This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

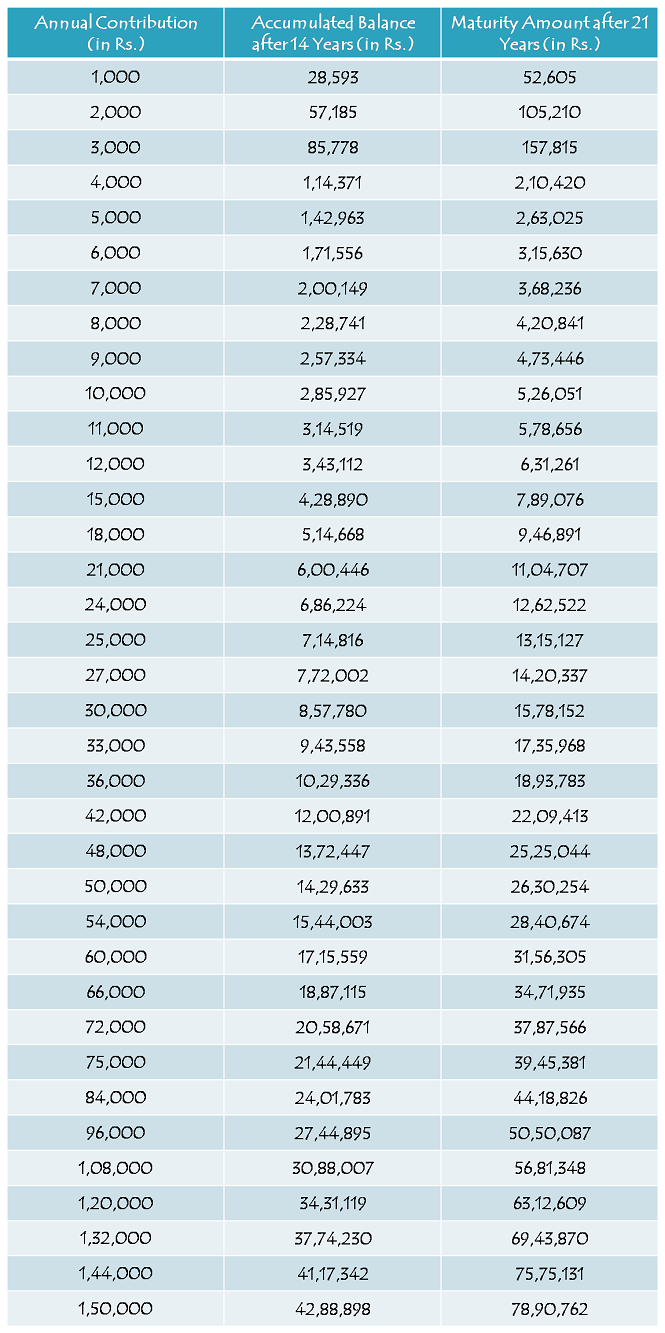

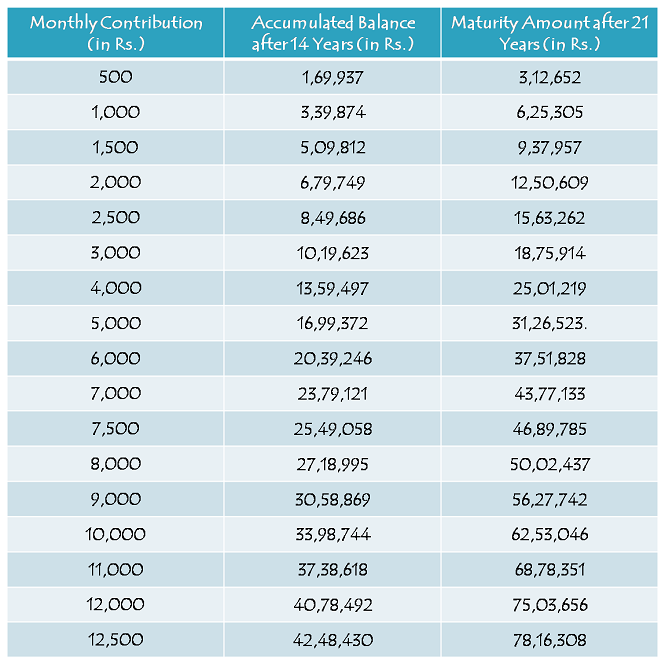

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Hi,

My daughter’s date of birth is 10.5.2004.Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

Hi,

My daughter’s date of birth is 10.5.2004.

Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

I have bank account in Indian Bank, Can I open the Same with them as Post office doest have ECS option

You need to approach your bank to inquire about it.

Hi,

My daghter is 2 and half years, I wud lke to invest in SSY and just want to knw should I invest till she’s 14 or a minium period of 14 years.

* In case the 2st year i pay 60,000 and 2nd year Im unable to make it upto same amout can I pay how much ever feasible.

Hi Jenny,

1. You need to invest for a minimum period of 14 years.

2. You can invest whatever amount you want to invest subject to a minimum contribution of Rs. 1,000 per annum.

My daughter is only 5 months old. Is she eligible for the scheme

Hi,

I would like to invest in SSY account. My daughter is 6 years old now,so how many years do i need to invest? Is it for 14 years of period starting from today or until my daughter turns 14 years.

Regards,

Venkatesh

Hi Venkatesh,

You need to invest for 14 years starting from the year you open this account.

Whether SSY account can be transferred from one post office to another ?

