This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Government of India in Budget 2014 announced the revival of Varishtha Pension Bima Yojana (VPBY) with the objective of providing social security to the senior citizens of this country. It is a Government subsidised single premium pension scheme with an assured effective return of 9% to 9.38% per annum. To ensure investors’ trust and complete safety of their investments, LIC of India was given the sole privilege to operate this scheme.

Relaunched in August 2014, the government had high hopes out of this scheme and it has been encouraging LIC’s top management to promote this scheme aggressively. However, this scheme has not received the desired response from the general public as it was anticipated. So, why this scheme has not been received well by the market despite offering high guaranteed returns of 9% to 9.38%?

I think there are several reasons for that, one, the pension income is taxable, two, there is no life cover with this scheme, and three, its effective rate of return is actually below the promised rate of 9% to 9.38%. There might be other reasons also for such a muted response, but I think these three are the most important ones.

To give this scheme one more budgetary support, the Finance Minister Mr. Arun Jaitley has made Varishtha Pension Bima Yojana to be exempt from Service Tax. This scheme has been attracting a service tax of 3.09% so far and the investors have been paying this tax over and above their investment amount. Come next financial year, this scheme will not attract service tax anymore.

How is it going to benefit its investors aged 60 years or more? Which date will it be effective from? Will it be retrospective from its launch date or will it be a prospective implementation? Before we explore all that, let us first try to understand the salient features of this scheme.

Rate of Return – This scheme promises to generate a return of 9% to 9.38% for its investors on an immediate annuity basis. However, due to 3.09% service tax, the effective rate of return has been lower. As per my calculation, its effective rate of return lies between 8.73% and 9.1% so far. But, once the service tax exemption gets implemented, 9% to 9.38% would become its effective rate of return.

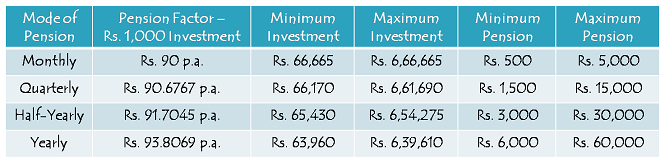

Minimum/Maximum Pension – Pension is paid on an immediate annuity basis in monthly, quarterly, half-yearly or annual mode, varying, respectively, between Rs. 500 to 5000 (monthly), Rs. 1500 to 15,000 (quarterly), Rs. 3000 to Rs. 30,000 (half-yearly) and from Rs. 6,000 to Rs. 60,000 (annually), depending on the amount subscribed and the option exercised.

Minimum Investment – You need to invest a minimum of Rs. 63,960 to get Rs. 6,000 annual pension or Rs. 65,430 to get Rs. 3,000 semi-annual pension or Rs. 66,170 to get Rs. 1,500 quarterly pension or Rs. 66,665 to get Rs. 500 monthly pension. In a way, you may also decide how much pension you need every month and then invest an amount as per your pension requirement.

Maximum Investment – You can invest a maximum of Rs. 6,66,665 in this scheme to get Rs. 5,000 monthly pension or Rs. 6,39,610 to get Rs. 60,000 annually.

Ceiling of maximum pension amounts apply to a whole family, including the pensioner, his/her spouse and dependants. So, two or more senior members of a family can invest in this scheme, but their total investment amount cannot exceed the limits specified.

Age Limit – Minimum age limit has been set as 60 years and there is no maximum age limit to invest in this scheme.

Nationality – Only Indian nationals are allowed to invest in this scheme.

Scheme Period – This scheme got launched on August 15, 2014 and will remain open for one year till August 15, 2015.

No 80C or 10(10D) tax benefits – Investment under this scheme does not qualify for any tax deduction under section 80C or 80CCD. Moreover, the pension income is taxable as per the tax slab of the pensioner.

Free Look Period – If you are not satisfied with the terms and conditions of this scheme, you may ask for a refund of your investment amount within 15 days from the date of receipt of the policy stating the reason of objections. The amount to be refunded within free look period will be the investment amount deposited by the investor less the stamp duty charges.

Premature Surrender – The policy can be surrendered after completion of 15 years. The investor will get the investment amount in full as the surrender value after 15 years. However, under exceptional circumstances, if the pensioner requires money for the treatment of any critical/terminal illness of self or spouse, then the policy can be surrendered before the completion of 15 years and the surrender value payable will be 98% of the investment amount.

Unfortunate Event – On death of the pensioner, the investment amount will be refunded in full to the nominee of the pensioner. However, as only the invested amount is refunded, there is no special insurance benefit available with this scheme.

Loan Facility – Loan facility is available after completion of 3 policy years. The maximum loan that can be granted shall be 75% of the investment amount. The rate of interest to be charged for the loan amount would be determined from time to time by LIC.

