This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

With the current financial year coming closer to an end, the investors, waiting to deploy their cash surplus or maturity proceeds from their other investments into tax free bonds, are currently spoilt for choice. There are as many as five tax free bond issues currently open and the much awaited NHB issue is getting open for subscription tomorrow i.e. March 7.

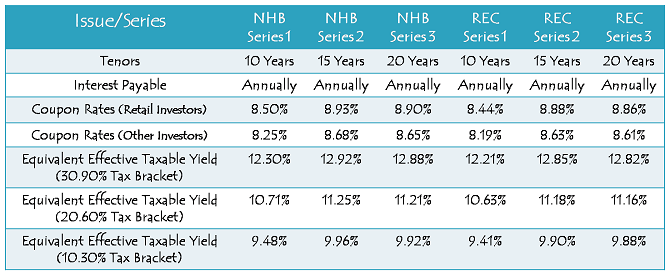

As expected, it is carrying the highest rate of interest among the ‘AAA’ rated issues which are currently open – 8.93% p.a. for 15 years, 8.90% p.a. for 20 years and 8.50% p.a. for 10 years.

Size & Closing Date of the Issue – NHB’s first issue in December was of Rs. 2,100 crore and it got subscription to the tune of Rs. 4,366.43 crore on the first day itself. Though the current issue is scheduled to close on March 18, going by the issue size of Rs. 1,000 crore, I think it too should get oversubscribed on the first day itself.

So, in order to avoid rejection of their applications, I would advise the interested investors to apply for these NHB bonds on the first day itself. In case of oversubscription on the first day, the applicants will get allotment on a pro rata basis.

NRI/Foreign Portfolio Investment – Foreign Institutional Investors (FIIs), Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – Once again the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 100 crore is reserved

Category II – Non-Institutional Investors (NIIs) – 25% of the issue i.e. Rs. 250 crore is reserved

Category III – High Net Worth Individuals including HUFs – 25% of the issue i.e. Rs. 250 crore is reserved

Category IV – Resident Indian Individuals including HUFs – 40% of the issue i.e. Rs. 400 crore is reserved

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges. As mentioned above, allotment will be made on a pro rata basis for that day on which the concerned category gets oversubscribed.

Rating of the Issue – Investors seeking safety of their capital give high importance to the credit rating of an issue. This issue has been rated ‘AAA’ by CRISIL, ICRA and CARE. Instruments with ‘AAA’ rating are considered to have highest degree of safety regarding timely servicing of financial obligations.

Lock-in Period & Premature Redemption – There is no lock-in period with these bonds, but at the same time, you cannot redeem these bonds back to the company before their maturity period gets over. In order to encash your investment before maturity, you’ll have to compulsorily sell these bonds on the National Stock Exchange (NSE) where these bonds will get listed for trading.

Demat/Physical Option – Though it is mandatory to have a demat account to sell/trade these bonds, you can subscribe to them in physical/certificate form as well. Interest payment will still get credited to your bank account through ECS.

Interest on Application Money & Refund – As always, NHB will pay interest to the successful allottees on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment, at the applicable coupon rates. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum Investment – As NHB has kept the face value of its bonds unchanged at Rs. 5,000, an investor is required to apply at least one bond in this issue i.e. minimum investment of Rs. 5,000.

Interest Payment Date – NHB has not fixed its interest payment date this time as well and its first due interest will be paid exactly one year after the deemed date of allotment.

Which issue should I invest in?

When I covered NHB’s first issue in December, I mentioned certain points to express my views. Let me mention those points again and express my current views regarding those points:

First, NHB issue is ‘AAA’ rated.

Current View: There is no change in NHB’s credit rating for this issue as well. So, I think it remains a good issue to invest rating wise.

Second, you are going to get 9.01% p.a. and 8.88% p.a. coupon rates which are the best 20-year and 15-year rates offered by any AAA rated or AA+ rated issuer till date.

Current View: NHB offered 9.01% p.a., 8.88% p.a. and 8.51% p.a. for the 20-year, 15-year and 10-year options respectively. These respective rates stand as 8.90% p.a., 8.93% p.a. and 8.50% p.a. this time around, which makes the 15-year option to be the most attractive for a retail investor.

Third, NHB is a wholly-owned subsidiary of the RBI and I don’t foresee the RBI to ever let its subsidiary default on any such bond issue. Also, NHB is the regulator of the housing finance companies, like RBI is for the banks and SEBI is for the capital markets. I don’t think any government would allow any regulator to default on its payments.