1.)able ke mutabit jo calculation bataya gaya hai. Kya wo fix ammount hai jo after maturity milegi?? Ya yearly budget pe depend karta hai??

2) agar ye budget pe depend karta hai to aage ke 14 saal mein aapke mutabit kitna interest rate aa sakta hai??

3) 3000 per month pay karu to aage ke interest badlne par approx ammoeunt kitni mil sakti hai hame??

1. Jo calculation show ki gayi hai, wo amount fix nahin hai. Interest rate har saal 1 April ko change hoga.

2. & 3. Agle 14 saal kitna interest rate rahega, iska idea mujhe nahin hai.

1) Yearly interest rate will change and accordingly maturity value will also effect. This calculation is done based on assumptions only.

2) It should be equal or more than PPF interest rartes

3) That can’t be calculated now and we don’t know the future interest rates 🙂

Sir,

If now girl child age is nine years then i deposit 1.5 lac per year then how much getting after maturity.

Pl. explain.

Thanks

Rajesh

Please check the table above, it is Rs. 78,90,762 as per the table.

Hi,

Q1. Suppose if my daughter’s marriage is after 24 year, can I withdraw the money on 21st year?

Q2. What happen if I could not complete the 14 year payment?

Q3. What if the girl is not willing for a married life?

Please reply.

Hi,

1. No, you cannot. You can withdraw the amount either on maturity or when your daughter gets married, whichever is earlier.

2. There is a penalty of Rs. 50 for each year of non-payment, along with minimum deposit of Rs. 1,000 for each year.

3. The account will get matured after 21 years.

Hi,

I would like to invest in SSY account.My daughter is 10 years old now,so how many years do i need to invest? For 14 years or till my daughter is 21 years?

Hi,

You need to invest for 14 years only, but the scheme will get matured in 21 years. Moreover, 21 years has nothing to do with the age of your daughter.

My daughter is USA born and she is a US citizen am I still eligible to avail this scheme for my daughter. If so what documents do I need to submit. Thanks!

Hi,

I don’t think US Citizens would be allowed to open this account. I’ll share the info here as soon as I get any update.

I want to invest 60000 per year which plan is best ppf, suknya smridhdhi yojna or bank FD or give other better option ?

Please provide best thing

Thanks in advanse

Among the three schemes you mentioned, I think Sukanya Samriddhi Yojana is the best.

Hi,

I want to know if I will deposit for example Rs. 10,000 a year and will get Rs. 5,26,051 at the time of maturity as per the table, will the total amount of Rs. 5,26,051 is free from tax or it will be taxable once we received it.

Thanks

Hi,

It will be completely tax-free as per the latest budget provisions.

this scheme is superb for people with girl child . But i must say that govt. launched this scheme without proper planning. No forms are available where ever you go.

Hi Gaurav,

Though the forms are now available online, banks are still not guiding people how to open an account. That is the bigger problem.

sukanya simridhi yogna plz detail me .

ecs is possible in post office ?

This yojana koyi bank operator karagi?

Some authorised banks is scheme ko operate karenge.

Online facility shayad available nahin hogi post office mein.

Hello,

if my early contributation is 1,50,00 per year.

how much will i get after 21 years ?

Thanks

Approximately Rs. 78,90,762, based on certain assumptions mentioned above.

Hi,

I had a few questions on this scheme:

1) Is the maximum investment possible Rs.1,50,000 per girl child? So, I have 2 daughters and so can I invest Rs.3,00,000 per year?

2) Can you detail what the maturity at “girl’s marriage” means? If the money available before or after marriage?

3) I presume on maturity the amount goes to the sole ownership of the girl child?

Regards,

sowmyanarayan.

Hi,

1. Yes, that is correct.

2. You cannot continue this scheme beyond your daughter’s marriage. As she gets married, you need to close this account and withdraw the balance.

3. Girl child will have the right over the maturity amount.

what is the maturity value if monthly deposit is 100/- for 14 years?

Approximately Rs. 62,530 based on assumptions mentioned in the article.

kya ye yojana SBI ki associate Bank me bhi shuru rahegi ?

Abhi iski info available nahin hai.

I cannot understand why would anyone trust their money with government. The government has no financial sense whatsoever, on managing it’s own (tax-payer’s) money.

A couple of questions to think about, what if this scheme is withdrawn after a few years or after a change in government. Or better yet, what if the tax benefits get withdrawn just like what happened to other otpions

If an individual has got a horizon of 21 years, does settling down for a mere 9% or 12.5% keeping the tax benefits at maturity & trusting the government.

Look what happened to baby boomer’s 401K accounts (retirement) of the USA.

I would never ever trust the government with my money. I’d rather make it a habit of learning the pros & cons of the different options & then make conscious decision of being in control of my finances and its returns.

Hi Sharath,

I understand your concerns, but I think you need to broaden your view. Small Saving Schemes like PPF, NSC etc. have been in existence for many years now and investors have got what they have been promised. I agree with you that the working style of the government is questionable and they need to improve their efficiency levels manifolds. But, then these schemes are for poor & middle class people and for them, safety of their capital is their primary motive. They cannot trust private companies with their hard earned money. Government is one institution where their money is highly safe. Whether it is put to use in an efficient manner or not is a different matter altogether.

I think you are a different kind of investor, most likely an educated investor, so you can understand many aspects of other investments. So, other schemes from private institutions might suit your risk appetite. But, common people of India probably require such kind of schemes for them to save for their basic financial goals.