This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

“Beti Bachao, Beti Padhao” is the mantra with which Prime Minister Narendra Modi launched Sukanya Samriddhi Yojana on January 22nd this year. Later on, the government issued a notification to allow 80C exemption equal to the amount invested in the scheme up to Rs. 1,50,000, which is also the maximum amount one can invest in this scheme in a financial year.

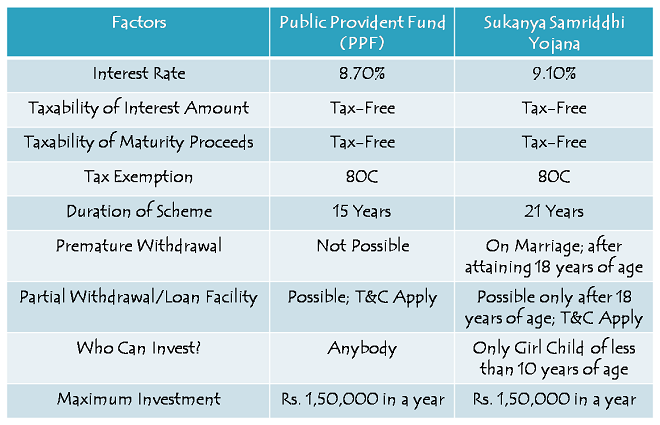

Now, the Finance Minister in his budget speech has proposed to make the interest component as well as the maturity proceeds as tax-free. I think this proposal has made this scheme to be the best small savings scheme available to the Indian investors. Yes, even better than our golden scheme of Public Provident Fund (PPF). So, what is this scheme all about? Let’s check.

Sukanya Samriddhi Yojana is a small savings scheme which can be opened by the parents or a legal guardian of a girl child in any post office or authorised branches of some of the commercial banks. The girl child is called the “Account Holder” and the guardian is called the “Depositor” in this scheme.

Before I compare this scheme with PPF, let us first check the important features of this scheme.

Salient Features of Sukanya Samriddhi Yojana

Who can open this account? – Parents or a legal guardian of a girl child who is 10 years of age or younger than that, can open this account in the name of the child. For initial operations of the scheme, one year grace period has been provided to make it 11 years of age. With this one year grace period in age, which is valid up to December 1, 2015, you can get this account opened for a girl child who is born between December 2, 2003 and December 1, 2004.

9.1% Tax-Free Rate of Interest – This scheme has been flagged off with a 9.1% rate of interest, higher than that of PPF which stands at 8.7%. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year like all other small savings schemes, including PPF.

Prior to the budget announcement, 9.1% annual return seemed unattractive, but not anymore, as it has been made tax exempt now. Interest amount gets added to your balance amount in the account and compounded either monthly or annually, as per your choice. Monthly interest compounding will be done only on your balance amount on completed thousands.

Duration of the Scheme – The scheme will mature on completion of 21 years from the date of opening of the account. If the account is not closed on maturity after 21 years, the balance amount will continue to earn interest as specified for the scheme every year. In case the marriage of your daughter takes place before the maturity date i.e. completion of 21 years, the operation of this account will not be permitted beyond the date of her marriage and no interest will be payable beyond the date of marriage.

Deposit for 14 years only – Though the scheme has a duration of 21 years, you are required to make contributions only for the first 14 years, after which you need not deposit any further amount and your account will keep earning the interest rate applicable for the remaining 7 years.

Premature Closure – The account can also be closed prematurely as your daughter completes 18 years of age provided she gets married before the withdrawal. As the maximum permissible age of the girl child is set as 10 years, the scheme effectively carries a minimum duration of 8 years i.e. 18 years of exit age – 10 years of entry age.

Partial Withdrawal – It is also allowed to withdraw 50% of the balance standing at the end of the preceding financial year, but only after your daughter attains the age of 18 years. So, effectively it has a complete lock-in period of at least 8 years, before which you cannot take out any money for any purposes.

Minimum/Maximum Investment – You need to deposit a minimum of Rs. 1,000 in a financial year to keep your account active. Failure to do so will make your account inactive and it could be revived only after paying a penalty of Rs. 50 along with the minimum amount required to be deposited for that year, which currently stands at Rs. 1,000.

Also, you can invest a maximum of up to Rs. 1,50,000 in a financial year. You can make your contribution to this account in as many number of times as you like.

How many accounts can be opened? – You can open only one account in the name of one girl child and a maximum of two accounts in the name of two different children. However, you can open three accounts if you are blessed with twin girls on the second occasion or if the first birth itself results into three girl children.