Current View: I think there is no need to change my earlier view as far as this point is concerned.

Fourth, it is almost certain that the CPI inflation will start falling from next month onwards. If that materialises, we might have G-Sec yields falling quite sharply.

Current View: Though there has been a sharp fall in the CPI as well as the WPI inflation January onwards, but unfortunately, G-Sec yields have not fallen in line with the inflation numbers. There have been many factors behind it – high fiscal deficit, high debt levels of the government, unexpected Repo Rate hike & start of inflation targeting by the RBI in its January policy, uncertain political & economic policy environment in the short term and the government’s unrealistic fiscal deficit target for the next fiscal year.

I think the G-Sec yields should move in a broad range till the time we have a stable government at the centre. If we have a sharp fall in the inflation numbers and controlled government expenditure in the next few months, we can expect G-Sec yield to fall sharply if we get a strong and stable government in May.

Fifth, IRFC is the next company to launch its tax-free bonds from January 6 and its coupon rates are lower than that of NHB at 8.48% p.a. for 10 years and 8.65% p.a. for 15 years. It is not going to issue these bonds for 20 years either.

Current View: There are five issues currently open, out of which three issues are ‘AAA’ rated, one is ‘AA+’ and one is ‘AA’ rated. As this ‘AAA’ rated NHB issue is offering the highest rate of return as compared to the other ‘AAA’ rated issues, I expect a very good response from the institutional as well as the retail investors.

Sixth, there are very few good companies left now to issue tax-free bonds this financial year. REC, PFC, NHPC and NTPC have already raised their quota of authorised amount from the markets. HUDCO is also very close to reach its targeted amount. Only IIFCL, NHAI, IREDA, Airport Authority of India (AAI), Ennore Port and Cochin Ship Yard are now left to issue these bonds and their issue sizes are also very small, except NHAI and IIFCL.

Current View: IRFC today extended the closing date of its current issue from March 7th to March 14th. Also, as AAI issue is not expected in the current financial year and Cochin Ship Yard is yet to file the prospectus for its issue, I think this NHB issue should be the last public issue of the current financial year.

Seventh, it is still not certain whether tax-free bonds would see the light of the day next financial year onwards or not. Like 80CCF infrastructure bonds got stopped getting issued from FY 2012-13 onwards, it is possible that the next government decides to stop extending this budgetary support to all such companies.

Current View: I think there is no need to change this view as well. You might not have tax free bonds available for subscription next financial year, in which case you will see a good demand for these bonds in the secondary markets.

Eighth, NTPC issue got listed a few days back and that too at a premium. If an issue with coupon rates lower than the NHB issue can trade at a premium, then it is almost certain that these NHB bonds would also trade at a premium on listing.

Current View: It has been the case with most of these issues in the current financial year. Most of these bonds have been trading at a premium and I expect NHB bonds also to list at a premium in the current interest rate scenario.

Ninth, NHB has reasonably strong fundamentals. It reported profit after tax (PAT) of Rs. 450 crore with total income of Rs. 3,030 crore for the period ended June 30, 2013 as against Rs. 387 crore and Rs. 2,492 crore respectively for the period ended June 30, 2012. Its net interest margin (NIM) also improved to 2.25% during this period as against 2.20% last year.

NHB’s asset quality has also been remarkable. Gross NPAs and Net NPAs remained quite close to zero for the periods ended June 30, 2011 and June 30, 2012. Though its gross NPAs and Net NPAs have jumped to 0.53% and 0.45% respectively in the latest period ending June 30, 2013, this relative poor performance was due to one large project exposure slipping into the NPA category. This large account was worth Rs. 179.60 crore out of its total NPAs of Rs. 180.62 crore.

Current View: There is no change in my view as far as NHB’s fundamentals are concerned.

Why you should not invest in this issue?

If I myself decide not to invest in this issue, I would have only one valid reason for that, higher expected coupon rates in the forthcoming issues. If any of you think that the rates would be higher with NHAI bonds or IIFCL tranche III bonds, then you can probably skip this issue. Personally, I would invest my family’s money in this issue and would also advise my clients to do that.

Current View: Last time I had only one reason. This time I don’t have any reason for me not to invest in this issue, except that I don’t have enough money for me to fully utilise Rs. 10 lakh limit applicable for a retail investor.

Application Form of NHB Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHB tax-free bonds, you can contact me at +919811797407