This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

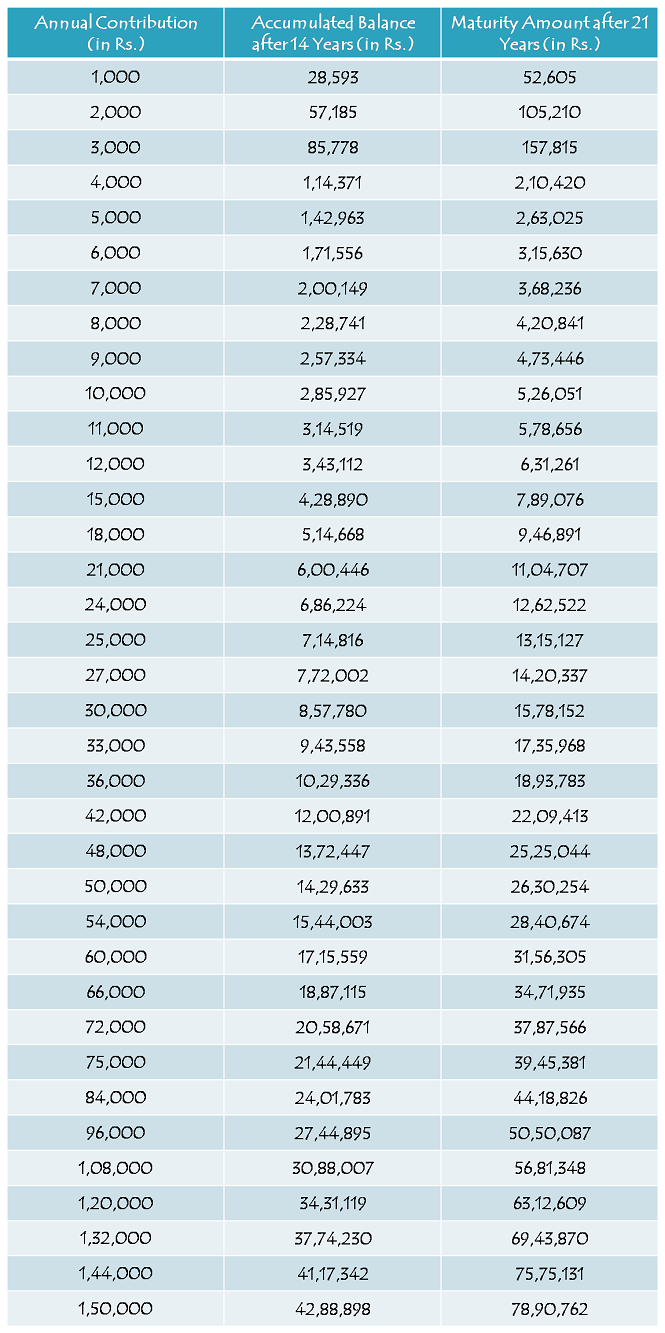

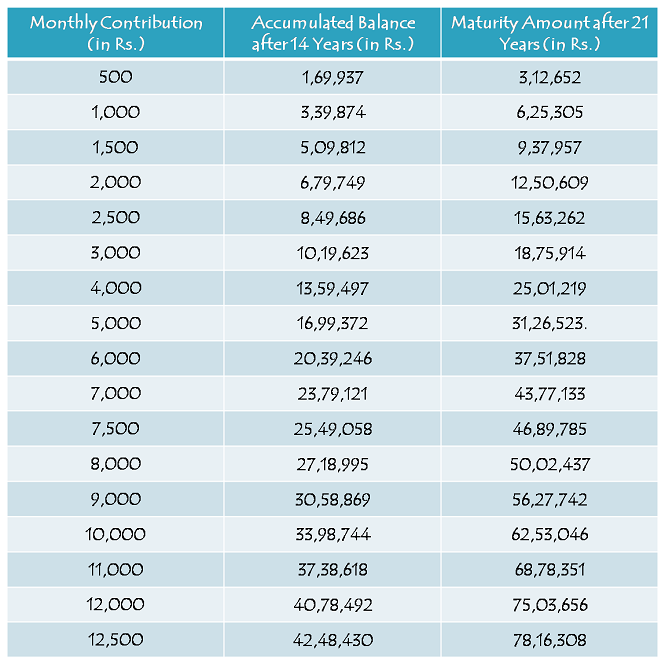

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Good

Is the deposited amount tax free?

Yes, it is tax-free.

Ok sir thanks g

You are welcome!

hi sir

meri beti 6 sal ki hai

mai har sal 2000 rs jama karta hu to

kitne rs jama karna hoga aur 21 sal ke bad

kitna milega

Hi Deepak,

Please table check keejiye, usmein maturity amount mentioned hai.

