This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

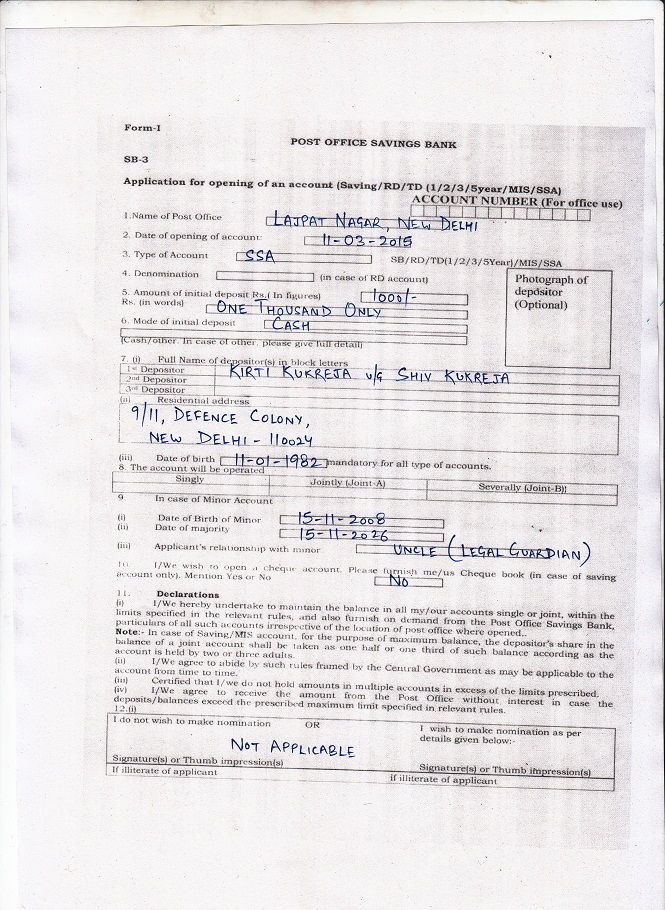

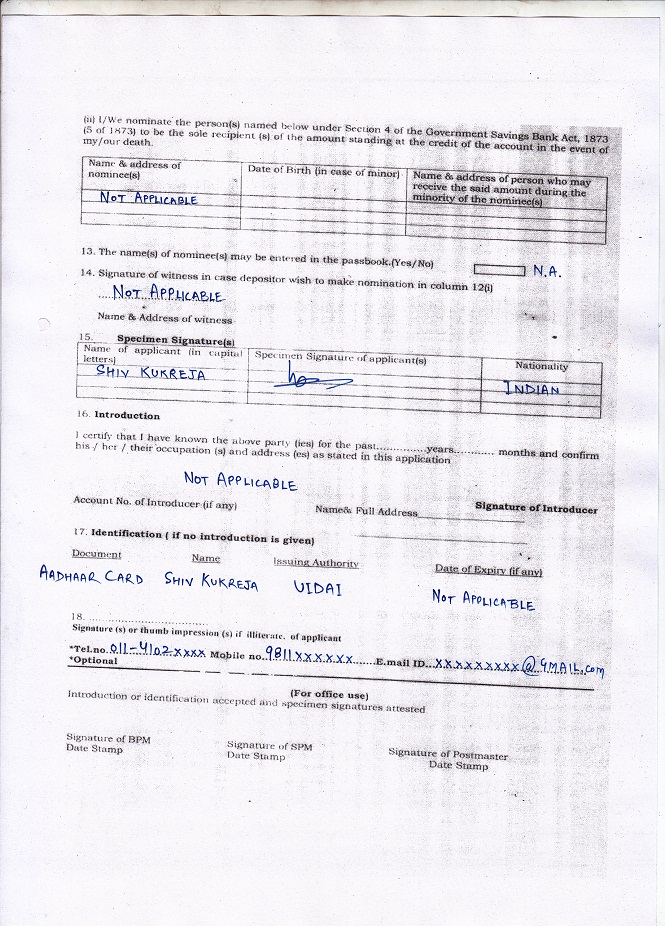

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Sir ,regarding kisan kvp is good against fd in bank and what is limit for it ,documents req or any age limit

There is no investment limit with KVP. One Id proof & an address proof would be required in documents. There is no age limit also for KVP.

Thanks Shiv for your prompt revert.

You are welcome Aastha!

Hello Mr Shiv,

I am a citizen of India and my daughter is born outside india. So can I pass for the sukanya scheme as well?

rgds

Hi Aastha,

Your daughter’s birth certificate would be of a country other than India. So, most likely you’ll not be able to open this account. But, you’ll have to confirm it with a post office or an authorised bank, as it is still not clear whether a girl child born outside India is eligible for this scheme or not.

Can the account be opened jointly by parents so both contribute half -half 75k-75k and get tax benefit

Yes, it is allowed for parents to get this account jointly opened and contribute amount as per their desire up to a maximum of Rs. 1.50 lakh.

I verified with Post Office, joint account is not allowed. Only one parent or guardian can open the account.