Loan interest will be recovered from pension amount payable under the policy. The interest on loan will accrue as per the frequency of pension payment under the policy and it will be due on the due date of pension. However, the loan outstanding will be recovered from the claim proceeds at the time of exit.

Service Tax Exemption on VPBY Effective April 1, 2015

So, now the question arises, whether service tax exemption be retrospective from its launch date or will it be a prospective implementation? What I understand from the info available publicly, it will be effective April 1, 2015. If it is correct, what about all those investors who have invested in this scheme till date? I think they will definitely stand disappointed and rightly so. I think they should also be provided such benefit right from their date of investment. The government should once again think about it.

As far as investment in this scheme is concerned, I think service tax exemption has made this scheme a little more attractive as compared to fixed deposits or other small saving schemes. You can consider this scheme if you want a super safe investment avenue with reasonably high returns for yourself.

Dear Shiv,

Please refer the letter available at this webpage link.

http://kiritsomaiya.com/%E0%A4%B5%E0%A4%B0%E0%A4%BF%E0%A4%B7%E0%A5%8D%E0%A4%A0-%E0%A4%AA%E0%A5%87%E0%A4%A8%E0%A5%8D%E0%A4%B6%E0%A4%A8-%E0%A4%AC%E0%A4%BF%E0%A4%AE%E0%A4%BE-%E0%A4%AF%E0%A5%8B%E0%A4%9C%E0%A4%A8%E0%A5%87/#prettyPhoto%5Bgallery%5D/0/

please quote reference or documents in which VPBY has been specifically subjected to service tax even after it being a debenture type security and without any risk coverage as well as the pension being drawn from the interest on the deposited amount is also subjected to income tax in the hands of the investor.

I have invested VPBY in 17.03.2015, paid Rs 687265.00 including 3% service charge, Govt has abolish the srvice tax from April 2015. Now how I can refund the service tax, please suggest.

For VBPY one has to attach a copy of Bank pass book/Account statement. Can somebody explain why this is required? Already a cancelled cheque is provided to facilitate ECS transfer of the pension.

As for Service Tax exemption, with retrospective effect, prospect seems to be dim. Perhaps, guess made by one of the commentator that the scheme was not selling, therefore, this exemption is given to attract more number of people. Like any private entity it offered a discount to improve sale. Can any one claim a discount on goods which he has purchased at full price,subsequently seller has given discount to clear the goods?

Only lesson you learn from the episode is- never rush for a scheme immediately, wait and watch the development as long as it is possible.

I had policy of pension plan no.is 10016487. Which was completed in May 2014.In May 2015 I have put my all documents like Affidavit signed by N.C.,Adhar card ,Blank cheque, and self photo etc.But branch office Batala (PUNJAB) has told me that achequeof near about 22500 and Pension Rs .3306 /- will come in your account . But pension deposit in my account, not cheque of Rs.22500/- till come Second time when again reached in branch office they noted my phone no.1875-224378 and say me it will soon deposit in your account. It is very much feeling sorry,that my payment has not come to this acount.It is very much difficult to continue pay Rs. 5000/- every yr.But amount to collecting in older age . Kindly return my Total compute amount in one time or two . I have paid Rs.50000/-in ten yrs. But recover it many yrs. It will be better to me ,if I have deposited F.D. I can take my whole amount in one.time. Kindly , return my balance amount,otherwise I will go to the RTI,to take my right. I hope you must , solve my problem and justice to me.

Dear Shiv Kukreja Ji

Today I approach to LIC agent and he say that there is no any notification for withdrawal of Service Tax on Varistha Pension Bima Yojana.

Can you help me for this matter.

Regards

Gopal Joshi

Dear Mr. Gopal,

Yes, your LIC agent is right. There is no such move taken by the government so far.

To

The Honorable Finance Minister

Government of India

Sir,

I have invested amounts in VPBY on 06.09.2014 and 06.03.2015 i.e. before 01.04.2015 at LICI, Singur Branch, WB – 712409. Additional amount regarding Service Tax @3.09% have been charged in both the cases. Now Government is kind enough to exempt ST for VPBY w.e.f. 01.04.2015. Thus I am deprived to avail such benefit. Government is requested to reconsider exemption of ST retrospective w.e.f. 15.08.2014. Government should refund the full amount of ST with interest to those Senior Citizens who have invested amounts in VPBY before 01.04.2015.

Yours faithfully,

Dr. Shyamal Kr. Sen

Mob: 9433026783

To

The Honorable Finance Minister

Government of India

Sir,

I have invested amounts in VPBY on 06.09.2014 and 06.03.2015 i.e. before 01.04.2015 at LICI, Singur Branch, WB – 712409. Additional amount regarding Service Tax @3.09% have been charged in both the cases. Now Government is kind enough to exempt ST for VPBY w.e.f. 01.04.20145. Thus I am deprived to avail such benefit. Government is requested to reconsider exemption of ST retrospective w.e.f. 15.08.2014. Government should refund the full amount of ST with interest to those Senior Citizens who have invested amounts in VPBY before 01.04.2015.

