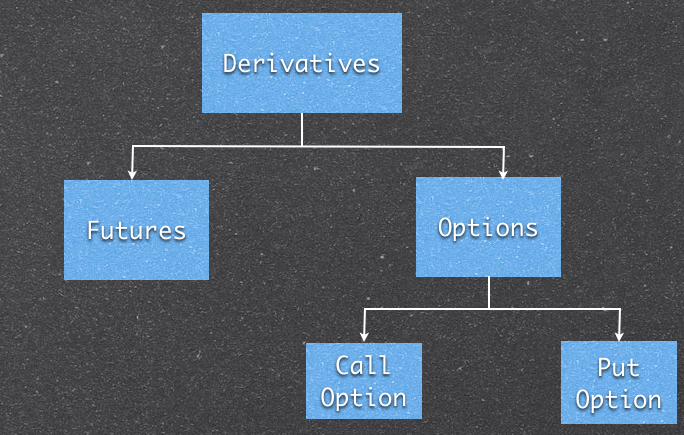

Two Types of Derivatives

There are two types of Derivatives commonly traded in the market – Futures and Options, and within Options there is further a Call option and a Put option.

The price of these derivatives is based on an underlying asset, and the price of the derivative usually moves in tandem with the price of the underlying. The underlying is usually a stock or an index in the context of investing in a stock market.

So, that means the price of Infosys futures or Infosys options will depend on the price of the Infosys shares. But if that’s the case then why don’t people simply buy the stock or the index fund?

Why Buy Futures or Options?

While there are other reasons, I think two big reasons are leverage and taking short positions. Options and Futures give you a lot of leverage and you can make (or blow up) a large amount of money in a short period of time with the same amount of capital than you can with a regular cash position.

The second reason is to take short positions, or profit from declines in the price of a share or commodity. If you want to take a bet that a particular company will do badly, and then profit from it then you can’t do it very easily in the cash market.

But you can sell a future, call option or buy a put option to take a short position in the stock or index.

The third common reason I hear is hedging risk, and while I agree that it is a big reason for institutional investors, I just can’t see how retail investors can efficiently hedge with derivatives. The notional values of derivatives is often too high, and the expiry periods too short to act as an efficient hedge for small investors.

Who should buy Derivatives?

I think the big difference between buying derivatives and buying a share in the cash market is that your investment can go to zero a lot more frequently in the derivatives market than in the cash market, and only those people who have a high risk appetite and who can stomach losing a lot of money should invest in derivatives.

I think you should also be fairly clued in on the market to make these kind of leveraged bets, but if you asked me what “fairly clued in on the market” means I would find it very difficult to define that.

That being said, they can be quite profitable as well because they give you the ability to profit from short positions and add leverage.

I think the bottom line is that you should only invest that amount of money in derivatives that you are comfortable in losing. They aren’t for everyone, and not everyone should dabble in them.

I’ll stop this post here, and in the next part of this series build on what it means when  you say the price of a derivative depends on the underlying.

This post is from the Suggest a Topic page.Â

- Part 1: Introduction to Futures and Options

- Part 2: How do Futures Work?

- Part 3: How do Options work?

If I purchased shares of Glenmark under Future Options at Rs.740/- on February 17, 2016 and the expiry date is say March 31, 2016, but this stock has jumped to Rs.800/- within two to three trading sessions, can I square off these shares purchased under Future optons before expiry date of March 31, 2016 and earn the profit.

Regards

santonu sir

If nifty down by 500 point. How loss can be 15 lakh

Although, Derivatives should be used for arbitrage and hedging purposes, but many people in India are using them as a tool to gamble where they take positions more than what they can digest

Very informative..but still waiting for the next part..also please try to include, how a retail investor can do research for F&O, some good website, blog which can help in doing so. Thanks.

Great topic to start a series on. Looking forward to the future posts.

Sir article seems to be half finished. You have not spoken about option side. It may be the PART-I also.My suggestion to investors is that always take a long position in future trade because you know the down side. As for example , you have have a long derivative position at Rs.100.00 . Now you can not lose at the most more than 1 lakh but if you have a short position , then you can can not assess your would be loss as upside is unlimited. If you really one want have short position , then take some long position in the same stock to minimise the loss if any.

More over if you want to have trade derivative , then commodity market is a better place because their price is rangebound. I observed in the last two yeas r that commodity like zinc,Aluminium,Lead are trading in the range Rs 85- Rs.120 . There is great demand at lower price and supply will beat the higher price. As you knoe the price-bandwidth, commodity derivative trading is a better option.

Thanks for your comment Santanu – I’ve never traded commodities and am curious about that. Where do you trade them at MCX? And what all can be traded there – gold, silver, crude?

I trade in commodity in MCX. and that only in zinc mini 1 lot (100o kg) and donot have money and courage to trade in silver,gold,copper

I trade e-gold,(purchase 2gm every month irrespective of price ) e-silver ,e-zinc,e-copper in NSEL. when prices are low i use to purchase in small quanitity

I also traded in currency future in MCX-SX but wild depreciation of rupee gave me loss(i shorted) few month back. But i will enter with long position when it will be back to 48 kind of level. In fact i gave farewel to short trading in deravitive of any kind

In all cases above my brooker is religare

I’m sorry I misspelled your name!

Thanks for that info and I can now see why you’re warning people about short trading as well 🙂

@Santonu

Do you also do arbitraging in Currency Futures?

I think you are true saying that commodity future market is better in trading point of view,as prices have a great support around the production value and is a good buying opportunity if anyone takes informed decisions about it…Of course sometimes these levels are not honored as what happened in 2008.

I think Manshu won’t mind if I place the link below:

http://www.saving-ideas.com/2012/03/how-commodity-future-market-works/

The article doesn’t describe the difference between futures and options. That would have been helpful.

That is valid criticism Swaroop – I’ll be sure to detail it out when I write more about this topic. My idea is that at the end of this series there should be 8 or 10 posts, and each about 500 words and on a specific topic. Please also let me know if there is anything else you’d like covered.