This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

SREI Infrastructure Finance Limited has launched its public issue of Non-Convertible Debentures (NCDs) from today, September 29. The company has set Rs. 250 crore as the base size of the issue, but it has the green shoe option to retain oversubscription to the tune of Rs. 1,500 crore. The issue is scheduled to get closed on October 31.

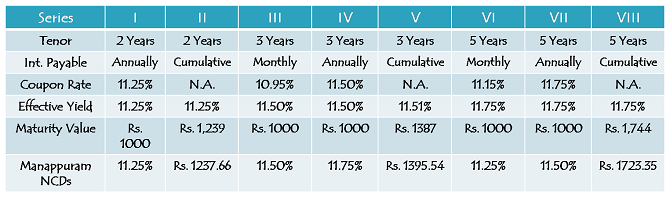

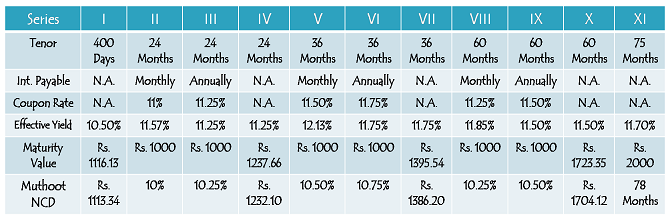

The company is offering interest rates in the range of 10.95% to 11.75% per annum for a period of 2 years to 5 years, which works out to be 11.25% to 11.75% effectively.

Additional 0.25% to Existing Shareholders/Bondholders/Senior Citizens – Like Manappuram Finance, SREI Infra will also reward its existing shareholders and bond investors by offering an additional interest rate of 0.25% per annum. Senior citizens aged 60 years or above will also get this additional coupon. To be eligible for this additional 0.25%, the investors will be required to hold their investments on the record date for the purpose of interest payment.

Coupon Rates for Non-Retail Investors – Unlike Manappuram Finance, which has kept its interest rate same for all categories of investors, SREI Infra is offering coupon rates which are 0.45% to 0.50% higher than the rates it is offering to its non-retail investors.

Categories of Investors & Allocation Ratio – The investors would be classified in the following three categories and each category will have the following percentage fixed during the allotment process:

Category I – Institutional Investors – 20% of the issue size is reserved

Category II – Non-Institutional Investors including corporates – 20% of the issue size is reserved

Category III – Retail Individual Investors including HUFs – 60% of the issue size is reserved

NRI Investment – Foreign investors including foreign nationals and non-resident Indians (NRIs) are not allowed to invest in this issue.

Ratings & Nature of NCDs – Credit rating agencies CARE and Brickwork Ratings have rated this issue as ‘AA-’ and ‘AA’ respectively, a rating which is a notch higher than the Manappuram issue of ‘A+’ in relative terms. Also, as mentioned above also, these NCDs are ‘Secured’ in nature and the claims of its investors will be superior to the claims of any unsecured creditors of the company.

Listing, Demat & TDS – These NCDs will get listed only on the Bombay Stock Exchange (BSE) within 12 working days from the closing date of the issue. Investors have the option to apply these NCDs in physical form as well as demat form, except Series III and Series VI NCDs which will be allotted compulsorily in the demat form.

As always, TDS will be applicable on the NCDs taken in the physical form if the interest amount exceeds Rs. 5,000. However, there will be no TDS on NCDs taken in a demat form.

Minimum Investment – Like Manappuram issue, the investors will have to put in at least Rs. 10,000 in this issue as well i.e. at least 10 bonds of face value Rs. 1,000 each.

Should you invest in these NCDs?

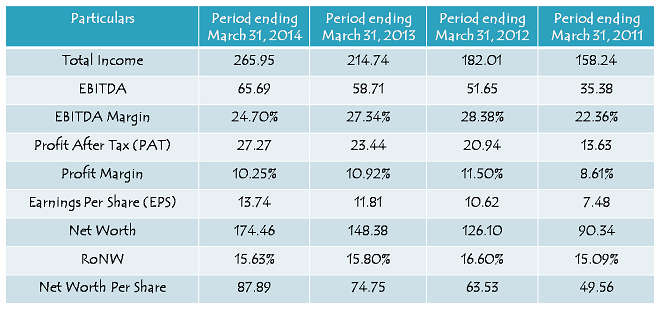

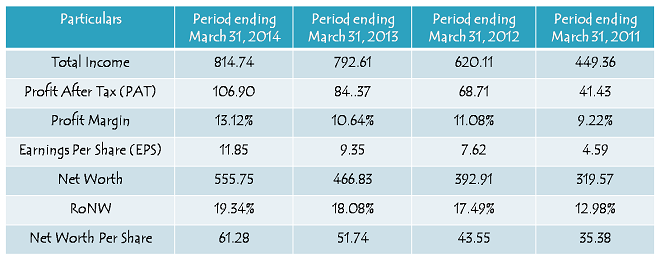

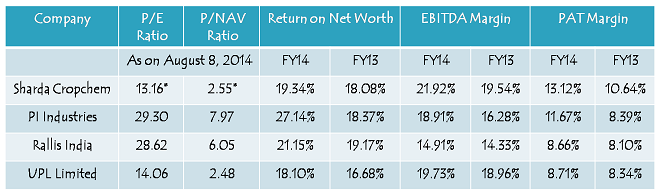

Concerns which I have with SREI Infra include its ineffective management, average financials and lousy debt management. These are the most important factors for me to consider while investing in any company whether I am investing in its equity or debt.

However, it seems like the Modi government is committed to resolve issues which are hindering the growth of India’s infrastructure sector. So, if one is hopeful that India will have a speedy recovery with its stalled infrastructure projects, then I think one should definitely invest with companies like SREI Infra.

Moreover, as the interest rates are headed lower, interest rates of 11.25% to 11.75% are definitely higher and quite attractive. Any improvement in SREI’s financials going forward will result in a reduced risk for its investors.

Application Form of SREI Infra NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Infra NCDs, you can contact me at +919811797407