This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

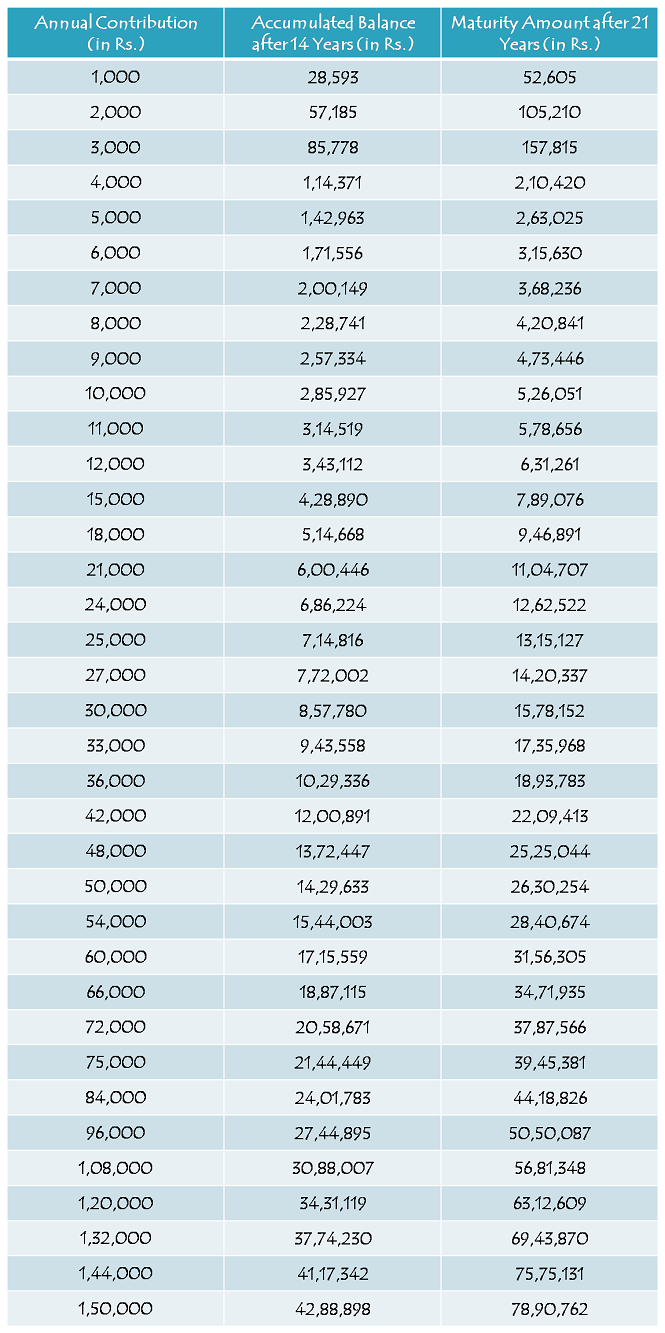

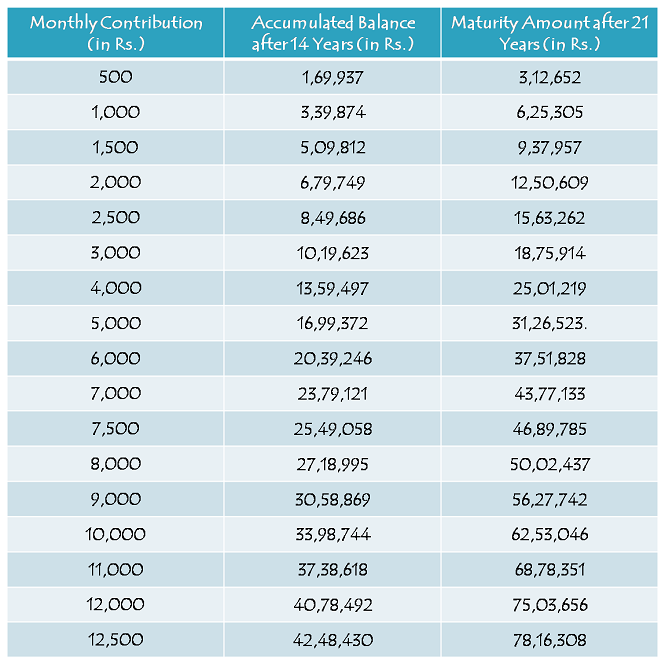

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

respected kukreja sahab mera prashna hai ki kya government bhi suknya samridhi account me contribute karegi .one person told me govt.will contribute 12000/- per year in each year for 14 year.

Nahin Arunishji, Government is scheme mein contribute nahin karegi. Ye account PPF ki tarah hi operate hoga.

Sir, after my elder brother’s death I married with his wife. Am I legal guardian of his daughter in this scheme? If yes, what are requirements (papers or something else)?

Yes, you are a legal guardian for the girl child. You need to contact the post office/bank for the documentation.

Hi Shiv,

US citizens (PIO) are eligible to open PPF and SSY accounts?

Hi Ravi,

It is still not clear, you’ll have to wait for further clarity.

