This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

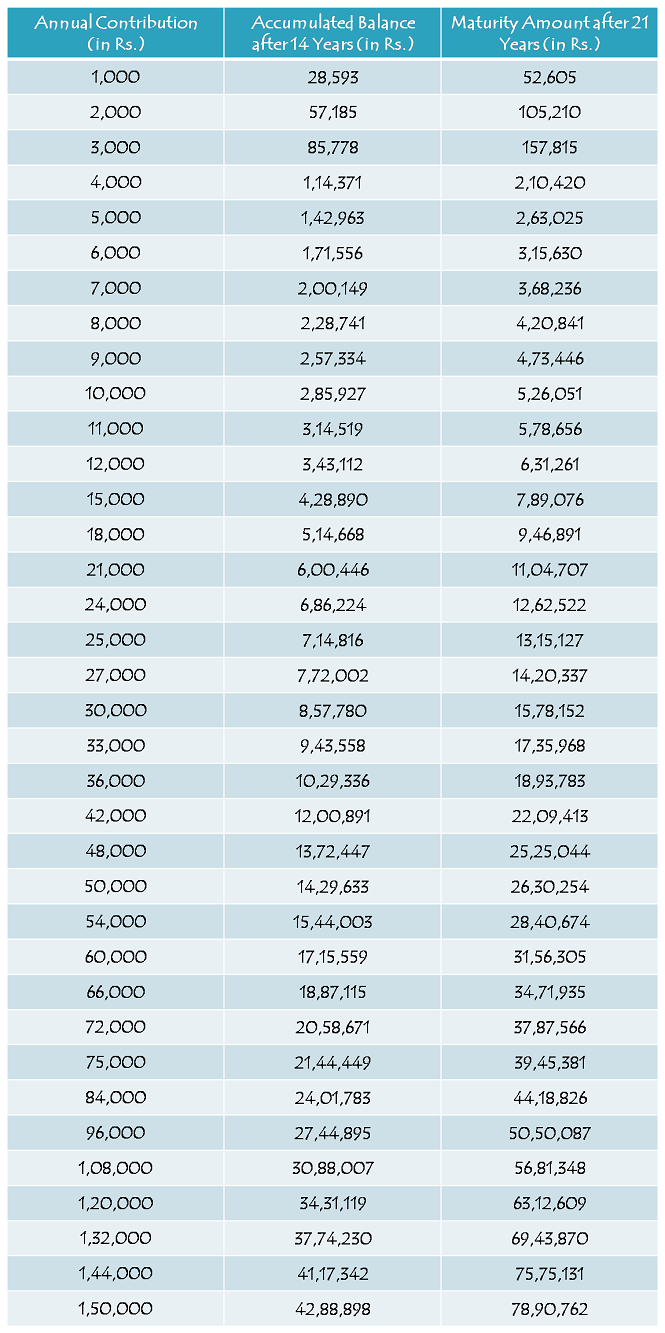

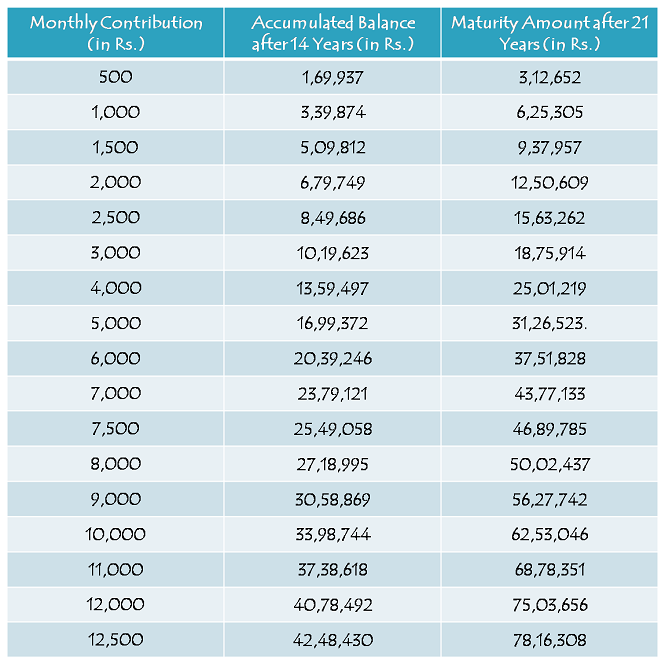

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

sir

agar main starting mein 50000 rs jma krwata hoon

aur iske baad 1000 rs per month jma krta hoon,

iska benefit mujhe milega ya nhi ?

Iska benefit aapko milega.

Sir

Suppose my saving under 80 C is completed I want to take tax rebate of housing loan interest of 50000 and also want to invest 50000 separately in NPS to take extra tax rebate in same financial year. So is it possible to take rebate of loan interest and NPS saving at a time ?