Nomination Facility – Nomination facility is not available in this scheme. In an unfortunate event of the death of the girl child, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Documents Required – Birth Certificate of the girl child, along with the identity proof and residence proof of the guardian, are the mandatory documents required to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

Sukanya Samriddhi Yojana vs. Public Provident Fund (PPF)

Budget 2015 has made this scheme quite attractive for the investors. If you’ve already exhausted your PPF deposit limit, want to save for your girl child’s marriage or higher education and have spare money to invest in this scheme, then this scheme provides you one more excellent avenue of safe investment with high returns. You can wait for the next financial year’s rate of interest to get announced anytime this month, if it remains higher than PPF, just go for it.

Application Form to open a Sukanya Samriddhi Account

List of authorised commercial banks where you can get this account opened

I have a daughter her d.o.b is 21.04.2014 can I take ssy plan

Yes, you can do that.

I have a daughter her d.o.b is 13 .07.14 can I take ssy plan

Yes, you can do that.

my daughter DOB is 08/03/2014 can i open the account for her… m i eligible for it

Yes, you can do that.

Hi Sir/Madam,

If i pay monthly Rs.2000/- for 14 years how much i will take it back.. Please confirm???

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

hi sir,

I have two girls first girl date of birth is 30/03/2007 and another date of birth

is 19/07/2009 if i deposit 30,000 yearly for both of them can you tell me maturity amount

Hi Manish,

Please check this post for your requirements – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Can someone help me with an application form for ‘Sukanya Samiriddi Yogana’

You can download the form from this post – http://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

My daughter DOB is 15 jan 2004.is it possible to open account

Yes, it is allowed with one year grace period.

If i wish to invest 3000 per month how much will i get at the time of maturity…..

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Sir

Good Morning, I thank you very much for your efforts in improving financial literacy for the people of India.

I would liket o have clarification on few points wrt SSA as per the wordings mentioed in Notification.

1- “Deposits in an account may be made till completeion of fourteen years, form the date of opening of the account. ”

My daughter has completed six yeras it means i can deposit the amount till she complete 20 (14 +6) years of age. It means If I will open account in April 2015, I can deposit till Mar 2029. It does not have any relation to the completeion of 14 years of age of my daughter.

2- “The account shall mature on completion of twenty one years from date of opening of the account. ”

It means If I will open account in April 2015 the account will mature in Mar 2036. It does not have any relation to the completeion of 21 years of age of my daughter.

Plz clarify.

Regards

Piyush

Thanks Piyush for your kind words! 🙂

1. Your understanding is correct.

2. Your understanding is correct; however, you cannot continue with this account beyond the date of your daughter’s marriage and no interest will be paid after that.

My sincere thanks to BJP govt. for the S.S.Y…… I am having two girl child, whose DOB is 2/1/13 and 1/3/2015 respectively. If i will invest Rs.100o per child per month, what will be the maturity value after 21 years…..

Once again thanks to Modi jii

with regards,

Dr. Biswajit Dutta

Dr. Navalakhi H. Dutta

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Hi

My baby is 6months and she’s born in Germany as my husband works there and now I have come here for vacation so heard about the scheme and thought to invest , is it possible that I can invest ? We all hold Indian passport and it’s been 3years that we are staying in Germany.

Hi Jyothi,

It is still not clear whether a child girl born outside India is eligible for this scheme or not, so you’ll have to wait for some more time for further clarity regarding this.

hi

sir what is the calculation for the deposit amount of Rs.1000 per annum a and how much money return after 21 year

Hi,

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Are you confirm that interest in this scheme is tax free (like ppf).

Yes, it is confirmed.

Hi my 8 month old niece is in abroad with her father and mother. Can her grand parents open account for that kid.

If the grandparents are legal guardian, the account can be opened. But, whether this scheme is open to NRIs/OCIs/PIOs, it is not yet confirmed.

sir

once direct money deposited 12000 at a time then remaining 11 moths not deposited is it possible or not??

Yes, it is allowed.

Hi,

Good afternoon

Which one is best ppf or say.?

Or lic child money back

I think PPF is better.

Dear sir

my daughte’s dob is 29/9/2004.can i open the sukanya samriddhi account in her name.

Kindly confirm

Yes, you can get it opened.

Ye form milne start ho gye he kya ?? Mtlb ki ye scheme kb se start hogi or hm kb form fill up kr skte he ??

Forms is link pe available hain – http://www.onemint.com/2015/03/04/sukanya-samriddhi-yojana-application-form-list-of-banks-to-open-an-account/

Account khulwane ke liye apne nazdeeki post office ya bank branch se sampark karen.

We have belong to hr than can i open an account in delhi bank braches.

Yes, you can do that.