This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

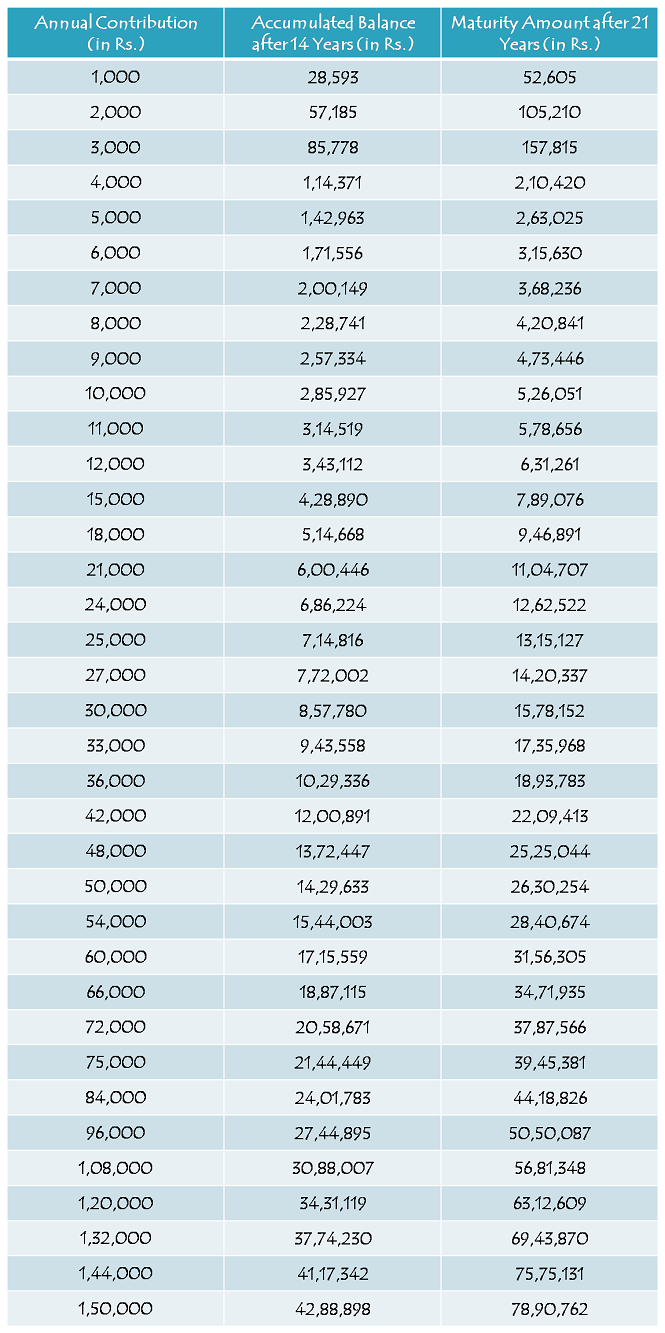

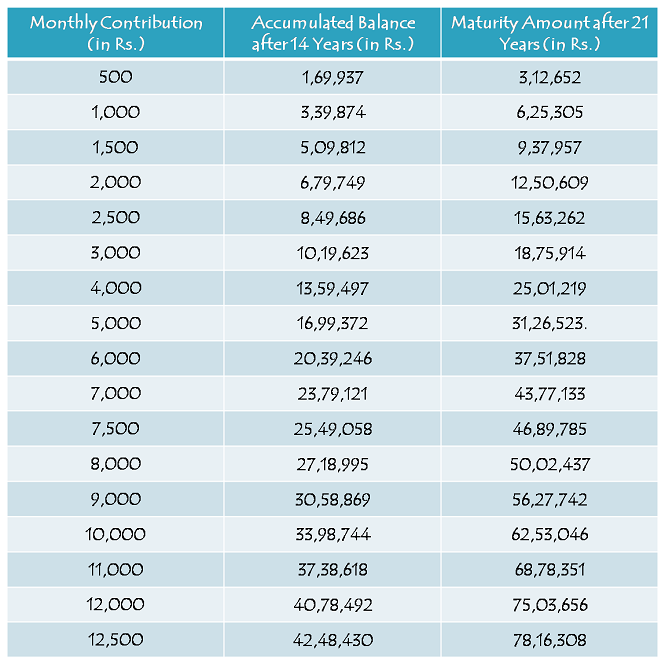

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Hi sir

I am staying out of India for last five years but am an Indian citizen, I want to invest 12500 INR for my daughter who born in 2009, and she also an indian citizen, can I apply it online? ??

Hi Dr Prakash,

Online investment facility is not available with the post offices. Some authorised banks might provide this facility in future, but at present, these banks have no information to provide to any of the interested subscribers. So, you’ll have to wait for some more time to get clarity on this matter.

My daughter is born on 19.07.2010 i want to invest 10000 on monthly basic (Ten Thousand rupees only),for how long i have to depoist the money & when will the plan gets matured.kindly help me plzzz.awaiting for your reply.