Yes, it is allowed w.e.f. financial year 2015-16.

sir

kya jo rupye hum 14saal tak jama karenge wo 14saal bad hi nikal sakte he ya barabar 21years pure hone par hi milenge

50% paisa aapki beti apne 18 saal complete hone pe nikaal sakti hai aur baaki account kholne ke 21 saal baad ya phir shaadi hone pe.

sir

mujhe 14 saal paise jama karne hain

aur 21 saal baad paise mileage.

kya ye teek hai.

meri girl ki dob 01.01.2007 hai

maine account 10.03.2015 ko khulbaya hai.

is hisab se mujhe paise 10.03.2029 tak jama karane hain aur paise 10.03.2036 ko mileage.

Sir,

I Have a Query that Every Month We have Deposite Same Amount Money Or Might Be Different Amount Money Can Be Deposited.??

And Also Limit is This Scheme Rs. 1,50,000/- / Yr.

Then We Deposite Every Month Rs. 10,000 / And Remaining Amount Of Limit Is deposited in Last Month Of Yr.

Is Possible.

Mr. Amit,

Firstly, it is not a monthly deposit scheme, you can deposit all Rs. 1.5 lakh in one go as well. Moreover, if you decide to deposit money on a monthly basis, then it is allowed to deposit different amounts each month.

Yes, that is correct.

sir

agar main starting mein jyada

amount jama krwaun aur iske baad

monthly 1000 rs jma krwata hoon,

toh mujhe benefit toh milega ya nhi ?

Sir

My daughter is now 7.5 years. I open SSY account on 1/04/2015. Sir mujhe amount 14 saal tak jama karana hai (means 2029), ya jab beti 14 saal (means 2021) ki ho jayagi tab tak jama karana h. Plz help me.

Aapko amount 2029 tak jama karna hoga.

I am Indian Citizen and my daughter is American citizen. Is she eligible for SSY?

It is still not clear whether NRIs are eligible to invest in this scheme or not. You’ll have to wait some more time for further clarity in this regards.

sir meri beti ki age 10 year he to mudhe kitana time tak jama rupee karne hoge kyo ki meri beti ki age 10+14+7=31 age ho jaye gi ap ke rule ke hisab se please conferm

regards

pradeep sharma

09997041674

Pradeepji, aapko 14 saal tak paisa jama karna hai, ya phir aapki beti ki shaadi hone tak.

sir ..

bank me ye skim kab shuru ho rahi hai ..

Dhaneshji, ye information aapko banks se hi mil paayegi.

My daughter Gungun”s dob is 25.08.07. After 14 yrs she will be 22 yrs old in 2029. If I start 2000 per month means 24000 per yr investment for 14 yrs then I m investing 24000×14=336000 (3lac 36 thousand ). What amt can I get in 2029 not after that. Plz give me ur suggestion .

Thank u in advance.

Mr. Rana, you’ll get approximately Rs. 679,749 after 14 years.

01/04/2015 ke bad ssy a/c open kar sakte plz tell me.

Yes, SSY account saal mein kabhi bhi open kar sakte hain.

Mera beti ki date of birth 27 oct 2006; aaj account khulenge to kitna saal diposit karna padega aur kab meturity milega plz tell me.

Good for money savings

Mere beti 6 sal ki h. Agar hat mahine Rs.1000/- Jama karate h to 21 sales bad kitna amount haga.

Gauravji, maturity amount ke liye upar diye gaye tables check keejiye.

sir mai Rs.1000 P/m deposit karna chahta hu to 21 years me kitana return hoga

Rakeshji, upar post mein diye gaye tables check keejiye.

SIR,

MENE START ME 3000 RUPE JAMA KARA DIYE HAI OR ME HAR TISRE MAHINA 3000RUPE JAMA KARA SAKATA HU KYA PLESE REPLY OR KITNE RUPE MILEGE

Ager ye scheme modi sarkar ka tenure khatm hone ke baad next government isko start rakhegi ya chalayegi

Prashantji, iske liye aapko next government aane ki wait karni hogi.

SIR,

MENE START ME 3000 RUPE JAMA KARA DIYE HAI OR ME HAR TISRE MAHINA 3000RUPE JAMA KARA SAKATA HU KYA PLESE REPLY

Yes, aap har teesre mahine Rs. 3,000 jama karwa sakte hain.

Jab meri beti 18 sal ki hogi to mujhe kitna milega abhi meri beti 9 saal ki hai aaj maine khata khola hai

Aapki beti 18 saal poore hone pe balance amount ka 50% withdraw kar sakti hai.

Sir kya main apni Beti ke liye sukanya Dev yojna or Sukanya samridhi yojna dono Le sakti hu?????? Plz reply

Renuji, mujhe Sukanya Dev Yojana ke baare mein jaankaari nahin hai.

My daughter dob is 24 November 2006, I want deposit 150000 rs per year from today, than what is the mechurity date and what will the amount at that date

Maturity date would be March 31, 2036. Please refer the first table in the post above for maturity values.