This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

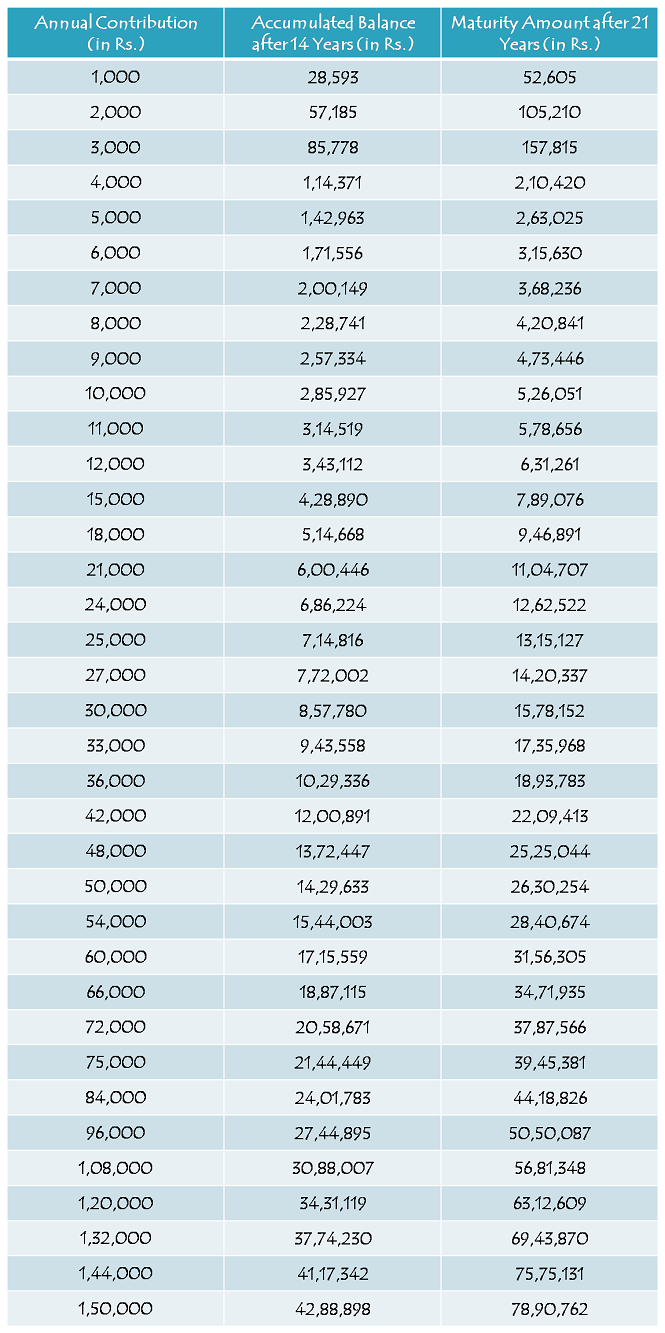

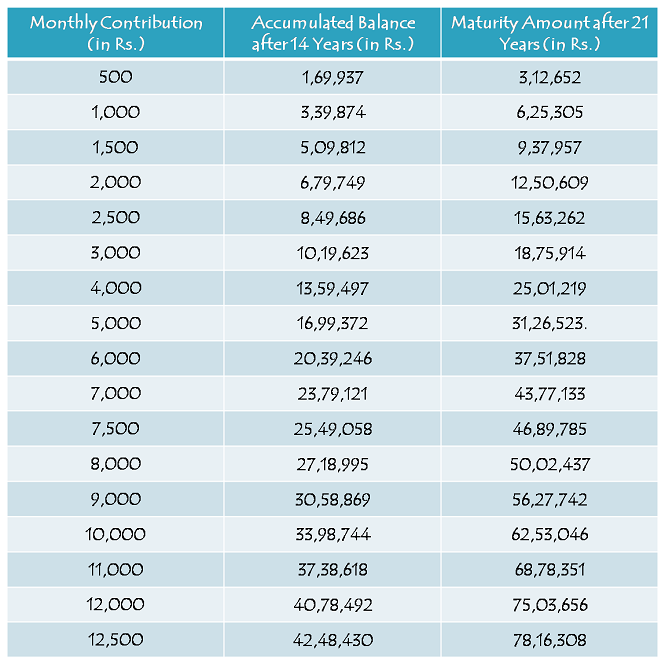

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Great work Sir. No need to find anything else, anyone visit your blog. He will get the complete information about Sukanya Samriddhi Account definitely. Thank you so much for this great work.

Thank you so much for giving complete information related to Sukanya Samriddhi Account.

Dear sir,

Can we take maturity value after girl child marriage. ??

Hi Puneet,

Yes, you can withdraw the whole balance as & when the girl child gets married.

agar ladki 9year ki h to use kitne saal kist bharni padegi or last me kitne amount milega

14 saal paisa deposit karna hoga. Maturity amount aapke deposit amount pe depend karega.

Red Sir,

My nephew is mentally retarded, so if we want to withdraw money in between for any treatment, can we do.

Hi Nashrah,

Under special circumstances, like death or medical support in life-threatening diseases etc., you can make a request to prematurely close the account and withdraw the amount.

Dear sir,

My sister date of birth is 2/1/2000 can i start this scheme pls explain.

No, your sister is not eligible for this scheme.

