This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

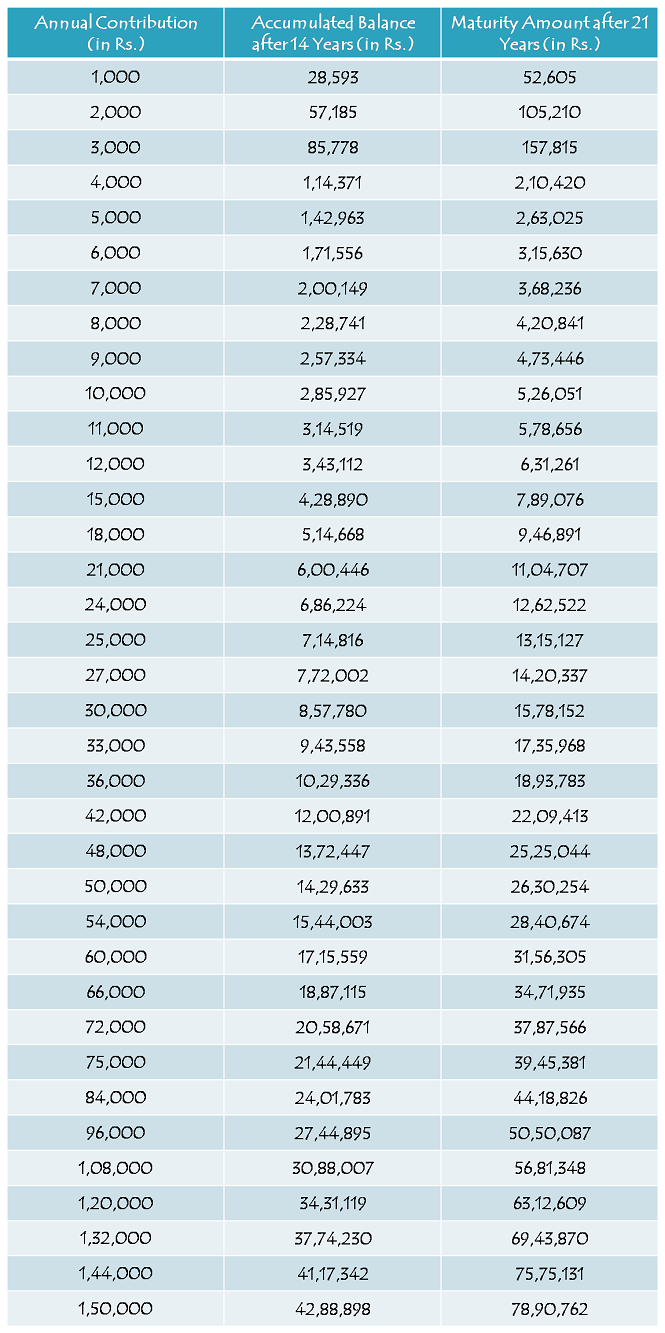

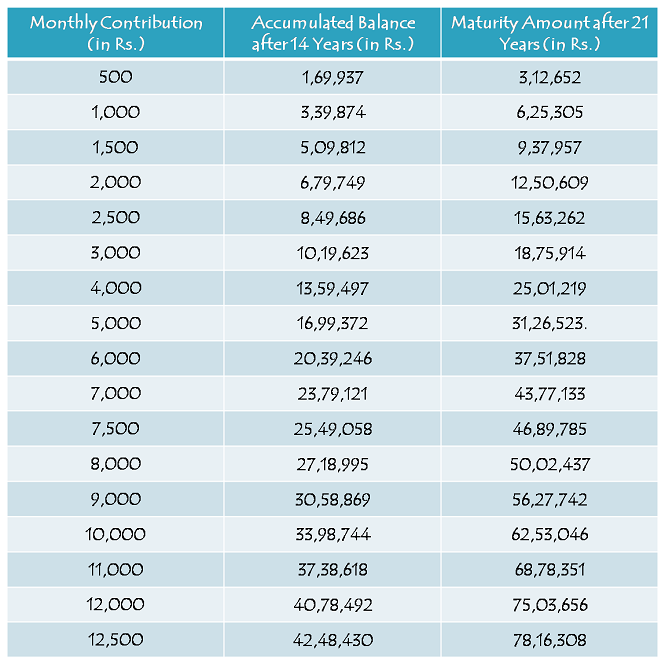

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Dear Sir,

In this year (2015) my daughterD.O.B 29/12/2007 age 7 years , I will be doposited 12000 per year , when my daughter age 21 years , suppose after 14 years or marriage time, how much matuarity amount will be received .

pl support..

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

As per the table, the amount is approximately Rs. 3,43,112.

sir agar me 3000 p/m paid karta ho to mughay Kab tak kitna paid karna parayga … aur milayga kitna… thanks

sir 3000 par month paid karo to mughay kitna paid karna hoga aur maturity par kitna milaga

sir 2000 par month paid karo t

o mughay kitna paid karna hoga aur maturity par kitna milaga

Please ye post check keejiye, ismein maturity values given hain – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Sir

Meri beti ki age 9 year 5 month hai aur mai

36000per year invest karna hai aur uski age 21 year ki ho jaygi to how much maturity amount will be recived

V . V. Rai

Ye scheme 21 saal ki hai, beti ki age 21 saal hone pe ye scheme mature nahin hogi.