Yours faithfully,

Dr. Shyamal Kr. Sen

Mob: 9433026783

We would really appreciate if Govt. plicies is fair to all investors at the same time . It looks like when they are trying to sell a scheme , n when the last month is approaching the govt is giving added advantages by waiving off service tax that means who deposited in the beginning n were real needed people were fools.

its like saman nahin bika toh last mein sale laga di its really rediculous if govt agencies are doing this then what to say about pvt. player.

My husband got this policy as well as our parents.

We request the govt to rethink n give equal importance to all their investors.

Regards

Mrs. Joshi

To

skukreja@investitude.co.in

Dear Shri Kukreja ji

I appreciate your efforts in raising the concern of the policy holders of the Varishta Bhima Yojana of LIC , those who took this policy from 15.08.2014 to 31.03.2015 . It is a social security policy rather than a business type investment policy to Seniority Citizen of India, who are not in earning age. You have rightly pointed out the technical lacunae in the scheme which has caused injustice to the policy holders of before 31st March,2015. Hence, exemption of Service Tax facility should be extended retrospectively. LIC and Govt. of India should workout to get equal justice to all the policy holders of VARISHTA BHIMA PENSION YOJANA .

Once again I appreciate your efforts which will render justice to the senior citizens of India. I hope u will continue your efforts till the exemption of Service Tax to this all the policy holders of this scheme.

A. HARI

Cel No.9949524191

DEAR SIR, I REQUEST YOUR RESPONSE ON SALES TAX EXEMPTION TO ALL THE SR CITIZENS OF THIS SHEME.

A.HARI , 9949524191.

Good info

My mother approached the Local LIC branch but they do not know, whether service tax exemption be retrospective from its launch date or not. What about the investors who have invested in this scheme till 31 March 2014? Can you please help us in clarifying this issue? Thanks…

Hi Shubh,

As of now, there is no clarity in this matter. I’ll update this post as soon as I get any such info.

Hi,

I have a copy of the letter (issued by the Minister of State Finance) confirming the reimbursement / adjustment of the Service Tax. Can you please advise the authenticity of letter? Kindly advise, how I should send this to you, as I do not find any option to attach the letter with the comment. Thanks very much…

I have income source through mainly deposits in bank . I wish to get such a varishtha pension. My querry is : is TDS income tax deductible by LIC before paying pension , or we have to submit form 15H to get pension without TDS deduction ?

Hi Ravindra,

No TDS will get deducted on the interest amount you earn from this scheme.

I mean TDS will not be deducted.

Sri Himanshu I am a LIC agent in Bangalore. I can help u in this regard. Please. Call me on my mobile No.9945158269

Sir, right now m in karnataka. In defence. I am having my mother’s aadhar card. Will dis work. How much i have to deposit for this scheme to get monthly pension in my mothers account . is it a one time investment. N in case of any mis happening then wat about d deposit.

Hi Himanshu,

1. Aadhaar Card would serve as the address proof & the identity proof, but I think PAN card copy would also be required.

2. This scheme involves one time investment only and the amount would depend on your requirement of the pension amount. Please check the table above in the post.

3. In case of any mishappening, the nominee would get the full investment amount back. There is no insurance component involved though.

Sir, i want to open this account for my mother. She is my dependent. What are the required documents. I want to know whether the account is transferrable or not.

Hi Himanshu,

As it is a scheme run by LIC, I don’t think you need to transfer this account to any other place within India. You’ll get the monthly pension transferred to your account and you need not visit any place for that. Basic documentation like PAN card copy, address proof copy, a cancelled cheque and 2 photographs would be required. If you are in Delhi/NCR, I can help you in getting this investment done.

One of the Agent says refund request can be made after 1 year with 2%dection but without medical background

Yes, that’s right. In case of premature withdrawal, you will get 98% of your investment amount.

Varishta Bima Pension Scheme

One of the Agents says the refund request can be made after one year with 2% deduction without any medical background

hi, again a great article. But i have one question in mind why the government is launching so much schemes without proper infra.. i was looking for sukanya samridhi form , but was amazed to see that no bank,post office has guide lines for this.

Hi Gaurav,

What you are pointing out is a concern and the government should take measures to rectify its systemic problems. Had it been a scheme launched by private players, they would have raised thousand and thousand of crores by now with such schemes.

what I have to pay after 1st April to enter this scheme for anual interest option without any service tax is it rs 6,39,610 or more

Yes, it is Rs. 6,39,610 only. No Service Tax is to be paid.