Sir,

My Daughter”s Birth day.26/08/2002.May I open this sukanya samridhhi yojana.Please guide me. Thank you.

No, your daughter is not eligible.

Sir, after my elder brother’s death I married with her wife. Am I legal guardian of his daughter in this scheme? If yes, what are requirements (papers or something else).

what is the total maturity after investment ?whether the investment amoun is fixed or varying ?

Investment amount is variable as per your desire. Maturity amount will depend on your investment amount, month of deposit and the rate of interest (9.1% is not for the whole tenure).

sir

Is it possible for NRI to open this account for their daughters and is the matured value tax free. my daughter is 2 year old now if i invest 150000 how much she will get on maturity at the age of 21

Thank you

smitha

Hi Smitha,

It is still not clear whether NRIs would be eligible for this scheme or not. You’ll have to wait for more clarity on this.

Dear Shiv khureja,

I have posted my query in your site. Please read and explain according my comment.

Thanks

Rajesh Panda

What is your query Mr. Rajesh?

Res sir,

Pls confirm me, at present is this scheme avilable in sbi branches ?

Hi Chandan,

SBI will be servicing this scheme. But, I don’t know from when.

Sir,

Thank you for sharing such information. If you could help me with the following query:

I have two daughters.

If I open two accounts, what is the maximum limit I can deposit?

Is it 1.5×2, i.e. 3 lacs or is it still 1.5 lacs.

I have not been able to get a proper reply on this query. Would appreciate if you can help.

Regards,

Swarup

Thanks for your kind words!

As per the Government Notification – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, I think it is Rs. 3 lakh for two girl children.

If the deposits are made for, say five years, and then for some reasons no deposits are made, can the money paid to date be withdrawn (1) prematurely (2) at the end of 21 year term? Will the interest on the deposited money continue to be accrued till the time it is withdrawn?

Hi,

Firstly, you can withdraw the balance only on completion of 21 years from the date of opening this account or whenever your daughter gets married, whichever is earlier. In some special circumstances, the balance can be withdrawn prematurely. Moreover, the interest will get accrued till the time it is withdrawn.

Sir,

I would like to be know that, Please confirm In Sukanya Yojana interest rate 9.1% only for first financial year or tenure of hole 21 years. if not for hole tenure of 21 years then Maturity calculate according changing interest rate on every year.

Please reply best of knowledge.

Thanks,

Rajesh Panda

9.1% interest rate is only for this FY. It will be changed every year.

Sir,

My question is that in Sukanya-samriddhi-yojana scheme , in the 1st year if i deposit Rs 50,000 per month in 2nd year on wards can i deposit more or less the 1st year deposit amount.

can i deposit like this scheme 1st year Rs 50,000

2nd year Rs 20,000

3rd year Rs 40,000

Please clarify my doubts.

Thanking You

Nigam Adhikari

Yes, you can very well do that.

Plz describ tha yearly contribution scheam,that I select 8000 rs. Contributions and I deposit 1000rs.

Than I can deposit remaing amount 7000 in installment in a year plz clear my queri.

Yes, you can do so. Yearly contribution can also vary depending on your financial condition.

sair,

I want, I open a account my daughter age 9 yer’s 2015 ,but if I died on 2019. when my daughter withdraw deposit amount. or continue the policy run by daughter?

Hi Supriya,

Yes, it is possible for your daughter to continue this scheme in your absence. She can pay on her own and keep this account active till maturity ore till her marriage (Aapki beti aapki absence mein ye account chala sakti hai. Aapki beti khud bhi paise jama kar sakti hai).

sir,

what is the best time for opening sukanya acnt now as early as posible or april 1st 2015 as of now ican pay less amount only after 6 months i can pay more next

it is good to open in bank or post office next

we can earn more interest on depositing 1.50 lac on april 1st every year or by monthly instalment but how can both be same

1. I think you should wait for next financial year’s interest rate to get announced. If it is between 8.7% and 9.1%, then you should go ahead and invest in this scheme. If it falls below PPF’s rate, then you should invest in PPF.

2. It is better to open this account in a bank which provides the facility of online transfer, like Axis Bank, ICICI Bank, SBI etc.

3. You’ll earn more interest by depositing Rs. 1.5 lakh on April 1st every year as compared to monthly deposits.

Sir my daughter age is 4yrs I will pay 4000 per month , my daughter gets 25 age I mean maturity period is 21yrs till that time if my daughter is not married I will get full amount or not with that money only I should do marriage to my daughter.

Srujanji, aapki query clear nahin hai.

Sir wat b the return amount after completion of ths policys if v ll deposit 25000 per year

Please check the table above, it is Rs. 13,15,127 as per the table.

Kya main Central Bank of India me yeh account shuru kar sakti hu kya ???

Yes, you can do so. Updated list of banks is there on this post – http://www.onemint.com/2015/03/16/sukanya-samriddhi-yojana-updated-list-of-authorised-banks-to-open-an-account-specimen-application-form-passbook/

hi,

please tell me that can I deposit different amounts of money in different months (or years) in SSA?

Hi Swapnil,

Yes, you can do so.