Sir agar meri beti ka umar 1-4-2015 ko 2 year hai aur mai 14 year tak 150000 jama kar deta hun lekin agar uski marriage uski date of birth ke anusar 18 year par karna hai to kitna rupya mil sakta hai milega or nahi ye bhi bataye

Aapko maturity amount aapki beti ki shaadi ke time mil jaayega. Kitna milega ye aapke contribution aur rate of interest pe depend karega.

sir my baby completed 10 yrs in Jan… I just want to ask can I open dis a.c I mean it will valid or not?

Hi Jolly,

Yes, your daughter is eligible for this scheme as she is born after December 2, 2003.

Dear Sir,

Mara daughter ka age 5years, mai 01/04/2015 sa SSY scheme open karna chahata hu Rs 12,000/ per year. Mai 21 sal ka bad he maturati Lunga. Hamko kitna sal rupeya dalna paraga?(14/21sal???)

Hi Manoj,

Aapko 14 saal paisa deposit karna hoga.

Dear sir

sukanya scheeme ke liye post office ya bank me se kon sa better raheg aur sbi aur pnb me scheem account open challo h kya h aur monthly plan aur yearly plan me kon sa better h

Thanks

Hi Vikas,

I think bank mein account kholna better option hai. Also, is scheme mein koi monthly option nahin hai, saal mein sirf ek baar paisa deposit karna zaroori hai.

Dear Shiv Kukreja,

Thanks for all the information. My daughter’s date of birth is 27.10.2008. Please tell me where it would be beneficial to open the account in Post office or Bank (Public or Private) . And also tell me what is the best time to invest , mean which month.

Thanks Rupesh for your kind words!

I think it is better to open this account in a bank as you’ll get online transfer facility in banks. Moreover, with a bank, you can deposit money in any of the branches in India. Also, the sooner you deposit money in this account, the more interest you’ll earn.

Sir, I need sample – filled application form…

Please check this post – http://www.onemint.com/2015/03/12/sukanya-samriddhi-yojana-sample-filled-application-form/

Sir. Meri beti Ki age 9 year 5 month hai aur mai 50 per year invest karna hai aur uski age 21 ho jayegi to how much matuarity amount will be recived

Aapko har saal minimum Rs. 1,000 jama karna zaroori hai. Rs. 50 per year is not acceptable.

hi sir meri beti ki umra 4year hai. mai 2000 per month jama karana chahata hu.to meturiti par kitana melega.

Hi Dileep,

Post mein jo table hai, please usey check keejiye. Table ke anusaar aapko maturity pe Rs. 12,50,609 milenge.

Dear Sir,

In this year (2015) my daughter age 7 years , I will be doposited 12000 per year , when my daughter age 21 years , suppose after 14 years or marriage time, how much matuarity amount will be received .

pl support..

Thanks.

Arun Kr. Dhika

9899924925

Faridabad (HR)

Please check the table above, it is Rs. 3,43,112 as per your annual contribution of Rs. 12,000.

Hi, as per the scheme it matures at 21 years of a girl child or her marriage whichever is earlier. If a girl don’t marry at 21 but Marries at 25years we will still get money at 21 years of age

No, this account matures on completion of 21 years from the date of opening this account (and not on the girl child attaining 21 years of age). So, in your case, you will get the maturity amount when the girl child marries at 25 years of age or 21 years from the date of opening this account, whichever is earlier.

Dear sir

Meri bati ka birth 29 november 2014 h

Kaya ye yogna meri beti ke liye eligible h .isme monthly plan le ya yearly kese diposit kar sakte h monthly ya yearly kon sa better h

Hi Vikas,

Aapki beti is scheme ke liye eligible hai. Is scheme mein yearly minimum Rs. 1,000 dalna zaroori hai. Saal ke shuru mein deposit karna zyaada beneficial hai.

Dear sir

sukanya scheeme ke liye post office ya bank me se kon sa better raheg aur sbi aur pnb me scheem account open challo h kya h aur monthly plan aur yearly plan me kon sa better h

Thanks

If I will open an account at the 5 years of my daughter’s age(this year),and if I invest rs 2400 annually,then how much I will get and when???

You will get the maturity amount after 21 years from today or when your daughter gets married, whichever is earlier. But, it will depend on the rate of interest which will be announced every year in March and also the timing of your contribution.

2004 date of breath aaj open karte ha to 21 years ho ne par mauchaurti valu Kay hoga so list batao

Maturity amount aapke contribution & rate of interest pe depend karega.

SIR

ISME CALCULATE KE HISAB SE LIKHA HAI KI 1000/MONTH KAREGE TO 631000 MILEGE TO ISME 14 SAL TAK HI JAMA KARANA PDEGA YA FIR 21SAL TAK JAMA KARNA PADEGA PLASE REPLY

14 saal tak hi jama karna hai.

Hi Shiv, do we have any table or calculator wherein we can calculate returns as per the age of child.

Hi Harinder,

No, we don’t have it here.

Can an NRI (Indian Citizen) open Sukanya Samriddhi Account.

It is still not clear whether NRIs would be eligible for this scheme or not. You’ll have to wait for further clarity on this.

sir if rate of inttt will vary this not risky because locking period is too long. gov may have many excues for reducing rate. or is there will some specific measurement or condition for reducing or increaing intt rate

Hi Vijay,

There is a mechanism as per which the interest rates are set for the small savings schemes. So, I would not blame the government for reducing interest rates for all these schemes. I think the rates are already on a higher side for all these schemes and the government should not keep rates so high which creates an imbalance for the interest rates in the market.