You need to deposit money in this account for 14 years. The scheme gets matured in 21 years from the date of opening this account or when daughter gets married, whichever is earlier.

Par post office vale bol rahe h ki sirf mumy papa k signature hi honge vo log mana kar rahe h him kya kare plz thoda batao

Legal guardian account khulwa sakta hai girl child ka.

Mere Bhaiya ki ladki h uski mumy ki dath ho gai or papa ki mansik halat thik nhi h or post office se bola ki vo bachhi yojna ka labh nhi le sakti

Post Office is wrong in doing so.

Plz tell me kya us bachhi ko yaojna ka labh nhi mil sakta jiske parents nhi j

Mil sakta hai. Koi bhi legal guardian girl child ke naam pe account khulwa sakta hai.

Give me ans.plz

What’s your query?

Give me and. Plz

Hello Sir,

After maturity of account, i.e 14 years, who has the claim on maturity amount, the child or the parents????

The girl child will have the right on the maturity proceeds.

Sir,

I didn’t get my answers yet..

Hello sir my daughter is 9 years old ,i want to know for how many year i hv to invest ?

N how much i vll get if i deposite rs.6000 per year

N also i cn wthdrw fr her stadies ?

Hi Rajani,

1. You need to deposit the desired amount in this account for at least 14 years or till your daughter gets married.

2. Based on certain assumptions and 9.1% rate of interest, it should be approximately Rs. 3,15,630.

3. Yes, you can withdraw 50% of the balance as your daughter attains 18 years of age.

Hello sir my daughter is 9 years old ,i want to know for how many year i hv to invest ?

N how much i vll get if i deposite rs.6000 per year

Please sir, tell me that 5000 yearly invest in S.S.Y after completion of 21 yrs. How many Rs. Will be return

Please check the table above. Based on certain assumptions and 9.1% rate of interest, it should be approximately Rs. 2,63,025.

My daughter is 9 yrs old fr how many year i hv to invest,how much i vll get if i want to invest 6000 per year

Sir meri beti ki age 10 saal h . Iss hisab se wo 11 saal me hi 21 saal ki ho jayegi toh kya mujhe 14 saal investment k complete nhi krne pade ge pahle hi Rs mil Sakte h. Yadi main Sadi 21 saal baad krta hu plzzzzz reply me

Aapko maturity amount ya to beti ki shaadi pe milega ya phir account kholne ke 21 saal baad. Aapki beti ki age 21 saal se koi farak nahin padta.

Sir, my daughter is 9 yrs now.After 9yrs when she will be 18 how much amount she can withdraw .Is it 50% of the maturity amount .?

Q2.If she got married at the age of 21 .Do we have to make the futher payments then.?

Hi Deepa,

1. It is 50% of the balance amount and not the maturity amount.

2. No, when your daughter gets married, you’ll have to compulsorily withdraw the balance and close the account.

Sir, Can I make the payment online if I open it through bank?

Hi Nia,

Yes, you can do so if the bank is providing the online payment facility.

Hello,

God forbid any of these happens to anyone… but life is harsh sometimes. So, I have three questions:

1. Can we assume that either of the surviving parent will be able to continue making payments in the event of death/disability of one the parents? Also, can either parent claim tax deduction?

2. Can kith or kin continue to make payments in the event of death of both parents? I doubt they can claim Tax deduction?!!

3. What happens to the corpus amount in the event of the death of girl child? Can either parent be made nominee?

Thanks

Nk

Hi Nk,

1. Yes, it is possible that the surviving parent can continue this account in the absence of one of the parents. Only the contributing parent/guardian can claim tax deduction.

2. It is still not clear whether kith or kin can continue this account in the absence of both the parents. I think there must be a provision for legal guardian to continue this account. Also, I think the legal guardian would be eligible to claim tax deduction.

3. Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Hi,My daughter’s date of birth is 10.5.2004.Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

Hi,

Yes, your daughter is eligible for this scheme. You need to invest for 14 years & it will mature in 21 years or when your daughter gets married. Please check the table above for maturity value.

Hi ,

The amount recieved on maturity (for eg 78lacs) is to be used for the marriage and Education only or can it be used for any other purpose? If marriage cost and education cost works out 50lacs what will happen to the remaining amount? Can the girl use it for any othe rpurpose?

Yes, it can be used for any purpose. The government will not track the final use of maturity proceeds.

Sir, I m a Govt employee and want to invest my money for future needs of my 2 little daughters ( First is 2 years old and second is 6 month old). Monthly contribution will be 1000/-each. Which scheme namely SSY, PPF, SIP will be better for me. I have a PPF account also with SBI.

With Best regards.

hello sir,

my daughter s 2yrs old.

1) i will pay for 14yrs under this scheme i.e till she turns 16, so will amount at maturity wary depending on the age of my daughter.

Hi Samkit,

Maturity amount has nothing to do with the age of your daughter.

Hi Mona,

At present SSY seems better than PPF. Investment in Equity SIPs has given better returns than PPF in the past. So, if you can take risk, equity investment is the best option.

Sorry, Monu & not Mona.