None of the banks including SBI and ICICI have the forms to open the account, at many places the staff hasn’t even heard about the scheme!

Only Post Office is opening account but they are not allowing joint account.

Sir,thanks for helping in filling form by giving eg of filled form as i opened the accont todayand also thanks for replying

That’s great, thanks for visiting our website and sharing info with us! 🙂

What is the future of the girl child in case of death of parents/legal guardian. Have the waiving of instalments in this scheme for girl child or not?

Ravinder kumar

No, there are no insurance provisions in this scheme. The girl child can withdraw the amount in case of such an unfortunate event like death etc.

its really a good scheme for ” beti bachao , beti padhao ” abhiyaan …………………its also bebeficial for parent’s bcoz its nice way to Tax saving……………….thanks to Mr. Modi and their team for develop the SSA project…….

Thanks for expressing your views!

Thank for your reply shiv . My daughter is only 5 months old can I open this account ? if yes, what’s the deadline to open this account

Regards

Raj

Yes, your daughter is eligible for this account. Moreover, there is no deadline as such for this scheme.

Hi Shiv Sir,

My query is my adhaar card has the address of delhi and now I have been shifted to Patna. I want to open an account for my daughter under SSA. As the residential address is of delhi n I don’t have any other residential proof of Patna. Please suggest.

Hi Deepika,

I don’t think it would be a problem. I think post offices or banks would accept your Aadhaar Card for opening this account.

sir, my daugher have a ppf account. can we open ssy account also and deposit 1.5lakh + 1.5 lakh yearly in both.???

Yes, you can do that.

Sir meri beti two y ki h to kya m post office m acount kholwa kar paisa deaposit kar sakta hu.plz sir aur kya ye methurity marigge ke bad hoga ,ya phir 21y ke bad ho jayega..

Yes, aap ye account khulwa sakte ho. Maturity marriage ke time hoga ya phir account ke 21 saal complete hone pe.

Shiv,

Do i need to invest a stipulated amount monthly to be able to continue with the scheme .

ex( if i choose to invest rs 10000 monthly for 1st month can i invest higher or lower than 10000 subsequent month )

Raj

Hi Raj,

Firstly, you need not make contributions on a monthly basis, even if you deposit money once a year, it is perfectly fine. Secondly, you can deposit any amount between Rs. 1,000 and Rs. 1,50,000 any no. of times in a financial year.

Thank you sir

You are welcome!

Thank you for replying sir. Sir my query is regarding the declaration and note given in the point 11 of the form.

You can use your form for Sukanya Samriddhi Yojana. You need to mention the name of the scheme in the space provided. For maturity amount, please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Maturity amount for Rs. 1000 monthly deposit is approximately Rs. 6,25,305. But, it has many assumptions for it to materialize.

Sir shiv ji

Payment saving account ke tarah kabhi bhi deposit kar sakte hai or policy ke tarah yearly usse date ya RD ke montly same date par deposit karna hoga

Saving account ki tarah saal mein ek baar kabhi bhi deposit kar sakte hain.

SSA AGAR MAI 14/03/2015 KO KHULWATA HU TO MERA INTREST KAB JUDEGA 14/03/2016 ME AUR 1 MONTH ME 2 BAR DEPOSITE KAR SAKTE HAI AUR AGAR SSA POST OFFICE ME HAI TO MAI YE ACCOUNT IDBI BANK ME KAR SAKTA HU

REPLY

1 month mein 2 baar paisa deposit kar sakte hain. Baad mein IDBI bank mein bhi migrate kar sakte hain. Interest calculation method abhi clear nahin hai, but mujhe lagta hai ye PPF ki tarah calculate hoga.

I want to know about the account details and declaration given in the form regarding saving and mis account.the form which I have taken do not have ssa option.please help in filling the form. What will be maturity amount if I select saving account?.if my depositing amount is 1000per month . Date ofbirth of the child is 20-5-2012.

Thank you.

You can use this form, it will work. But, your query is not clear to me.

Kya ye Kolkata me uplabdh hai.. ?

Please mail kare….

Shiv,

Your handwriting is as beautiful as your articles.

Anyway, Thanks for article on ‘Sukanya Samriddhi Yojana’. I had requested article on it in ‘suggest a topic’

Thanks,

Amit.

Thank you Amit for your kind words! 🙂

Yes, I just checked it that you had suggested us this topic on 28th January. But, like many of other suggestions, we could not cover it. Honestly speaking, there is a lot of difference between a 9.1% taxable scheme and a 9.1% tax-free scheme. Like others, I did not find this scheme to be extraordinarily attractive earlier.

But, with budget announcement of making it tax-free, much has changed now to make it a really attractive scheme. This made me cover it and now we are getting an extremely good response to all its articles. We are also feeling pumped up now. 🙂

In post office they said that one can do many transations ina year,n i means first yr start ac with 25;000.in any yr after if i put less amt will do

Yes, you can do as many transactions as you want, there is no cap. Also, you can deposit any amount between Rs. 1,000 to Rs. 1,50,000 after opening this account. Higher as well lower than previous years.

Reply with me