Res sir,

At present this scheme is avilable in sbi or not… Pls clear me

As per the feedback we have received from the readers here, banks, including SBI, have not started accepting these deposits.

Sir my baby age is 15/5/2013.i want deposit 1000 per month upto 21yr.how much amout i got after 21yr .

You need to deposit for 14 years only in this scheme. Maturity amount after 21 years is given in the table above for various monthly/yearly contributions, please check.

Hello Sir,

Meri daughter abhi 9 years ki h to mujhe kb tk jma krvana hoga. Me 50000/- rs. Yearly Jma kravata hu to jb vo 21 ki ho jaayegi tb use kitne pese mil jayenge.

Hi Onkar,

Aapko 14 saal tak minimum Rs. 1,000 jama karne honge. Aapko maturity amount aapki beti ki marriage pe milega ya is scheme ke 21 saal complete hone pe.

Sir

I want open ssy account on post office. Sir plz advice me supoues 1000/ rs deposit the amount if i want deposit next month 10000/ rs .sir i could deposit as above this amount next month .plz update guide me .

Thanks

VVirendra rana

Your query is not clear.

After complete the age of 21 years of my daughter can I withdraw full money from this scheme?

No, this scheme has nothing to do with the age of your girl child. You can withdraw the balance at the time of your daughter’s marriage or on completion of 21 years from the date of opening this account.

Res sir,

My daughter is 7 years old pls clear my confusion I have to deposit money next 14 years or till the age of 14 of my daughter…in sukanya suraksha scheme…

You need to deposit money for the next 14 years.

Hi sir,

I just would like to know about all terms and conditions of this scheme. Request you to provide your valuable guidance.

With regards,

Jay

Hi Jay,

Please check this post, it has all the details – http://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Hi sir

meri beti 6 year ki hai to kya mujhe beti ke 14 year hone tak amount deposit krna hoga ya regular 14 year amount deposit krna hoga jaise 2023 tak ya 2029 tak

Hi Jyoti,

Aapko 2029 tak amount deposit karna hoga.

Can any explain how the interest is calculated for every year. For Example – 12000 per year how the interest is 592? when its 9.1%

Hello Sir,

I want to know, how is this scheme better, if I invest 100000 in a recurring deposit every year for 14 years and stop depositing after that?

and also if I invest a particular amount in SSA for first few years and then onwards make no further investment, what will happen to the account in that case?

Hi Monika,

You need to deposit a minimum of Rs. 1,000 in a financial year. Not doing so will attract a penalty of Rs. 50 per year. This scheme is tax-free as against a recurring deposit.

SSA AGAR MAI 14/03/2015 KO KHULWATA HU TO MERA INTREST KAB JUDEGA 14/03/2016 ME AUR 1 MONTH ME 2 BAR DEPOSITE KAR SAKTE HAI AUR AGAR SSA POST OFFICE ME HAI TO MAI YE ACCOUNT IDBI BANK ME KAR SAKTA HU

1 month mein 2 baar paisa deposit kar sakte hain. Baad mein IDBI bank mein bhi migrate kar sakte hain. Interest calculation method abhi clear nahin hai, but mujhe lagta hai ye PPF ki tarah calculate hoga.

what will be fixed installment monthly/yearly & amount will have to deposit up to how many year.

There is no fixed amount you need to deposit. However, you need to make deposits for 14 years.

Hello Shiv,

The previous comments are very helpful, I have a question, My daughter age is 5years now. I want to take this ssy account with 50,000 deposit per month. I will do marriage for my daughter at the age of 20 year, so here i want to take the amount at the age of 20 years means after 15 years, so how much amount i will get after 15 years?

Hi Prasad,

Firstly, Rs. 50,000 per month is not allowed, you can deposit a maximum of Rs. 1,50,000 in a financial year. Moreover, the maturity amount will depend on the deposit amount, rate of interest and the timing of your deposit.

i had one quires about how much should be paid per month to my daughter can i open an account now for her, she is just 1 year child .

What are the document needed to open the a/c

You need birth certificate of the girl child, along with the identity proof, residence proof and 2 photographs of the guardian, to open an account under this scheme.

Hi sir mein poochna chahti hun ki…interest ke percentage ki minimum aur maximum limit kya hai?

There are no such caps on interest rate.

Sir,my daugher has completed 9 years .if i deposit 2000 per month how much amt i’ ll get on maturity i.e.21years and tell me how many years i have to pay( till 14th year of my daughter’s age or 14 year of now)

Wat is the ratio% of getting income tax rebate on this scheme

You need to deposit money for 14 years from now and not till 14th year of your daughter’s age. You’ll get rebate u/s 80C as per the tax slab you are in. Please check the table above for the maturity amount after 21 years.