Dear sir,

A news published in Facebook about Kanya Samridhi Yojana that a girl child between 0 to 10 yrs can deposit 1st time 1 thousand and then 100 per month upto 21 yrs , after 21 yrs its maturity value will be 650000 this news true or false please clarify about this Yojana.

Hi Dilip,

It is a misguiding news, ignore it. Please check this post for all the details about this scheme – http://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Sir, I have gone through the scheme. You’ve mentioned that the amount can be withdrawn on the maturity after 21st year, or on the girl’s marriage, whichever is earlier.

Whereas I have read that half the amount can be withdrawn before the 21st year.

Hi Milind,

50% of the balance can be withdrawn as the girl child attains 18 years of age. Please check this post, it has all the details – http://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Sir,

Suppose Me 15dt ko account khola monthly scheme me or meri agli installment dt kab hogi Sir,

agli kisti dene me late ho gayi to fine hogi kya or hogi to kitni hogi Sir.

Hi,

This is not a monthly deposit scheme. Aapko saal mein ek baar deposit karna zaroori hai, monthly nahin.

res sir ,

my daughter is 2 years old ..can i open an account ..and what will be the maturity amount if i pay 1000 per year ..

i have one more query my niece is 9years old if her parents open an account for about 1.5 lakh per year what is the maturity amount ..and if they marry her at the age of 19 can they withdraw the amount or have to wait till she gets 21..please help

Hi Nitish,

Yes, your daughter is eligible for this account. For maturity amount, please check the table above.

Your niece can withdraw the whole balance if she gets married at 19.

Sir, interest calculation finennencial year keep last main hoga kind after 1year

Yes, interest calculation financial year ke end mein hoga.

Sir

Can i transfer money through netbanking i the account has been opened in the same nationalized bank as of my account from which i want to transfer

My daughter date of birth is 15/03/2014, I deposit 12000/= P.A. How many amount get interest per annual

It is 9.10% annual interest. So, if you deposit Rs. 12,000 on April 1, 2015, interest amount will be Rs. 1,092 on March 31, 2016.

sir, if the girl child never gets married ,

then how will she claim the money?

sir…if the girl child never gets married , then how will she claim the money ?

Hi Pallavi,

In that case, 21 years is the upper limit. This account will get matured after 21 years whether the girl gets married or not.

21 years is from the date of opening this account and not the girl’s age.

In the booklet/ pamphlet issued by Head post office Guna (MP) it is written that account can be closed at the end of the completition of the 21 yrs girl’s age. and also I have clarified online talking in the live program “Your Money” on CNBC AWAAJ the expert has clarified that maturity is 21 years of the girl’s age. Mr Kukreja You can clarify from head post office Guna 07542 -255212, 9406914114 With your opinion people are getting confused. So it is better you confirm before advise anybody

Hi Rajesh,

Please check this link – http://rbidocs.rbi.org.in/rdocs/content/pdfs/494SSAC110315_A2.pdf

The link is of the passbook specimen, issued by the RBI. If you read point no. 10 under its salient features, it is mentioned – “The account shall mature on completion of 21 years from the date of opening of account”. So, I think I need not clarify with anybody as of now. If what you are saying gets clarified by the government itself, I’ll update it here with a post.

Monthly deposit karne aur yearly deposit karne me kaun sa benefit rahega

Jo aap jaldi se jaldi start kar denge, usmein zyaada benefit hoga. I mean agar aap April mein yearly deposit kar denge to aapko zyaada interest milega as compared to monthly deposit.

sir,

Please clear my doubt

My daughter dob is 17-06-2008, if i open ssa in her name in 2015 for Rs 1.50 lakhs yearly then the completion of 14 years of account opening and her marriage age(21) will occur in the same year. When and how much i get the maturity amount?. Thanks

Hi Devak,

This scheme is for 21 years from the date of opening this account (and not till a girl child attains 21 years of age). But, when the girl child gets married, she will have to withdraw the balance and close the account. So, if your daughter gets married at the age of 21 years, only then you can withdraw the balance which would be approximately Rs. 42,88,898 at the end of 14 years from now.

it will be more profit for those girl who is less than 5 yrs am i right shiv sir

No, I don’t think age of the girl child makes any difference. It is the time period, timing of the deposit and the rate of interest which will make a difference.

sir i mean suppose i have girl child with 10 yrs old after 14 yrs he will be 24yrs old he will be eligible for getting marriege in that situation i will have to withdrawl amount from bank. so there is no government interest will be added bcoz u told that in 21 yrs i have to pay 14 yrs and rest 7 yrs will be paid by govt . but i will withdrawl within 14 yrs.

Government will not deposit any amount in your account for the rest of 7 years. The balance amount after 14 years will earn interest for these 7 years.

1000 rs ka monthly plan le rahe hai to 14 year bad aur 21 year bad kitna milega total kitna milega

Please check the table above, calculated maturity amount hai tables mein.

The interest rate for current year is 9.1%. What happens if the interest rates fall in the upcoming year that is to say 7.2 or even low due to high sales of this policy in the market or some other reason ? How will the calculation being done at this time for say if I invest 15,000 pa for year (2015-16) sn the intrest rate is 9.1% and in the year (2016-17) if the interest rate falls (for eg. 8.4 %) so how this be calculated for year (2016-17). Please advise.

It is natural that we’ll have to base our calculations based on the revised interest rate set by the government every year. If the government decides to change its interest rate from April 1, 2015 itself, then we’ll have to change our calculations as well and the maturity amount will then differ from the amounts given in the tables above.