This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

ECL Finance Limited, a subsidiary of Rashesh Shah’s Edelweiss Group, is launching its third public issue of secured, redeemable non-convertible debentures (NCDs) from the coming Thursday, February 26th. The issue will carry a maximum of 10.60% coupon rate with monthly, annual and cumulative interest payment options and will remain open till March 16th.

Size & Objective of the Issue – The company plans to raise Rs. 800 crore from this issue, including the green shoe option of Rs. 400 crore. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

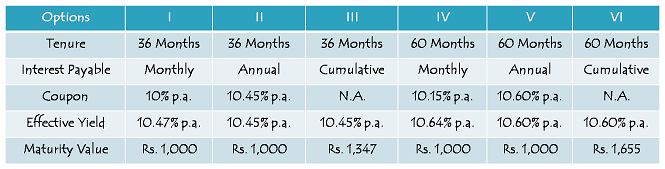

Coupon Rate & Tenor of the Issue – Last time, the company offered its NCDs with 12% coupon rate and 70 months maturity period. This time the company has decided to issue its NCDs for a duration of 36 months and 60 months. The company has cut its offered rate of interest sharply to 10.45% and 10.60% for 36 months and 60 months respectively.

Minimum Investment – Investors need to apply for a minimum of ten bonds in this issue with face value Rs. 1,000 each i.e. an investment of Rs. 10,000 at least.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 30% of the issue is reserved

Category II – Non-Institutional Investors – 20% of the issue is reserved

Category III – Individual & HUF Investors – 50% of the issue is reserved

NCDs will be allotted on a first come first served basis.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and ICRA have rated this issue as ‘AA’ with a ‘Stable’ outlook. As mentioned above, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges.

Demat & TDS – Demat account is not mandatory to invest in these bonds as the investors have the option to apply these NCDs in physical form as well. Also, though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS.

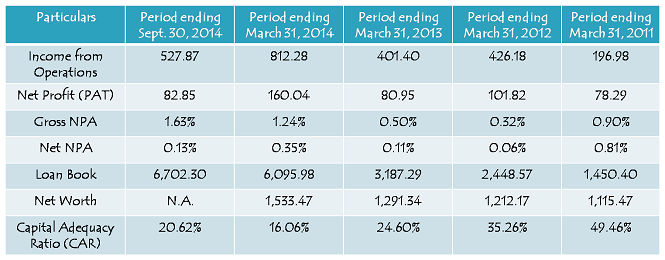

Financials of ECL Finance

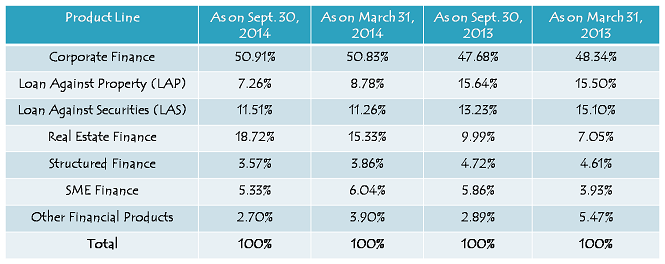

Loan Book of ECL Finance

Should you invest in these NCDs?

Though the interest rates have fallen in the past one year and it is widely expected that there will be more rate cuts by the RBI and the commercial banks in the next 6-12 months, I think the rates offered by ECL Finance are on a slightly lower side for me to call it an attractive issue. I think these NCDs are suitable for those investors who have no taxable income or who seek regular monthly income. The investors would do well to invest in Gilt funds or bond funds as I think they should fetch higher returns in the next 3-5 years.

Application Form of ECL Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in ECL Finance NCDs, an investor can reach us at +919811797407